Edition 813

January 31, 2020

Trading with More Special Set-Ups Webinar - use coupon code during checkout for 35% OFF: MORE35

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Implied Volatility and Iron Condors Part 1

In the past few issues of Chart Scan we’ve been talking about trading options. The way many traders trade with options is much too complicated. Options, when used correctly are really simple. There is no need to learn a whole lot of ‘Greek’ words and no need to use multiple complex option strategies to get yourself out of a trade that has gone against you. Why churn your own account? As I wrote in my book, “Trading Optures and Futions,” you can use the best features of options combined with trading in the actual underlying instrument. To be perfectly clear, do not be afraid to combine futures with options-on-futures, or stocks with options-on-stocks.

One of my favorite ways to trade options on stocks is to pick the most volatile stock in a sector and trade it with an Iron Condor when that sector is having earnings. I can’t go into the whole strategy here in Chart Scan but this will give you something to study, and think about.

The question is: “How do I take advantage of the rising, and ultimately spiking, of Implied Volatility.

Notice that in the days prior to the earnings report, volatility began to rise. This kind of rise is almost universal ahead of an earnings date. The day prior to the earnings report, there was a very sharp upward spike in volatility. But as soon as the earnings report was out, volatility dropped like a rock. This means you would have to be in the trade no later than the day before earnings are reported, and out the day earnings are reported.

To be continued next week.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading with More Special Set-Ups Webinar - use coupon code during checkout for 35% OFF: MORE35

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: So, You Made a Mistake…

John is kicking himself right now. He just made an unexpected losing trade and he feels especially down. He expected to make a killing, and he was looking forward to winning and celebrating big. He thought he had done everything to prepare for the trade. He had looked at the moving average to discern the trend. He looked at the....read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Example: ZS

- On 5th December 2019, we sold to open ZS Jan 17 2020 40P @ 0.50, with 42 days until expiration and our short strike about 20% below price action.

- On 19th December 2019, we bought to close ZS Jan 17 2020 40P @ 0.25, after 14 days in the trade.

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Wiping out the Trading Account

Most successful traders failed at some point in their careers and wiped out their account. Many traders lose because they do not...read more.

Numbers don't lie!

Impressive performance when trading with Traders Notebook.

Andy Jordan is offering you 50% off his annual subscription free.

Click here for more information.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

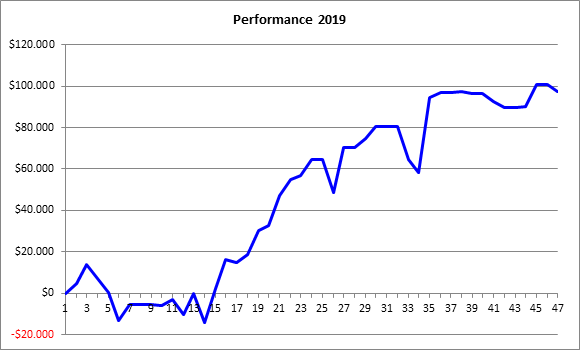

Traders Notebook Performance 2019

Today I want to have a closer look at the performance chart of all Traders Notebook trades in 2019. As you can see on the chart below, 2019 didn’t start well with the performance going negative very quickly. After trade 16, we were back in positive territory and we never got negative again thru the complete year.

The chart below shows the trading of a larger hypothetical trading account somewhere between $100,000 and $200,000 depending on the risk level of the individual trader. (Just to make sure, it is not necessary to trade an account of $100k to follow the trades of Traders Notebook. Most of our subscribers trade an account somewhere between $20k and $30k.) We had only 3 outright trades in 2019 the rests was done with spread trading, mainly calendar spreads.

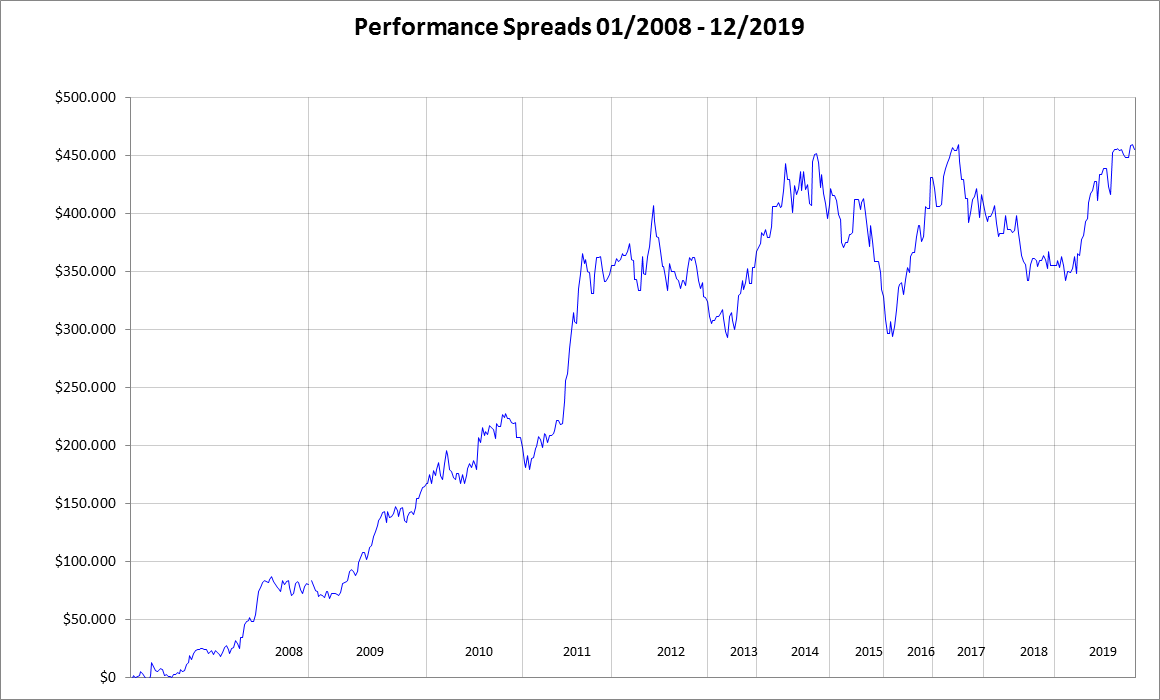

The overall hypothetical Traders Notebook performance looks nice as well, as you can see on the chart below. We are back to equity highs and there is a good chance that we move much higher this year.

By the way, all our performance is tracked by a third party using average entry/exit numbers of our subscribers. Because Traders Notebook doesn’t give any recommendation regarding trading size (we are not allowed to), some subscribers are doing better some are doing worse depending on there overall risk and money management.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

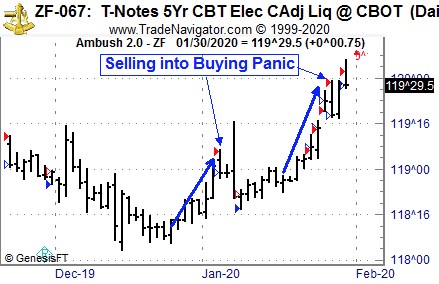

Ambush Signals: How pro traders profit from novice panic buyers

A common theme that occurs over and over in the markets is so-called panic buying. It usually happens after a market has already rallied for a couple of days, which is when professional traders are buying. In such a state, novice traders will finally notice the rally and out of fear to miss the rally start buying like crazy. No one wants to miss out so this can go on for quite a while.

Guess what happens at that point. The pro traders who bought much earlier sell right into these rallies, right into the buying panic. This way they get their orders filled without issues and when the novice traders realize what's going on, it's already too late. They got caught in a bull trap that will usually reverse violently!

The Ambush System is built to exploit exactly such situations in the markets, as we can see on the following chart of the ZF (5 Year T-Notes Future). Ambush keep on selling right into these buying panics and allows Ambush traders to profit big time:

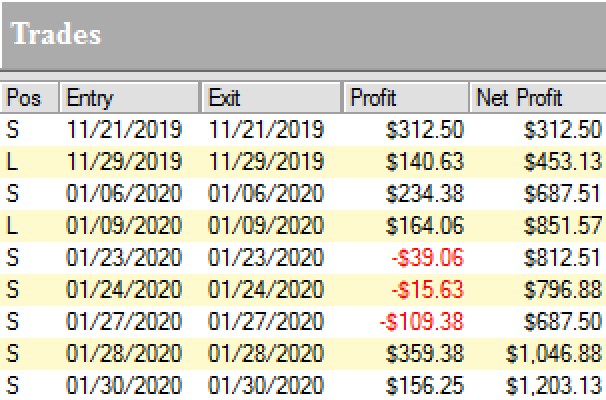

Here are the results of all the trades you can see on the chart:

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush Signals is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away and go for the big intraday moves!

The 5 Year T-Notes Future (ZF) is one of the futures that are part of the Mini-Future version of Ambush Signals. It's much cheaper than the pro version of Ambush Signals and is targeted to traders with smaller accounts. Check it out!

Happy Trading!

Marco

Marco Mayer is an Educator for Forex, Futures and a Systematic Trader, so if you have questions, he wants to hear from you! Contact Marco with questions!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.