Edition 706 - December 22, 2017

Chart Scan with Commentary - The Importance of the Big Picture

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

When prices on a daily chart remain contained, traders can become complacent, and vulnerable to emotional breakouts.

When prices trade in a range for an extended time, the market begins to depend on those prices. Traders make assumptions and plans about such markets, and tend to trade accordingly. Sometimes those plans can extend well into the future, in turn generating other plans contingent on a certain level of continuing price containment.

But what if prices break out of that range? Complacency gives way first to surprise, then to denial, sometimes to desperation. The latter can eventually induce panicky behavior, driving prices even further.

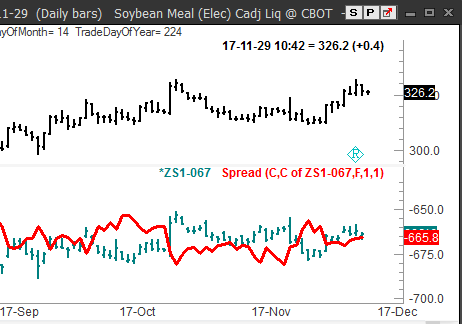

The chart below shows a currency spread (line chart overlay) long Soymeal (upper bar chart) and short Soy beans (lower bar chart). As you can see, each of the two markets is in a trading range, and so is the spread.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - It Can Look Good in Hindsight

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

The human mind is capable of extreme optimism. We have a strong need to win. This need can be so strong that everything looks rosy. For example, you may look backward at old charts and think, “It’s easy to see winning patterns.” Behavioral economists call this optimism, ‘hindsight bias.’ When we know how a stock price moved in the past, we think it all seemed inevitable when we look backward. For example, if you looked at a rise in stock price over the past few years, you may think in hindsight that it was inevitable. People have been positive about stocks.

Profits have been good, and of course, stock prices went up. You may have also seen the decline at times as being inevitable as well. If too many investors buy, prices were bound to go down a little eventually. The patterns all make sense in hindsight. The problem, however, is that people have difficulty seeing these patterns in foresight.

People are, indeed, too optimistic. Our thinking can be biased and self-serving. We can falsely believe that good quality setups are easy to spot, and we can convince ourselves that success is assured. But our expectations don’t always match reality.

The mind is prone to bias and unrealistic optimism. That’s why it is crucial to cultivate a healthy sense of skepticism. Skepticism isn’t the same thing as pessimism. A pessimist falsely distorts reality to the point that he or she believes that even a reasonable plan is doomed. A skeptic is optimistic yet is also realistic. No trading plan is foolproof. You may look back at old charts and see a foolproof way to make money. But history only repeats itself when it does (and sometimes it does not), and the mind can make it all look so obvious in hindsight. The markets don’t always cooperate with you. The winning trader is the person who questions a trading plan before executing it. He or she tries to anticipate what could go wrong, and thinks of ways to work around these potential setbacks. Being a healthy skeptic can be difficult at times, but the cautious optimist usually ends up making the most profits in the end.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - SLCA Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 19th November 2017 we gave our IIG subscribers the following trade on U.S. Silica Holdings Inc (SLCA). We sold price insurance as follows:

- On 20th November 2017, we sold to open SCLA Jan 19 2018 27P @ 0.425$ (average price), with 59 days until expiration and our short strike about 21% below price action.

- On 12th December 2017, we bought to close SLCA Jan 19 2018 27P @ 0.20$, after 22 days in the trade

Profit: 22.50$ per option

Margin: 540$

Return on Margin annualized: 69.13%

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post: I just wiped out for the second time.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

This week, Andy asks if he's some kind of trading freak. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video: Presenting Ambush Signals

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Learn all you need to know about our new Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier!

Happy Trading!

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.