Edition 662 - February 17, 2017

Trading Idea - Mixed Meat/Grain Butterfly

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

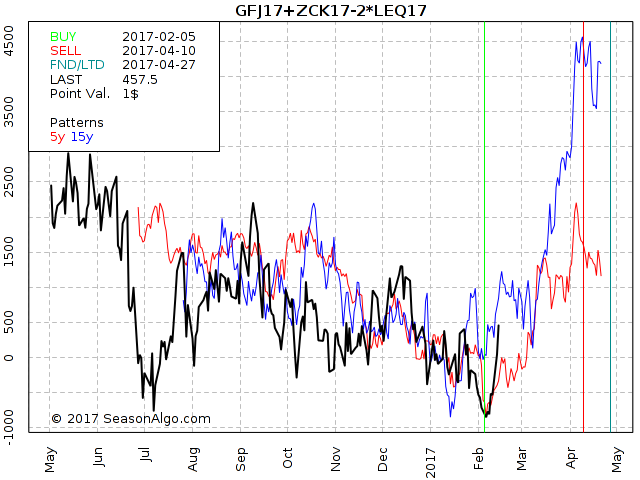

Once again I want to show you a “strange looking” butterfly: Long 1 April Feeder Cattle + 1 May Corn and short 2 August Live Cattle.

As you can see on the chart below the seasonal time window usually opens around February 5 with a close around April 10. Interestingly how precise this spread changed the direction this year. After testing the July low on February 6 it turned around and has been trading higher since then. Maybe it is already too late to enter the spread this year and the spread will not look back. But with these kind of volatile spreads there is always a chance the spread might show some weakness and maybe return to test the break even line again.

If you want to know how we trade this spread in Traders Notebook, please follow the link below.

Traders Notebook Complete had its most profitable year in 2016!

Learn how to manage this trade by getting daily detailed trading instructions, click here.

There is a special deal available for the ones new to our Newsletter.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Why Knowing When Not to Trade is an Edge

Why Knowing When Not to Trade is an Edge

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Traders want to trade. That’s what we feel is our job and that’s when we feel that we’re actually really doing something. And I think that’s why it can be so tough to go through periods of low trade frequency. It just somehow doesn’t feel right. Might be missing out on something. For sure the markets keep on moving and others are trading, right?

But feelings are often misleading, especially when it comes to trading. The fact is that to know when to not take a trade is as important as to know when to put on a trade and be active in the markets.

Whatever approach you’re using to trade in the markets, there is always a time when that approach will actually not give you an advantage in the markets.

That’s why most trading systems have some kind of a market regime filter that defines when to actually follow a signal or not. That filter might measure volatility, check if there’s an up- or downtrend going on or look for periods where the market is not trending at all. Other kinds of filters are limiting trading to certain trading hours or specific weekdays or certain regular news events.

Without these filters, without these periods of standing on the sideline and not trading, it’s very hard to make money in the long run. As whatever money you’ve made during the time when the market was in sync with your trading style, you’ll probably give most of it back if you stubbornly keep on trading when the market is not. One exception that comes to my mind is long term trend following where you simply cannot afford to ever miss a trade and where filtering trades can be very expensive.

But in general, knowing when not to trade and then do exactly that is actually an edge. If you keep on trading all the time, you will on average lose money during these periods where you should not trade. And to avoid a losing trade is at the end of the day as good as having a winning trade. The only difference is that it just doesn’t feel that way. Taking a trade and making $1000 feels like you did something, you see that trade on your daily account statement. If you skip a losing trade, you might not even notice that you just saved yourself from a $1000 loss, and it actually doesn’t even show up in your trade history. Still, you now have $1000 more than you would have otherwise. So remember that and be patient during times of low trade frequency.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Emotions in Context

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

When you put your money on the line, it's hard to avoid getting a little emotional. Beginning traders may be especially prone to experience a roller-coaster ride of emotions, feeling euphoric after a winning streak, yet disappointed after a string of losses.

How well do you handle emotions? Winning traders control their emotions. They don't let their emotions control them. But emotions don't happen in a vacuum. How emotional you feel depends on the context in which you experience emotions. For example, market conditions matter. When the markets seemed to go up in the late 1990s with no end on the horizon, it was easier to stay calm. But after the bubble burst in 2000, many traders learned how hard trading can become. Take the story of a young trader named Bozo. I spoke with him about once a year for three years. His emotional life changed over time, depending on market conditions and his experience with the markets.

At one point in time, stock prices increased with little resistance. Back then, Bozo saw himself as a relatively unemotional trader. He said, "It takes a lot to shake me up. Even if I do have one of those bad days, it just doesn't hurt that bad because I know that I'll probably make it up." It was easy to stay unemotional back then, but after a while things changed.

I asked Bozo about his emotional life a year later after the market had fallen: "The days that I lose a lot are the days that I am too greedy. Maybe I'll have one bad trade in the morning, then I'll be down, and it is frustrating. And then I'll just want to climb my way out. My worst days always start out like that. Then I'll just dig my hole a little deeper all day long. Those are my worst days. That will usually carry over until at least one more day. By then, though, I realize what I did wrong the day before. I take smaller positions at first and just try to get myself a little bit in the positive. I'm fine if I just end up making four or five hundred bucks that day because I'm just slowly climbing my way out of the hole I dug the day before. I'm not out to recapture my losses in one day." With regard to the previous year, Bozo observed, "I get more frustrated than I used to, obviously just because it didn't used to matter so much when I was making money because I knew that I could make it back."

Bozo continued to be introspective about his emotions. One year later, in 2002, when the markets were relatively flat, I asked him what he observed. "To make me realize whether or not I was emotional, I had to go through hard times with trading. I think it's crazy how the market can take you from a high to a low, and back to a high and then back to a low. You think you've got it all worked out, and then six months later, you're thinking of finding a new job. What I realized is that when I'm doing okay, I'm totally unemotional when it comes to trading, like when a new trading strategy has been working. I just sit there and have a good time. Even if I have a bad trade, it doesn't bother me. But when I was having trouble, like earlier this year and late last year, when I was only able to keep my head barely above water, it was really frustrating. I guess that's when you learn more about how emotional you are when it comes to the market. I'm not the kind of guy who is going to throw my keyboard around, but it definitely has a psychological impact on the rest of my day."

Experienced traders say that trading the markets reveals your true nature. You learn how you react to stress and how you react to failure. Over time, Bozo learned more about his emotional life. He went from thinking he was unemotional to thinking that his emotional life was more complicated and depended on his experience and current market conditions. When asked to summarize his emotional experience, Bozo said, "Obviously, when you're doing better, it's much easier to relax and trade. I now see that I can't say I'm always an unemotional trader. It all depends on how I'm doing. I've heard that if you were to see most successful traders who have been trading for 20 years, you couldn't tell if they had a good day or a bad day. They are supposedly that unemotional. You read that all the time. But I have a hard time believing it. Let's see how they would feel after eight months of losses."

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - EWW Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 29th January 2017 we gave our IIG subscribers the following trade on EWW (iShares MSCI Mexico ETF), which was in an established uptrend on the daily chart. We decided to sell price insurance as follows:

- On 30th January 2017, we sold to open EWW Mar 17 2017 39P @ $0.25, ie. $25 per option sold, with 47 days to expiration, and our short strike below a major support zone, about 14% below price action.

- On 10th February 2017, we bought to close EWW Mar 17, 2017 39P @ $0.07, after 11 days in the trade, for quick premium compounding.

Profit: $18 per option

Margin: $780

Return on Margin annualized: 76.57%

This trade was pretty safe.

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.