Edition 674 - May 12, 2017

Chart Scan with Commentary - 1-2 on Same Bar

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

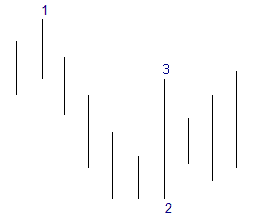

A couple of times this past week, people have asked me to explain how two points can possibly be on one bar using the Law of Charts. Since this question invariably comes up from time to time, I decided to show you how it can happen. First we will look at a chart sent to me by one of our students in Brazil. The chart shows a #1 and a #2 point existing on a single bar. Next you will see a hand drawn chart I made to answer a question, in which you will see a #2 and #3 point existing on the same bar.

The Law of Charts dictates that the #1 point of a 1-2-3 high formation must be equal to or in itself be the highest high. Following the bar labeled 1-2, we see first a higher low followed by a higher high, thus creating the 1-2 on the same bar.

In the chart below, we note that the Law of Charts dictates that the #2 point must be equal to or in itself be the lowest low following the #1 point. Following the bar labeled 2-3, we have first a higher low followed by a higher high, thus creating the 2-3 on the same bar.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - BG Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 11th July 2016, we gave our subscribers a new type of trade on Bunge Limited (BG), to play the recovery of the agricultural sector.

We entered a "complex position" for a net credit (still working with OPM, i.e. other people's money, as usual), but with unlimited upside potential.

- On 12th July 2016, we entered the trade for a credit of $3.25 (or $325 per position).

- On 1st December 2016, we took partial profits on our long position.

- On 28th December 2016, we took new partial profits on our long position.

- On 20th April 2017, we closed our short position (no more margin requirement for the trade).

- On 3rd May 2017 we closed our last long position.

Profit: $908

Margin: $1,721

Return on Margin Annualized: 65.29%

These are low maintenance, low stress trades with lots of upside potential.

We presently have 24 of these trades opened and we closed 5 already.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - Is it really possible to be consistently profitable?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Find out the consequences to negative thinking. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

8 Tips on How to be an Open-Minded Trader

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In my last article, I wrote about why it is so important to stay as open-minded as possible as a trader.

But that is easier said than done, so here are 8 tips you can actively follow on how to be more open-minded:

- Question everything and never stop doing so. There’s only one way to continue improving and that’s to constantly question your beliefs about trading and yourself. If you think you figured something out forever, you’re probably in trouble! That strategy that has been working for years might have stopped doing so. Maybe a market you’re trading in has changed in a significant way and you need to adopt.

- Doing so you have to be completely honest with yourself and your trading and scrutinize everything to make sure your trading and your beliefs about the markets are as close to reality as possible. You do want to know when you’re wrong or have made a mistake right away. Even if that truth might hurt. If you’ve been working on a trading strategy for weeks you want it to work, you want that edge to be true. But the fact is that if it’s not, you do want to know that, otherwise the markets will take it apart for you!

- Never stop learning. The markets, it’s participants and the trading technology evolves quickly. To stay ahead of the game you have to know what’s going on. Read new books that come out, watch videos, read articles and blog posts. There might even be some interesting posts on Twitter, Facebook, and other social media sites.

- But while doing so never believe any "truth" you hear or read about the markets before you have verified it for yourself. Doesn’t matter if it’s on TV, a trading book, a forum or from Paul Tudor Jones himself. In my experience, most of the information you can get for free or for significant amounts of money is absolutely worthless in terms of potential real trading profits. That’s why you need to scrutinize all of it.

- Workout, meditate or do whatever helps you to reset your brain on a daily basis. Find some method that works for you and make it into a routine. This will create the space in your head that’s required to come up with unique ideas.

- Try to get completely away from the markets for longer periods at least twice a year. After trying to crack the markets for months we all tend to get stuck and stop seeing the simple solutions. This is when you need a break so you can start from scratch again. You’ll find that very often you’ll solve the problem you’ve been working on right away after the break. Go on vacation, visit your parents, travel! Whatever helps you to free your thoughts from the markets for a while. For me, hiking does the job.

- Relax. This might be the best and the hardest to follow advice. Of course, it’s necessary to think through everything in a logical way when it comes to trading. And this works fine, but the best trading ideas/ideas for a new system usually come by themselves and as a surprise. You can not force these and thinking hard will take you only to a certain point. At some point, you have to relax and trust in your subconscious (or whatever you want to call it) to work this out for you. That’s when the magic can happen and an idea/solution you never thought about before is suddenly there. Eureka!

- Get in touch with other traders. Talking to someone else about trading who understands what you’re talking about can be very helpful. You can exchange ideas, get completely new perspectives and if you’re talking with someone honest get your ideas and views challenged. This can be very helpful as it forces you to clarify your trading thoughts that can be quite vague. Just having someone ask you "why?" and "how?" a couple of times might save you from wasting weeks of time. And of course, it’s fun to meet other traders!

As always, should you have any questions or feedback, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.