Edition 845

September 4 , 2020

LEARN FROM TRADING EDUCATORS OVER LABOR DAY WEEKEND

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

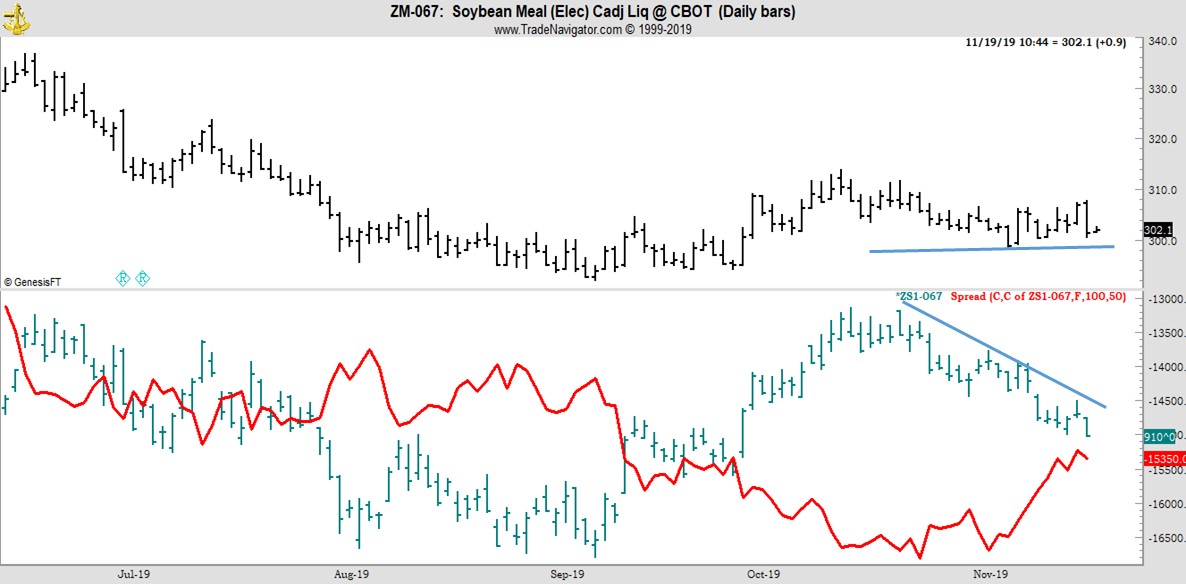

Chart Scan with Commentary: It Might Have Been 1973

During the early 1970s the markets went flat. It was really hard to trade. I think it was 1973, when the only way I could make any profits in the markets was to use spreads. Commodity futures markets were flat, so also was the stock market.

In those days, almost everyone was a trend trader, but for over a year, as I recall, prices swung in narrow trading ranges. When you’ve been trading for 60 years, you don’t always remember exactly when one thing or another happened.

What I do remember is that if you went long, trying to follow a trend you got clobbered. Same thing was true if you got short.

However, if you could find a market that was flat, and a related market that was tilted slightly up or down, you could make money with a spread. The day I’m writing this I looked at a spread long Soybean Meal and short Soybeans. It really reminded me of those terrible days back in the 1970s. Take a look!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Losses

Sometimes I write an article that elicits a good response from our readers. One of those articles is written below in blue italics.

I blended together the gist of what some of you wrote back to me, and many thanks to those of you who did.

“Why are losses such a big deal? I can tell you why. In your book Trading Is a Business, you said that once we enter the market, we are the market. And you also mentioned that 80% of traders are correct about direction when they enter.

“If this is true, then why do 90% still lose?

“The reason they lose is...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

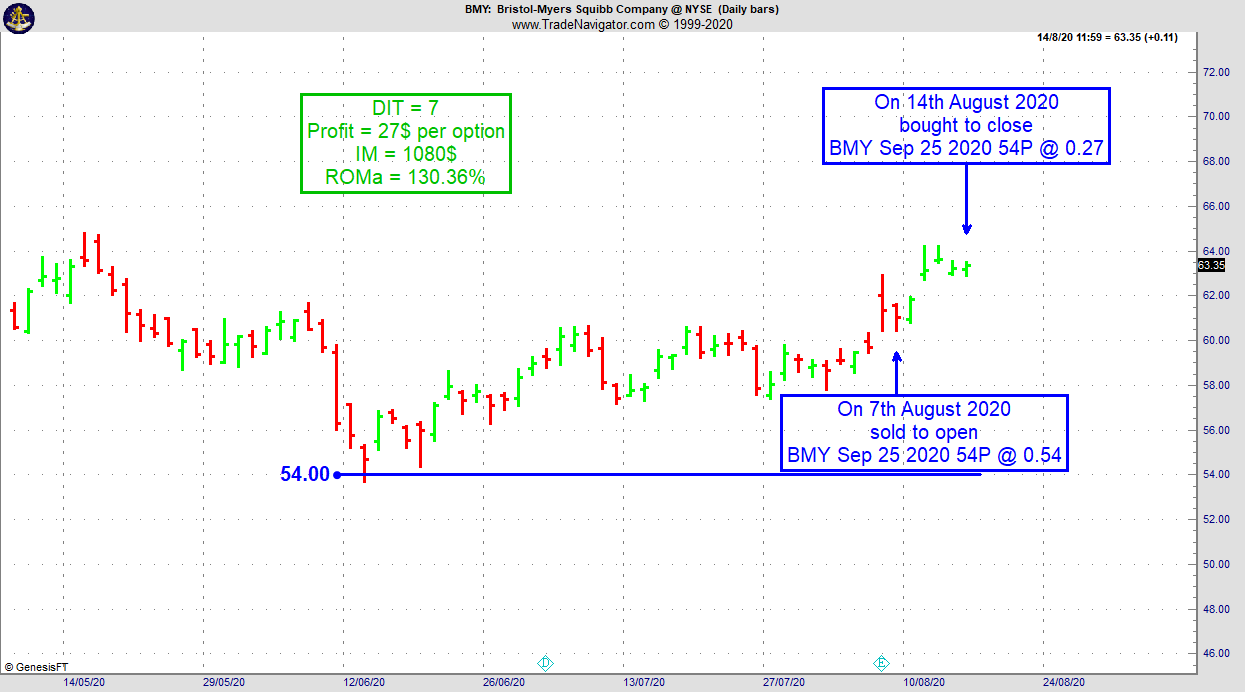

Instant Income Guaranteed - BMY TRADE

On 6th August 2020 we gave our Instant Income Guaranteed subscribers the following trade on Bristol-Myers Squibb Company (BMY). Price insurance could be sold as follows:

- On 7th August 2020, we sold to open BMY Sep 25 2020 54P @ 0.54, with 48 days until expiration and our short strike about 12% below price action.

- On 14th August 2020, we bought to close BMY Sep 25 2020 54P @ 0.27.

Profit: 27$ per option

Margin: 1080$

Return on Margin annualized: 130.36%

Philippe

Receive daily trade recommendations - we do the research for you.

Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

Trading Article: Many Traders don’t make it!

Figures show that 90% of traders who ever trade lose their account and that 10% actually go bankrupt. Those are scary numbers, I’m sure you’d agree.

Traders are not stupid people; most traders have an above average IQ and are above average in most categories such as education and income. I think they don’t make a success out of trading because they lack...read more.

Contact Andy Jordan with Questions

Private mentor with Andy Jordan - Invest in yourself!

Read a testimonal from one of Andy's most recent session with a student:

“Andy helped me to improve my own strategy and while doing this he taught me how to correctly read a chart, choose the right time frames to watch and how to try to filter possible bad trades. In the mentoring we talk also about the psychological aspect of trading and how to manage the risk. Great experience.” Alex Bertolino

Andy Jordan is the creator of Traders Notebook, a successful spread trading daily guidance advisory service. Do you want to receive how to manage trades and detailed trading instructions every day? Click here for additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

NEW PRODUCT BY ANDY JORDAN

IT'S HERE - SIGN UP TODAY!

JOIN ANDY'S TRADING TEAM

Introducing: Traders Notebook Seasonal Spread Trading (TNsst)

LEARN MORE - WATCH THIS INFORMATIVE VIDEO

Contact Andy Jordan

Click Here to Learn more!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

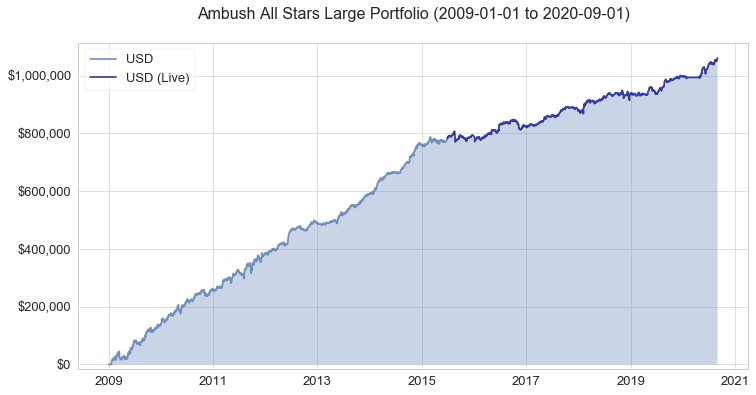

Ambush makes new all-time-highs again in 2020!

After having a blast in 2019, Ambush Traders are set up to have another great year as the Ambush performance is making new all-time highs again!

And I have to say, it is really amazing to witness this year after year for over a decade now. And all the time I get the same kind of questions which are all versions of "will Ambush keep on performing well in the future?!". And obviously I don't know for sure, because like everyone else I also can't look into the future.

But I can make some guesses and one of them is that unless a lot of markets start to behave very irregular and go all crazy, odds are that the very robust idea that makes Ambush work will continue to do great. Now talking about crazy years how much crazier can things get than in 2020 so far? I don't know about you but if that's not a serious stress test of a system I don't know what is. Yes it's been a bit of a rough ride for a couple of weeks but here we are again at new all-time highs!

Here's the long-term performance of the Ambush All-Stars large Portfolio featuring 10 markets consisting of stock indices, currencies, treasuries and commoditiy markets:

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves!

Ask yourself whether you want to miss out on such trades or at least not be aware of the signals while trading these markets.

I don't think you want to, so if you didn't already, join Ambush Signals today! For traders who prefer to trade the Micro contracts, we have a special Mini-Version of Ambush Signals that's a lot cheaper.

Also, the Ambush System itself is still for sale as an ebook at a bargain price for a system that keeps on performing for so many years now: Have a look.

Happy Trading and stay healthy!

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.