Edition 703 - December 1, 2017

Chart Scan with Commentary - Copper

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

This week we are going to see how to use the Law of Charts to stay out of a bad trade. Part and parcel with the Law of Charts is one of the implementations of the “Law” using the Traders Trick Entry (TTE).

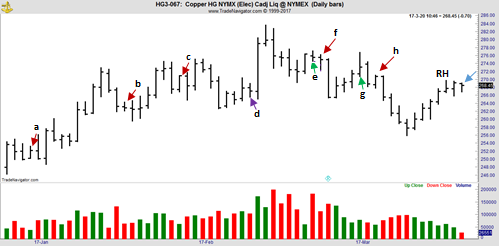

I want to call your attention to the New York, Comex Copper futures. Look first at the blue arrow which points to Friday’s price bar. Notice that on Monday there is a TTE to go long 1 tick above Friday’s high for entry ahead of a violation of the Ross hook (RH), which is the high of the recent leg up.

The question I propose to you is this: Should you consider taking that TTE? In order to determine an answer, let’s look at a bit of history. Beginning from left to right using the red and purple arrows, let’s see how the TTE fared previously in this particular market.

There was a TTE to go long ahead of a Rh at “a”. Had you gotten long you didn’t get very far and may very well have been stopped out, as prices ended up at the low of the day. There was a TTE to go long at “b”. Following that trade there was a similar move against you with prices moving lower before rallying a bit at the close. The same thing happened at points “c.” and at “d” the TTE to go short ended up in disaster. The TTEs at “f” and “h” were not filled, but the TTEs at “e” and “g” turned out to be good trades. However, the TTE to go short at “e” is the only one that took prices out of the trading range.

An additional consideration is that there is very little room for making a profit between the high of the current TTE (blue arrow) and the point of the RH. What else can we know about trading in the copper market?

Daily volume has been falling and Friday’s volume was very weak. Weak volume indicates poor liquidity. It takes many buyers hitting the offer and many sellers hitting the bid to create a liquid market. Absent real liquidity, all you have is the chance for a few insiders to run the stops. That is what we saw on Friday and at the Traders Tricks were not so good.

What else do we know? Copper is a somewhat thinly traded and notoriously crooked market. If you don’t know about things like that, you have no business trading.

Avoid illiquid markets. Be sure to check volume. How much is it on average and is it steady day after day. And perhaps the greatest lesson of all should you happen to leap before you look--never, ever trade on hope or stay in a trade based on hope. If you are wrong, get out. If you don't have the discipline to do that, you shouldn't be trading.

Joe Ross has put together a special recorded online webinar: "The Traders Trick – Advanced Concepts." In it you will learn how to use the Traders Trick Entry (TTE) as one of your tools, very likely your greatest trading tool and setup. This webinar will last about 1 hour 52 minutes. Follow this link to find out more and watch it today!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading is a Business

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Is learning the trading business like learning any other business?

The importance of how you learn the business of trading cannot be minimized because of the factors that determine your success or failure. Learning the business of trading is basically no different from learning any other business. Winning means learning major guidelines and concepts that you repeat so often in your own behavior that they become good habits. These good habits then become automatic behavior patterns, which are formed as brain pathways by the rewards you get for trading well and the punishment you receive from trading poorly. When you associate yourself with other traders, try to associate with those who are building their personal net worth, not just talking about it. True success is silent. Try not to do something just because everyone else is doing it. Successful traders are rare. If the crowd is doing it, watch out!

If you'd like to turn all your hours of effort in studying the markets into profitable trading, to rid yourself of the mental gridlock that often plagues traders, and to truly become an intuitive trader, then you'll want to read this very important book to make money trading - Trading Is a Business.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - MEOH Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 7th November 2017 we gave our Instant Income Guaranteed subscribers the following trade on Methanex Corporation (MEOH). We sold price insurance as follows:

- On 7th November 2017, we sold to open MEOH Dec 15 2017 45P @ 0.45$, with 38 days until expiration and our short strike about 12% below price action.

- On 22d November 2017, we bought to close MEOH Dec 15 2017 45P @ 0.20$, after 15 days in the trade for quick premium compounding.

Profit: 25$ per option

Margin: 900$

Return on Margin annualized: 67.59%

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea: CLN18 – HON18

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

This week, we're looking at CLN18 – HON18: long July 2018 Crude Oil and short July 2018 Heating Oil (NYMEX on Globex).

Today we consider an inter-market spread in the energies: long July 2018 Crude Oil and short July 2018 Heating Oil. The spread has been in a down-trend for several months but seems to slow down. As we can see on the seasonal chart the July Crude Oil usually outperforms the July Heating Oil during the time between 12/06 and 01/18. Because we are spreading between two different markets the spread requires high margin and high risk of about $1,000 to $1,500.

Learn how we manage this trade and how to get detailed trading instructions every day!

Please visit the following link:

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Day Trading Market News

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

What to do around news events or when the market starts to move strongly caused by some news that just hit the market? I’m sure this is one of the most common questions traders ask themselves every day. At least I do!

If you’re new to trading and actually take this as a serious business, not just another place to gamble here’s my answer: Don’t trade shortly before or after news releases and come back when the market is back to normal. The odds of getting into trouble are much higher than making a profit if you don’t know what you’re doing.

On the other side if you’re an experienced trader you might have recognized that it’s not all black and white when it comes to trading news. Yes, volatility can get crazy, liquidity can be worse than usual and often you’ll just get stopped out of trades before the market takes off. But often this is also the time when the market does make major moves and to survive as traders it’s helpful if you can capture some of these. That’s especially true in news driven markets like the currency markets.

What I like to do when the setup is right is to fade the initial market move at price levels where I consider the market too stretched to move through. Here’s what I watch out for:

- Get into trades only with limit orders, the odds of getting negative slippage are too high using market orders. Using limit orders chances aren’t bad you’ll get positive slippage on a regular basis.

- Cancel any orders that are close to where the market is trading before the news. Odds are they’ll get filled simply due to the volatility in the market.

- Fade the move at support/resistance points where the market might be too stretched to move through on the first attempt. Moving to a lower timeframe to look for reversal patterns can be helpful if you don’t like blindly fading a strong move.

- Use small stops and multiple R targets. This will only work if you capture > 3R winners on a regular basis. Many of these trades will not work out and often you’ll have to take a full loss.

- To achieve this, don’t scale out. You don’t want to hit that 5R profit target with only 1/3 of your position on! Instead, trail your stop and tail it tighter the more parabolic the move gets.

- Have a far-off profit target in place in case the market goes crazy enough to make it there.

Here’s an example from this Monday of such a trade in GBP/USD. It’s a very nice example and most trades don’t turn out that nicely but showing a losing trade that just stopped me out would be boring right? I had planned to buy around 1.3290 but as the news hit the board I canceled the order. But just in case the market would go there I put in a new entry order at a much lower price (see chart). I got filled there when the pound really was sold off and about 2 hours later the market unexpectedly hit my profit target. While the pound was moving higher I kept on moving up my stop but luckily didn’t get stopped out before the target was hit.

Happy Trading!

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.