Edition 685 - July 28, 2017

Chart Scan with Commentary - Reversal Bars

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Let’s talk about reversal bars, which are important because they signify important changes in trends and swings.

Swings are much more common than are trends. Short-term to intermediate-term swings consist of a leg up and a leg down in the movement of prices. Long-term trends seem to be a thing of the past (unless driven by strong supply and demand factors), mainly because of the amount of information available to traders and also because of computerized and program trading.

I’ll explain more about swings, and then we can look closely at several types of reversal bars.

There are two basic configurations available for computerized trading:

- Trend analysis

- Value analysis

Both greatly affect what happens in today’s trading. Following is a somewhat simplified view of the outcome of these two types of computer-generated methods. Naturally, real supply and demand will always come into play when speaking of trends and swings.

There are only so many ways that anyone can detect a trend, especially when using a computer. What are the variables available for use? Open, High, Low, Close, Volume, and Volatility. There is little else of value.

These factors are integrated into moving averages of various kinds, but an examination will show little difference in the end result of each. We have:

- Simple moving averages

- Exponential moving averages

- Geometric moving averages

I suppose by now there are even others. Moving averages are often turned into oscillators by the simple process of detrending them.

Next comes the question: How many ways can you massage this handful of variables in order to come up with a way to detect a trend?

The conclusion of it all is that virtually all trend-finding techniques are correlated. As soon as one computer algorithm detects a trend, so do most other computer algorithms. The result is a mass of buying coming into a move up, and a mass of selling coming into a move down. Instead of prices trending, they begin to move in the direction of the momentum detected by the computer algorithms.

Now, what about the computers programmed for value analysis? As prices move strongly upward, those computers programmed to look for relative value suddenly discover that prices are now too high. The value computers issue a sell signal. Buying and selling collide massively in some type of topping formation. Ultimately, selling overcomes buying, and prices reverse direction. Within a short space of time the trend-following computers detect the fact that prices are now moving down. They enter the market by selling, and prices drop until the value-programmed computers detect that prices are now too low relative to where they have been before. Value-programmed computers issue a buy signal and the swing—consisting of an up-leg and a down-leg—is now complete.

I admit this is a somewhat simplified view of what takes place, and, as mentioned earlier, a trend in either direction driven by true supply and demand factors will generally defeat the value-programmed computers so that the trend in prices will continue.

Regardless of whether prices turn at the end of a trend or whether they reverse as a result of the exhaustion of supply-demand factors, the turn is often marked by a reversal bar. Let’s look at those now. There are a number of different types, but all have a high degree of reliability and are generally low risk trades, due to the fact that a tight protective stop can be used.

In all cases of reversal bar entry signals, the best and most reliable signals take place after a strong swing or trend.

Reversal bars occur in all markets and in all time frames. Reversal bar moves generally are relative to the time frame involved. As a rule, the longer the time frame, the greater the move will be in the opposite direction. Such resulting momentum is naturally expected—a reversal bar on a monthly chart is logically greater than a similar move on a five-minute chart.

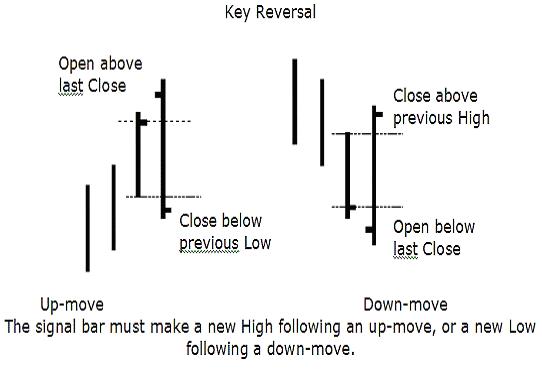

Key Reversal Notes:

- After an up-move:

- The Close must be lower than the previous bar’s Low

- The price bar must make a new High

- The Open must be higher than the previous bar’s High

- After a down-move:

- The Open must be lower the previous bars’ Close

- The bar must make a new Low

- The Close must be higher than the previous bar’s High

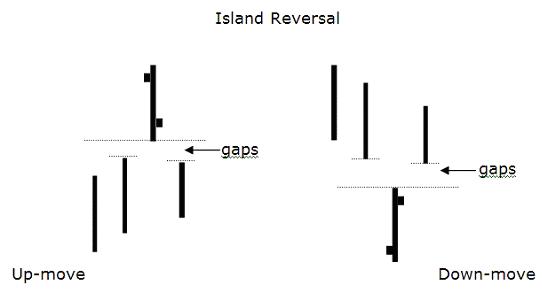

Island Reversal Notes:

- After an up-move:

- The bar’s Low is higher than the High of previous price bar and the following price bar (a gap on both sides of the reversal bar).

- The bar’s Low is higher than the High of previous price bar and the following price bar (a gap on both sides of the reversal bar).

- After a down-move:

- The bar’s High is lower than the Low of the previous price bar and the following price bar (a gap on both sides of the reversal bar).

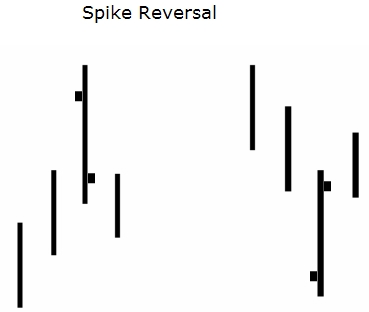

Spike Reversal Notes:

- A Spike High reversal after an up-move:

- Displays a High considerably above the price bars on either side.

- An Open higher than the Close.

- A Spike Low reversal after a down-move:

- Displays a Low considerably lower than the price bars on either side.

- An Open lower than the Close.

Reversals show a change in direction. Either the change is real or it isn’t. This is why you want to use a tight protective stop in trading them. You don’t want to give such trades much room. However, the percentages are definitely with you on reversal bars, so do a bit of testing for the market and time frame you wish to trade. You should be able to come up with a percentage of times that reversal bars will work in your favor.

I’ve shown the three basic types of reversals. There are of course, variations of these three. You can make your trading life much simpler by learning to use the Law of Charts and the Traders Trick entry. You might also want to consider taking one of our “Recorded Webinars”.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Contrarian Trader

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Being a contrarian trader means not just following the crowd. It means being willing to break the rules when necessary!

Statistics show that the “crowd” loses close to 80% of the time position trading, and very close to 90% of the time day trading. Why would anyone want to do what all those people are doing?

So, what is it the crowd is doing? For the most part they are struggling with Fibonacci numbers, a variety of indicators—some of which are proffered as having magical qualities—reading books by authors who never made it as traders, and thrashing around with mechanical trading systems, which are said to work all the time, when it is plain as the nose on your face that such a thing is impossible.

It seems that considering the high percentage of losers in this business you are repeatedly being warned that trading isn’t all that easy, and truthfully, it's much harder than it looks.

Think about it for a minute: If trading were easy, if it were really possible to make a lot of money quickly being a trader, why would anyone want to be a plumber, or an electrician, or an engineer, or ….

It seems that many traders fall into two categories. The first category is the wild gambler, who thinks rules have no meaning and wonders why anyone would try to set them. At the other extreme is the absolute conformist who tries to exactly follow the rules, as if there were some great virtue in doing that.

Have you ever run into a system trader who will boastfully tell you how proud he is of having stuck to a system with great discipline, following it exactly until he lost all his money? Bragging about his discipline as though it had some sort of virtue to it? In reality, that kind of trader is a lemming who happily runs off the edge of a cliff only to drown in a sea of his own stupidity.

Neither extreme is the best for trading. You don’t want to be a total rule breaker and you don’t want to be a total rule follower, and for sure you don’t want to follow the crowd because the crowd is usually wrong.

As a trader, you have to find the right balance between extremes—breaking and following rules—and following or not following the crowd. It takes maturity derived from trading experience, self-examination and a solid concerted effort to act independently, and it is essential to develop this skill in both those areas.

Following the crowd is a natural human tendency. It appears that there is safety and comfort in numbers. But such a situation is certainly not true in trading. Group dynamics just don’t seem to work very well when it comes to trading the markets. From time to time there have been partnerships that worked, but they are few and far between. In all the years I’ve been in the markets, I’ve known only one partnership that worked, and it was structured in such a way that one person did all the research and the other person made the trading decisions and performed the actual trading. Nevertheless, people somehow feel secure when they follow the crowd.

I grant you that not everyone follows the crowd in the same way or to the same degree, but it is the contrarian who views the crowd to see what they are doing, and then does the opposite. In my own case, I am contrarian in the following way: When everyone is hot to trade the e-minis, I avoid them, preferring to trade where the crowd is not looking. I find lots of great opportunities by looking around, being eclectic and discovering trades that meet my criteria for profit potential, tradability, and personal comfort.

I tend to be adaptive most of the time, adapting my trading management to setups offering me high potential for successful trades.

When the mob is losing their shirts in the e-mini, I am trading options with at least a 75% chance of producing a winner. When the crowd is thrashing around trying to daytrade forex, I am trading spreads with at least an 80% chance of bringing home a profit. I am not averse to trading anything, anywhere. I trade Exchange Traded Funds and individual shares. Why not? Some of them have excellent potential.

I find that instead of searching for opportunity, most of the people losing money in the markets are looking for rules to follow, indicators to dream up, and systems to pursue. The crowd spends an inordinate amount of time backtesting.

If you are going to trade, it is time to matriculate to the real world of trading. We are no longer in school or on the job where to be successful, it was critical to follow the rules and it might have been essential to protect your self-interests and stay within the parameters of acceptable behavior. In school and on the job it was important to develop a clear sense of individual values so that you could be somewhat self-sufficient within the boundaries of the group.

The contrarian trader is eclectic to the extent that he or she can follow the crowd when it seems right, but go his or her own way when it's necessary to protect self-interests. What the contrarian trader does that others will not or cannot bring themselves to do, is to go the opposite way when it seems that everyone else is going the same way.

Time and again history has proven that when everyone is buying and a market seemingly will never stop going up, that is the time to sell. And when something has sold down to the point where no one wants it and the media are all screaming out that it is the end for this market then it is time to take a trade the opposite way from the crowd, and become a buyer—that is what it means to be a true contrarian.

Contrarian traders heed the frequent warnings about the pitfalls of following the crowd. When no one wanted gold and the media screamed about how gold was a relic whose time had passed into history, it was buying time. When everyone was selling the Nasdaq and the media screamed “end of the world for tech stocks” it was again time to buy.

When you read in the media that a market it too volatile and too dangerous for trading and they flash warnings for their readers to stay out, that is the time to be looking to be an option seller. Options sellers make money by selling volatility. If you are a contrarian option trader, you aren't looking for safe markets. You are looking for volatility, reasonable risk, and a good chance for making a big profit. Most of the time, it means going your own way—the way that is opposite the mob.

Being a contrarian requires thinking like a contrarian, guessing what the crowd will do next, and anticipating how the movement of the crowd can benefit your trading.

When virtually everyone has taken the position that the market is headed in a particular direction, who is going to be left to push the trend further? It is precisely then that a countertrend begins and moves the market in the direction of the contrarian trade. The challenge is predicting when that turning point will occur, anticipating it, and developing a trading plan to capitalize on it.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - PKX Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 28th June 2017 we gave our IIG subscribers the following trade on Pohang Iron & Steel Co (PKX). We sold price insurance as follows:

- On 29th June 2017, we sold to open PKX Aug 18 2017 50P @ $0.30, with 49 days until expiration and our short strike 20% below price action.

- On 17th July 2017, we bought to close PKX Aug 18 2017 50P @ $0.10, after 18 days in the trade

Profit: $20 per option

Margin: $1,000

Return on Margin Annualized: 40.56%

With implied volatility extremely low, we still managed to sell price insurance 20% below price action and well below a major support level, making the trade particularly safe.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Latest Blog Post - Admit When You Are Wrong

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Does this trading path sound familiar to you? Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video -Marco's Q&A: Pinbars, Forex Brokers & 5-Min Charts

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

I will answer some follow-up questions of a past video related to Pinbars, give recommendations on Forex brokers and why it's so hard to trade successfully on a 5-min chart. Enjoy!

Feel free to This email address is being protected from spambots. You need JavaScript enabled to view it. with any questions or whatever is on your mind about trading.

Happy Trading,

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.