Edition 821

March 20, 2020

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Cup with Handle

Recently, I was asked if the 1-2-3 low is the same as the Cup with Handle formation. The answer is that it isn’t. The 1-2-3 low is probably as old as the hills. Certainly, it is much older than the Cup with Handle. At times the 1-2-3 was/is known as an A-B-C formation. As far as I know, 1-2-3s and A-B-Cs can form at both bottoms and tops. This is not true for Cup-with Handle formations, which occur at market bottoms, and are considered to be a bullish continuation pattern.

The pattern was created by William O'Neil and discussed in his book, “How to Make Money in Stocks.”

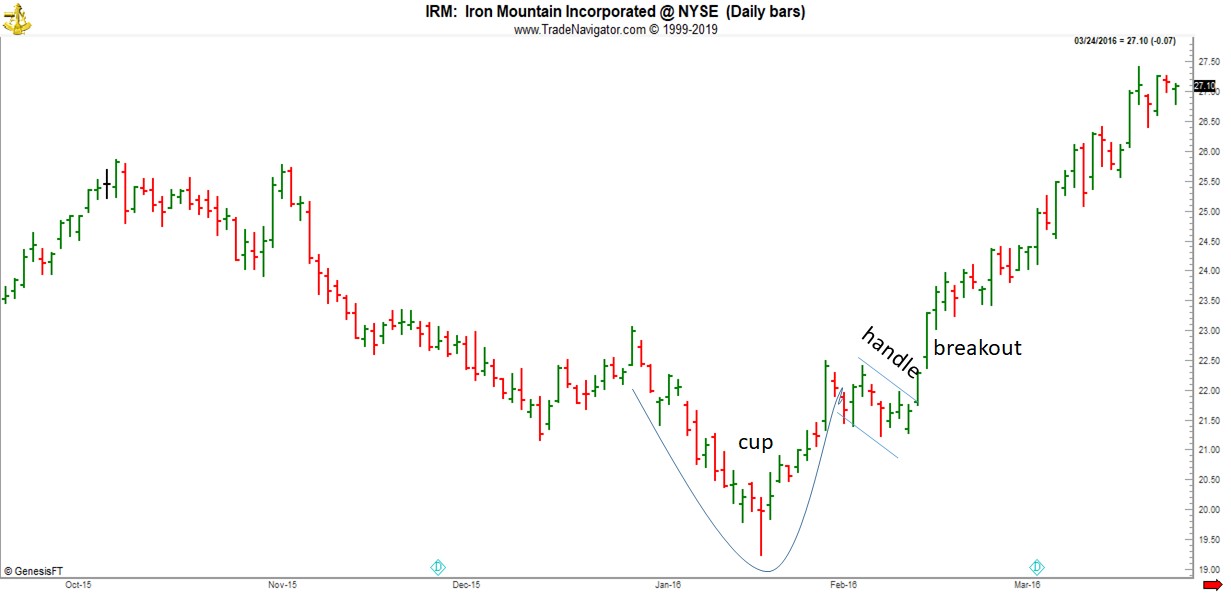

Sometimes, a Cup with Handle may contain a 1-2-3 low. Chart below shows a narrow cup. The cup handle is the most important part of the formation, and may be a sideways congestion, a pennant, or a flag.

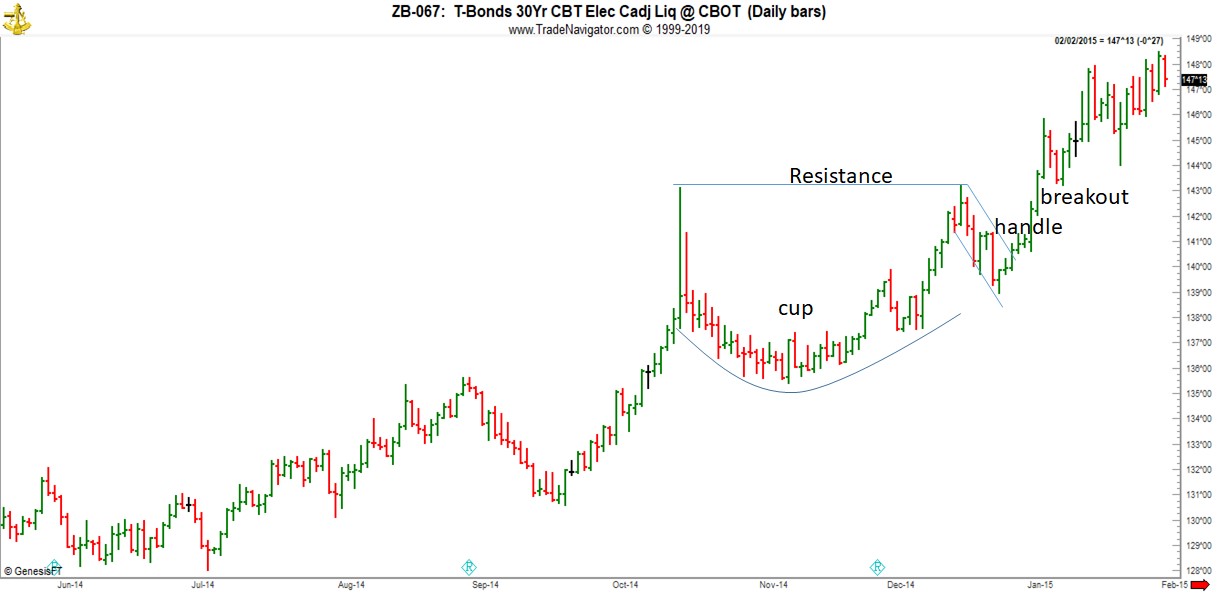

The depth of the cup may indicate more or less volatility. Chart below shows a very wide, bowl-shaped cup. As you can see, volatility was low going into the handle.

Do all Cup with Handles have bullish results? Definitely not. I believe that no more than half of them result in a bullish move.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Why I Commit to Teach and Train Others

Science has been called the most creative art form. It expresses its creations in technology. Valuable information is the most prized commodity, because it makes the wealth creation process and individual creative process possible. For me, passing on valuable information and...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

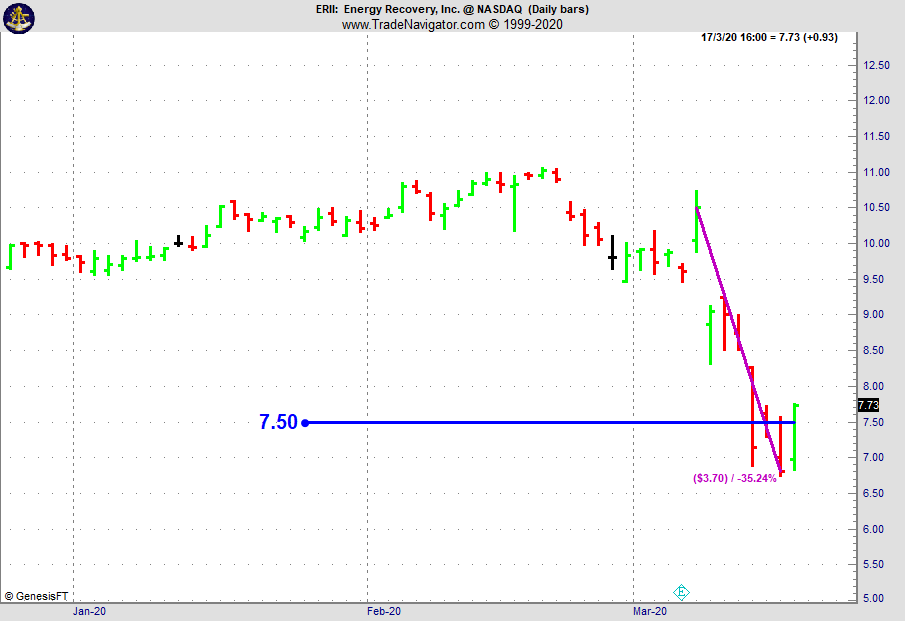

Last week we showed this quick trade on ERII options:

But we are living in a period of violent moves, up and down, driven by coronavirus and government news, every trade carrying a much higher degree of risk. Six trading days after my exit on a gap up on earnings, ERII had dropped more than 35%. ERII recovered my original short strike on Tuesday on a short covering rally.

If you cannot manage your emotions during these violent moves, this is probably better to stay on the side lines, waiting for the dust to settle.

Philippe

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Rationalizing Actions when Trading

One of the most important things to learn in this life is how we ourselves behave, not only when we are acting on our own, but when we are part of the crowd. And what few of us understand is...read more.

Let Andy Jordan show you how to manage trades!

Visit Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: 5 Tips on how to Deal with drawdowns

With the ongoing crash in the stock markets, cryptocurrencies and many other markets like crude oil, many traders and especially investors currently find their accounts in a not so nice drawdown. So I thought this might be a good time to give some advice on how to deal with such drawdowns.

What’s a drawdown? Here’s a quick explanation: You buy one stock of a company at $100 and after a month it’s trading at $120. You’re now having profits of $20 or 20% on your account. Now the stock drops from 120 to 110, that’s $10 off the highs and therefore a $10 or 8.3% drawdown from the so-called high-water mark.

You don’t like these drawdowns at all? Neither do I but the fact is that drawdowns are the norm in trading, not the exception. Most of the time you’re simply not making new all-time highs in your equity curve. Meaning that usually, you’re in some kind of drawdown so if you want to completely avoid drawdowns, stop trading. Or learn how to deal with them.

Here are some tips on how to make it through these unavoidable trading valleys…

1) Zoom out: You’re long the S&P 500 and woke up to a 30% drawdown? That’s bad but hey it more than tripled over the last decade. So yes a 10% drawdown is not nice but seeing it in the right perspective helps a lot to see things actually aren’t that bad. Zoom out and get some distance to see the drawdown in a larger context.

2) Switch perspective: You’re in a drawdown and therefore lost money. That’s tough but how does this actually affect your daily life? Is there something you can’t do today you’d have been able to do otherwise? Any real changes in the quality of your lifestyle? Did your wife and kids leave you? If so you surely overtraded! But if not, the only thing that actually changed is your trading account balance. That’s not nice as it’s still real money you could do real things with but being aware that your daily life isn’t actually affected is a healthy thing to remember. It helps to reduce the emotional stress and to get back into the right mindset for trading. Stop the mental drawdown and get back up!

3) Think Long-term: Remind yourself of your long-term goals regarding trading. Why are you in this business at all. If your plan is practical the current drawdown won’t change it. You can still reach the long-term goal and succeed. See this drawdown for what it is and what happens in every business out there. You’re having a bad month/quarter/year. No reason to close your business right? Same with trading and in a couple of years you won’t even remember that little setback.

4) Look at the past: Have a look at previous similar drawdowns. The S&P had 30% drawdowns in the past, Bitcoin had 50% corrections and the system you’re trading might have had similar drawdowns in the past. This helps to notice that the drawdown you’re in might not be as unusual as you first thought. But what helps most is to notice what happened after these previous drawdowns. That’s what you want to focus on.

5) Move on: Finally, you got to accept the drawdown and move on. Everyone has these if you don’t believe me look at other professional traders/funds equity curves. Even the best out there have drawdowns especially if they’re in the game for many years. Not really accepting the drawdown makes you likely to do real mistakes. Or you might end up being paralyzed, unable to put on the next trades and miss exactly what would take you out of the drawdown. So in the end, you have to forget about it and move on!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.