Edition 822

March 27, 2020

Dear Subscribers and Customers,

We value your customer satisfaction, please be aware that our server will be upgrading over the weekend to provide better performance and load times. However, you may experience some issues accessing our website or logging in the Member Area between Saturday 12AM to Monday 12AM. Please contact us with any questions or concerns: Click here!

Happy trading,

Trading Educators Team

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Options

Lately, we have been seeing a growing interest in option trading, especially for those who trade them in the stock market.

Personally, I’m mostly interested in selling options through our Instant Income Guaranteed program. It is a rare event for me to buy an option. But because there is real interested in both buying and selling options, consider this as the first in a series of articles I will be placing into some issues of Chart Scan.

Let’s begin with what an option is: Options are a type of derivative security. An option is a derivative because its price is intrinsically linked to the price of something else. If you buy an options contract, it grants you the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Similar to buying an asset, buying a Call Option gives you a long position in the underlying asset. Similar to shorting an asset, buying a Put Option gives you a short position in the underlying asset. Traders who buy options (Calls or Puts) are not obligated to buy or sell. They have the choice to exercise their rights. This limits the risk of buyers of options to only the premium spent.

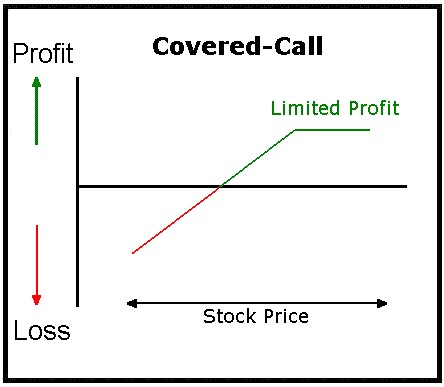

Most investors and speculators are buyers of options. Typically, they will purchase Calls because there is a definite bias toward rising prices. A covered Call involves buying a call on an underlying asset you already own.

There are three possible scenarios that can occur when you initiate a covered call: The asset can move higher; the underlying asset can move lower, or the underlying asset can stay at relatively the same price as when the trade was first initiated. I will cover each of these three possible scenarios one by one.

Let's assume that you bought ABC stock at $92, and it's currently trading a $92.00 per share. Earlier the same day you sold a $95 strike price call option that expires 7 weeks from now. When you sold the call option you took in $4.50 of premium or a total of $450.00 since each option contract equals 100 shares.

ABC stock trades higher

If ABC stock moves up to $100.00 before expiration, you will end up selling the stock to the buyer of the call option. The buyer will exercise his option, and you will end up selling 100 shares of ABC stock at $95.00 per share to the buyer of the call option.

In this case, you made money on the call option, since you kept the $4.50, which was the premium that you received on the deal. In addition, since the buyer bought the 95 strike price call option, he is required to buy the stock from you at $95.00 per share, even though the current market price is $100.00 per share.

Nevertheless, since you bought ABC stock at $92.00 per share and you sold it at $95.00 per share, you still made $3.00 per share profit, in addition to the $4.50 per share that you received from selling the option, so you made a total of $7.50 per share on the transaction.

ABC stock remains at or near the strike price

In this scenario, ABC stock will move from $92 dollars to $95.00 but won't move higher prior to expiration.

This creates the best case scenario for the call seller. If the underlying stock is at or below the strike price at expiration, the call seller gets to keep the premium and the shares. While the call buyer loses his $4.50 that he paid for the 95 strike price call option. The only time the buyer would exercise the call option is when the stock closed above the strike price before expiration. In our scenario, the stock never traded above $95.00 per share, so there would be no incentive for the call buyer to exercise the option. In fact, the call buyer would have to see prices move above $99.50 to avoid a loss.

The call seller can liquidate the stock after his obligation expires and collect the difference between paid and the current market price for the stock, which in our case would be $3.00 per share, since the stock was purchased at $92.00 and sold at $95.00.

Or alternatively, the call seller can once again sell calls against the same position since he never had to sell the stock and his obligation to sell already expired.

ABC stock trades below purchase price

In this case scenario, ABC stock begins moving lower after the call seller created his obligation, and settles at $88.00 per share at the time the call option expires.

The worst case scenario for the call seller occurs when the underlying asset moves lower after the call option is sold.

In this situation, the calls would expire worthless, since the stock went lower instead of moving higher and when the call option expired, the stock was well below the 95 strike price. The call seller would once again get to keep the premium which would be used to offset the loss that was incurred by the stock moving from $92.00 per share to $88.00 per share.

The call seller lost $4.00 in the value of the underlying asset, but gained $4.50 from the sale of the premium to offset the loss completely.

However, the situation could have been much different and the stock could have lost substantially more value between the time the option was sold till the option expired; which is the amount of time the option seller is locked into the trade, unless he chooses to end his obligation by buying back the option at market price.

Buying back a call option to unwind your obligation is not a bad idea, since call options decrease in value when stocks move down, giving you an opportunity to buy back the call option at a lower price than what you originally sold it for.

My best advice, is to figure out your breakeven point and liquidate the position if the underlying asset reaches that level. I typically calculate my break-even on the trade and liquidate the stock and my obligation as a seller of the option when the stock gets dangerously close to my break-even on the trade.

To calculate your break-even, simply subtract from your entry price the amount received from selling premium. In our particular case, we bought the stock at $92.00 and brought in $4.50 in premium, so our break even on the trade is $92.00 - $4.50 = $87.50

If ABC stock began breaking down and traded close to the $88.00 level, I would strongly consider liquidating the stock and buying back the option at that time.

Please note: Covered Call selling is a wonderful way to make money in a rising, or sideways market. I began my own option trading selling covered calls.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: That GUT FEELING is no mere figure of speech!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Your Worst Enemy

In general, we are our own worst enemy when it comes to trading. There are many ways to sabotage yourself as a trader.

Not creating a trading plan, or creating one and then not following it are two of the most common.

Some ways to self-defeat are deep seated; they lurk at the back of your mind and work behind the scenes. These are often self-image problems that can rise from as far back as...read more.

Let Andy Jordan show you how to manage trades!

Visit Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Knowing when NOT to trade

Traders want to trade. That’s what we feel is our job and that’s when we feel that we’re actually really doing something. And I think that’s why it can be so tough to go through periods of low trade frequency. It just somehow doesn’t feel right. Might be missing out on something. For sure the markets keep on moving and others are trading, right?

But feelings are often misleading, especially when it comes to trading. The fact is that to know when to not take a trade is as important as to...read more.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.