Edition 670 - April 14, 2017

Can you ever be sure that you have an edge in trading?

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Thank you for your feedback on my last article "Having an edge in the markets". Some of you have been brave enough to take that article to the next logical step and ask the question most traders hardly dare to ask.

Here's an email I got: "I have experienced all the things you described. The thing that I always wonder about is how do you know if you have a real trading edge? Every time I have a winning period and then move into a period of drawdown I start asking myself, "Do I really have an edge or am I now just giving everything back because I don't?". Is there a way to have an assurance that your methodology has an edge? Is it possible to have that confidence?"

Definitely, one of the hard questions when it comes to trading. And one that makes most traders feel very uncomfortable for a reason. I myself kind of blanked out each time it came to my mind for years. Why? Probably because I already knew that I wouldn't like the answer too much. And it's much easier to just move on with some magical thinking and decide to "trust in your guru" or "believe what you've read in a book".

But one day every honest trader has to face this, so let's not lose time and dive right into it.

First, let's redefine the question. I'll assume you have read the last article and if you didn't, now is a good time to do so. In the article, we discussed that a casino has an edge at the roulette table, a real edge that is indisputable and 100% real. You can explain it in a few sentences, it has been there 10 years ago and will still be there in 10 years as long as the rules of the game don't change. The house has an advantage, and the owners of the casino can be 100% confident about this.

How's the situation in trading? Are there edges equal to the house advantage of a casino? And the answer is actually yes, here are a couple of examples:

- When most trading still happened in the pits, traders who had a seat at the exchange and were trading directly from the pit had an edge. They could see the big players placing their orders, immediately see/hear/feel when the market started to move and jump on the move early. By the time the retail traders called in their orders to join the trend they could already cash in. Notice that almost all of these successful pit traders failed to make money when they were forced to trade in front of a computer screen without that locational advantage. Many of them are now trading gurus...

- Market makers who were front-running orders. These are almost gone these days in electronic trading, but HFT trading algorithms have actually taken their place. They usually have a very small speed advantage, being a bit closer to the exchanges than everyone else. And a huge part of their game is running the same strategies as the human market makers did back in the days. With smaller amounts but a lot faster and at much higher frequency.

- Arbitrage opportunities, trading the same stock but on different exchanges for example to exploit price differences. This was a really nice edge but the margins got smaller and smaller over the years as the markets became more efficient. Nowadays there still are some opportunities in markets like cryptocurrencies or developing markets in countries that are just opening up to the global world. But they're not easy to find and the profit margins usually are very small.

There's more, but the truth is that all of that kind of sure thing edges I know of are gone or too expensive to exploit for a private trader. One example of this is HFT trading where you need a serious amount of money to get a fast enough connection to the exchanges and super cheap trading costs to make this really work. Unless you have that, HFT trading is a sure way to ruin due to the trading costs you have to pay and getting beaten constantly by faster HFT trading algorithms.

Now let's move on to the kind of edges most of us are looking for on a daily basis. These aren't sure thing edges like the one the casino has. Let's call them speculative edges. One might be that during a certain time of the month's stocks tend to move higher. Or a chart pattern that increases the odds of prices to move in a certain direction. Or a trader who believes he has exceptional gut instincts about where the markets will move. It could also be a specific system/method like the well-known turtle system.

What differentiates all of these speculative edges from the ones we discussed before is that they're always uncertain. A trading method like the turtle system might work for a decade and then stop working. The reason for this might be that too many people are doing the same thing or because the markets change. The same can be said of a chart pattern. Markets, market participants and market relationships change all the time. Some markets even completely disappear. And so do market inefficiencies.

Because of that, truth is you can never be sure if what you believe to be an edge actually still is an edge.

But there are things you can do to increase the odds of an edge being valid and to make this a bit less of an issue.

First of all, don't just blindly believe and bet your money on a chart pattern/method/idea because it's on some website, a trading guru tells you about it or you find it in a magazine/book. I can honestly say that I've looked at most of what's out there in the trading world (for free and expensive/premium products). Truth is that even when you ignore the obvious bullshit it’s very hard to find any real edges in what's on offer out there.

Also just because something sounds logical and reasonable doesn't mean it will actually give you an edge. This is a very common scheme in the trading education world. We all love these little stories and explanations as for other areas of life, this actually works quite well. But not in trading.

Here's an example: "this price pattern shows you clearly that the big players in this market bought at price X, after which prices moved higher very strongly. So the bulls clearly won and the traders who are short have to cover their position once price Y is hit." Sounds logical, makes some sense, could be true right? But all of this is just an interpretation of what everyone can see on a price chart. It doesn't mean that bla-bla actually has any predictive value. The opposite could be as true!

So what to do? I suggest to always backtest and validate any trading idea. Yes, you'll still just look at the past and backtesting has its flaws but it surely puts you ahead of a trader who doesn't backtest at all. If you don't believe in backtesting, simply ask yourself if you would still trade a chart pattern if you'd know that it lost money every year for the last 10 years in the market and timeframe you plan to trade it. I wouldn't and that's why I want to know at least that much before betting my money on an idea.

Backtesting the right way is not easy. You need to learn how to do it as well as possible, knowing it's limitations and flaws. Do your best to avoid over optimizing, make sure your backtest is statistically sound and you have enough trade samples (no, 30 is not enough). Evaluate trading costs correctly and use high-quality historical data. Depending on the strategy, use out of sample validation, walk-forward optimization, cross validations and monte carlo simulations.

If you're doing proper backtesting, you'll be way ahead of all the traders out there who just blindly trade some signal. You'll know a lot more about the possibly good signals and you'll have filtered out tons of strategies that you now know for sure have no edge whatsoever.

Even now though you'll still not know for sure if your strategy really has an edge or not. You've done all you can to strongly improve the odds but it still is a speculative edge and should be treated as such.

That’s why I see trading systems as investments. After having done my research, I might decide to invest in a trading system. And like investing in stocks, I'll diversify as good as possible by investing in multiple systems. This way if some of my systems are actually just "data accidents" that somehow still made it through my strict system development process, it's not going to be a disaster as long as the other systems perform as expected.

I believe that's as close as you can come to a sure thing edge as a speculative trader. Of course, that's not what traders want to hear but it's always much better to know and be aware of what’s true rather than to ignore it.

Happy Trading!

Marco

PS: If you know of any sure thing trading edges out there, please email me, This email address is being protected from spambots. You need JavaScript enabled to view it.!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

When it comes to trading...more-less-confused.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

When it comes to trading it seems that the more you know, the less you know, and the more you become confused.

People have the tendency to believe that the accuracy of their forecasts increases with more information. This is the illusion of knowledge - that more information increases your knowledge about something and improves your decisions. However, this is not always the case - increased levels of information do not necessarily lead to greater knowledge. There are three reasons for this. First, some information does not help us make predictions and can even mislead us. Second, many people may not have the training, experience, or skills to interpret the information. And, finally, people tend to interpret new information as confirmation of their prior beliefs.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Why don’t more people know about spreads?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Could it be that those who are in the know don’t want YOU to know?

Spreads are kind of a strange thing to be writing about in a trading newsletter the goes out mostly to traders who are probably trading everything and anything except spreads. You see, trading spreads on futures contracts is mostly for people "in the know," but there are few who know much about spread trading.

Since spreads can be traded strictly using spread orders shortly after the Open or during the Close, it really doesn’t matter where you live on this planet should you care to take advantage of spread trading. But why would you want to do that? I suppose I’d better answer my own question: It’s because of the many, many advantages spread trading has over every other kind of trading I’ve seen in my decades of trading experience.

It’s truly amazing that people don’t know much about spread trading, and please don’t confuse it with "spread betting", they are not at all the same thing. What’s startling about it is that there is more refined information about trade selection when it comes to spreads than you can find in any other trading venue. With so much great information available about which spreads to enter, you have to wonder why so few people know about spreads.

A spread is the arithmetic difference between the prices of two outright contracts. You simply subtract the one you want to sell short from the one you want to buy long. Technically, you can spread any two contracts you care to, but normally a spread is done between two futures contracts that are in some way related to one another. The reason for using futures to do spreads is that the US exchanges offer substantially reduced margins for trading them.

Trading futures spreads brings you a whole new trading experience. Is there anyone out there who would not want to trade free of any costs for data? It is possible when trading spreads.

Can you imagine situations where even though prices in the underlying are moving sideways, you will be trading a chart that is trending? For the most part, isn’t it the trend where you make the most money? The fact is that spreads trend more steeply, more often, and for longer periods of time than the trends in the outrights. You see when a spread trends, it trends based on reality and not on market manipulation by those able to move prices.

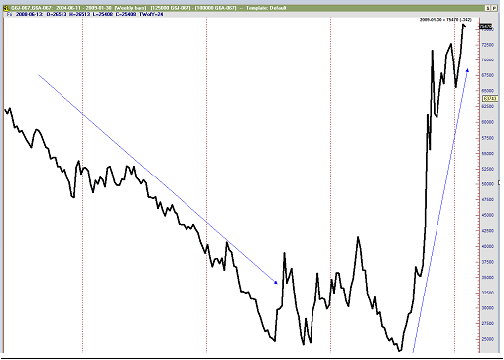

As an example of how long spreads can trend, let’s look at a weekly chart of being long the Japanese yen futures contract for March, 2009 spread against being short an Australian dollar contract for March, 2009. These currencies are traded in Chicago at the CME Exchange. Of course, prior to the March, 2009 contract, you would have been in the December, 2008 contract, and before that in the September, 2008 contract. The uptrend began in August, 2008 and at the time I wrote this it was still going. The scale on the right shows actual dollars earned by the spread. It moved from approximately US$25,000 to US$75,000 (US$50,000+) profits at the time of this writing.

Prior to that uptrend, it would have been best to have been long the Australian dollar and short the Japanese yen (that trade lasted from some time prior to June 2004 until July of 2007, a period of more than 3 years.

Here’s another advantage of trading spreads: Market manipulation has no effect on spreads. Neither does stop running. Whether it be shares, forex, futures, or options, stop running is the major enemy of most traders in the outright futures of any market you care to trade!

You read that right, spreads are immune to stop running. In fact, there are no stop orders in spread trading. There are only entry and exit points. When you trade spreads you become invisible to the market manipulators.

I want to tell you about some of the many additional benefits of spread trading but first we need to identify the various kinds of spreads, because they go from very low risk to somewhat riskier. Reduced margins are available among the following:

- Intramarket Spreads

- Intermarket Spreads

- Inter-exchange Spreads

Intramarket spread are generally the least risky. They involve two contracts having different months, but of the same underlying. June Crude Oil – August Crude Oil would be such a spread. A slightly more risky intramarket spread would be an old-crop year – new-crop year Soybean spread, i.e., October 2006 Soybeans – March 2007 Soybeans. The Soybean crop year runs from November of one year to September of the following year.

Increasing just slightly in risk would be an Intermarket spread between Chicago Wheat and Kansas City Wheat. Note that this is also an Inter-exchange spread, as the two are traded on different exchanges. But the one variety of wheat is in a sense closely related to the other variety of wheat, and so margins to trade the spread, which in turn reflect risk, are extremely low.

While all reduced margin spreads carry lower risk than the risk for any outright futures contract, I need to tell you about the spreads that carry the most risk. These would be some spreads in the currencies. Even though they are Intermarket spreads, currencies are not necessarily sufficiently related to offer extremely low risk. The risk on some currency spreads comes close to that of the outrights. Yet for others, which are related by virtue of seasonal economic factors, the risk is considerably less. For example, the Canadian dollar – Australian dollar spread does not see excessive adverse movements. These two nations are both what some traders call "commodity countries". The spreads between their currencies is seasonally related. When it is summer in Canada, it is winter in Australia and vice-versa. Trade between the two nations is also a factor in the spread. Swiss franc – euro spreads are also good, as the two are closely related. The Swiss, because their major trading partners are the other Europeans, cannot afford to allow their currency to become too expensive.

Risk, in spreads is a product of how closely related are the two legs of the spread.

Low margins are one of the greatest advantages of trading spreads, which in turn means you are getting more efficient use of your trading capital.

Margins on spreads carry as much as a 95% reduction as compared with margins for trading the outright futures. There are only a handful of spreads that have reductions in margin that are less than 50% of those for trading in the outrights.

When it comes to planning, spreads have no equal. Are you aware that you can plan spread trades days, weeks, and months in advance? You will know when they should be entered, and what the chart should look like when it is time to enter.

You can trade spreads without ever having to use an indicator, point and figure, or candlesticks. A simple line chart is all you’ll ever need and to make things even easier, if the spread line isn’t rising you are not making any money. You never trade a spread if the line on the chart isn’t going up.

In the area of trade selection, you will find that you never have to enter a spread trade with less than 80% probability of winning based on how the spread traded seasonally in the past. In fact, there are spreads that have been winners in 15 out of the last 15 years. You can also trade spreads that offer an 80% or greater chance of winning based on regression analysis.

I wish I were able to tell you the many other benefits of spread trading, but I cannot because of space limitations. I must use the words I have left to explain the chart and recap some of what I’ve written.

As concerns the chart, (March 2009 yen) minus (March 2009 Australian dollars) the spread must be adjusted for the difference in point value of the two currencies. Yen move $12.50/tick, or $1250 dollar/point, while Australian dollars move $10/tick, or $1000/point. What I want you to notice is that I multiplied each leg of the spread by its point value.

Using the multipliers of 1250 and 1000 allows me to see the spread in terms of US dollars. Currency spreads can be very profitable and I have traded them frequently. Currency futures are highly liquid as well.

In the early 1970s, there were only a few markets available for trading. They were all commodities; There was no such thing as financial futures, or stock index futures. There was one year in particular when all 8 markets that were available for trading were flat. In those days almost everyone was a trend trader. But there were no trends. Most traders found themselves churning their own accounts because there was no way to get on the right side of the market. Many of those who survived did so because, even though the markets were flat, the spreads between the various months or related commodities were trending.

I encourage you to at least look into futures spread trading. You can do them no matter where you live and work. In times of flat markets especially, or wildly swinging markets, spread trading can be a mainstay of your trading career.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - X Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

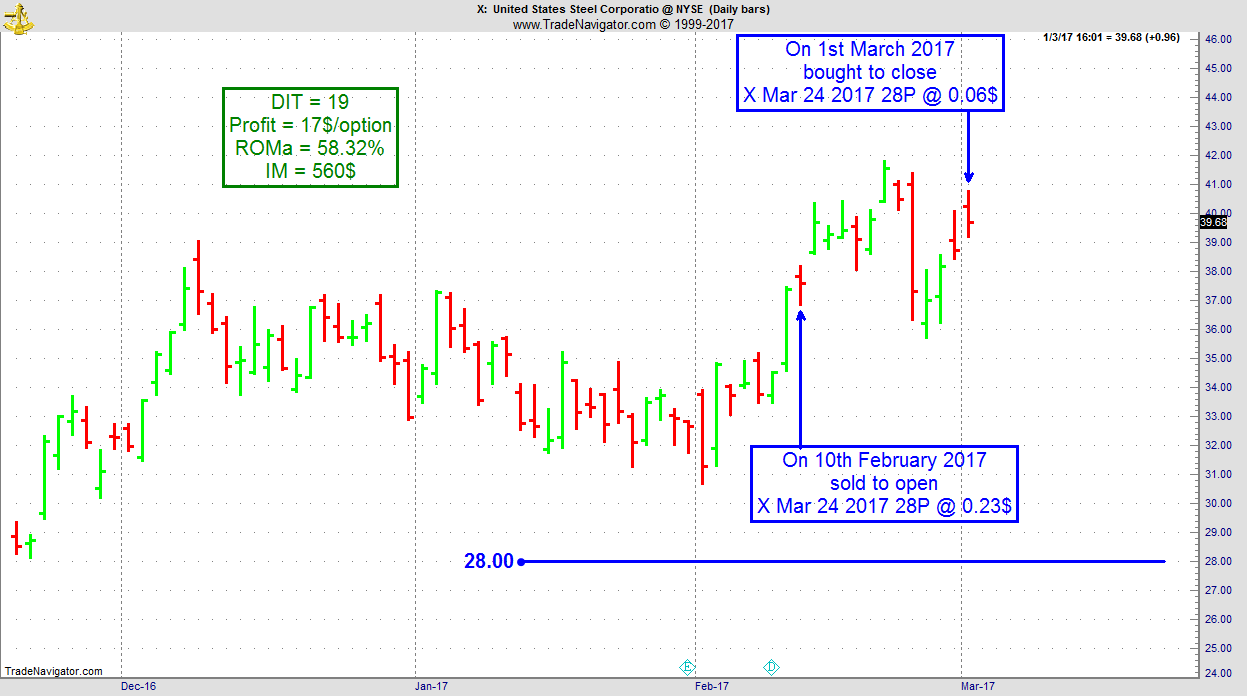

On 9th February 2017 we gave our IIG subscribers the following trade on X (US Steel). We decided to sell price insurance as follows:

- On 10th February 2017, we sold to open X Mar 24 2017 28P @ $0.23, i.e. $23 per option sold, with 44 days to expiration, and our short strike below a major support zone and 25% below price action.

- On 1st March 2017, we bought to close X Mar 24 2017 28P @ $0.06, after 19 days in the trade, for quick premium compounding

Profit: $17 per option

Margin: $560

Return on Margin Annualized: 58.32%

This trade was pretty safe in spite of overall very low implied volatility levels.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.