Edition 691 - September 8, 2017

Trading Article - Is there a correct way to trade the markets?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

There isn't one “correct” way to trade the markets. While it may be tempting to emulate your favorite “Market Marvel”, in the end it’s really crucial to match your trading style with your personality. Some traders are methodical and almost compulsive in their tactics, carefully backtesting their strategies, scrutinizing all possibilities and taking sound precautions to ensure success. Other traders are more laid back, taking risk and uncertainty in stride, confident enough to formulate trading plans as they go along, finding opportunity as it happens. Again, there is no best approach. The approach you use to trade the markets depends on your unique personality and what you are comfortable with.

Above all, to trade successfully, the critical requirement is self-confidence. Developing a sense of confidence requires the accumulation of real life experience – becoming acquainted with various market conditions and discovering how you react to them. Once you have rock solid confidence based on copious experience, the way you approach trading is a matter of preference.

It is vital to your performance to be yourself, and not try to be someone you aren’t just because you think there’s ultimately a “right” way to trade. You must discover what works best for you, and what you need to do to trade profitably. The only standards that matter are your own.

Happy trading,

Andy

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

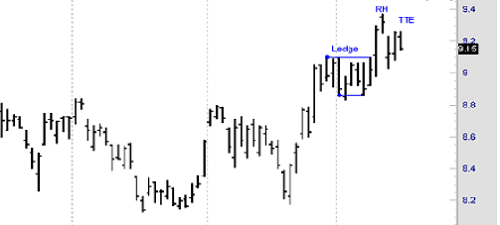

Chart Scan with Commentary - From Ledge to Ross Hook

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Prices for a stock I was trading broke out of an extended trading range on September 27, 2015. Almost immediately prices began to form a nine bar ledge with matching highs at 9.10 and matching lows at 8.87 and 8.86. The Law of Charts states that a ledge formation must contain at least four price bars, but no more than ten price bars. Prices broke out to the upside of the ledge on the tenth bar (October 11, 2015), and were followed the next day with the recent high. The Law of Charts states that the first failure of prices to continue in the direction they were going subsequent to the breakout of a ledge constitutes a Ross hook. There was a potential double high Traders Trick entry to go long showing on the chart. A breakout one tick above the double high at 9.26 offered a consideration to buy at 9.27. However, as we show in our online seminar Traders Trick, Advanced Concepts there are refinements that can make the probabilities for a winning trade approach the 90th percentile.

Notice also that entry on the breakout from a ledge is taken only in the direction of the previous trend or swing.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Achieving Self-Esteem

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

The single most important component of the personality related to personal achievement is self-esteem. Self-esteem is simply how much an individual likes himself and correlates to high achievement on a one-to-one basis. The more an individual likes himself the higher levels of performance he can achieve in any area of his life. Traders should always have at least one physical or mental activity every week that helps them feel good about themselves, like chess or golf. After a trader takes a loss or makes a mistake, he should consider going to a mirror looking himself in the eye and repeating the phrase, “I like myself,” with intensity, at least five times. This should boost the trader's self-esteem despite his losses, assuming he committed no trading discipline violations.

To reach high performance and personal achievement, understanding the three components of the self-concept is beneficial. The Ideal Self is a mental picture of the trader a person would like to become, a composite of the all positive qualities admired in other traders. Schwager's “Market Wizards” is filled with these admirable characters with their winning personalities. The Self Image is the inner mirror of the person a trader thinks he really is, and relates how he interacts with others on a day-today basis. A person seldom reaches levels of achievement beyond his self-image limitations. The Self-Esteem is how much a person likes himself. The more a person likes himself the higher levels of achievement are possible. These three components of the personality are always changing every moment. The self-aware trader shapes these personality components to compliment his goal achieving efforts to profitably trade the markets.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - RIO Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 22nd June 2016, we gave our subscribers a new type of trade for RIO (Rio Tinto), on a pullback within an uptrend on the weekly chart.

We entered a spread position for a net credit (still working with OPM, i.e. other people's money, as usual), but with unlimited upside potential.

- On 12th June 2016, we entered the trade for a credit of 2.00$(or $200 per position).

- We took partial exits for a profit on 9th November 2016 and 24th January 2017.

- On 31st August 2017, we completely closed the trade, after 455 days in the trade.

Profit: $850 per spread

Margin: $561 per spread

Return on Margin Annualized: 136.79%

These are low maintenance, low stress trades with lots of upside potential.

We presently have 25 of these trades opened. We took partial profits on some of them.

This technique is allowing us to take advantage of sector rotations (metals, gold and silver miners, etc.).

If you are interested in learning this new technique, come and join us!

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Ambush Signals

Trading Video - Ambush Signals

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Ambush made new all time equity highs! Be on the lookout for Special Pricing in next week's newsletter with Marco Mayer's Ambush ebook and Ambush Signals.

Learn all you need to know about our Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.