Edition 690 - September 1, 2017

Chart Scan with Commentary - Spreads

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I know I often write about spreads, and it is because there are some important lessons to be learned about spread trading. One of my favorites is learning to spread when I need more time for a market to decide which way it wants to go.

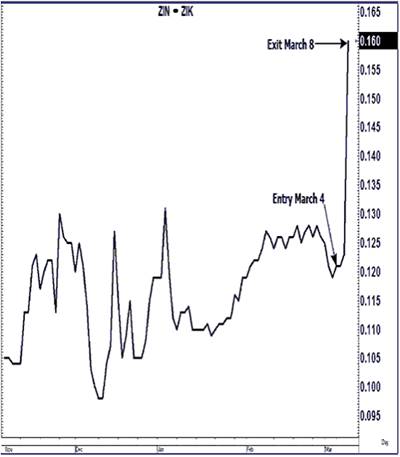

One day, I got myself tangled up short in a May silver futures trade. Due to circumstances beyond my control, I ended the day still in the market with May silver going nowhere. It was struggling to find direction, but it didn't seem to be going anywhere.

I found myself down a bit by the end of the day and, because sometimes I am persistent in trying to turn a trade into a winner if I can find a way, I decided to spread off by going long the July contract. I was down only a few ticks, and prices were not yet close to my stop loss when I entered the spread long July and short May. The chart shows what happened. I got out with a win, and now I'm standing aside until things begin to rock and roll once again. Sometimes you get lucky!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - One market or several?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Why do traders bail out of some markets to go to other contracts? Wouldn’t it be better to learn one market and stick with it?

The main reason traders bail out of a market is that they are not making any money. This has happened in various ways. In the currencies in the 1990s, for instance, lot sizes became too big for the market movers to fade (take the opposite side). The big players did not want to fade the trades of the smaller locals in the pit. In some instances, the smaller locals were standing around with their hands in their pockets for lack of something to do. Some locals were forced into conglomerates that took away their freedom to trade as they pleased. If they wanted to stay in the pit, they had to team up with other traders and together, as a group, they would fade the large orders that were/are coming into the pit. This meant that the biggest of the small traders would fade let's say a 500-lot order. He would then parcel out all the contracts he didn't want to the smaller traders: “Okay, you take 50, and you take 20, and you take 10, and you take 30,” etc.

If you didn't take what was parceled out to you, you would never again trade in the pit. It was either take it, or get out of the pit. No one would trade with you if you refused even one segment that was parceled out to you. That’s not exactly a free market type of situation. If you lost, then the "boss" trader would try to make it up to you, but this was seldom possible. In other words, your own trades depended entirely on someone else's judgment and ability to trade. The end result was the beginning of Forex as a major venue for currency traders. What happened then is that many currency traders moved to other markets.

What are the pit traders doing now that the best markets have moved to electronic trading? Just as with anything else, if you can't make money where you are, you move on. Some are moving on to other careers. Others are trying for success through trading from a screen. But here's a startling statistic: "Ninety percent of pit traders fail at trading from a screen."

So why does anyone leave one market for another? You leave when you can no longer make money. In 2003 I stopped trading the e-mini S&P 500. I was unable to make money there. That is not to say that others can't make money there, but for the way I like to trade, I had to move to other markets, and I found plenty of other markets in which to trade. To some extent, I had to change my trading style in order to succeed, but the changes were minor. I went from trading only the S&P 500 in open outcry to trading several markets other markets electronically. Being eclectic, I go where I am able to succeed.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - AEM Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 30th July 2017 we gave our IIG subscribers the following trade on Agnico-Eagle Mines Ltd (AEM). We sold price insurance as follows:

- On 31st July 2017, we sold to open AEM Sep 15 2017 42P @ $0.435 (average price), with 45 days until expiration, with our short strike about 11% below price action.

- On 4th August 2017, we sold to open AEM Sep 15 2017 42P @ $0.65 on a GTC order for the second half of our position.

- On 16th August 2017, we bought to close AEM Sep 15 2017 42P @ $0.25, after 16 days in the trade for quick premium compounding.

Profit: $29.30 per option

Margin: $840

Return on Margin Annualized: 79.57%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - The right mindset to deal with drawdowns

Trading Article - The right mindset to deal with drawdowns

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Drawdowns are an unavoidable fact in trading that's tough to deal with. But you probably already noticed that and might have encountered some of the serious issues this can lead to during your trading career. Maybe you tend to stop trading a system or switch systems always at the wrong time. Or worse. But as I've written about these issues before, here's a mindset that has helped me a lot to deal with drawdowns in the long run.

Things got a lot easier for me once I started to treat trading a system or just following a specific trading plan or strategy like an investment. Let me explain.

Let's say you believe in the success and growth of a certain company, Apple for example. Therefore you decide to invest a certain amount of money in it and buy the stock. You get in at $100. Right after you bought the price of the stock goes down to $95. You're down 5% and probably a little bit disappointed about your bad timing. If you're sane that's where you stop worrying. You won't start questioning your investment because the price of the stock dropped $5. You still believe in the company, nothing fundamental changed so you just keep your stocks. A year later Apple trades at $140 and you're quite happy but it might have been a volatile journey up to $135 during the year. Again though that's no big issue as you expect this. Stock prices can be volatile and you don't expect them to move higher in a straight line!

Why not apply the same mindset to trading a system? Take a certain amount of money and invest it into the strategy. As long as you believe in the strategy and the drawdown is within what you expect, why worry? Just keep on trading it, stop worrying about the daily ups and down and questioning it on every little drawdown. Of course, if something fundamental changes or you hit unexpected drawdowns you act. But otherwise, it really helps to treat it like an investment, leave it alone and let it do its thing.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea - Lean Hogs Butterfly Spread

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

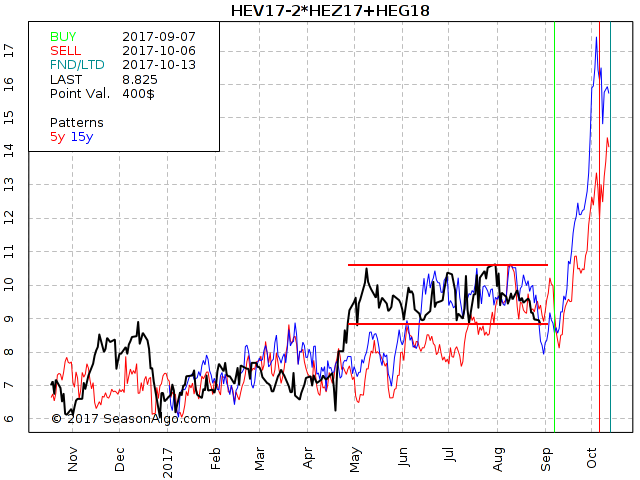

This week, we're looking at the HEV17 – 2*HEZ17 + HEG18 Butterfly Spread: long 1 October 2017, short 2 December 2017, and long 1 February 2018 Lean Hogs (CME on Globex).

Today we consider a Lean Hogs Butterfly Spread: long 1 October 2017, short 2 December 2017, and long 1 February 2018 Lean Hogs (elec. symbols: HEV17 – 2*HEZ17 + HEG18 or HEL1V17 on CQG). The Butterfly Spread has been in a range since May as you easily notice on the chart above. For the next few weeks, the spread usually moves to the up-side as shown by the blue (15 year seasonal) and red (5 year seasonal) line on the chart. Will this also happen this year? Of course, we never know for sure but the spread closed higher on 10/06 compared to 09/07 during the last 20 years. Statistically speaking, there is a high chance we will see higher prices of the spread during the next few weeks.

Happy trading,

Andy

Do you want to see how we manage this trade and how to get detailed trading instructions every day?

Traders Notebook Complete

Please visit the following link:

Yes, I would like additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.