Edition 702 - November 24, 2017

We hope you had a wonderful Thanksgiving

celebration with your family and friends!

ENDS SOON!

30% Off All Products and Services

Coupon Code

stuffed30

Use during checkout expires midnight U.S. Central time on November 26, 2017

Chart Scan with Commentary - Consolidation Part 8

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

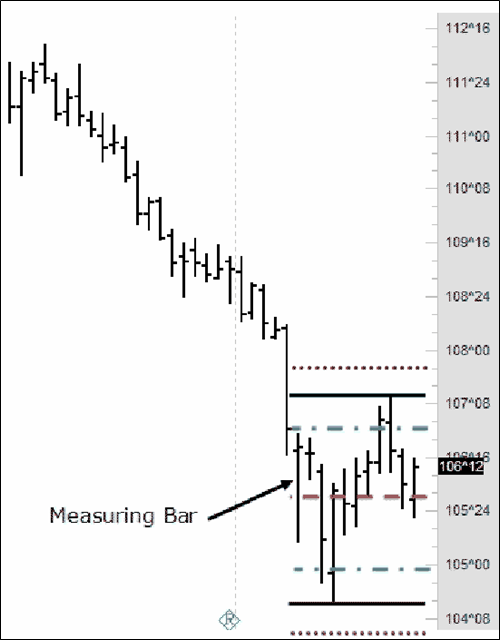

We have been taking this series one step at a time. I have drawn the trading envelope at the earliest possible time — the time I was first able to identify congestion (11-20 bars). Prices had entered the upper trading zone between the congestion high and the .146 inner zone (dash-dot green line). The entry was on the 8th bar from the left including the measuring bar.

Once prices entered that zone, I was looking to go short 1 tick below the inner zone line. Assuming I was trading 10 contracts, and because I could afford it, I placed my initial stop loss 1 tick above the congestion high. My objective was to liquidate 7 contracts at the midpoint line (red line). If prices would reach the midpoint line, I would move the protective stop on 1 contract to break even and the protective stop on 2 contracts to protect 50% of my profits. As you can see from the chart, I was filled as prices exited the inner zone. Two bars later I was filled at the midpoint line. On the last bar on the chart you can see that my 50% stop was hit.

Because the bar that hit my 50% stop was a reversal bar, I moved my breakeven stop to 1 tick above the high of the last bar on the chart. The following day (not shown) I was stopped out there. I was paid to trade on all parts of my position. That’s all I ever ask of a market.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ENDS SOON!

30% Off All Products and Services

Coupon Code

stuffed30

Use during checkout expires midnight U.S. Central time on November 26, 2017

Trading Article - Fitting it all together Part 4 - Market Spillover

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Markets can and do spillover from one to the other. We saw this back in 2007, and we can now see how dangerously close we were then and are now to a melt-down.

Until early in 2007, I had never heard of US subprime lending. On hearing the detail, it left me with a sense of wonderment.

“You mean, the borrower lies about his income (no job, no income, no hope) and the lender offers exceptionally low 'teaser' interest rates, with the proviso of these going up by half (!) within two years, and nobody screamed?”

And then they took such loans, bundled them with better loans, sliced and spliced the end result like so much rope, got rating agencies to apply the last rites, and sold them on to unsuspecting institutions looking for yield enhancement (a little extra margin, magnified sixteen times by leveraging, so that anything small really started to look impressively large)!

And that house of cards was supposed to remain intact?

If you had never tasted snake-oil before, this was your golden opportunity. About a $1 trillion of the stuff was written, first Fed estimates were that $100bn would go bad, but add the misadventure of any misguided leveraging, and the final bill would be about $250bn.

That would have sunk the US banking system. But because banks securitized and offloaded the stuff faster than they generated it, relatively little stuck to banks, except to the extent that their asset management funds invested in such stuff.

Anyway, the $250bn was spread around the world, at least 10% in Japan, a goodly portion in Europe and a fair amount in lower Manhattan. The losses would rest where they fell. Rest in peace.

Meanwhile, financial markets in their entirety couldn't quite figure where all the bodies were buried. A few hedge funds owed up (and folded). A few banks wrote off early and got mostly ignored. A few latecomers owed up and got clobbered. But by then the greater universe was on a witch hunt, while pulling away from leveraged corporate debt as well.

Banks became wary of counterparty banks. “Are you still good?

A rush for Treasury bonds ensued, sinking such bond yields. A flight to safety was in progress.

On 10 August it got so bad that European money market rates no longer reflected central bank targeted rates. Trust was out of the window and the willingness to deal getting thin indeed. Liquidity was drying up. The ECB, faced with banks being unable to get funds, injected $130bn, followed shortly by Fed and BoJ.

Another week and US credit markets generally seized up, with heavy spillover into equity markets, as uncertainty bit and induced risk aversion, good assets were sold to cover bad credit losses, and basically everyone lost their nerve.

Even Japanese housewives reversed positions, dumping Aussie and Kiwi and causing the Japanese Yen to shoot through the roof as the carry-trade got liquidated.

Not a moment too soon the Fed finally capitulated, but not in the usual way. The unusual twist was to lower only the discount rate by 0.5%, halving the penalty the banks pay to go into the central bank to cover their liquidity needs.

Would it be enough? If liquidity didn't improve, with massive volatility marking most markets as investors tried to re-establish value where anarchy ruled, the Fed at some point had to capitulate for real and go the whole hog, even lowering fed funds rate once, twice or even three times by 0.25%.

It proved to be an interesting year. Instead of being floored by bird flu, or getting fallout from US nuking of Iranian nuclear facilities, the world got old-fashioned credit failure, coupled to stress-testing leveraged universes.

Are we due for another such cleansing?

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ENDS SOON!

30% Off All Products and Services

Coupon Code

stuffed30

Use during checkout expires midnight U.S. Central time on November 26, 2017

Instant Income Guaranteed - GDXJ Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 25th September 2017 we gave our Instant Income Guaranteed subscribers the following trade on Market Vectors Junior Gold Min (GDXJ). We sold price insurance as follows:

- On 26th September 2017, we sold to open GDXJ Nov 17 2017 30P @ 0.27$, with 51 days until expiration and our short strike about 14% below price action.

- On 9th October 2017, we bought to close GDXJ Nov 17 2017 30P @ 0.10$, after 13 days in the trade for quick premium compounding.

Profit: 17$ per option

Margin: 600$

Return on Margin annualized: 79.55%

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ENDS SOON!

30% Off All Products and Services

Coupon Code

stuffed30

Use during checkout expires midnight U.S. Central time on November 26, 2017

Trading Article - Time Stop

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

If it was easy to win at trading, there would be more millionaires. The techniques for trading are simple. The age-old question is how to balance patience, wisdom, and prudent care against going for the grand slam.

In trading, pulling the trigger on when to trade equally important as all the preparation and attention to detail that went before. In other words, timing is everything when it comes to entering the trade. If a trade does not do well at the start, the trader must be disciplined and have ready a variety of alternate courses of action. As long as the circumstances for making the trade are still in effect, the trader can stay with the position. However, I believe in using a time stop. A time stop says, “I will exit the trade within a set amount of time even if the circumstances for making it are still in effect.” In the way I trade, success depends on prices quickly moving my way. If they fail to move my way, I know that my timing was off and I exit. Sometimes I have made a little and sometimes I lose a little. Overall, I do a little less than break even on the trades that time out. If circumstances are still the same, I look for a better time to get into the trade. My point is this: If my timing was off, I was wrong. When I’m wrong, I get out.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ENDS SOON!

30% Off All Products and Services

Coupon Code

stuffed30

Use during checkout expires midnight U.S. Central time on November 26, 2017

Trading Video - Trend Following Is Not Yet Dead: Part I

Trading Video - Trend Following Is Not Yet Dead: Part I

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco gives you some insights on his journey into the world of traditional trend following. He talks about how trend following works, what to consider, and if it's a trading style for the average trader to consider. This is Part 1 of a 2-Part series. In his Part II, Marco will go into the details of his backtests.

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ENDS SOON!

30% Off All Products and Services

Coupon Code

stuffed30

Use during checkout expires midnight U.S. Central time on November 26, 2017

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.