Edition 792 - September 6, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Chart Reading

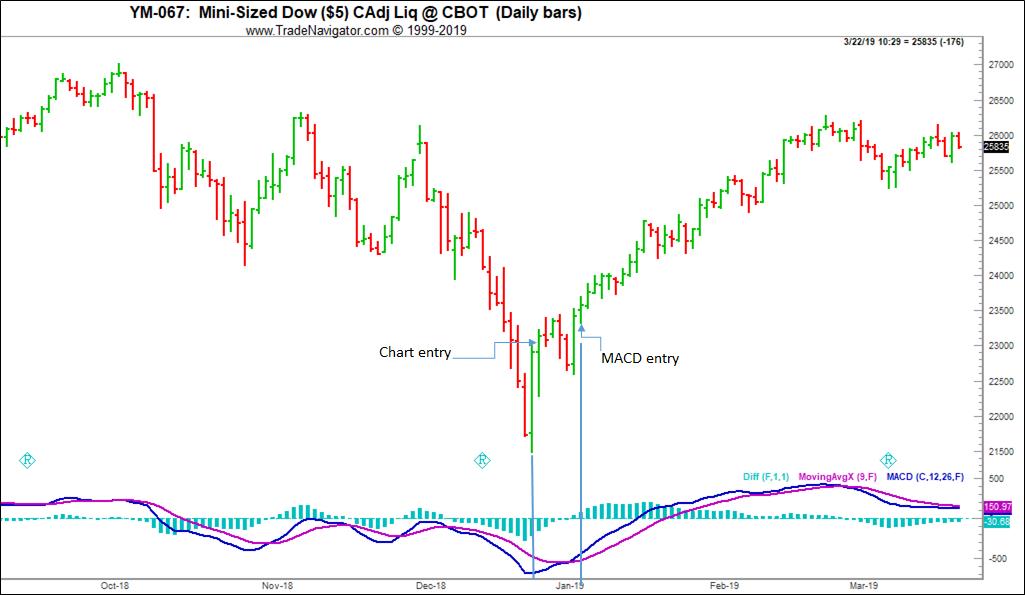

Early in my trading career, apart from moving averages, there were no indicators worthy of much mention. The computations needed for creating indicators were much too time-consuming for anyone to do without having a large main-frame computer, or at the very least a mini computer (cost $400,000). I learned to trade by reading a chart. In my opinion, chart reading still has the advantage over trading with indicators, especially if an indicator become the prime reason for entry into a trade. Indicators are okay as confirming entities to what a trader can see with the naked eye, but in my opinion that’s all they are good for. Of course, this kind of thinking is contrary to the vast majority of opinion among those who trade the markets.

The greatest weakness of an indicator is the fact that it requires historical data. Indicators are generally detrended plots of moving averages of whatever is the underlying. Because they depend on historical data, they are always behind the actual price action. The following is an example of what I mean.

For the Chart entry all that was needed was single reversal bar. Buy on the following bar at the price of the high of the reversal bar. Take a scalp trade and a second trade was possible at the MACD entry. The reversal bar gave its signal 7 bars before the MACD entry signal. The MACD entry was possible on the 8th bar of the series.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Be Flexible

As traders in the markets, it's informative to study everyday examples of mass psychology. Although humans are highly intelligent, they can act like cattle blindly following the leader of the pack to the slaughterhouse. For example, have you ever...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Getting in Step with the Market

Early in the trading day, as part of your daily preparation (you do have a daily preparation, don’t you?) it's helpful to practice a little to get a "feel" for what you might do and how you might trade. One way to do it is to make....read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.