Edition 664 - March 3, 2017

Chart Scan with Commentary - Anticipation

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

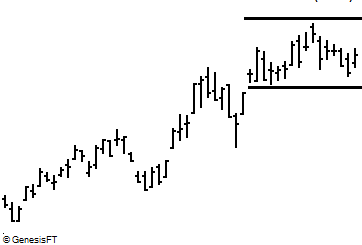

With prices overall being in an uptrend, what should be our anticipation for prices exiting the consolidation?

As we view the chart, we see that prices are off their recent highs and have made 5 correcting bars prior to the last bar shown. The question is will prices stay in consolidation, break out to the upside, or break to the downside?

According to the Law of Charts and the Traders Trick the current anticipation is for sideways action. When there are more than 3-4 bars of correction, the percentages change to favor consolidation. Adding to this concept is the fact that the last 5 bars have either opened or closed inside of a "measuring bar". The measuring bar is the long bar that took place on November 18. In fact, there is another way to look at this chart which you will see below.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - When Low Probability Setups Seem Attractive

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

“I’ll worry about it later?” When trying to deal with the fact that we must eventually cope with an unpleasant event, such statements help us get through life. We often put off things we don’t want to do, hoping that we will gather enough energy and enthusiasm to deal with them in the future. Take your taxes for instance. Do you wait until the last day to pay them? Why not start working on your taxes today? Most people avoid gathering and organizing their financial records until they need to. We prefer to put off facing an unpleasant reality, such as doing our taxes, until the very last minute. The same thing seems to happen when we make trading or investment decisions. Researchers suggest that people may be willing to invest in low probability setups as long as they don't have to deal with the consequences of the trade immediately.

Research participants were asked to imagine making various economic decisions and to indicate which economic decision they would prefer and under what conditions. In the first hypothetical economic decision, the payoff was high, but the chance of receiving the payoff was low. In the second economic decision, the payoff was low, but the chance of receiving the payoff was high. People’s preferences depended on whether the payoff was to be received immediately or in the distant future. People indicated that they would be willing to accept a low probability of success if the potential payoff was high and they didn't need to find out what happened until the distant future. People did not prefer an economic decision that had a low probability of success if they had to deal with the outcome of the decision in the near future. Indeed, if they had to make an economic decision that had consequences for the near future, they would take the option of receiving a low payoff as long as it had a high probability for success.

These research findings may explain how decisions about long-term trades and investments are made. When it comes to long-term investments, people are willing to risk money on a low probability setup as long as they believe the potential profit is high. This is somewhat irrational, however. The probability of success is an important element when deciding whether to risk capital. It doesn’t matter whether it is a long-term investment or a short-term trade, a trade setup should have a high probability of success. But people have a natural human tendency to accept a low probability setup as long as they don’t have to face the outcome until the distant future, and they believe that the potential payoff is high.

When making trading or investment decisions it's necessary to consider all possible aspects of a trade. It is essential to always trade high probability setups. If you trade low probability setups, you are likely to lose money in the long run. But greed can bias our decisions. If we believe that the potential profits are high, we tend to irrationally invest capital even when the odds of success are low. In the end, however, it's more beneficial to look for setups that have a high probability of success, even if it means standing aside until we find them.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - MRK Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 2nd February 2017, we gave our IIG subscribers the following trade on MRK, after an earnings gap. We decided to sell price insurance as follows:

- On 3rd February 2017, we sold to open MRK Mar 24 2017 58.5P @ $0.35, i.e. $35 per option sold, with 51 days to expiration, and our short strike below a major support zone, about 9% below price action.

- On 22d February 2017, we bought to close MRK Mar 24 2017 58.5P @ $0.10, after 19 days in the trade, for quick premium compounding.

Profit: $25 per option

Margin: $1,170

Return on Margin annualized: 41.05%

This trade was pretty safe in spite of the very low implied volatility environment we are now in.

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Latest Blog - How to Approach Trading - Part 4

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

In Part 4 of his series, Andy explains a crucial point for successful trading and what to avoid. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Why Entry Signals Are Important

Why Entry Signals Are Important

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

We hope you will enjoy one of Marco's popular videoes posted back in October of 2016 - it provides a good trading lesson.

0

Click here to learn more about Professional Trader Marco Mayer - AlgoStrats.com!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.