Edition 827

May 1, 2020

TRADERS NOTEBOOK SPECIAL!

"Traders Notebook helps to learn to trust entry and exit signals more. I have learned to trust myself more, watching and listening to Andy." ~ B. T.

25% OFF

1-YEAR and 6-MONTH SUBSCRIPTIONS

Coupon Code: tn25

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Beautiful Trend

Hey Joe! I’ve heard you say that futures markets used to trend for long periods of time. You said they made “beautiful trend.” I’d like to know what a beautiful trend looks like.

Yes! I’ve said that many times. There’s a reason why commodity futures (not all futures) markets are able to trend for very long times. It’s simple: Supply and Demand. If there is a shortage of a commodity it will usually trend upward until one of two things happens. 1) the shortage ends or, 2) the commodity becomes so high priced that people stop buying it. For example, if corn prices become too high, a cattle farmer can switch to oats, or wheat for feed.

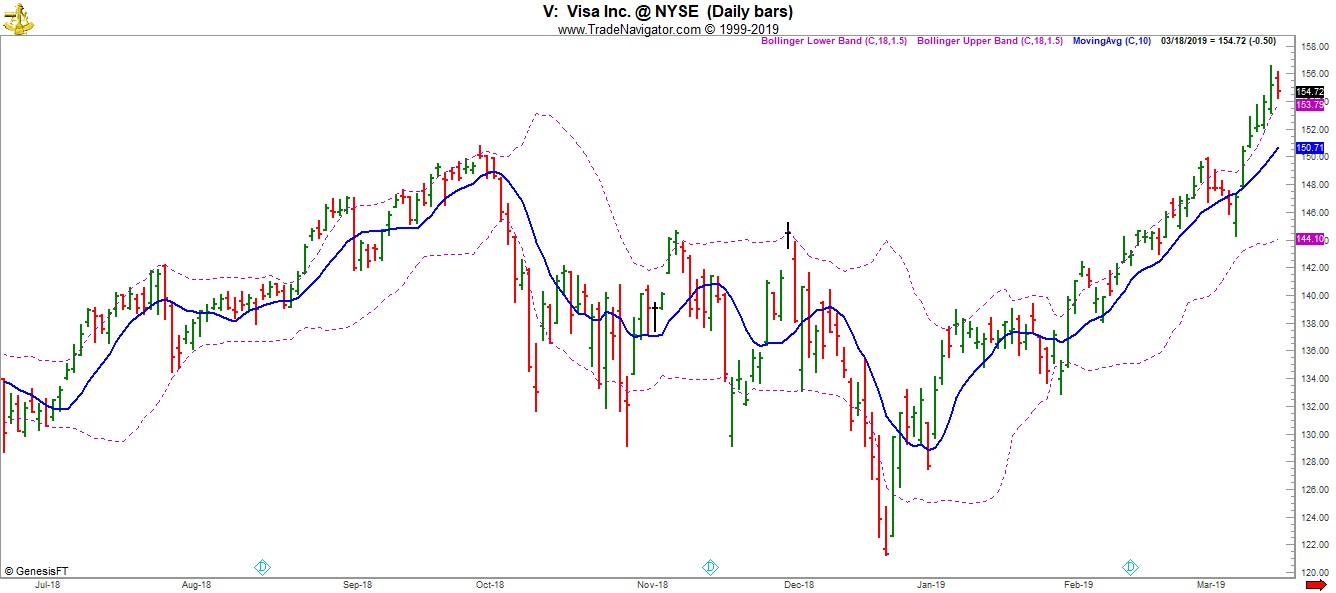

However, the ability to trend as much or as often as they used to, has been somewhat mitigated by the use of computers and computerized indices. When computer algorithms decide a commodity is overbought or oversold, prices will start moving countertrend. That said, let’s look at a beautiful trend in Visa Inc., at the New York Stock Exchange. Visa began trending with a huge move on February 1, 2019. Prices crossed from 2 Standard Deviations below the average price to 2 Standard Deviations above the average price. Since that day, it has closed above 2 Standard Deviations from its average price, 15 times. That is incredible strength. Apparently, Visa Shares are in great demand.

Notice that Visa share prices trended strongly for brief periods of time from July of 2018, until October of 2018.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Finding extra time to study? Use coupon code to broaden your learning experience:

web40

40% off Joe Ross' Webinars - Don't miss out!

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Money Supply

How does money supply affect trading in the markets?

There are two important components of federal market activity which affect long- term economic activity and stock and commodity values; these are interest rates and money supply. A contracting money supply was one of the factors that caused the Great Depression of the 1930's. In the early 1980's most traders focused almost totally on the money supply figures..read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

TRADERS NOTEBOOK SPECIAL!

"The help I think is in the comments where things are clarified for beginners and of course Andy's choices are of help in comparison to trading on your own blindly. I like most in TN the quality of advice and serious motivation by Andy to not trade stupidly (and of course by JR)." -- V. M.

25% OFF

1-YEAR and 6-MONTH SUBSCRIPTIONS

Coupon Code: tn25

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Traders Notebook is now trading in Minis and Micros!

During times with very high market volatility, it is almost impossible to swing trade the futures markets, using the full futures contracts. Even some minis, like the US Indexes, are usually out of reach for the private trader with swings of sometimes over $10,000 on a single day.

That’s the moment when trading in the Micros makes a lot of sense. With 1/10 of the mini contract, the micros move only between $500 - $1,000 per day (today is 04/06/2020) which is more than enough for swing trading on a daily chart.

Imagine, I am day-trading a rather large account on a rather short time frame and even I had to move to the micros because the risk per contract was too high for me!

Unfortunately, not all markets offer micros. That is why we had to take a long trade in Crude Oil using the mini contract, which is ½ of the full contract.

We went long at 21.600 on 04/02 with an initial stop at 19.850. Our first and second target was hit on the same day after the market exploded to the up-side after Trumps tweet regarding the reduction of the oil production. We managed to exit the complete trade at around 26.500 by using a tight trailing stop.

Don’t get me wrong, even if this was a lucky trade for us, I still hate Trumps tweets because it makes the lives of a trader very difficult.

Of course, we are not getting a trade every day because not all micros and minis are liquid enough. But the ones we are using right now are highly liquid and we usually get really good fills.

If you are into futures trading and you find it hard to navigate in today’s markets, you should have a look at Traders Notebook.

Let Andy Jordan show you how to manage trades!

Visit Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

TRADERS NOTEBOOK SPECIAL!

"I really learned trade management. It also provides a good track to learn to be consistent, and saves my time in finding trading opportunities." -- G. N.

25% OFF

1-YEAR and 6-MONTH SUBSCRIPTIONS

Coupon Code: tn25

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: How much to risk per trade

One of the questions every trader has to think about at some point is, how much of my account should I risk per trade? A percentage? If so, what percentage?

I’d love to have the right answer in my pocket for you, like "exactly 1.25% per trade/market and no more than 5% at the same time," but unfortunately, I don’t. I know you don’t want to waste too much time with this boring aspect of trading and just want...read more.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Finding extra time to study? Use coupon code to broaden your learning experience:

web40

40% off Joe Ross' Webinars - Don't miss out!

TRADERS NOTEBOOK SPECIAL!

25% OFF

1-YEAR and 6-MONTH SUBSCRIPTIONS

Coupon Code: tn25

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.