Edition 826

April 24, 2020

TRADERS NOTEBOOK SPECIAL!

"Traders Notebook helps to learn to trust entry and exit signals more. I have learned to trust myself more, watching and listening to Andy." ~ B. T.

25% OFF

1-YEAR and 6-MONTH SUBSCRIPTIONS

Coupon Code: tn25

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: MACD

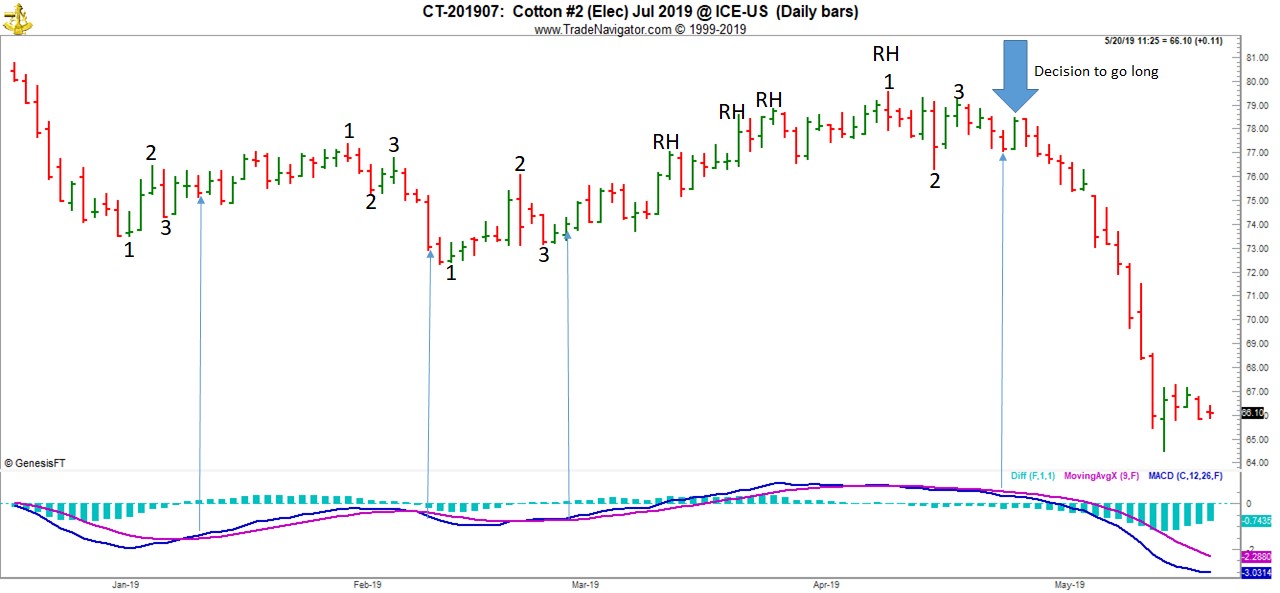

Apparently, a lot of traders use MACD. I get a lot of questions about the use and validity of this indicator. I will put what I have to say about it at the moment because I’m involved in helping someone who is in trouble in a cotton trade, and was using MACD.

Let me begin by saying I do not trade cotton other than using it in a spread trade. My great uncle had a seat on the cotton exchange, and he told me it was a crooked market and difficult to trade. At times it has also been a very thinly traded market. It’s possible now that the Chinese trade cotton, that it is no longer an illiquid market. The chart I show below for July of 2019 shows only 8,952 contracts traded for the July contract on May 17.

I will also add that the person involved is long July cotton, and currently paralyzed with fear. When you see the chart you will understand why.

After being greatly disappointed with the results of having traded MACD crossovers (blue line crossing purple line), the decision was made to trade based on, “prices looked like they were going higher, so I simply got long.”

I rarely use indicators, and when I do, I use them strictly for confirmation of The Law of Charts (TLOC). Please realize that the way cotton was trading throughout the year, any momentum indicator would have had trouble with the cotton market. Overall, it was swinging sideways, with only moderate size swings. Let’s look at it now:

I marked a bunch of 1-2-3 formations as a way of comparing the MACD crossover signals to possible entries based on TLOC. I insisted on seeing a clear space between the MACD lines prior to using it for entry. Starting at the left of the chart, MACD would have signaled a buy entry one bar later than the 1-2-3 low formation. Still, it was good signal. Next came a 1-2-3 high signal. MACD was horribly late for going short.

The third 1-2-3 formation was a 1-2-3 low, and like the first 1-2-3 low it gave a good buy signal, one day later than TLOC. Following the third 1-2-3 formation, there were a series of Ross Hooks. During that time, the blue line stayed above the purple line, and presumably you were long.

Finally, there was a fourth Ross Hook, which evolved into the number 1 point of a 1-2-3 high. (Note: Every RH has the potential to become the number 1 point of a 1-2-3 formation)

The TLOC sell signal came 1 bar after the number 3 point of the 1-2-3 high. The confirming signal from MACD came three bars later. It, too, was a good signal for going short. However, the long green bar (fat blue arrow) following the MACD sell signal convinced the trader that cotton was about to breakout to the upside, and so a long position without a stop loss in place was taken. You can laugh or cry about the rest of what happened.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Finding extra time to study? Use coupon code to broaden your learning experience:

web40

40% off Joe Ross' Webinars - Don't miss out!

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Closing Out a Trade

You must be disciplined in following the plan of your trade. Once you have closed your position, you should record everything about the trade. Write down where you wanted to enter the trade, what you expected out of the trade, and what you actually did get out of the trade. Make sure to include...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

TRADERS NOTEBOOK SPECIAL!

"The help I think is in the comments where things are clarified for beginners and of course Andy's choices are of help in comparison to trading on your own blindly. I like most in TN the quality of advice and serious motivation by Andy to not trade stupidly (and of course by JR)." -- V. M.

25% OFF

1-YEAR and 6-MONTH SUBSCRIPTIONS

Coupon Code: tn25

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Traders Notebook is now trading in Minis and Micros!

During times with very high market volatility, it is almost impossible to swing trade the futures markets, using the full futures contracts. Even some minis, like the US Indexes, are usually out of reach for the private trader with swings of sometimes over $10,000 on a single day.

That’s the moment when trading in the Micros makes a lot of sense. With 1/10 of the mini contract, the micros move only between $500 - $1,000 per day (today is 04/06/2020) which is more than enough for swing trading on a daily chart.

Imagine, I am day-trading a rather large account on a rather short time frame and even I had to move to the micros because the risk per contract was too high for me!

Unfortunately, not all markets offer micros. That is why we had to take a long trade in Crude Oil using the mini contract, which is ½ of the full contract.

We went long at 21.600 on 04/02 with an initial stop at 19.850. Our first and second target was hit on the same day after the market exploded to the up-side after Trumps tweet regarding the reduction of the oil production. We managed to exit the complete trade at around 26.500 by using a tight trailing stop.

Don’t get me wrong, even if this was a lucky trade for us, I still hate Trumps tweets because it makes the lives of a trader very difficult.

Of course, we are not getting a trade every day because not all micros and minis are liquid enough. But the ones we are using right now are highly liquid and we usually get really good fills.

If you are into futures trading and you find it hard to navigate in today’s markets, you should have a look at Traders Notebook.

Let Andy Jordan show you how to manage trades!

Visit Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

TRADERS NOTEBOOK SPECIAL!

"I really learned trade management. It also provides a good track to learn to be consistent, and saves my time in finding trading opportunities." -- G. N.

25% OFF

1-YEAR and 6-MONTH SUBSCRIPTIONS

Coupon Code: tn25

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Some people seem to like to lose, so they win by losing money

This is one of the quotes about trading that stuck with me. I googled it and it's from Ed Seykota, I probably read it in one of the Market Wizards books, which I can highly recommend.

The exact quote is...read more.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Finding extra time to study? Use coupon code to broaden your learning experience:

web40

40% off Joe Ross' Webinars - Don't miss out!

TRADERS NOTEBOOK SPECIAL!

25% OFF

1-YEAR and 6-MONTH SUBSCRIPTIONS

Coupon Code: tn25

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.