Edition 667 - March 24, 2017

Men working the floor at the Chicago Board of Trade. Photograped by Stanley Kubrick for Look Magazine in 1949.

Image is in Public Domain and available through Library of Congress

Latest Blog - How to Approach Trading - Part 7

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

It is critical to develop a well thought out and organized trading plan. It is then important to have...read more.

Begin reading from Andy's first blog in his series!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Ambush Signals

Ambush Signals

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Learn all you need to know about our Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System? What's the idea behind it? Ambush Signals trades in a variety of markets:

- Futures: Stock Index, Commodity, Currency, and Interest Rates

- Spot Forex Markets

- ETFs

- CFDs on any of the supported markets (results may vary, depending on your broker's quotes)

Time-Proven System

Easy to Follow

Stress Free Day Trading

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Can you have it both ways?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Many traders are highly concerned with reducing their risk, and/or getting out when their positions turn against them. The normal method for doing this is to use a stop order. In his books, William O’Neal advocates getting out after an 8-10% loss. Many other authors of trading books also suggest this approach.

This is an adequate approach, except for two details never mentioned in most books: the first is that you don’t know when the 8-10% is going to happen; the second is that the price can gap over your 8-10% stop, causing you to exit with a greater loss than planned.

However, there is a way to know exactly when to exit, and how much of a loss you are willing to accept. More importantly, the stock can gap as much as it wants, but you would lose only the predetermined amount you decided upon when you entered the position.

The Protective Put or Call is a synthetic options strategy that allows you to have predetermined risk and unlimited growth potential. A Protective Put is used for a bullish position, and a Protective Call is used for a bearish position. The following example shows Protective Puts. A good Protective Put position is usually one that limits your risk to about 6%. This strategy positions you at least 2 – 4% better than would using the conventional wisdom of an 8 – 10% stop.

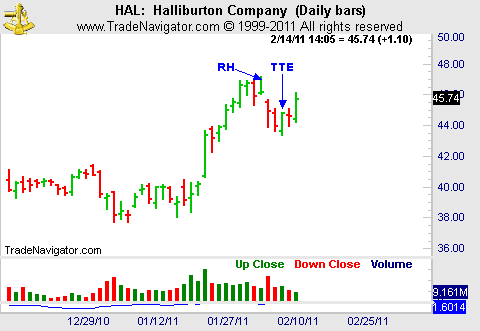

Additionally, there is a method for entering a Protective Put with very little, and sometimes negative, risk. You enter it using the Trader’s Trick Entry (TTE), using the principles of the Law of Charts. In the following example, our entry uses a Ross Hook (RH) chart formation with the TTE.

Trading is never without risk, but the length of time for which you accept that risk is under your control. When you are able to control events, the probability of your making a profit increases dramatically. The question is, how do you use the Law of Charts to create negative risk more quickly, without any additional risk when entering the position? Assume the following:

Stock/ETF price = $50

Put strike price is $60 and 6 months' out

The $60 Put premium is $13.80, creating a 6% ($3.80) risk on capital 1

7-Day Average Trading Range (ATR) is 1.50

Examining our situation using 100 shares, we have:

Traditional 8 – 10% stop loss

| Cost of Stock/ETF | $ 5,000 |

| Stop Risk (10%) | $ 500 |

| Downside Gap Open Risk | ??? |

| Total Risk | Unknown |

| Protective Put | |

| Cost of Stock/ETF | $ 5,000 |

| Cost of Put | $ 1,380 |

| Total Cost | $ 6,380 |

| Put Sell Rights | $ 6,000 |

| Total Risk | $ 380 |

| Downside Gap Open Risk | $ 0 |

| Total Risk Guaranteed | $ 380 |

From the initial entry, the Protective Put limits our risk without any potential for more.

How do you reduce the risk even more? With the above parameters you would have to make up $3.80 upon entering the position, without risking more than 6%. That would be the same risk as if you had entered the Protective Put directly. To make up the $3.80, you will use a combination of Options and Stock to reduce your risk to near zero or less.

First, you need to determine the Law of Charts' formation with which to enter. The preference would be to enter a position with momentum. Therefore, look for a Ross Hook in a trend, and select your entry point according to the Law of Charts.

1 Rounded to the nearest option premium.

As mentioned above, there is no such thing as risk-free trading. However, the amount of time for which you accept that risk is your decision. The total time to execute this entry strategy will be 1 day. During that day, you employ the traditional stop methodology for your positions. However, since you will enter the positions after the market opens, there is no chance of your experiencing a gap down on the open.

The second step is to divide the risk amount of $3.80 into a portion for the stock and a portion for the options you will use. You will then employ a technique like the double or triple ETF to gain an advantage. For a double advantage, buy a long Call for each 100 shares of stock purchased. For a triple advantage, buy 2 long Call contracts. Buying long Calls requires less margin than does selling short puts. Our allocation for the triple advantage will be:

Stock/ETF risk = $1.80

Long Call Risk = $1.00 x 2 = $2.00

Total Allocated Risk = 3.80

These are the stops you will use for the stock and 2 option contracts when you enter them according to the Law of Charts and TTE methodology. In this manner, you are risking the same amount as if you entered the Protective Put directly. Do not get greedy, you just want to reduce your risk.

The third step is to place contingent orders to enter the stock and 2 option contracts with stops of $1.80 and $1.00 respectively. Be sure to select an option with a delta of 75 or greater. It will not take much movement to get close to a negative risk Protective Put with this set up, as it is very likely to occur within one day.

The 7-Day ATR (Average True Range) is 1.50; its significance is how much you can expect the stock/ETF to move in one day. Do not expect to get 100% of the movement: 70% is good, and 80% is very good. This is what you should be looking for as your decision point to exit the Long Call options and enter the Protective Put.

| Stock Increase of approximately | $ 1.20 |

| Option increase of approximately $0.75 x 2 | $ 1.50 |

| Decrease in $60 Put of approximately | $ .40 |

| Total Advantage | $ 3.10 |

Protective Put Risk

| Cost of Stock/ETF | $ 5,000 |

| Cost of Put | $ 1,380 |

| Total Cost | $ 6,380 |

| Put Sell Rights | $ 6,000 |

| Total Risk | $ 380 |

| Downside Gap Open Risk | $ 0 |

| Total risk guaranteed | $ 380 |

| TTE Strategy | $ -310 |

| Total Risk | $ 70 |

| % Risk | 1.1% |

Can and does this work? Yes, it does, but you have to have your plan in place before you jump into the market. You must have your plan in place BEFORE you enter the trade

There is one more step to this trade, and that is how to set yourself up for unlimited upside potential. This is a bullish strategy, and the two simplest methods are to do nothing and just let the stock appreciate, or to sell a Call at or above the strike price of the Put.

These are very effective and profitable strategies. However, selling a Call will remove you from any profits above the strike price of the Call. Doing nothing requires the stock to rise $10.70 before you have any profit. There is a third and more effective trade: sell a Bear Call Spread at or above the Protective Put strike price.

| Total Current Risk | $ .70 |

| Sell Bear Call for at least | $ .70 |

| Total Position Risk | $ 0 |

| % Total Risk | 0% |

The advantage of using a Bear Call Spread instead of the Covered Call is that you participate in the appreciation of the stock when it rises beyond the $75 strike price of the short Call. The worst you can do is 0% return, and the best is unlimited. However, as the expiry date approaches you will have to make a decision to sell the long Call to take your profits.

Other methodologies for adding profits include selling Puts when the stock/ETF is rising, taking small profits. When the stock is falling, selling the stock and buying it back at a lower price provides the same return as short selling, but without the risk.

In the above example we used a stock. You can use this strategy equally well with futures contracts with one precaution. Whereas a stock will not expire, a futures contract will expire, so you must carefully structure the trade with the understanding that the expiration date for a futures contract must be taken into consideration.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading for a living

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading for a living involves more than getting in and out of the market at the right time, and more than thinking about moving averages and indicators. Trading is a business, not just a job, and every business in the world has to be managed. Every business involves the managerial functions of organizing, planning, delegating, directing, and controlling. If you, the trader, are to perform these functions well, you must learn to practice self-discipline and self-control.

It is actually painful to see traders who are highly successful in their present occupations, yet who come into the business of trading for a living using few, if any, of the managerial skills that make them winners in their own area of specialization. They have entered into a high-stakes venture, but are acting as if there were no way to lose. By omitting the functions of management, they often lose a considerable amount of money. They blindly throw themselves, their time, and their capital resources at the markets.

There is much more to the business of trading for a living than just trade, trade, trade, with no regard for the managerial aspects of trading. Traders are generally defeated by their own bad habits.

If you have any bad habits, expect the market to discover them and destroy you with them. In the business of trading, you have to take every step possible to save yourself the pain of having the markets discover your weaknesses. You need to find those weaknesses yourself, before you are hurt, and learn how to deal with them. Do you stay in too long? Do you expect too much from a trade? Are you greedy? Do you find yourself ending up "the greater fool?" Are you overtrading? Are you selfish? Are you fearful? If you have any of those bad habits, they are problems; and for problems, there are solutions.

If you think trading for a living is the same as investing, you are way off base. You need to realize there is a vast difference between the business of investing and the business of trading. You need a wake-up call if you are trading from desperation or the opinion of others — even your own opinion is worthless! You cannot change the market with your opinion. The only thing you can do if you want to win is to get in step with the market.

If you are looking for the holy grail of trading, or if you are trading because you’re bored, then you need to stop, think, and take a good look at yourself.

Until you establish your trading as a business, you will find that you don’t know what it means to let your profits run — you won’t have any consistent profits! Until you discover your real personal risk tolerance, you won’t really understand the meaning of risk. True risk management involves matching your risk tolerance with the risk in the marketplace.

If you are losing money, it’s because you don’t actually understand losing! Believe it or not, there’s an art to losing in the market. You have to learn how to control your losses; when you do, the wins will take care of themselves!

Are you a trader who tries to reinvent the wheel? Are you a trader who shoots his mouth off? Do you lie to yourself? Do you change your trading plan in mid-stream? You need to fix these bad habits.

Are you getting out of a trade too soon? Are you afraid to be wrong? What are your character faults? Do you see them?

Do you suffer from lack of humility? Are you throwing good money after bad? Just what is your sad but true story?

If you’re a losing trader, you need to be taken apart at the seams, put back together, and placed on the path to success.

The business of trading for a living involves making and taking profits. In addition to finding the solutions to your problems, you have to learn the chart patterns for success, as well as how to manage trades and manage yourself.

Over fifty-six years ago, I (Joe Ross) went through the very same problems you face today. I had to deal with those problems, and believe me, I had many of the bad habits discussed in this article.

Partly to help myself, and partly to help others, I wrote down the problems and solutions in what has become a classic manual for traders. It’s called Trading Is a Business, and it’s about making money in the markets. The book deals with solving the problems most traders have. Since I wrote the book, I have discovered that there are numerous traders who are successfully trading for a living through using what they learned in Trading Is a Business.

Trading Is a Business caused one trader to write, "I have been trading for six years with limited success. Joe’s techniques have really brought my trading into focus. Joe’s trade and money management techniques in particular, have helped me to become more consistent in my trading. Learning to take some profits early on has made a huge difference." Simon H.

I knew I had succeeded at getting my message across when I received this email: "Learning that trading is a serious business has changed my life. I was about to give up, when I began to fully realize just how serious this business really is. However, now that I finally woke up, I am a winning trader making money for myself and my clients." Mark C.

My book has helped thousands of traders. You, too, might consider studying your own copy of Trading Is a Business.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - MOMO Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 7th March 2017, we gave our IIG subscribers the following trade on MOMO, right after earnings. We decided to sell price insurance as follows:

- On 8th March 2017, we sold to open MOMO Apr 21 2017 22.5P @ $0.20, i.e. $20 per option sold, with 43 days to expiration, and our short strike below a major support zone, about 25% below price action.

- On 20th March 2017, we bought to close MOMO Apr 21 2017 22.5P @ $0.05, after 12 days in the trade, for quick premium compounding.

Profit: $15 per option

Margin: $450

Return on Margin annualized: 101.39%

This trade was pretty safe in spite of overall very low implied volatility levels.

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade (see recent EWZ example in Newsletter Edition 649 found in our "member only" area under the archives tab).

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.