Edition 663 - February 24, 2017

Chart Scan with Commentary - Traders Trick - Does it work in all markets?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

The Australian dollar had been rising against the U.S. dollar. At the time, I had been in the Aussie dollar for at least 3 years, and in addition to dollar deposits using Australian interest bearing notes I had begun trading iShares. iShares are an index of some of the top companies in Australia. It is through iShares that a trader can trade in another nation and still have the convenience of trading in his own country. Australian companies had been doing quite well supplying China with foodstuffs and raw materials. But in addition to the fat profits these companies were making, their stocks were rising because of the gain of the Aussie Dollar against the U.S. currency at the time. Trading or investing this way is a great way to hedge against a falling U.S. dollar.

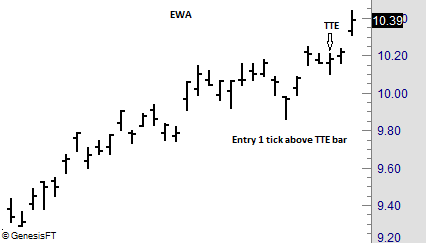

One day, iShares (Symbol EWA) offered up a Traders Trick for entry at a price of 10.24, 1 tick above the high shown at the arrow. Entry was actually made at 10.19, and the shares Closed two days later at 10.39 for a gain of 30 cents, or $300 on 1,000 shares.

The Law of Charts and the Traders Trick work in all markets, even markets as little known as Exchange Traded Funds or iShares.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Self-forgiveness and resolution

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

If your financial losses have injured or hurt your personal relationships, you must apologize and ask those persons for their forgiveness. Most people will forgive you immediately but whether or not they forgive you is unimportant. It is most important that you forgive yourself and resolve not to repeat the same mistakes. It’s also important to realize that if the offended person does not forgive you, it becomes his or her problem. Once you ask forgiveness, the problem is no longer yours. Self-forgiveness and resolution not to repeat mistakes is the best antidote for fear, anger and guilt, the three emotions of personal and financial destruction. Never use living expense money to trade the markets. Traders should only trade disposable income, an oxymoron if there ever was one.

Markets seldom make major tops or bottoms based on any one government report. Many traders have a look of shock on their faces when markets fall after a bullish report, but that is what the market wanted to do before the report was released. There is a natural tendency of professional traders to discount reports and state that the price action was already in the market before the report was released. Fundamental traders should rate reports as: + = bullish, + + = very bullish, 0 = neutral, - = bearish, and - - = very bearish. I traded cattle in the late 1970's and early 1980's and the market moved opposite the reports over 60% of the time the next day and over 70% of the time by the following week.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - GDXJ Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 6th February 2017, we gave our IIG subscribers the following trade on GDXJ (Market Vectors Junior Gold Miners ETF), which had a strong up day. We decided to sell price insurance as follows:

- On 7th February 2017, we sold to open GDXJ Mar 24 2017 33P @ $0.33, i.e. $33 per option sold, with 47 days to expiration, and our short strike below a major support zone, about 22% below price action.

- On 17th February 2017, we bought to close GDXJ Mar 24 2017 33P @ $0.15, after 10 days in the trade, for quick premium compounding.

Profit: $18 per option

Margin: $660

Return on Margin annualized: 99.55%

This trade was pretty safe.

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Latest Blog - How to Approach Trading - Part 3

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

In Part 3 of his series, Andy takes a look at what a good trading plan includes and answers an often asked question, "How do I get started?" Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Why paying close attention to FX trading costs is so important

Why paying close attention to FX trading costs is so important

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

I don’t know if there are still brokers out there advertising that there are no trading costs in trading Forex. But you all do know better by now. If there are no commissions, they’ll simply mark up the spread to get their share, or worse (see latest FXCM scandal) in some way profit from your positions. That’s why I always prefer to pay commissions, this way there’s at least a chance you’re actually trading and your broker isn’t just on the other side of your "trades". Also paying commissions results in smaller spreads which will save you more money in the long run than the commission you’ll pay.

Let’s have a look at the major trading costs in Forex. First of all the BID/ASK spread you almost always have to pay (unless it’s 0 which can happen, and sometimes you’ll even get filled at a better price than expected), then volume-based commissions you pay to your broker for executing your trade and if you keep your trade overnight you got to pay some overnight commissions/swaps. Depending on what kind of orders you are using to enter/exit trades, you’ll also have to deal with slippage to some extent.

As trading costs are a reality, it’s important to be aware of them. If you think you can ignore them, maybe because you believe your trading strategy is so good that a couple of pips don’t matter to you then you should think again. There’s a reason why so many professionals are literally obsessed in trying to reduce trading costs all the time. Over hundreds of trades, trading costs will make a huge difference and many strategies that look very profitable without trading costs will look much worse once reality is factored in.

Now each currency pair has slightly different trading costs and it’s important to keep track of these. To keep things simple, I’ll focus just on the BID/ASK spread for now. But you definitely should also pay close attention to the overnight swaps, especially if you’re trading longer term positions and to trading commissions and slippage if you’re day trading.

A day trading strategy might work nicely in EUR/USD for example when your average spread during liquid market hours usually is about 0.25 pips and the average daily trading range (high-low) is about 80 pips. That gives you a daily range (80) to spread (0.25) ratio of 320 (80/0.25 = 320). If either volatility or liquidity dries up in a market, this ratio will drop too. The higher the ratio, the better and for every strategy, there is a point where it will stop being profitable should the ratio drop below. That’s why this is an important ratio you should always keep track of.

Now let’s compare that daily range to spread ratio to EUR/CHF where your average spread during liquid market hours is about 0.5 pips and the daily range is about 30 pips. That’s a ratio of just 60, meaning trading in EUR/USD is about 5 times „cheaper“ in our example. Due to the lower volatility, you’ll also need to trade more contracts than in EUR/USD to get the same bang for the buck which means you’ll also have to pay more commissions. Will your day trading strategy still work in EUR/CHF despite the higher trading costs? That, of course, depends on the strategy but you better do the math and see if it’s still worth trading it in that market after trading costs.

The higher your trade frequency, the more important trading costs are and the fewer markets will your strategy be profitable in. The reason for this is the ratio between the average trade result and the BID/ASK spread + commissions. If on average you make 3 pips per trade, an average spreads of 0.5 pips is much more of an issue than if you’re trading on a longer timeframe and make 30 pips on average.

That’s why it’s so easy to come up with a strategy that trades on a 5-minute chart and looks like it will make you rich in no time until you add trading costs. Trading costs will kill you here unless you’re very efficient in your trade execution (which most retail traders simply cannot afford).

Whenever I develop a new trading system, I run different kinds of simulations to get a good idea of how sensitive the system is to trading costs. This way I get a pretty good idea if it’s actually worth trading the system in the real world. Once I start to actually trade a system, I keep close track of its trading costs. Then I compare the simulated trading costs (what I expect) vs. real trading costs (what I get in real trading). This way I’ll find out rather quickly if I underestimated trading costs or maybe have been too pessimistic and overestimated them. During the last 6 months, for example, I got about 25% better execution on average than my simulated results for AlgoStrats:FX. That’s fine for me as it’s a close enough estimation for my trading style and I’m rather slightly too pessimistic about trading costs than the other way around.

There’s a lot more to say about this topic, but for now, I’d like to wrap it up with my advice that you better pay close attention to trading costs.

Happy Trading!

Marco

Click here to learn more about Professional Trader Marco Mayer - AlgoStrats.com!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.