Edition 820

March 13, 2020

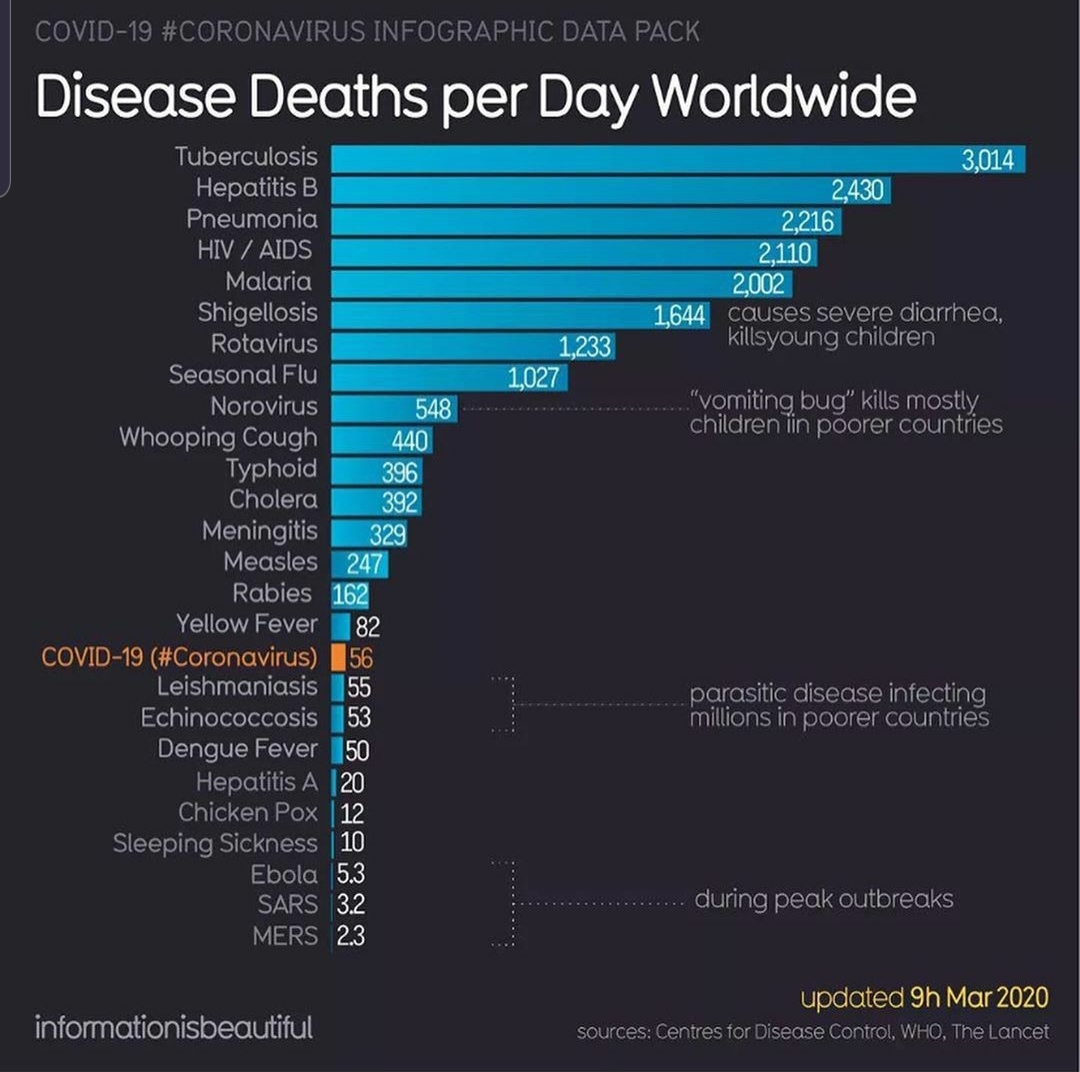

The World Health Organization (WHO) made the announcement on Wednesday, March 11, 2020, that the Coronavirus is a “pandemic” which is actually not as bad as an Epidemic which is a term that describes any problem that has grown out of control. An epidemic is therefore defined as “an outbreak of a disease that occurs over a wide geographic area and affects an exceptionally high proportion of the population.” Consequently, an epidemic requires a high proportion of society to be infected and is an event in which a disease is actively spreading. That is clearly not the case with the coronavirus. since the proportion of society infected has not even reached 1/10th of one percent of the population.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

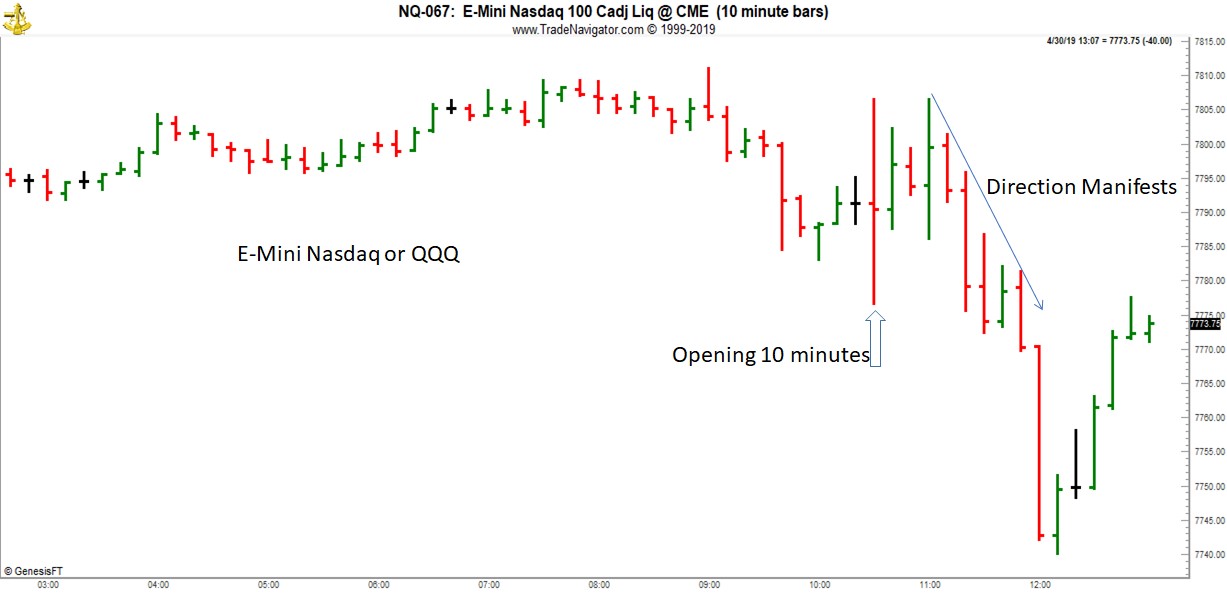

Chart Scan with Commentary: Avoid Trading Decisions During the 1st 20-30 Minutes

An important mistake many traders make involves making trading decisions during the first 20-30 minutes of a trading session. Trading decisions have nothing to do with executing orders during the first 20-30 minutes of a regular daily session. Keep in mind, making trading decisions and trade executions are two separate things.

If you have an existing signal from the previous night or a stop loss order in place and these trades are triggered and executed during the first 20-30 minutes of trading session, you are just following your trading plan and that's okay.

What I'm referring to is making new trading decisions, changing your trading plan or order placement based on what occurs in the first 20-30 minutes of the session. The first 20-30 minutes of a trading session consists of mostly trading noise and emotional volatility. The first 20-30 minutes is heavily involved with order filling, also known as stop running.

After the first 30 minutes the market sets the tone for the rest of the day and allows you to make less emotional trading decisions. In other words, the minutes immediately following the open is mostly random trading noise.

I’m adding one further thought that comes from my friend Steve C., a great trader in his own right: “If you’ve watched the markets for an hour looking for a trade, and have walked away not having done a trade…”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Winning Traders

The winning trader must be cold, calculating, and logical. It is absolutely necessary to control your emotions, rather than let them interfere with your trading decisions. While it is true that fear and greed are major factors in market behavior, there are other emotions, such as...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Example: ERII

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: These are the Times when Millionaires will be Made (but many more will lose their shirt)

I’ve read this phrase over and over again in scam emails, Twitter posts of different Gurus and other sources mainly because of marketing reasons using the current panic in the markets to sell there wisdom.

But all I know from brokers I know is, that many of there clients are losing or...read more.

Let Andy Jordan show you how to manage trades!

Visit Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: 5 Tips on how to Deal with drawdowns

With the ongoing crash in the stock markets, cryptocurrencies and many other markets like crude oil, many traders and especially investors currently find their accounts in a not so nice drawdown. So I thought this might be a good time to give some advice on how to deal with such drawdowns.

What’s a drawdown? Here’s a quick explanation: You buy one stock of a company at $100 and after a month it’s trading at $120. You’re now having profits of $20 or 20% on your account. Now the stock drops from 120 to 110, that’s $10 off the highs and therefore a $10 or 8.3% drawdown from the so-called high-water mark.

You don’t like these drawdowns at all? Neither do I but the fact is that drawdowns are the norm in trading, not the exception. Most of the time you’re simply not making new all-time highs in your equity curve. Meaning that usually, you’re in some kind of drawdown so if you want to completely avoid drawdowns, stop trading. Or learn how to deal with them.

Here are some tips on how to make it through these unavoidable trading valleys…

1) Zoom out: You’re long the S&P 500 and woke up to a 30% drawdown? That’s bad but hey it more than tripled over the last decade. So yes a 10% drawdown is not nice but seeing it in the right perspective helps a lot to see things actually aren’t that bad. Zoom out and get some distance to see the drawdown in a larger context.

2) Switch perspective: You’re in a drawdown and therefore lost money. That’s tough but how does this actually affect your daily life? Is there something you can’t do today you’d have been able to do otherwise? Any real changes in the quality of your lifestyle? Did your wife and kids leave you? If so you surely overtraded! But if not, the only thing that actually changed is your trading account balance. That’s not nice as it’s still real money you could do real things with but being aware that your daily life isn’t actually affected is a healthy thing to remember. It helps to reduce the emotional stress and to get back into the right mindset for trading. Stop the mental drawdown and get back up!

3) Think Long-term: Remind yourself of your long-term goals regarding trading. Why are you in this business at all. If your plan is practical the current drawdown won’t change it. You can still reach the long-term goal and succeed. See this drawdown for what it is and what happens in every business out there. You’re having a bad month/quarter/year. No reason to close your business right? Same with trading and in a couple of years you won’t even remember that little setback.

4) Look at the past: Have a look at previous similar drawdowns. The S&P had 30% drawdowns in the past, Bitcoin had 50% corrections and the system you’re trading might have had similar drawdowns in the past. This helps to notice that the drawdown you’re in might not be as unusual as you first thought. But what helps most is to notice what happened after these previous drawdowns. That’s what you want to focus on.

5) Move on: Finally, you got to accept the drawdown and move on. Everyone has these if you don’t believe me look at other professional traders/funds equity curves. Even the best out there have drawdowns especially if they’re in the game for many years. Not really accepting the drawdown makes you likely to do real mistakes. Or you might end up being paralyzed, unable to put on the next trades and miss exactly what would take you out of the drawdown. So in the end, you have to forget about it and move on!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.