Edition 676 - May 26, 2017

Spread Trading Idea: ZMF18-ZMH18

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

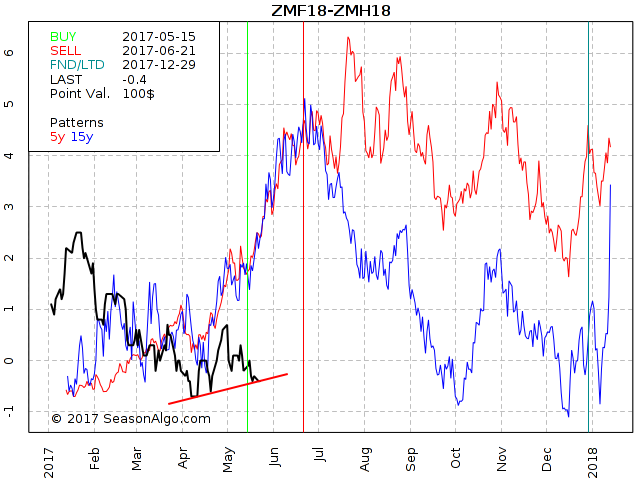

Chart Scan Trading Idea: ZMF18-ZMH18, long January and short March 2018 Soybean Meal

Today I want to have a closer look at a Soybean Meal spread using 2018 contracts. While the spread doesn’t show much volume, you can easily trade 10 or 20 contracts without any problem and bid/ask with only 1-tick away (nevertheless, I recommend the use of limit orders).

So far, the spread has not made its strong seasonal move to the up-side but at least it is showing higher lows for the last few weeks. We are in an up-trend since April as shown by the red line even if the up-trend is not very strong. Personally, I would wait what happens next before entering the trade but keep in mind the seasonal time window will already close in about 4 weeks and this doesn’t give the spread much time to develop. The spread seems promising with 15 winning years out of 15 (seasonally speaking) and because volatility is low, it may also work for the once with small trading accounts.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - Money Management

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Don't confuse money management with trade management. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Error: Trading Your P&L

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco talks about another very common trading mistake, and that's trading your P&L instead of the actual market. If you're struggling to become a winning trader, this might be an eye-opener, especially if you're a breakeven trader right now.

If you should you have any questions, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Second Look

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Taking a second look at potential trades at times results in “why didn’t I see this before?”

For instance, what if you are looking at a market as it approaches a support area? Isn’t it reasonable to ask yourself, “If this market breaks through and I am long, what will I do?” Ask yourself how such an event would change the picture. If you have a position, will you still want to hold it? If you have no position, will this cause you to take a position opposite what was the trend? If it will, then why not place an order entry just the other side of that support area? Very often, when prices approach support from what has been a trading range, they are already in a counter trend within the confines of the trading range. That means a breakout of the trading range would be a continuation of a newly formed minor trend.

After a second look, I will put my work aside before looking at my charts again. Then I make a plan for the orders I want to place.

I make sure my trading platform is working. To do this, I issue an order I know will come back as “unable.” I also check to see if my phone line is working by making a call to my cell phone. In the event of an emergency, I want to be able to call my broker.

Another thing I do is to quickly check the news to see if there is anything that has come out or is reported to come out that might affect my trades. I want to know if any reports are due or any speeches scheduled that might affect the market in which I intend to trade.

I do all this before I enter a trade. But do you know what most traders do? They do their analysis after the trade is made. Too often, they do it when the trade is already going against them.

How many times have you entered a trade, and then said to yourself, “Oh no, why didn’t I see that before?” How could you have seen it if you hadn’t looked, and looked again, and thought about it, and then perhaps looked one more time?

Also, many traders do their analysis after entering the trade in search of a justification for having entered. “Now I’m in the trade, let’s see if I can find out a couple of good reasons as to why!”

If you want to be a successful trader, you have to be hard: Hard on yourself. I don’t mean that you have to be browbeat yourself, or tell yourself you are a loser and can’t win. I don’t mean you have to blame yourself for everything that happens to you when you are trading. Some problems and situations are unavoidable. You just have to be firm with yourself in all that you do. You can’t afford to be a mouse about the way you do things. You need strong self-discipline and self-control. This is a business; you must be businesslike in conducting your affairs.

As a business person, you must manage your business. One of the main functions of management is planning. You have to plan your trades. Other things to look for as you go through your charts are: Tradable formations and setups. Look for reversal bars that indicate a move may be ending. Look for a drop in volume that may indicate illiquidity, or perhaps a coming change of direction. Watch all the things that you can that reveal to you the kinds of information that are needed for the way you trade. These should all be part of your plan.

Some people give more thought to choosing which flavor ice cream to eat than to which market to enter and how and when to do it.

By not taking the time for preparation, you end up not having enough time to weigh the pros and cons or really familiarize yourself with what you are getting into.

You don’t have time to realize that prices have supported two ticks away from your entry about forty times in the past. You don’t have time to see that you are trading right into overhead selling. You don’t have time to notice that if prices break out of a consolidation area just ahead of yesterday’s high or low, they will also probably violate yesterday’s high or low. You don’t have time to see where prices are in relation to the trend line. You don’t have time to really grasp the overall trend, or the correction that is going counter trend. You don’t have time to really consider where you will place your stop. You don’t have time to read the market and to see what it might be telling you.

All of these things can be done ahead of time. If you do not do your homework, you will end up chasing markets in a desperate attempt to get into “the big move.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - KSU Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 25th April 2017 we gave our IIG subscribers the following trade on Kansas City Southern (KSU). We decided to sell price insurance as follows:

- On 26th April 2017, we sold to open KSU Jun 16 2017 80P @ $0.75, i.e. $75 per option sold, with 50 days to expiration, and our short strike below a major support zone about 11% below price action, making the trade pretty safe in spite of a low implied volatility environment.

- On 15th May 2017, we bought to close KSU Jun 16, 2017 80P @ $0.30, after 19 days in the trade, for quick premium compounding.

Profit: $45 per option

Margin: $1,600

Return on Margin Annualized: 54.03%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.