Edition 682 - July 7, 2017

Chart Scan with Commentary - Strategy

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

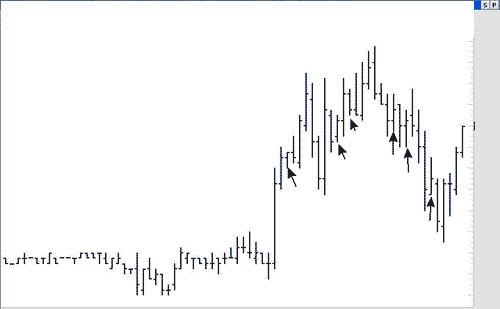

I had a bit of fun scalping the eMini S&P 15-minute chart. I figured out that the best time to do it was between 07:30 AM U.S. and 14:45 PM (Central Time). Sometimes the best trades are made simply by just looking around for stuff to do, and what I saw in the eMini S&P from past days gave me a chance to test a strategy I was thinking about using.

Caution: When using a strategy such as the one I will show you, don't expect it to work all the time, or for a very long time. No doubt, shortly after this issue of Chart Scan comes out, it will stop working. Do you want to know why? It's because if a lot of people jump onto it, the market will adjust, and the strategy will stop working.

There is a wise saying which came into being primarily since the advent of mechanical trading systems, and it goes something like this: "Your system will stop working when someone else builds his system based on your system." Can you see the truth in that? It is because of that reality that it is best to scout around for what may be working recently, and why it is a waste of time to backtest a system or method to see if it has worked for the last 10 years. You can't trade history you are forced to trade the present in an attempt to take advantage of the future.

When scalping, it is vital to understand the mind set needed for this kind of activity. You must not allow yourself to look for the big trade. You must not allow yourself to look for how much you can make by riding a winner. The discipline calls for seeking a set number of ticks, pips, or points, and then taking your money. You must have absolutely no regrets about missing out on what happens after you have taken your money--you must exit at your money objective. This is not to say that you cannot come up with a management scheme that allows for only part of your money to be taken at an objective, and then developing a scheme for trailing a stop in case the move continues. You might even have two objectives for a trade, maybe more.

The idea behind a scalp trade is to find a very high percentage trade and then use a lot of shares or contracts, so that you make a pile of money on only a very small move. You have to be fast, so I suggest you do this kind of scalping only in fully electronic markets like the eMini S&P. Also, be sure there is sufficient volume to enable your scalp. You will be badly hammered by the market if you go long with a lot of size in a market that is not trading sufficient volume to handle that size in the time interval you are trading.

Example: A market is trading a volume of only 70 contracts in a 15-minute period, and you enter with a 50 lot. You will definitely move the market, and there will be only 35 potential fills to take the other side of your trade. You would be overtrading.

Example: A stock is trading a volume of 9,000 shares in a 15-minute period, and you decide to enter a trade for 5,000 shares. Do you see what will happen to you? There are only 4,500 potential fills for your position. You would be overtrading.

With those things in mind, and probably a few I've forgotten, let's look at how I traded the eMini S&P.

I have placed arrows pointing to the available trades. My objective was to get .75 per trade on a lot of contracts. There were 6 trades in all, and 100% winners. One of the trades made only .50 and one made only .25. The remaining 4 trades made .75. Total made was 3.75 points. On the surface, that is not a lot for a day's work. But I did a lot of contracts. I'm not telling how many, but you can figure out for yourself how many you need to do. If you wanted to make $1,875 you would have had to trade a 10 lot. Of course, that would have been the gross amount. Commissions and fees would have reduced your take-home pay.

What was the magic method? Here it comes, but it is not the Holy Grail of trading. The five trades were all breakouts of inside bars, bought or sold at the high or low of the inside bar. Take a look:

What does all this have to do with the Law of Charts? The Law of Charts states that the breakout of the high or low of any bar is an entry signal. In my book Day Trading, I describe major, intermediate and minor entry signals. Every book or article I've written, every seminar or webinar I've given, is and has been, in one way or another, based on the Law of Charts. If you haven't studied it, get it. There is no charge for it.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Pulling the Trigger

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Dear Joe, Sometimes I absolutely dread sitting down to trade. I have had so many bad experiences that I’m not sure I can pull the trigger. Is there anything I can do about it?

What happens to us as we trade colors the way we see things in the market and influences the way we approach them. We take a big hit in a particular market, and we decide never to trade there again. Or, when we have a great trade in a market, it produces pleasure, so we try to trade there again as soon as we can.

How do you envision the markets overall? More importantly, how do you conceive of your role in the market? Do you see the markets as potentially hazardous arenas in which you must be very, very careful? Do you see them as though everyone in them is out to take your money? Or do you view them as a place in which there is dynamic profit opportunity?

Each time you sit down to your trader workspace, do you feel uncomfortable and wish you were somewhere else? Or are you really eager to jump into your work, look over your charts, and get down to trading? Does plowing through new material feel like a lot of hard work, or does it excite you to learn new information that will add to your ability as a trader?

The way you envision the markets will have a powerful influence on your actions! So it's absolutely necessary for you to be very much aware of just what your perception is and what past experiences colored your perception. You need to honestly assess your vision of - and feelings towards - the markets and your role in them. It will surely be time well spent.

Here's something to think about: the longer you sit in front of your screen, the more bad experiences you are going to have. The thing that defeats most day traders is that of overtrading. As you continue to sit in front of your trading screen, your focus and your sensibilities become increasingly numb. The longer you sit there, the more the probabilities increase in favor of your making bad decisions and wrong trades.

Let me ask you a question that may put the entire situation into perspective for you. Have you ever seen old people in a nursing home sitting hour upon hour staring at the TV screen? If you haven't, can you picture what it would be like? Almost everyone has seen people who either by choice or circumstance, sit all day watching TV. They sit and watch the "boob tube" hour after hour. What do you suppose this is doing for their minds? Do you think they are becoming increasingly sharp? Is sitting there all day helping them to grow? What would you say is happening to their minds? Are they not going to suffer from an increasing amount of atrophy as they fail to think - as they fail to use their minds?

When I see a trader sitting in front of his trading screen all day long, it generates the same kind of picture for me as when I see someone watching TV all day. They are destroying their minds. At least with TV you might learn something. But what are you learning watching a cursor tick up and down hour after hour?

Trading is a terrible occupation if all you do is trade. Taking signals from a mechanical trading system is one of the most mind numbing, emotionally crippling things anyone can do. The shorter the time frame being watched, the worse it is. Is it any wonder that 90% or more of wannabe day traders last only 3-6 months in the market?

A successful trader has two major things going for him/her: 1. Plenty of money to have an excellent life-style. 2. Plenty of time to do some good in this world. But if you sit and trade all day, what do you have to show for it in the end? What have you produced that is of benefit to anyone but yourself?

I'll let you answer that. But my suggestion to you is that you strive to trade less, not more. Learn what the good trades look like, and then trade them only when they occur. And when they do occur, focus your money - trade as many contracts on the good trades as you can. Don't trade more of the time on lots of trades, trade lots of contracts less of the time on the good trades.

Use your time and money to help those less fortunate than you. After all is said and done, it is more blessed to give than to receive. Do you know what the word "bless" means? It is a verb meaning to "make happy." Paraphrased, that old saying translates to "you will be a happier person if you 'give,' than if all you do is strive to 'get.'" But if you are busy spending all your time on a 1-minute chart trying all day long to get, you're not going to be able to get much of the happiness that is available from giving.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - TXT Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 15th May 2017 we gave our IIG subscribers the following trade on Textron Inc. (TXT). We sold price insurance as follows:

- On 16th May 2017, we sold to open TXT Jun 16, 2017 44P @ $0.37, with 30 days until expiration and our short strike 8% below price action.

- On 1st June 2017, we bought to close TXT Jun 16, 2017 44P @ $0.10, after only 16 days in the trade, for quick premium compounding.

Profit: $27 per option

Margin: $880

Return on Margin Annualized: 69.99%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan Trading Idea - Cocoa trading at the ICE

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

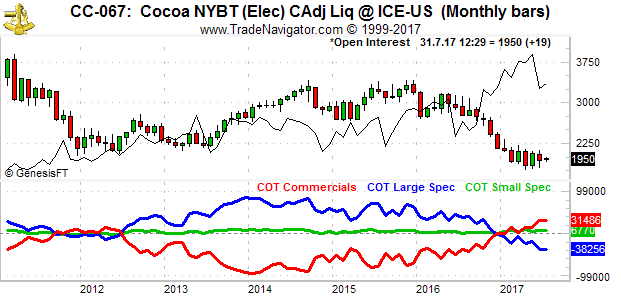

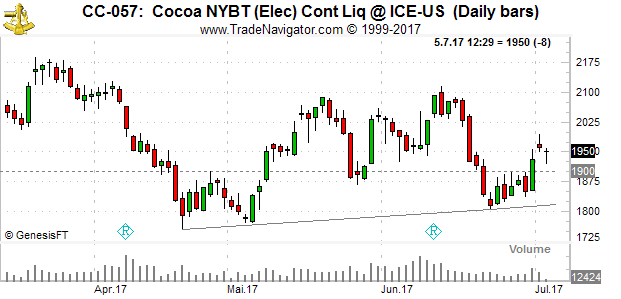

This week, we're looking at Cocoa trading at the ICE. What caught my first attention was the net long position of the Commercials. As you can see on the chart below it is at an all time high with the Large Specs at an all time low.

On the second chart below you can see that we are (slightly) in an up-trend since April with making (slightly) higher lows. The break above 1900 might be another sign for Cocoa to move higher.

Because of above reasons you might want to look into selling Cocoa puts using a far out of the money strike price. I’d prefer the December puts with a delta of about 10.

Do you want to see how we manage this trade and how to get detailed trading instructions every day?

Please visit the following link:

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video Marco reviews an "Outside Bars" pattern as an entry signal. He shows you how if it works as an entry signal in the Russell 2000 Mini Future and how to evaluate entry signals in general by using a systematic approach.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.