Edition 832

June 5, 2020

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Buying New Highs

Joe! What do they mean by buying new highs? Frankly, I’m scared to buy them. It seems the times I’ve done it I always get stopped out.

Buying new highs requires some careful consideration. I’ll show you what I look for, and then get into how to trade them.

One of the best times to trade new highs is when a market, any market, makes a new 52-week high. Remembering that markets change over time, we have to look at how they have been trading in recent years. One thing to notice is that more often than not, when a market makes a new 52-week high, prices pull back before once again approaching the high area for a second time. It is the second time through that you want to attempt an entry.

You want to start by finding stocks, futures, or Forex markets that have reached the 52-week high price level.

It’s best to find a market that is creeping slowly towards the 52-week high level, but rather they are approaching with strong momentum and high volatility. I’m going to use PayPal as an example of what I mean.

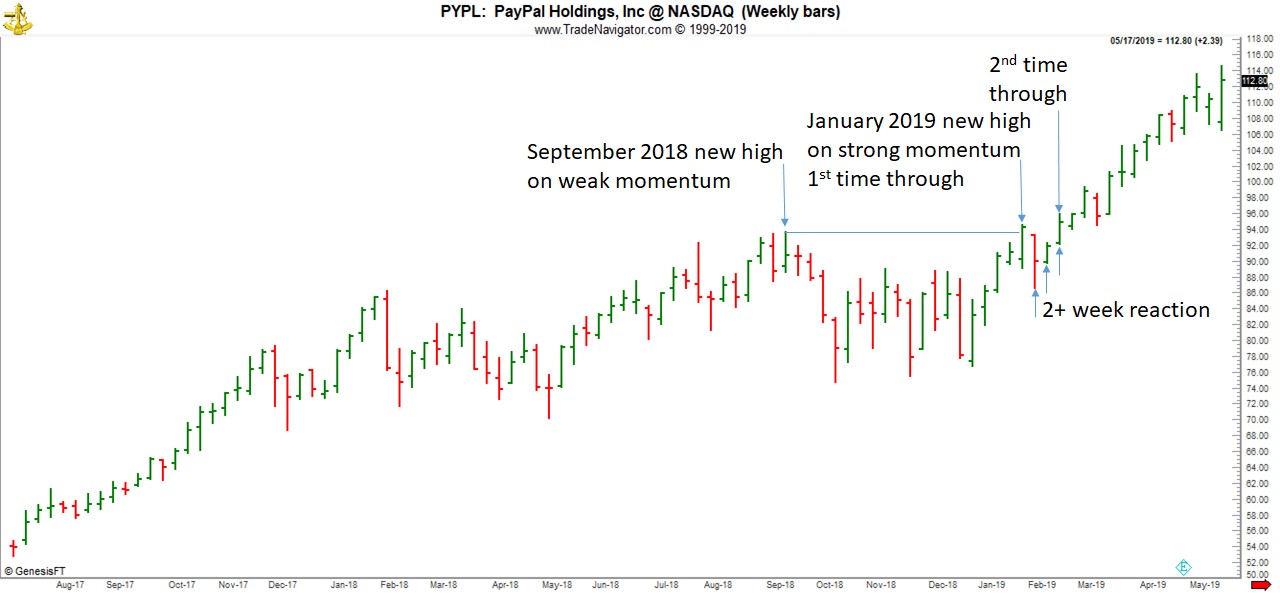

The week ending September 14, 2018, PYPL made a new 52-week high, at $93.70. Notice, it did not do so with strong momentum. It would take until the week ending in January 25, 2019 for prices to break through the September 2018 high. When it did so, it was with strong momentum. Prices reached $94.58, before reacting to the new high. It took a bit more than 2 weeks of daily bar corrections before prices broke the new high. The weekly chart shows what I mean.

Once prices hit the 52-week high, there was the expected pull-back. The market should take anywhere from 1-3 weeks to consolidate and try again to break through the 52-week high level. Following is how it looked on the daily chart.

As you monitor the market each day, you are looking to buy $0.25 above the high of the 1st time through (Jan. 25, 2019). For futures, and Forex, buy 1 tick or pip above the high of the 1st time through.

You may want to monitor the trade intraday. If so, for stocks use a 15-minute chart. For futures or Forex, use a 5-minute chart.

by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

If you place your stop a certain number of ticks or pips distant from your entry point, or a certain distance from your entry using a percentage basis, you probably are placing your stop in the wrong place. If you place your stop a certain dollar amount from your entry, below "support," above "resistance," or based on a chart pattern, we know you are upside-down in stop placement. Please believe us, there are much better ways! Joe Ross wrote this eBook "Stopped Out" in order to show you four specialized ways for stop placement. Every single one of them is based on reality. Your stops will rarely be where everyone else puts theirs. Your stops will be unique to you, based on your personal risk tolerance, in conjunction with the risk in the market.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Trading Psychology

Many traders are aware that trading psychology is the most crucial piece of the puzzle in learning how to become a profitable trader. However, most traders avoid taking the steps that are necessary to correct or improve their response to market behavior and end up paying a hefty price in the end.

There are some specific steps you can take to improve your...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

CHGG trade

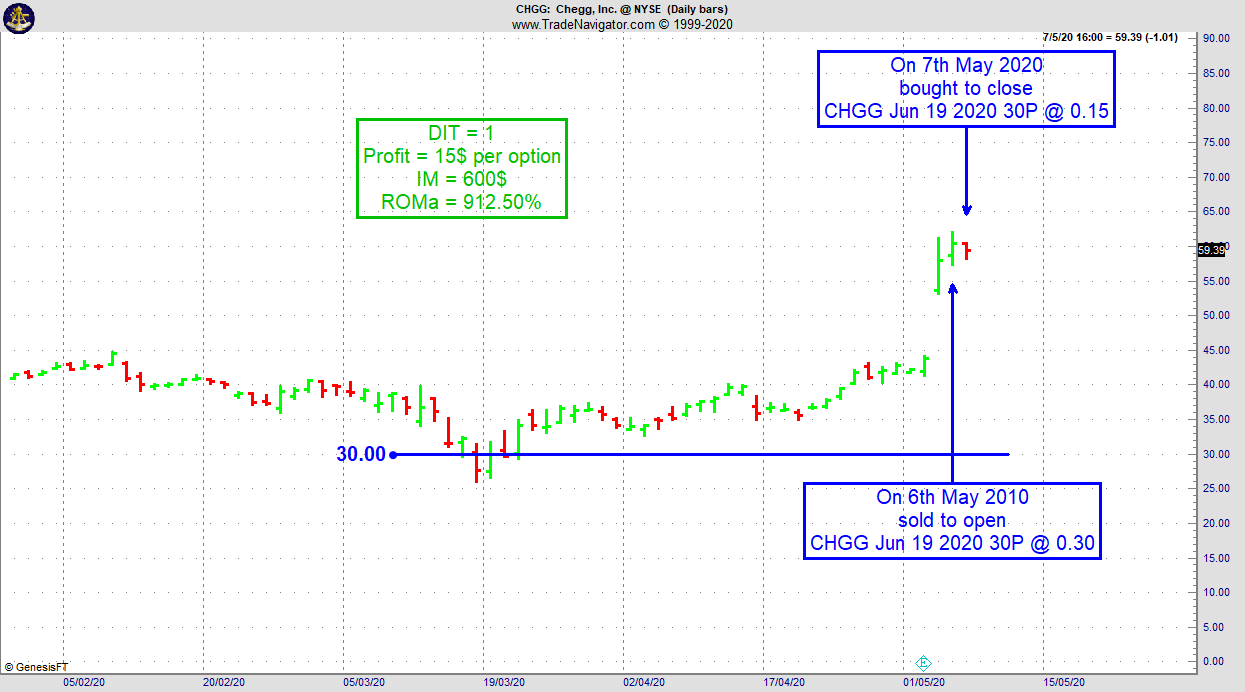

On 5th May 2020 we gave our Instant Income Guaranteed subscribers the following trade on Chegg Inc. (CHGG), right after earnings. Price insurance could be sold as follows:

- On 6th May 2020, we sold to open CHGG Jun 19 2020 30P @ 0.30, with 43 days until expiration and our short strike about 48% below price action, and well below the earnings gap.

- On 7th May 2020, we bought to close CHGG Jun 19 2020 30P @ 0.15, after only 1 day in the trade.

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 912.50%

Philippe

Learn More! Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

WEALTH BUILDING FOR YOUR FUTURE

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Is Trading Futures Gambling

Trading futures is gambling only when you trade them without full knowledge of what you are doing. There is a good measure of self-knowledge required to choose the proper course to follow if you want to become a trader. It has even been postulated that many small traders in the futures markets, without knowing it, secretly want to lose. They jump in with high...read more.

Learn from the Best: Futures Spread Trading - Contact Andy Jordan

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Signals Free Trial ends in a Sea of Green!

Many of you have joined our free trial last week and could see on their own how the profits kept on flowing in on a daily basis.

Previously I had reported how Ambush Signals subscribers managed to make it through the corona crisis relatively smoothly and how traders got informed well before the markets crashed in March (and got two months of Ambush Signals for free). Now since April 26th, I took back that warning a notch and let subscribers know that the markets had returned to a more regular behavior again.

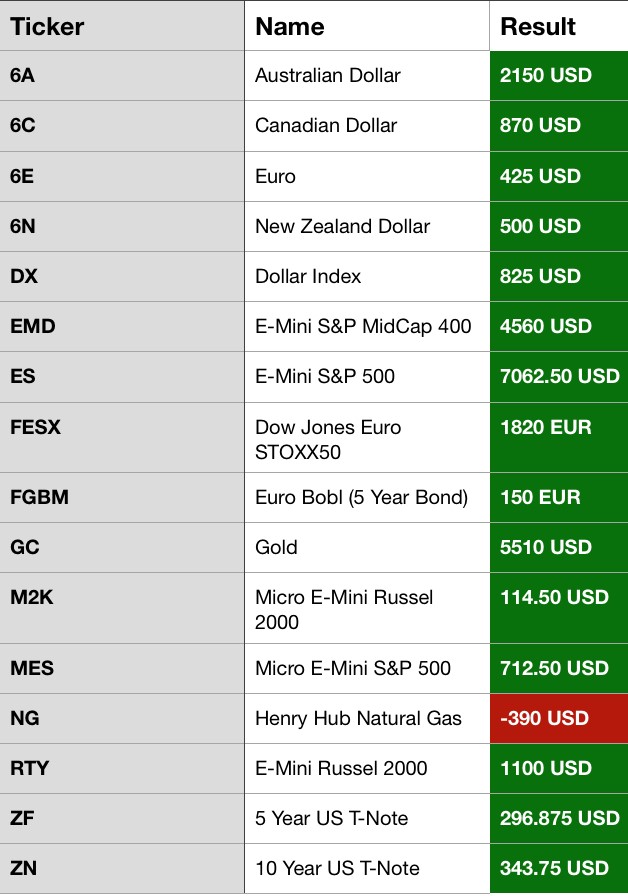

So it's time to have a look at the Ambush Signals results since then for each of the Futures markets (it looks the same in Forex):

Here are the results for one contract traded in each of the markets from April 26th till today:

Yup, it's been a crazy winning streak with almost all of the markets in the green and over $25k in profits in less than one month! Additionally, all of the All-Stars Portfolios are making new all-time highs again, have a look at the updated performance report.

Those of you who participated in the free trial could see for themselves day by day how easy and simple it is to actually take those trades. The feedback I got mostly was focused around:

- Really, that's all I need to do?!

- I had no idea you actually can day trade profitably with so little effort and time!

- Wow this is EASY and REALLY takes just a couple of minutes each day!

Don't miss out on the next trades and sign up now to Ambush Signals!

Also if you're interested in the Ambush Method eBook, we have good news for you. If you buy the eBook now, you get three months of Ambush Signals Pro for free! That's a $387 saving!

Happy Trading and Stay Healthy!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.