Edition 693 - September 22, 2017

AMBUSH TRADING METHOD - 3:1 Ratio

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

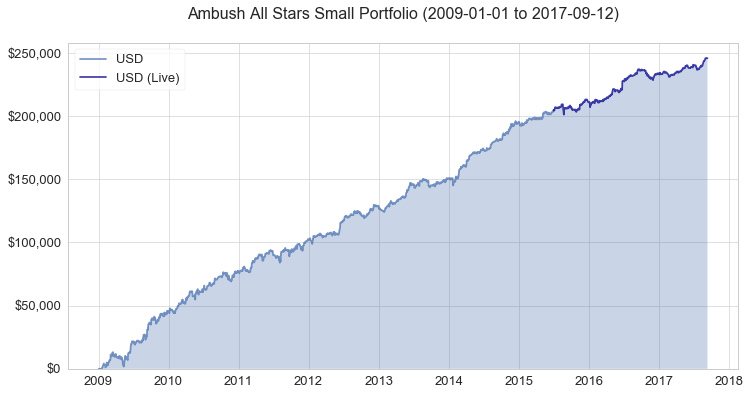

Ambush made new all time equity highs having its best month EVER!

Marco Mayer has extended his 6-Month Subscription Special Offer until September 26th!

Ambush Signals has almost a $15,000 profit so far in 2017 with a maximum drawdown of about $4,000. That’s an excellent ratio of more than 3:1. That’s very, very hard to find in the industry, especially in 2017.

Ambush beat its historical pre-live backtest!

View more sample portfolios on the Performance Page.

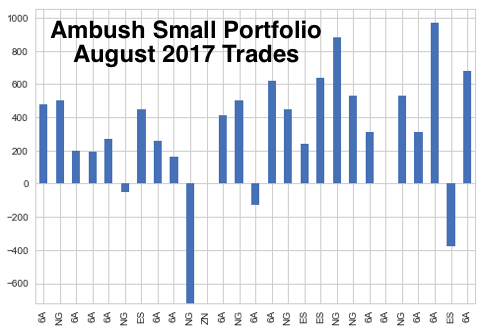

In total the portfolio gained more than $8,000 in August, with 85% winning trades while having made over 1.4 times more profits on winning trades than on losing trades. How’s your favorite market doing with Ambush? Go to the Performance Page!

Become an Ambush Trader!

- Ambush Signals does all the work for you

- Customize your markets

- Position sizing tool to automatically adjust the positions to your risk preferences

6 months of Ambush Signals

Low Price of $499

$215 savings!

Build the Confidence through Drawdowns

6 months of Ambush Signals for $499 today, click here!

If you prefer to generate the signals on your own, buy the Ambush eBook today!

Coupon Code, ambush300, takes $300 off regular price!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - eMini Russell 2000

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Personally, I enjoy trading the e-mini Russell 2000. It makes beautiful Law of Charts formations. I take trades in it mostly from the 3-10, minute time frames, but also quite often from the daily chart. The formations are always clean and clear, and the moves tend to be spectacular. As one of our trading friends put it, you get ten ticks to the point with Russell for $100 total, versus only four ticks per point with the e-mini S&P for a total of $50. That makes Russell easier to trade.

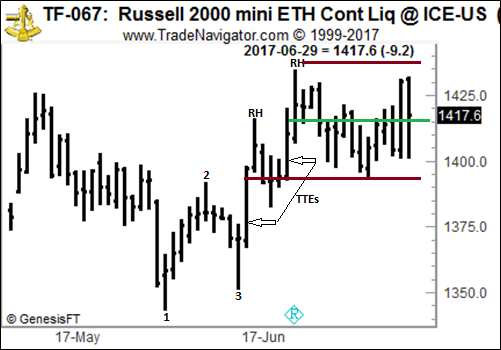

Let's look at a daily Russell chart to see some classic Law of Charts formations that have happened recently.

As you can see, prices reached the low in May with a beautiful reversal bar. Based on that reversal bar, frightened shorts began buying to lock in any profits they might have had from earlier price action. Reversal bar breakout traders joined in the buying, and prices moved from #1 to #2. Again at #2 there was profit taking by longs, and their selling took prices down to where we see #3. There were four correcting bars in the move to #3, at which time there was Traders Trick Entry available for going long.

Prices then proceeded to move past the #2 point, and a Ross hook formed. From the point of the first Ross hook there were three bars of correction, yielding another Traders Trick Entry.

Prices moved up again, formed a second Ross Hook, but then fell back into a 16-bar consolidation. The high and low of the consolidation I showed as brown horizontal lines. The green line is the center of the consolidation.

As I write this, it is not yet clear what will happen from where we see prices on the last bar. But a lot of money was available from the two TTEs.

Implementing The Law of Charts using the Traders Trick Entry continues to produce profits for thousands of traders around the world. Because of this we are proud to offer the Trading All Markets Recorded Webinar, or The Law of Charts In-Depth Recorded Webinar. We hope those of you who have been unable to take private mentoring will take advantage of the wealth of knowledge available in either of these Recorded Webinars.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Plans and Objectives

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I was watching an old movie "Coach Carter," starring Samuel L. Jackson. I couldn't help thinking about the many similarities between what a coach must do to prepare his players and what a trader must do to prepare to trade.

Since trading is largely a self-directed business venture, embarking on a trading career requires that you are able to set clearly defined objectives and develop a specific plan for achieving them.

Clearly defined objectives and well-developed plans carry the stamp of success in any professional undertaking.

Imagine an ocean liner departing without a navigational plan, a repairman doing repairs on your refrigerator without full knowledge of the workings of the compressor, or a professional basketball team running onto the court without a game plan.

In each case, the lack of a clearly defined plan in which specific objectives are set and specific steps are outlined can produce disastrous results. Clearly defined plans are essential. The captain sails his ship with plans for the safe and on-time arrival to a destination city. The repairman examines the inner workings of your refrigerator and uses the correct parts and tools to fix the problem. The coach tells the basketball team to run specific plays to defeat the opponent.

Successful trading careers start with plans that specify objectives, which in turn lead to success. There are psychological benefits to establishing objectives and developing plans to reach them. First, you may find your stress levels are reduced. Making a specific plan allows you to detail any vague and seemingly unattainable objectives into clearly defined steps, which in turn make the larger goal seem more reachable. When you have a specific plan, you can more easily identify which steps to do first, and then figure out how you will achieve each one. In addition, you will find that following a plan ensures you stay positive, so you control each aspect of your trading day (instead of its controlling you). This leads to increased confidence and consistency, which leads to increased effectiveness, which in turn leads to advancement towards your ultimate goal.

You must then write down the way you envision your goal. Create a definitive statement detailing as much of it as you can. Be very specific. Then read your objectives aloud every day. They must become believable.

Accordingly, you adjust trade size and protective stops so that you never lose more than your planned amount on any trade.

Now, map out your plan. What is your budget for hardware, software, and education? How much time can you devote? How much money will you use? What trading time frame, or style, matches your personality? For example, if you have trouble making split-second decisions, then scalping is not for you. Perhaps position trading, with a 2 to 5-day hold, better suits your personality.

Maybe you want to target certain markets and become a “specialist” in those markets. Or maybe you prefer to trade spreads or options. What set-ups do you prefer? Become an expert at trading a particular set-up and have it deliver the main part of your gains. Detail your trade, risk and money management strategies. Finally, establish a list of trading rules that you keep close-by.

Once you establish convincing and realistic objectives, and map out a plan that leads to those goals, you will find your trading efforts to be easier, more exciting, and certainly more successful!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - UFS Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 20th August 2017 we gave our IIG subscribers the following trade on Domtar Corporation (UFS). We sold price insurance as follows:

- On 21st August 2017, we sold to open UFS Oct 20, 2017 35P @ $0.35, with 59 days until expiration and our short strike 12% below price action.

- On 11th September 2017, we bought to close UFS Oct 20, 2017 35P @ $0.15, after 21 days in the trade.

Profit: $20 per option

Margin: $70

Return on Margin Annualized: 49.66%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Blog - Achieving Self-Esteem

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

The single most important component of the personality related to personal achievement is self-esteem. Self-esteem is simply how much an individual likes himself and correlates to high achievement on a one-to-one basis. The more an individual likes himself the higher levels of performance he can achieve in any area of his life. Traders should always have at least one physical or mental activity every week that helps them feel good about themselves, like chess or golf.

To reach high performance and personal achievement, understanding the three components of the self-concept is beneficial. The Ideal Self is a mental picture of the trader a person would like to become, a composite of the all positive qualities admired in other traders. Schwager's "Market Wizards" is filled with these admirable characters with their winning personalities. The Self Image is the inner mirror of the person a trader thinks he really is, and relates how he interacts with others on a day-today basis. A person seldom reaches levels of achievement beyond his self-image limitations. The Self-Esteem is how much a person likes himself. The more a person likes himself the higher levels of achievement are possible. These three components of the personality are always changing every moment. The self-aware trader shapes these personality components to compliment his goal achieving efforts to profitably trade the markets.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.