Edition 683 - July 14, 2017

Chart Scan with Commentary - TTE Rule

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

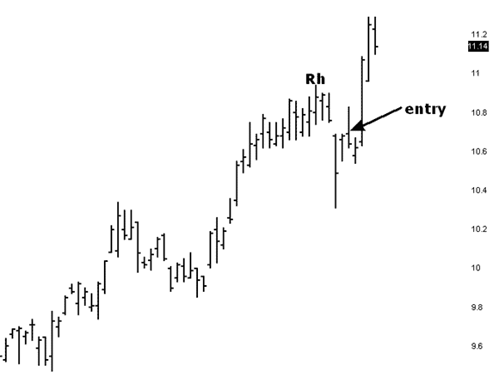

The chart below shows something I feel we need to learn about the Traders Trick (TTE). Prices reached a high of 10.94 and then retraced for two days. Those two days made identical highs [at 10.90]. Prices then dropped again, and again we had two identical highs [at 10.69]. The TTE rules say that after 4 bars of correction you are no longer to enter a trade based on the TTE. However, the rules also state that when expecting a continuation towards the upside, equal highs count as only one bar of correction (retracement). So, although we have 4 bars in the correction, because of the equal highs we count this as only two bars of correction. Now you can see why we made an entry 1 tick above 10.69. What happened afterwards is of no consequence to the rule I am showing you here. In accordance with your money and trade management, you made a little, took a loss, or made a lot on this trade. I will tell you only that we made a little.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Information Overload

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Do you do an awful lot of research into a market before you attempt to take a trade in it? Do you look at fundamentals and try to glean as much information as you can about the underlying? Do you feel that you are doing a more than adequate job of information seeking, but are still not as much as a breakeven trader? Are you beginning to feel that you are doing something wrong?

Well, it could be that you are suffering from information overload. It could also be that you are gathering information about the wrong things. People have a tendency to believe that the accuracy of their trading increases with more information. This is one of the illusions of knowledge—that more is somehow better—that more information increases your knowledge about something and improves your decision- making ability. But that is not necessarily true—increased levels of information do not always lead to greater knowledge. There are three reasons for this. First, people tend to interpret new information as confirmation of what they previously believed. You believe what you want to believe—you are biased, even if you are not conscious of the fact. Second, some information doesn't help us at all in making predictions, and can even mislead us. Finally, we often do not have the training, experience, or skills to interpret the information correctly.

You have to closely examine the kind of information you are looking at and determine its real value to the markets you are trying to trade. I have seen traders keeping elaborate records of everything they are doing as they trade. They keep files full of articles and reference materials which they pore over prior to making a trade. But is all this really necessary? I doubt it. It is much better to trade what you see without having to find justification for every trade through research.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - EWW Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 14th June 2017 we gave our IIG subscribers the following trade on iShares MSCI Mexico Investable ETF (EWW). We sold price insurance as follows:

- On 15th June 2017, we sold to open EWW Jul 28, 2017 49.5P @ $0.38, with 43 days until expiration and our short strike 9% below price action.

- On 7th July 2017, we bought to close EWW Jul 28, 2017 49.5P @ $0.10, after 22 days in the trade.

Profit: $28 per option

Margin: $990

Return on Margin Annualized: 46.92%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Latest Blog Post - Overtrading

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

My latest blog post points out 5 mistakes when it comes to overtrading. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - What you should know about winning percentage

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

The winning rate or percentage of winning trades are very common statistics. And while it can be a useful metric, it can also be misleading, so let's have a look!

The winning rate or winning percentage tells you how much percent of the trades in a backtest (or real past trades) have been winning trades. So if you have 100 trades in total, and 75 of those trades closed with a profit, you have a winning rate of 75%. Now the first thing to notice here is how those winning trades are defined. Are breakeven-trades included? What about commissions? If you have 100 winning trades in the E-Mini Dow Future and each of those trades was closed at 1 tick profit ($5) and you pay $7.50 per round turn, you actually lost money even if you hit your profit target 100% of the time.

Which leads us to the next question. What was your profit to loss ratio? Without knowing how much money was made on the winning trades and how much was lost on the losing trades, the winning rate is completely useless. Here’s an extreme example. Let’s say you have 90 out of 100 winning trades, a winning rate of 90%. Sounds great right? But what if on average you had an average profit of $100 per winning trade ($100 x 90 = $9000) but an average loss of 1000$ per losing trade ($1000 x 10 = $10000)? Right, you'd have lost $1000 even with a winning rate of 90%. Of course, this also works the other way around, if you only have 10% winners, but those are 10 times the size of your 90% losing trades, you’ll come out ahead!

Don't forget to always have a look at the profit/loss ratio and don't get all excited right away if you see a very high winning rate.

Happy Trading,

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.