Edition 688 - August 18, 2017

Trading Idea

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

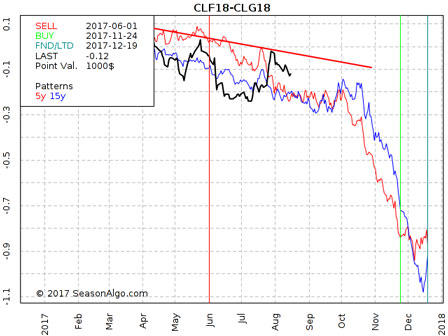

This week, we're looking at short CLF18 – CLG18: short January and long February 2018 Crude Oil (NYMEX at Globex).

Today we consider a Crude Oil calender spread: short January and long February 2018 Crude Oil (elec. symbols: CLF18 – CLG18 or CLES1F8 on CQG). The spread has been in a down trend since the beginning of 2017 trading now close to the upper side of its down-trend channel. Because there is only one month of difference between the two legs, the risk is at a manageable level of about $300 per spread contract. The spread should gain stronger momentum regarding seasonality to the down-side in later months (October and later) but a trader might already now scale into the trade.

Do you want to see how we manage this trade and how to get detailed trading instructions every day?

Traders Notebook Complete

Please visit the following link:

Yes, I would like additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - A Gold Trader

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

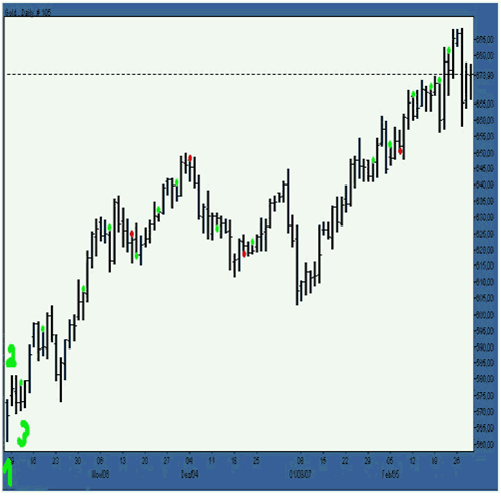

This week I lifted the chart I want to show you from one of our students, and it shows you how he trades gold using only Traders Trick Entries. You’ll have to look closely to see the green and red dots

"I traded lots of gold lately and thought I should share this chart as an example of how nice TTEs [Traders Trick Entries] can work.

"It's a daily-chart of gold. It starts with a 1-2-3, where I luckily bought and I'm still in with 1/3 of my initial position using natural supports to trail my stop.

"The green dots shows TTEs that 'worked,' the red dots are TTEs that 'failed.' For me they worked when they reached the point of the RH where I usually take profits, and move my stop to break even, or did a large enough move to take some profit, and did not go below the last day's low where I trail my stop when getting into a position.

"Of course I wouldn't have traded all of those TTEs; some of them are much too near the RH so that they don't allow to take enough profit at the RH. Some don't look 'good', and some come too close together. But just if you had taken them blindly, you still would have won big using the right money-position-management."

Notice that he says, "Of course I wouldn't have traded all of those TTEs.” Over the years from our own experience and feedback from our students there have been a number of refinements made to the way we select and trade the TTE. You can discover the filters we use to achieve close to 90% accuracy when selecting which TTE to trade. The material is covered in an online webinar “The Traders Trick, Advanced Concepts.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - The Lottery Mindset

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Do you ever dream about winning the lottery? There are actually people who have such good luck that they repeatedly enter contests and win. They win so often that if they wanted, they could count on winning, even though they are essentially trying to capitalize on chance. They develop a "lottery mindset" in that they approach life by counting on rare chance events. The rest of us aren't so lucky, and we don't live our lives counting on a fluke like winning the lottery. We work hard, master a profession, and work steadily to make a living. In many ways, top-notch traders approach their profession in the same diligent way. They don't view trading as recreational gambling, and count on a fluke to make a profit.

Many people do experience key life-changing events. We have all heard of people who needed a lucky break and got it. You often hear of actors who with their last 50 bucks went on an audition and landed a job and ended up as a star of a hit sit-com. You probably know of friends who were desperately searching for a job for months, and needed a job fast! With only a week's worth of resources left, they found a job. It can also happen in sports. Olympic athletes may practice their entire life for "one moment in time" when they can perform at their best. But there is some luck involved. A family member may pass away or they may become ill, and it may throw them off their game. Sure, they have rare talents, but the Gold Medal winners are also lucky enough to have everything go their way. There are times when life can come down to a few key moments. It's a little like playing Lotto and hoping that you'll win.

Even though profitable traders don't approach trading as if they are playing the lottery, they all have at least one big winning trade in their careers. Do people make huge profits capitalizing on a once in a lifetime trade? Sure they do, but the question you need to ask yourself is, "Do I want to trade hoping to make all my profits on a fluke?" Do you want to approach trading with a lottery mindset? If you do, you'll always be on edge and you will have difficulty trading with discipline. You'll tend to take big chances, and you may end up losing big. It's better to trade more prudently. That doesn't mean never taking a risk or pushing yourself to invest a little more capital when you hit upon a winning streak. What it does mean, though, is controlling over-confidence. Don't seek out those one or two trades a year that will make up for all you've lost. There's an advantage to using a more methodical approach: Continue to search for solid, high probability trade setups, outline detailed trading plans, and trade prudently with unwavering discipline.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - NTNX Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 16th July 2017 we gave our IIG subscribers the following trade on Nutanix Inc (NTNX). We sold price insurance as follows:

- On 17th July 2017, we sold to open NTNX Aug 18 2017 17.5P @ $0.175 (average price), with 31 days until expiration and our short strike 21% below price action.

- On 7th August 2017, we bought to close NTNX Aug 18 2017 17.5P @ $0.05, after 21 days in the trade.

Profit: $12.50 per option

Margin: $350

Return on Margin Annualized: 62.07%

When the trade was given, $VIX had closed at 9.82, a particularly low level historically. But by widening our choice of underlying stocks (a recently introduced stock in September 2016 in that case), we can still find safe trades with quite decent levels of premium.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Q&A Episode 1: BID/ASK-Spread/Discipline in Trading

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

This first episode, Marco Mayer answers trading related questions sent in from viewers like you!

Feel free to This email address is being protected from spambots. You need JavaScript enabled to view it. your questions or whatever is on your mind about trading.

>

Happy Trading,

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.