Edition 689 - August 25, 2017

Chart Scan with Commentary - Spread

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

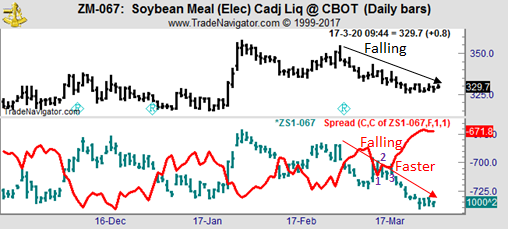

A spread can be profitably entered even though prices on both legs of the spread are moving down. As you can see both soybean meal and soybeans were moving down, only prices for soybeans (lower chart) were moving down more steeply and faster than prices for soybean meal. This is a situation for creating a spread between the two.

You can see the spread line begin to rise in late February. The spread formed a 1-2-3 low and then broke out above the #2 point.

At this point in time it is of no importance whether this spread is seasonal or not. The fact is that it can be entered simply my mere observation. Prices falling on one hand and prices falling faster on the other. The beauty of spread is that they are based on reality, rather than price manipulation. There is a fundamental reason why soybean prices are falling faster than soymeal prices. We don’t have to know the reason why this is happening. We have only to look and see the truth.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Computerized Trading

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Someone wrote in: “Will trading eventually be done by programmed computers and not by people? Are we really headed that way?”

The answer is that it is already true. I read that at times 90% of daily trading in the stock market is computerized trading.

The computer age is bringing about unprecedented change in the markets. Even now it is altering the manner in which we conduct business, interpret events, gather information, and keep ourselves entertained.

While computers can expand our intellectual horizons, they can also limit creative interpretation. There is a tendency these days to let computers do the work of designing and discovering rather than relying upon intuition and imagination. All too often this is taking place even when it flies in the face of reality.

In a business context, computers reduce problems to statistical probabilities without necessarily considering the broad effects of events and relationships. No computer can keep you safe from those events which come unexpectedly, and which cause markets to go berserk. Wars, sudden shifts in political power and alliances, and natural disasters, can cause markets to become suddenly and extremely volatile. Even when statistics take such extremes into account, how do you defend yourself if you are long and a market suddenly crashes? Prices can leap right over your protective stops. A severe crash can shut the market down, and when it reopens you could be staring at a huge loss.

I’m not saying that computers shouldn’t be used to prove or disprove theories. But keep in mind that the intuition of the human mind has not yet been duplicated by electronic circuitry. Our educated insights are the critical tools with which we learn and comprehend how markets work.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - HST Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 27th July 2017 we gave our IIG subscribers the following trade on Host Marriott Financial Trust (HST). We sold price insurance as follows on a GTC order as we could not get filled initially at our minimum price:

- On 9th August 2017, we sold to open HST Sep 15 2017 17P @ $0.20, with 36 days until expiration.

- On 17th August 2017, we bought to close HST Sep 15 2017 17P @ $0.10, after 8 days in the trade for quick premium compounding.

Profit: $10 per option

Margin: $340

Return on Margin Annualized: 134.19%

By patiently waiting for a retracement to get our minimum fill price, we could exit the trade very quickly.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Don’t get married to a market!

Trading Article - Don’t get married to a market!

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

There are so many different instruments to trade like stocks, bonds, futures, spot forex, options and so on. And even when you decide to get into futures, there are tons of futures out there! So where to even start? I was as confused as anyone else about this when I started trading.

That’s why it probably feels good to focus on just one market in the beginning. "I just trade the EUR/USD" or "I only trade the ES" or "I'm a Gold trader" are common statements out there. And that’s not a bad thing. It’s almost impossible to start otherwise, you have to over simplify things in the beginning. Otherwise, you’d never get started trading at all.

But at some point, you should move on and expand your trading world. There are times when it’s almost impossible to make a profit in the EUR/USD or when it’s better to stay away from the ES. During these times maybe Gold or Crude Oil or AUD/USD are providing really good trading opportunities.

Especially as a day trader, you got to go where the action is. I’ve seen many traders going under because they kept on trying to milk a dead cow. That’s why recognizing when it’s time to look elsewhere is one of the most important skills to survive in the long term.

Don’t get marries to a single market, don’t keep on throwing good money after bad just to prove to your ego that you can get the money back from that market. Be flexible, go where the easy buck is.

There’s almost always a low hanging fruit…and usually, you know where it is. You’re just too stubborn to take it.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading is not a Black-and-White Game

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Many traders seem to have trouble understanding this concept. They cannot get their mind around it. Some are able to attain a composed calm and harmony when they are winning, but go berserk when losing. Others become defeatist when things turn bad. Still, others become resigned or go on tilt in various ways.

They try to abolish losing completely from their trading, and do everything in their power to avoid it. The solution they choose is to tighten up their trading to the nth degree. But unfortunately, swings in fortune are part of the game and need to be included. They must be worked with and controlled, not eliminated.

This attempt to turn trading into a black-and-white game goes like this: “I’ll trade absolutely safely. I will stay only in perfect trades, and if they are not perfect, then I’ll drop out.” On paper, this seems foolproof. The problem with this strategy is that you get trapped whenever you are in the gray areas (which is often). Trading is dynamic and constantly changing, with many rough edges. Trying to be too perfect is like trying to keep your clothing and life vest perfectly arranged during a river-rafting trip. You must roll with the water as it is moving along, not try to confine and control it!

Finally, there is also the frustration aspect that occurs if you try to banish all losses from trading. Stress occurs whenever a loss happens – anger, despair, indignation, outrage. Every trade becomes a life-and-death matter. This is the result of telling yourself that you must never fail. By including losses in the system, however, we anticipate them and thereby remove all the power from them. We are cool and composed; calmly factor them in, and move on.

"He who fears being conquered is sure of defeat".

- Napoléon Bonaparte

Happy trading,

Andy

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.