Edition 653 - December 16, 2016

“You have to find something that you want to accomplish, that you want to achieve…There has to be some goal that you set for yourself and, after you’ve reached that goal, you set a new one. You always have to be shooting for something, striving for something.” Larry Fitzgerald

Trading Idea

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Andy is looking into a seasonal Crude Oil spread going long June and short May.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Are you an efficient Trader?

Trading Article - Are you an efficient Trader?

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Most traders start out with a dream. And usually part of that dream is that once you’re a successful trader you’ll have a lot more time for the things in life you enjoy spending time with. Your family, friends, hobbies, spend time in nature and start other business opportunities you’ve been dreaming of realizing. Besides making money, for many the main reason to start trading is actually that they no longer want to spend 40 hours a week sitting in a office staring at a screen.

Unfortunately many traders end up doing the exact opposite of that. Staring at their screens for hours each day, looking at charts and quotes. They don’t really have a precise plan of their trading day. Instead they wake up, turn on their charts and wait for what they perceive as a trading opportunity. No need to say that this often leads to overtrading, but let’s say our trader has matured enough to be mostly free from such flaws.

Still being an active day trader he’s trading a lot in and out during the day, but being very talented he usually comes out ahead at the end of the trading day. Trading the E-Mini S&P 500 he manages to make a profit of 2 points a day on average. He’s trading two contracts so that’s 2.0 x $50 x 2 = $200. Doing 10 trades on average each day, paying $5 round turn per trade, that’s 10 x 2 x $5 = $100 commissions we have to subtract. So his actual profit after commissions is $100. Trading for 8 hours each day, that’s $12.50 per hour…for doing a quite exhausting job! Ouch.

Let’s have a look at our second trader. He knows his business very well after having invested a considerable amount of time and money to learn about the markets. Our second trader trades a system with precise trading rules, also in the E-Mini S&P 500. Let’s call it Ambush. He knows exactly at what times of the day he has to take action. In his case, when to place his entry order and when to exit his positions each day. This way he can easily plan his day, knowing that he won’t have to watch the markets at all. Being a professional he takes his trading business very seriously and religiously tracks each trade, checks his fill prices and so on. Still he doesn’t need more than 10 minutes each day to run his trading business. On average he makes about $105 per trade per contract. Never making more than one trade a day, he just has to subtract $5 commissions which leaves him with $100. As he just needs 10 minutes each day to place his orders, that’s $600 per hour on the days where he actually trades! For doing a not very exhausting job…

What a difference compared to our chart watcher! Hope you see the light here. This is huge, and once you realized this truth you can make a big step forwards in your trading career. Herein lies the reason why I decided to move towards systematic trading many years ago. First of all watching charts all day does get really boring once you no longer trade for the excitement, and I had a very different dream of what my days would look like as a trader. But even more importantly I can use all that freed up time for other business ideas, hobbies, to create new systems and to write articles like this one and make additional money helping other traders.

At least I’d suggest that even if you’re day trading discretionary, take your time to really learn about the markets you’re trading. Get some statistics and you’ll discover that every market has times during the day where it makes most sense to trade. Focus your trading activity on these time periods. They’re hardly changing over time so you can plan your trading day nicely. Truth is that most of the time it simply is a waste of time and money to day trade. I can almost guarantee you that you’ll make more money this way than trading all day long, especially after subtracting trading costs.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

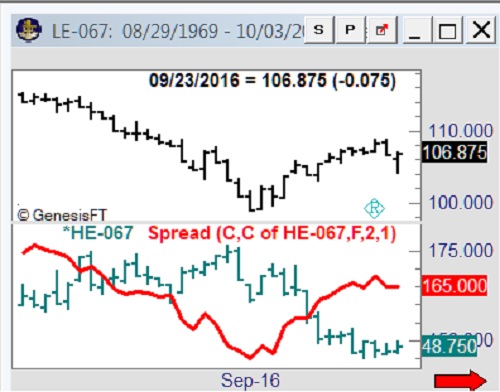

Spreads

I was cruising through my charts one morning looking for an easy spread to trade. I saw that the spread between long Lean Hogs, and short Live Cattle had reached an extreme and was beginning to bottom out. Looking at the prices themselves, I saw cattle price possibly rising, while hog prices continued to fall. I thought to myself, "Aha! Here is my opportunity for a simple observation spread."

The markets are full of these kinds of spreads, if you just look for them. Because cattle and hogs trade with equal point values, it is not necessary to use multipliers to truly see whether or not the spread is making money. Nevertheless, I wanted to see the dollar value of the spread, so I multiplied each leg of the spread by its full point value of $400. That means I entered the spread as 400*LE - 400*HE, and brought up the chart fully expecting to see some kind of entry point. It was there, a 1-2-3 low.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Do you think that what this guy wrote is true?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

"You can get ahead of yourself in this game, and it’s dangerous to get cocky. But I’ve had times where for an hour I could do no wrong. I’m trading and 99 percent of the trades are good, they’re all for 30 or 50 contracts, and I’ll make 10 grand. Then I’ll overextend myself and maybe buy 10 or 15 contracts, fighting the trend just because I know prices have hit a support level. Then prices blow through that support and I can’t get out without losing half of what I made earlier. When that happens, you’ve just got to sit back, take a deep breath, drink a glass of water, and get back in."

I think that there is some truth in what was written, but there is also a lot of bad advice there as well. You can get ahead of yourself in trading – and trading is not a game, it is a business in which it is dangerous to get cocky. We’ve all had our “magic” moments when we could do no wrong. But a truly great trader will learn to take his money off the table and be satisfied with what he made. It is the greedy trader who overextends himself. It is the foolish trader who fights the trend. It is an even greater fool who believes that there is such a thing as “support.” The foolish advice here is that whoever wrote what you quote readily admits that prices blew through so-called support, which makes it not support at all! He has already proved he is a fool by overtrading his account at what he determined to be support. Now he tells you to continue overtrading by gritting your teeth and jumping back in. Whoever wrote that “advice” sounds like a real blow-hard. He claims to trade big-time, but I don’t know any truly great traders who make that many mistakes and then pass it off as advice!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.