Edition 648 - November 11, 2016

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

VOLATILITY STOP

In past issues of Chart Scan I mentioned that The Law of Charts has many implementations. One of them is the Traders Trick Entry. But there are others. One implementation of The Law of Charts is done using the Volatility Stop study (VS).

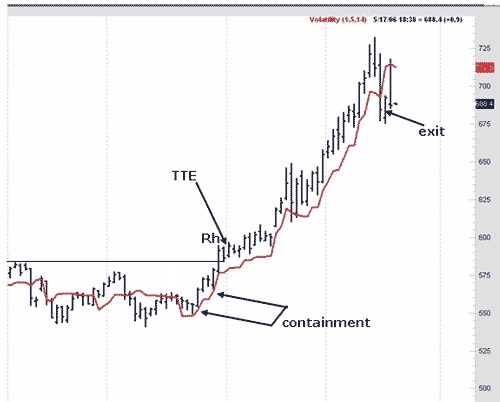

When you have a trading range and prices ultimately break beyond the trading range, you have a defined trend. When they subsequently form a Ross hook, and then violate the point of that hook, a trend has been established. This is what happened in gold futures based on the daily chart. A low was in place at the base of a trading range. Prices violated the high point of the trading range, and then violated the point of the Ross hook. The VS could then come into play. I will not have time or space to describe in detail the parameters of the VS; however, it is a wonderful device for curve fitting to the reality of a trend. Unlike a moving average, the VS is reflective of current volatility in the market.

The way I use it is to curve fit so that VS shows containment at the base of the new swing that is being formed. From that point you can stay in as long as you do not get a Close below the VS. Some implementations of the VS enable you to offset the VS line by pushing it ahead one day, so that you can know where you will place your protective stop tomorrow. You can change the number of bars to be placed into the moving average of the volatility, and you can use a combination of offset, moving average, and a multiplier to make that VS line snuggle right up to the lows of the trend. The parameter settings for the chart below were a multiplier of 1.5 and 14 bars in the moving average of volatility. The rest of the story is on the chart.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Question from a Subscriber:

A reader asks: "I bought a system that requires a minimum account size of $20,000. If you were me, how would you manage it?"

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Well, since I’m not you, I can only tell you how I would manage it. If I lost $10,000, I would stop trading and examine my losses to discover if a logical trading plan of action is being pursued. I would separate losses into technical and psychological failures. I would examine each of them separately to discern if any consistent losing behavioral patterns are evident, such as violating the rules of the trading system or if self-discipline is not being maintained. If I were winning, I would be sure to remove my initial startup capital from my account, once my account size had doubled.

Your question brings to mind a sad story about a friend of mine. It took place years ago in a market situation much like we are seeing today in the metals. He was trading the Mexican peso with insider information, and managing an account of $200,000. Each participant in the managed account put up $20,000. In very little time, the account grew to $500 thousand. At that time, with that amount of money, you could really move the peso and cause prices to move against you. There was simply no room for that much money to be traded in that market at that time, and they had no desire to be market movers. So my friend began to trade silver futures, also with inside information. Silver was on a rampage along with gold. Before long, they had $1.2 million in the account. However, their timing was terrible. They were caught in the fiasco when the Hunt brothers tried to corner the silver market. Silver began to crash, and soon their account was wiped out. All the money was lost, the entire $1.2 million. I asked my friend, "When you had $1.2 million in the account, why didn't you at least take out the seed money? Why didn't you take out the $200,000? He said, "No one wanted to touch that money. We were on a roll!" Lesson learned: Take the money when it is there to be taken. At least take out your seed money.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

AA TRADE

Instant Income Guaranteed

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 12th July 2016 we gave our IIG subscribers the following trade on AA, which gapped up on earnings and was showing strong accumulation. The trade was suitable for very small accounts, with an initial margin of only $180. We decided to sell price insurance as follows the following day:

- On 13th July 2016, we sold to open AA Aug 26 2016 9P @ $0.10, i.e. $10 per option sold, with 43 days to expiration, and our short strike at a major support zone, 16% below price action.

- On 21st July 2016, we bought to close AA Aug 26 2016 9P @ $0.05, after 8 days in the trade, for quick premium compounding

Profit (average): $5

Margin: $180

Return on Margin Annualized: 126.74%

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Instant Income Guaranteed

♦ SIGN UP TODAY! YOU ARE WORTH THE INVESTMENT ♦

This includes a daily 80+ page report along with a daily podcast!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Traders Notebook Outright Futures Trading

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook Complete and Traders Notebook Outrights

Traders Notebook Outrights gives you high probablity trades that are hand-picked for optimum results. If you are a futures swing trader looking for real trades while learning the correct way to place stops and the art of trade management, this is for you.

Traders Notebook Outright Guide explains the Outright trading service from Trading Educators. It shows you around on the Outright Campus, and how to use the information provided by the service.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

This Week's Blog Post: Vacation trip to Samaná

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook Complete and Traders Notebook Outrights

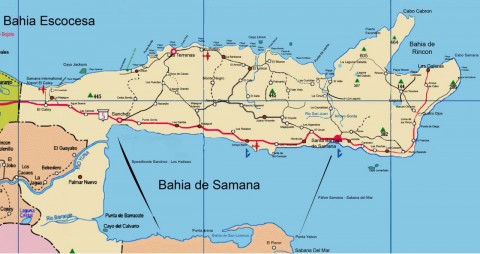

From Saturday October 29 until November 5 my wife and I took a vacation trip to Samaná, Dominican Republic. From Santiago, where we live, it takes about a 3 hour drive to get there. I love the region of Samaná because it is still very virgin compared to Bavaro or Punta Cana with only a few hotels. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

AlgoStrats:FX Live Account Gain With Low Risk

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com

Marco Mayer's AlgoStrats:FX Live Trading account gained about +4% with a very low target risk of 0.5% per trade in October.

To learn more, here's a video where Marco walks you through the recent performance of AlgoStrats:FX:

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.