Edition 825

April 17, 2020

I would like to thank each and every one of you who sent me birthday wishes. You know how to make an 85 year young trader feel special and loved. Thank you, Joe Ross

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

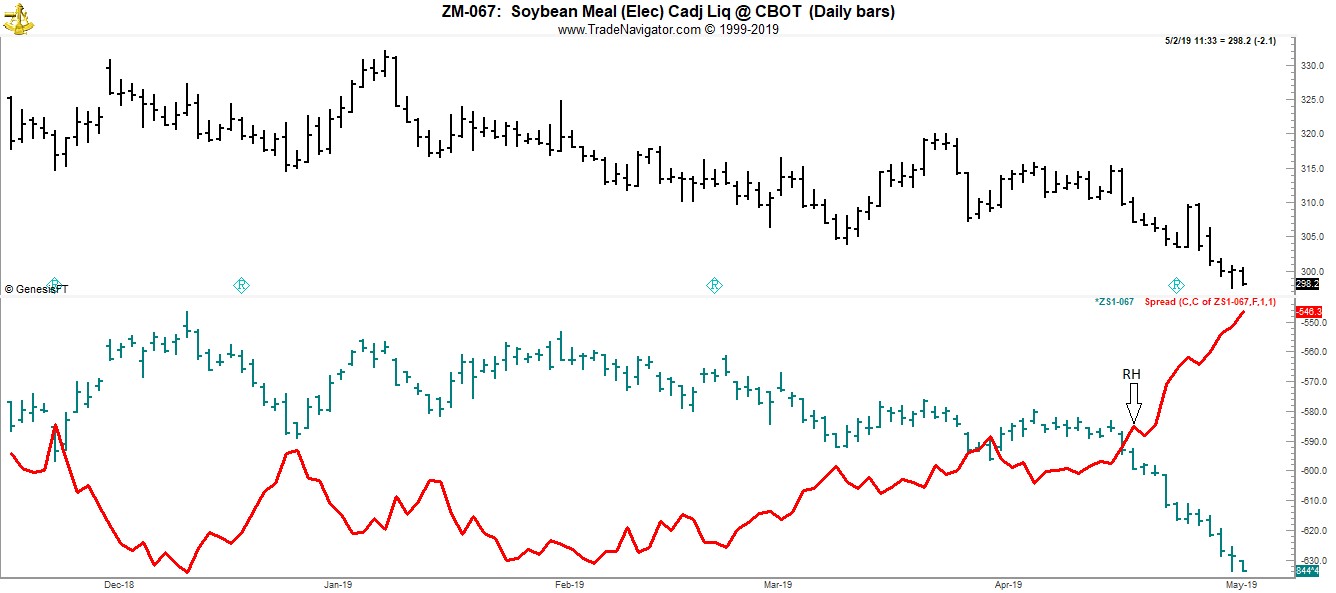

Chart Scan with Commentary: Spread Trading

On April 17, 2019 a long soymeal, short soybean spread formed a Ross Hook (RH). On April 22, 2019 the spread value violated the RH, and began moving up. I don’t know if the move was seasonal or not. I look at a few spreads every day, just to see if any of them should be entered. I made my entry at -581.40. So far, I’m up, with the spread value at -545.50.

Notice that both markets are in an established downtrend. However, soybeans are falling much faster than soymeal, thereby causing the spread between the two to widen—move up in value. In order to equalize the spread, you have to multiply the price of soymeal by 100, and the price of soybeans by 50.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Finding extra time to study? Use coupon code to broaden your learning experience:

web40

40% off Joe Ross' Webinars - Don't miss out!

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: What will success as a trader bring to my life?

Success has many faces: peace of mind, high levels of health and energy, loving relationships, financial security, meaningful goals and aspirations, and the feeling that you are growing into all that you are capable of becoming. Becoming all that you can be is called...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

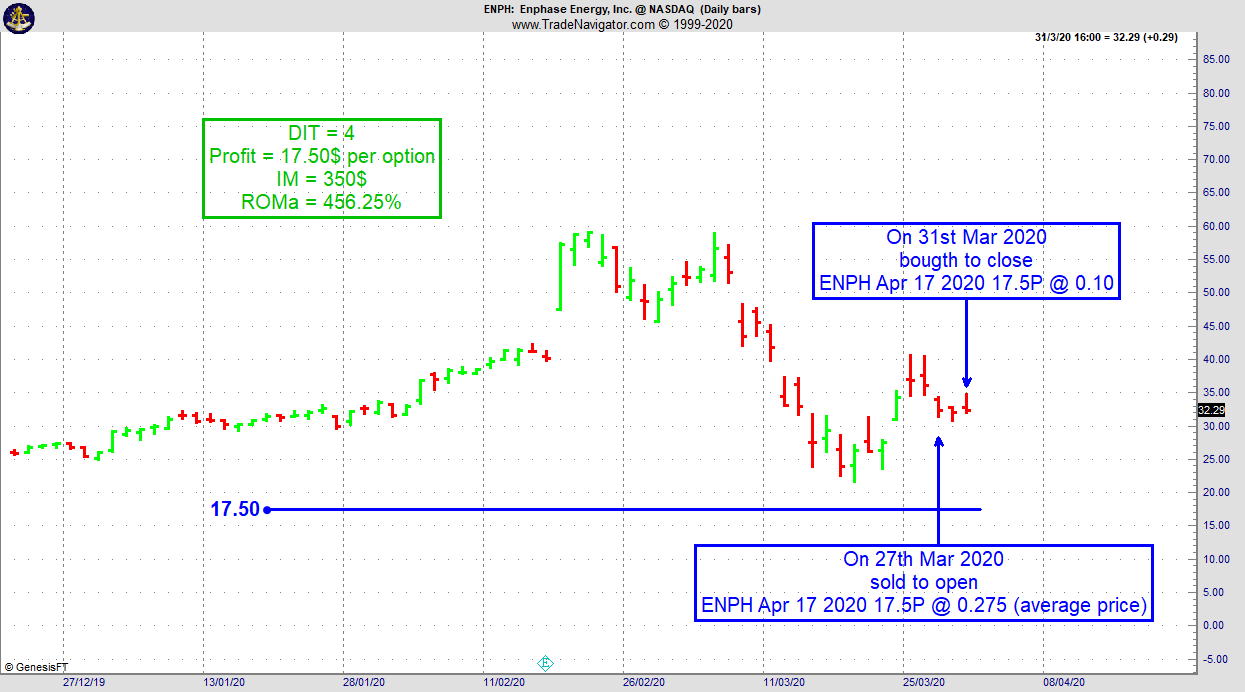

- On 25th March 2020, we sold to open ENPH Apr 17 2020 17.5P @ 0.275 (average price), with 22 days until expiration and our short strike about 49% below price action, making this trade extremely safe in spite of the volatile environment.

- On 31st March 2020, we bought to close ENPH Apr 17 2020 17.5P @ 0.10, after only 4 days in the trade, weekend included

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Finding extra time to study? Use coupon code to broaden your learning experience:

web40

40% off Joe Ross' Webinars - Don't miss out!

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Traders Notebook is now trading in Minis and Micros!

During times with very high market volatility, it is almost impossible to swing trade the futures markets, using the full futures contracts. Even some minis, like the US Indexes, are usually out of reach for the private trader with swings of sometimes over $10,000 on a single day.

That’s the moment when trading in the Micros makes a lot of sense. With 1/10 of the mini contract, the micros move only between $500 - $1,000 per day (today is 04/06/2020) which is more than enough for swing trading on a daily chart.

Imagine, I am day-trading a rather large account on a rather short time frame and even I had to move to the micros because the risk per contract was too high for me!

Unfortunately, not all markets offer micros. That is why we had to take a long trade in Crude Oil using the mini contract, which is ½ of the full contract.

We went long at 21.600 on 04/02 with an initial stop at 19.850. Our first and second target was hit on the same day after the market exploded to the up-side after Trumps tweet regarding the reduction of the oil production. We managed to exit the complete trade at around 26.500 by using a tight trailing stop.

Don’t get me wrong, even if this was a lucky trade for us, I still hate Trumps tweets because it makes the lives of a trader very difficult.

Of course, we are not getting a trade every day because not all micros and minis are liquid enough. But the ones we are using right now are highly liquid and we usually get really good fills.

If you are into futures trading and you find it hard to navigate in today’s markets, you should have a look at Traders Notebook.

Let Andy Jordan show you how to manage trades!

Visit Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Are you an efficient trader?

Most traders start out with a dream. Usually, a part of that dream is once you're a successful trader, you will have more time to enjoy things in life such as spending time with your family, friends, hobbies, time in nature and start other business opportunities. Besides making money, for many, the main reason to start trading is...read more.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Finding extra time to study? Use coupon code to broaden your learning experience:

web40

40% off Joe Ross' Webinars - Don't miss out!

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.