Edition 669 - April 7, 2017

Ambush Signals

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Learn all you need to know about our new Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea in Soybean Oil

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

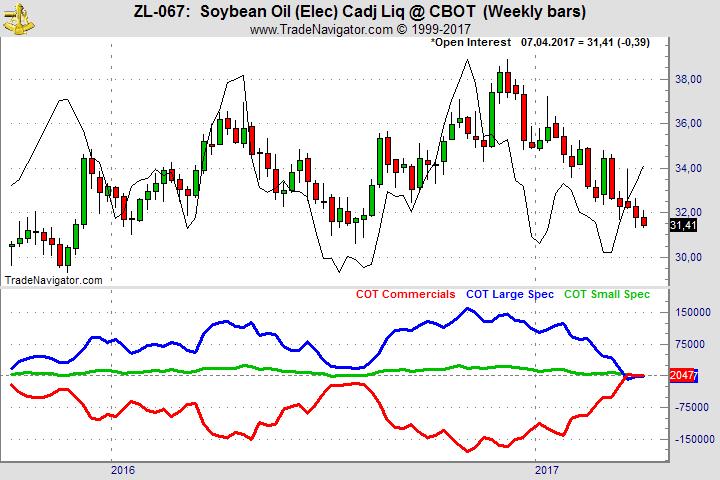

Today, I want to have a closer look at the Soybean Oil chart. As you can see from the chart below, Soybean Oil has been moving lower for several months and is coming close to the level around 30. This level is interesting to me because ZL bounced off of this level a few times in the past. Will it do the same this time? I have no idea, but we will see.

In addition, the commercials have turned to net long the first time for a long, long time. The last time commercials were net long was in June 2014.

Both, the long term chart and the COT chart, together with good Implied Volatility put Soybean Oil on my watch-list. I am now waiting to see what happens around 30 or 31 before I jump in to sell puts probably using the July contracts.

Learn from us by receiving daily detailed trading instructions on how to manage this trade and others! Click the below link for more information:

Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Latest Blog: Unlike many games and sports, trading has an additional factor: the market!

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Trading is more than just "a game". Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Trading options and futures combinations

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Option traders trade options, futures traders trade futures, "and never the twain shall meet." But why is it that way? Why are people who are trading options and futures combinations so rare?

Years ago, I set out to discover why we don’t see people trading both options and futures in order to get the best features of each. What I discovered is that option traders were scared of the underlying futures, and futures traders were afraid of the complexities of trading options. The result was that I couldn’t find a single person who was trading options and futures simultaneously.

What I have trouble understanding to this day is why traders don’t see that combining trading options and futures makes the trading of both much easier, and gives them the best of both worlds. What do I mean by that?

Let me give you an example that will show you why trading options and futures within a single strategy is a whole lot easier than trying to do the job using either options or futures separately.

Let’s say you want to create what is known in option trading as an "Option Box."

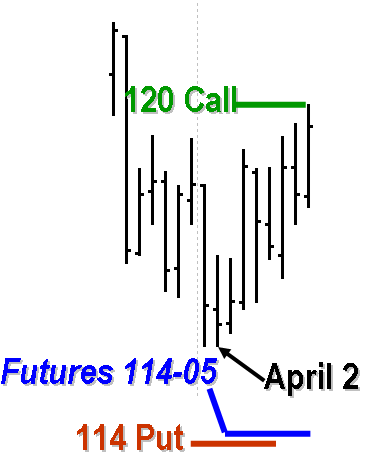

To create an Option Box, you must first create a synthetic long or short position. In this example let’s say you think prices will rise, so you want to be artificially long. You buy a call three strike prices distant from the current price of the futures, and you sell a put two strike prices distant from the current price of the futures. You do this only if you can achieve a satisfactory credit in your account for doing so.

Since we are talking here about trading options and futures, at the time we complete both transactions, we are synthetically long futures. (This same thing can be done with stock shares, CFDs, or Forex pairs.) Being synthetically long, we are now vulnerable. In the event that futures prices fall, we would be in trouble.

How would a straight options trader protect from the possibility of prices falling? Typically, the trader would buy an option at a strike price more distant than the one he just sold.

However, doing that would probably create two problems:

- Buying the more distant strike price for protection could or probably would eat up all or most of the premium credit earned by entering the position to begin with.

- The more distant strike price might involve more risk than could be had by protecting another way.

What is another way? The trader trading options and futures could simply place an open-order, good-till-canceled sell stop in the futures, anywhere in front of or behind the strike price of the option sold, thereby more closely tailoring the amount of risk he is willing to take. There are even more benefits to this strategy:

- The open order short futures has zero costs associated with it. It is a free hedge against the possibility of falling prices.

- There is no margin requirement for the short futures unless it is filled.

- There are no commissions to be paid until the short futures is filled.

- There are no Deltas to worry about because the futures position is always at full Delta and cannot decline from full Delta.

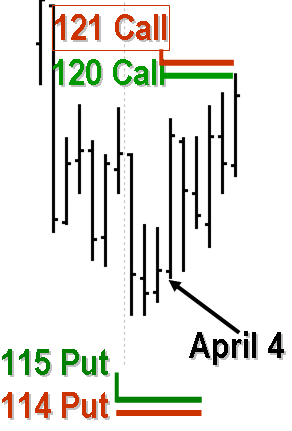

When trading options and futures with the objective being to create an Option Box, the trader now needs to close the box as quickly as possible. To accomplish that, he creates another synthetic futures position. This time he needs to sell a call and buy a put to become synthetically short futures. The trader needs to sell a call further distant from the call he bought, and buy a put closer in than the put he sold. And just as with the initial position, he should attempt, if possible, to accomplish the transaction with an additional credit to his account.

With the box closed, it is impossible to lose. By trading options and futures, the trader has opposing synthetic long and short futures, which now constitute a bear spread and a bull spread.

This strategy in combined trading has even further benefits:

- The closed position carries a guaranteed win. The trader owns the inside of the box and is short the outside — he has a covered call and a covered put. The original open-order short futures position is no longer needed and can be discarded.

- It eliminates the cost of having to buy one additional option that presumably would expire worthless or be sold for salvage value.

- The second synthetic futures position can be put on with a debit as long as it does not use up all of the credit originally earned from the combination of trading options and futures.

- An option model is not needed to trade this strategy (although a model could be helpful in extracting the most credit).

- As long as prices remain inside the box created by short options, the trade will expire and the trader gets to keep the premium earned.

- If prices break out of the box, in addition to the premium earned, the trader will enjoy a capital gain equal to the money earned between his long call and the more distant short call.

In trading options and futures combinations, an option box begins like this: Short a 114 Put, long a 120 Call, protected by an open-order sell stop in the futures.

In trading this combination, an option box ends like this: Short a Call, long a Call; long a Put, short a put.

This is just one example of the innovative way traders can trade using combinations of options and futures. There are many more examples and explanations included in the book I wrote entitled Trading Optures and Futions, which is, of course, about various combinations of trading options and futures.

Follow the above link to find out how you can learn more about trading options and futures to realize the best of both worlds.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading Discipline

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading discipline exists in two distinct parts:

-

Before your order is filled.

-

After your order is filled.

Let’s look at each of these categories, because both are tremendously important.

Trading Discipline Before Your Order Is Filled:

Here we are talking about all the things you do as a trader that require the consistency that comes from having good habits of preparation. Let’s look at good habits in terms of a series of questions:

- Do you research your trades?

- Do you study the markets?

- Do you regularly engage in chart analysis, technical analysis, fundamental analysis - even all three?

- Have you studied every kind of order available to you? Have you built strategies around the types of available orders, and have you come up with tactics -- ways to implement those strategies?

- Have you thoroughly mastered your trading software and the platform from which you trade?

All of these are part of trading discipline, and still there’s more:

- Have you practiced paper trading or trading on a simulator before launching a new strategy? This is especially necessary if you have never before traded.

- Do you have plans for what you will do if your computer goes down in the middle of a trade? What will you do if your data feed stops working? What will you do if you inadvertently place a wrong order — or your statement shows an order you didn’t place, or doesn’t show an order you did place?

Taking care of the seemingly little things are all part of trading discipline, and I’m sure I haven’t covered everything. My purpose is to get you thinking!

Trading Discipline After Your Order Is Filled (Also called Self-Control).

There is a saying in martial arts that goes something like this: "If you are suddenly and unexpectedly attacked, you have two seconds in which to make a rational response." This response must come automatically, as part and parcel of who you are, and the response is gained through disciplined practice and repetition. Another way of describing this kind of trading discipline is to call it self-control.

All the discipline practiced before your order has been filled, including the trading discipline derived from practice and repetition, finally comes into play as self-control in a battle situation. The moment you are filled you are in battle, and if you are not fully prepared you will begin to behave emotionally. Without the discipline gained through practiced repetition resulting in self-control, you will begin to act irrationally, emotionally. Fear, greed, pride, guilt, and other emotions will come into play, causing you to fail to carry out your strategy or to implement the tactics you need for fulfillment of your trading plan.

How Do You Gain Discipline and Self-Control?

Many, many years ago, I was in the same situation in which many of you find yourself today. You are asking yourself, "How can I acquire the discipline and self-control I need to become a successful trader?

When I asked myself the very same question, I eventually discovered the solution. I began to chart my life. After all, chart reading was a huge part of my trading life. Chart reading was what I did every day. My entire world concept revolved around reading charts. Charts were one of the main ways through which I perceived the world around me.

There was another aspect to trading discipline that intrigued me. I had always heard that if I wanted to be a winning trader, I had to keep my losses small and let my winners run. Wow! Great idea, isn’t it? But no one ever showed me how to do it!

I was now confronted by two mountains. The first was how to chart my life, and the other was how to keep my losses small and let my winners run.

The answer to both seemed to come at the same time. By charting my equity, it became crystal clear to me as to how to keep my losses small and let my winners run.

Charting my life was somewhat more difficult. I had to think hard about which factors of my life most affected my trading. I had a trading life, but how was I to break it down into chartable pieces? And what about my emotional life, how did that affect my trading? And there were still other life categories that affected my trading: my relational life was one; my financial life was another; and my spiritual life was yet another.

Eventually I came up with two tools: one I called the "Life Index;" the other I called the "Equity Evaluator." I laboriously maintained these tools manually until the computer age. Both of these tools have now been digitized, which makes it extremely easy to enter the data and quickly see the patterns of results. Now both tools are available to assist you with your trading discipline: learn more about the "Life Index for Traders” and the “Equity Evaluator."

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - SLW Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 22nd March 2017, we gave our IIG subscribers the following trade on SLW, right after earnings. We decided to sell price insurance as follows:

- On 23rd March 2017, we sold to open SLW Apr 28 2017 18.5P @ $0.20, i.e. $20 per option sold, with 35 days to expiration, and our short strike below a major support zone, about 14% below price action.

- On 31st March 2017, we bought to close SLW Apr 28 2017 18.5P @ $0.10, after 8 days in the trade, for quick premium compounding.

Profit: $10 per option

Margin: $370

Return on Margin Annualized: 123.31%

This trade was pretty safe in spite of overall very low implied volatility levels.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.