Edition 673 - May 5, 2017

AlgoStrats:FX Free Trial & April Report

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Another month passed by and as there have been some exciting changes happening at AlgoStrats:FX I wanted to give you a quick update.

First of all, we are offering you a Free Trial starting now until May 10th. Go ahead and join us for free! If you already have an account, you can simply login with your existing account. If you don’t have one yet, register here. And if you forgot your password, you can go here to reset it.

I've been quite excited about the month of April as I have been working on some major changes to AlgoStrats:FX during the last couple of months which have finally all been implemented in March.

To learn more about what changed in AlgoStrats:FX 2.0 and how it actually performed in April, check out this video:

That's it! As always, should you have any questions or feedback, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

Join the AlgoStrats:FX Free Trial

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea - Selling Soybean Oil Puts

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

It took a while until the July Soybean Oil broke out of the range, but with the break and close above 32.30 Soybean Oil might move higher. Also the Implied Volatility is high in Soybean Oil compared to other markets. I would not want to touch Currencies or Financial markets until the French Presidential Election on May 5, but I don’t see any high risk for the Soybean Oil market.

In Traders Notebook we have started to sell July puts with a strike price at 30.00.

Do you want to see how we manage this trade and do you want to get detailed trading instructions every day?

Please visit our website for additional information:

Traders Notebook

Blog Post - Kramer (from the Seinfeld show) on the Swiss Franc

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

“Hello, Kramer? You got a minute? Take a look at the Swiss Franc chart what do you think?” Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Gaps

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I don't know where the term "stop-gap" originated, but I do know that it certainly applies to the markets. It seems that when traders see a gap, they are not sure of where to place their protective stop, so many of them place it at one end or in the middle of the gap. Remember, if you will, that it is the job of the market to fill orders; prices almost surely will move to fill the gap. I once read somewhere that gaps are always filled. The use of the word "always" usually gives me the chills. Virtually nothing in the markets is "always."

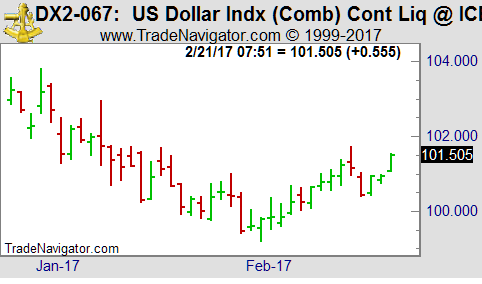

I'm looking at a March 2017 Dollar Index chart on February 21, 2017, and I see prices having just made a gap. Will that gap be filled? I really don't know. There is nothing in my notes that states that "gaps must be filled!" However, to state that gaps are usually filled would be true, and that is what I see as possibly happening.

Gaps on daily charts are less frequent now that more and more markets are becoming fully electronic and trading pretty much around the clock. This means that when you do see a gap, it has more significance than in the past. The question we receive most often is, "What should I do about gap openings?" "Should I trade the back-fill?" In the past, it was true that trading the back-filling of a gap was right 50% of the time and wrong 50% of the time.

However, you always have to pay the commission, so it did not pay to trade on the back-fill unless you could prove by testing that it paid you to do so in any one individual market.

Now that gaps occur less frequently, it is crucial to test what happens in a particular market when a gap occurs, especially as trading continues to increasingly trade 24-hours.

One question you will want to ask, market-by-market, is "Does this market usually move in the direction of the gap following the back-fill, or does it move in the opposite direction from the gap following the back-fill?"

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Time stops in intraday trading

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

For the most part, trader’s stops are based on money, ticks, pips or some percentage of their trading account. All of these are money management stops. In this respect, the level selected for the stop should take into consideration your risk tolerance.

However, very few traders use time stops in addition to money management stops. Time stops are trade management stops.

Using a time stop is quite simple. You apply a stop to your intraday positions which has nothing whatsoever to do with price. With a time stop, you decide how much time since entry is enough for your position to have moved in the direction you anticipated.

When you are trading there are two ways to be wrong:

- You can be wrong about direction

- You can be wrong in your timing.

Think about how many times you have entered a position, then saw your money management protective stop get hit for a loss, only to see the market turn around, and go in your desired direction; a most discouraging situation. You were right about the direction it was your timing that was wrong!

The idea behind the use of a time stop is that it has been proven that the longer an intraday trade remains suspended between a profit and a loss the more likely it is that the position will produce a loss.

The use of a time stop goes hand-in-hand with having a defined trading plan. You should have a well-defined setup or entry signal, a definite profit objective, and a money management stop loss. The stop loss can be fixed or trailing, as you prefer.

The question almost always comes up: “How long should I give the trade to materialize before I simply exit?”

The answer is that you make that determination through study and testing of your chosen market and time frame. If you trade in more than one market, then you make the determination for each market and time frame in which you actually trade.

Experience has shown that the best time to get out—win or lose—is when trading slows down while you are still in the position.

What we want to gain by using a time stop is a reason to exit those trades which are hanging around break even, but have are not really going anywhere—doing nothing to encourage us to stay in the trade. Profits are made when there is momentum in the direction of our profit objective. If momentum decreases, simply get out. You will find that some of the time you will exit with a profit and other times with a loss. Either one will be small and inconsequential in the long run.

When a market becomes volatile a time stop may be as little as 1 minute. If volatility is low, you may choose 5 or 10 minutes for the trade to go your way.

Even when using a time frame as long as 60 minutes in a less volatile environment, your time stop is not likely to be more than 30 minutes.

The major objection to the use of time stops is that they can involve a lot of in-and-out trading. It is true that positions are exited even when they are not actually losing money, simply because they have run out of time to materialize. I have no argument against that point, it is valid.

However, experience dictates that sitting in front of a screen hoping that a position reaches your profit objective, more often turns into a loss than into a profit. You certainly don’t want to be holding a position when liquidity dries up, the market suddenly becomes volatile, or you see an entry signal for a trade in the direction adverse, to your current position.

You should become aware of those times when liquidity dries up. Typically, it will be around the lunch hours of the major trading centers. Also be aware of when reports or news releases are scheduled to come out. Ten to fifteen minutes before a report or news release is due to come out, liquidity will dry up as traders wait to see what is in the report.

Keep in mind that although electronic markets are open for extended hours, traders are not willing to trade during all those hours, so liquidity tends to dry up during the hours when a lot of traders are simply asleep. Traders are creatures of habit. They still tend to trade the most during the hours they traded during the years prior to electronic trading.

The use of time stops adds a dimension to your trading that few traders ever employ. If you use them wisely they can definitely improve your trading. Time stops quickly dispatch non-performing positions and reduce the burden carrying a position that is going nowhere.

Instant Income Guaranteed - TSO Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Underlying stocks don't always go straight up or sideways after our entry. So it is of utmost importance to choose our short put strikes carefully.

On 19th March 2017, we gave our IIG subscribers the following trade on Tesoro Petroleum Corporation (TSO). We decided to sell price insurance as follows:

- On 20th March 2017, we sold to open TSO Apr 28 2017 75P @ $0.40, i.e. $40 per option sold, with 38 days to expiration, and our short strike below a major support zone and 12% below price action.

- On 24th April 2017, we bought to close TSO Apr 28 2017 75P @ $0.10, after 35 days in the trade.

Our short strike was never violated during the life of the trade (lowest daily low 11 ticks above $75 put strike).

Profit: $30 per option

Margin: $1,500

Return on Margin Annualized: 20.86%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.