Edition 678 - June 9, 2017

Chart Scan with Commentary - Classic Another Chart Revelation

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

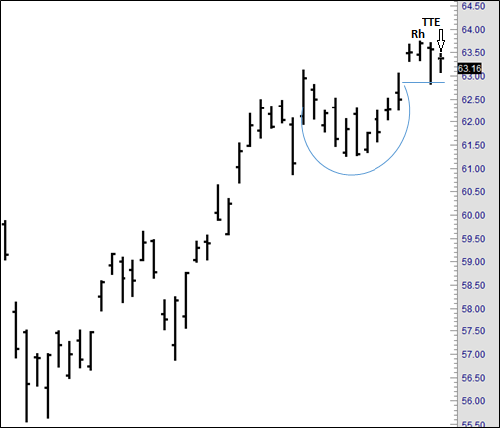

In one of my books I discuss the formation called "Cup with Handle." It is a formation that has been known about for a long time, and was first mentioned by that name by the publisher of "Investor's Business Daily." Actually the cup with handle is often nothing more than a head with a right shoulder. Lots of times the left shoulder is missing or, as in the case of the daily chart below, the left shoulder is there but very small and shallow. Notice this is an upside down head with a right shoulder to go long.

If you look closely you will see that the high of the cup "handle" is also a Ross Hook. Two days after the Ross Hook there was a Traders Trick Entry to go long at 63.40.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Protecting Profits

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Over the years, I've had the most profitable results by always making an attempt to receive pay for the risk I am taking. I want to be paid to trade. Being "paid to trade" has become a slogan at Trading Educators. The moment you can realize some profit from a trade, the sooner the pressure is off. You sleep well during nights where you have taken some money out of the trade during the day. You make fewer mistakes. Your growth in your confidence and faith in what you are doing, and seeing that what you are doing is succeeding, do wonders for your feeling of well-being.

If a trade gives you $1000 from a risk you have assumed in the market, never give them back more than $500. If someone gives you $2000, keep $1200; $3000, keep $2100; $4000, keep $3200; $5000, keep $4500. Remember the Point of Diminishing Returns as applied to trading. Never allow a $1000 per contract open equity profit to become a loss. As the market moves further beyond the Point of Diminishing Returns, the probability of a short-term trend reversal increases exponentially. The best market moves make the majority of their initial profits in 2 to 6 days. Therefore, a higher percentage of profits needs to be protected as the market moves higher and you approach at least a temporary end to the current move. Traders feel good about themselves to the degree they control trade profits and losses. This is the psychological Law of Control applied to the trade decision-making process.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - MDLZ Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 21st May 2017 we gave our IIG subscribers the following trade on Mondelez International (MDLZ). We decided to sell price insurance as follows:

- On 22d May 2017, we sold to open MDLZ Jun 30 2017 41.5P @ $0.24, with 38 days until expiration and our short strike 9% below price action.

- On 2nd June 2017, we bought to close MDLZ Jun 30, 2017 41.5P @ $0.07, after 11 days in the trade, for quick premium compounding..

Profit: $17 per option

Margin: $830

Return on Margin Annualized: 67.96%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

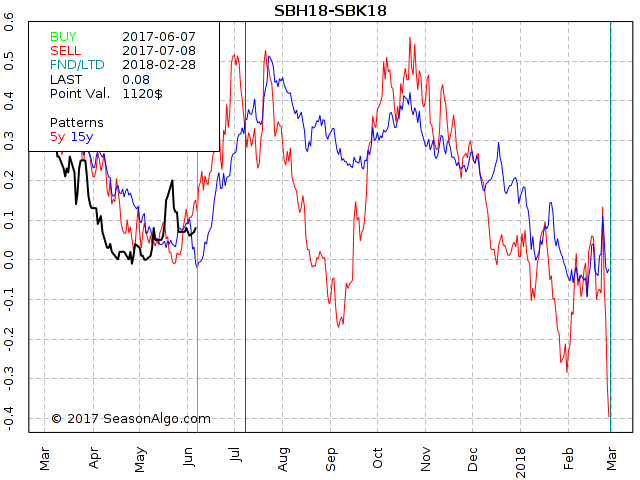

Trading Idea - Sugar spread long March and short May 2018

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Sugar is one of the markets I use mainly for spreads. In general, the Soft markets are not easy to trade and, because of exchange data fee costs of about $110, expensive. The calendar spread catches my interest because we are right at the beginning of the seasonal time window (06/07-07/08), the statistic regarding seasonality looks promising with very small draw-downs in the past and also the chart looks like the spread might turn to the up-side soon.

Do you want to know how we trade this spread in Traders Notebook?

Did you know Traders Notebook Complete had its most profitable year in 2016?

Learn how to manage this trade by getting daily detailed trading instructions, learn more!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - 5 Tips to Improve your Day Trading

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Day trading has always been a tough game, requiring a very strong psyche, discipline and a high level of trading skills to succeed in.

Nowadays though it's even harder due to the stronger competition, not only by humans but especially by computers trading at a speed a human trader simply can not match up to. High-Frequency Trading is happening in literally all of the popular markets out there and like Chess, scalping has become a game where humans cannot win against the AIs anymore. Add to that the speed/location advantage of the HFT shops and the odds of success decrease even more.

My advice is to forget about scalping. Even without the trading bots, odds of success to make money scalping are very low as the trading costs involved are incredibly hard to overcome. To not get completely killed by trading costs you need to trade in very liquid markets. But that's exactly where the robots are.

But not everything is lost, maybe all you have to do is to slightly adapt as a day trader. Here are some of the things you can do:

- The longer your trades last, the higher your profits (and losses) will be on average. It's a simple fact, if your trades last 4 hours on average, you'll be much more likely to catch a big move than if you average trade lasts 5 minutes. This way the HFTs can't hurt you as much anymore and also trading costs will have much less of an impact.

- You don't have to do 20 trades per day to be a successful day trader, quite the opposite! The more you trade, the higher your trading costs and believe me these trading costs will kill you in the long run.

- Don't get married to a specific market, instead, diversify your day trading over different, uncorrelated markets. This will strongly increase your chances of success as you'll stop seeing opportunities in a market where there aren't any.

- Day trade only markets that provide a good bang for the buck. I do this by looking at the average daily range of a market in relation to the average trading costs.

- Trade the news. I know you often hear the opposite advice but if you learn how to do this right, trading the news is one of the best ways to day trade. Just look at the markets, especially currencies. Isn't it true that most big moves happen right when some economic report is coming out? Sure, volatility explodes and liquidity often isn't that great. But hey, isn't high volatility exactly what you're looking for as a day trader? Now first you need to do your homework of course and have a plan ready on how to trade each of the specific news events.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.