Edition 846

September 11 , 2020

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

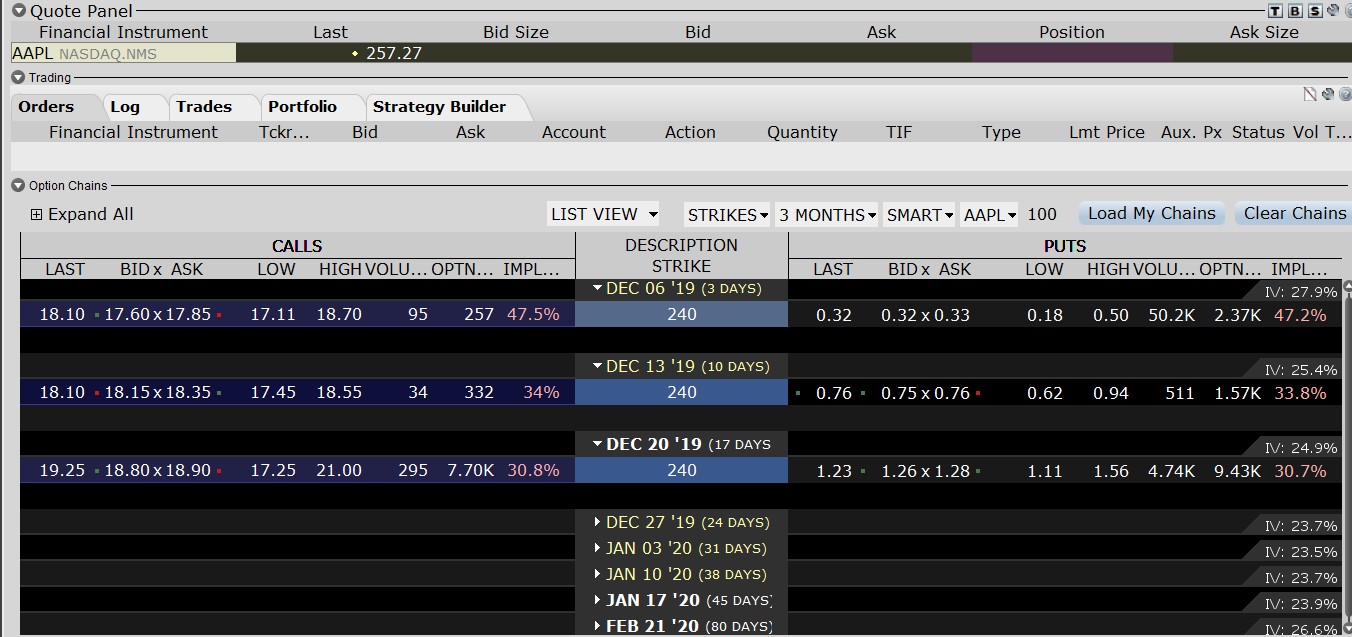

Chart Scan with Commentary: What’s with Weekly Options?

Hey Joe! I’ve been away from trading for many years. I used to trade options and I did quite well. Now that I’m back, I want to start with options again, but I’m puzzled, what are weekly option and why does anyone need them? Also, does this mean that the option lasts for only one week?

Let’s give this one a shot at understandability.

Weekly options became available in 2010, with the very first expiration date of July 9, 2010. In answer to part of your question, these options are listed on Thursdays and expire on the following Friday unless there is an already expiring option on the following Friday. Now, this needs a bit of explanation. I can trade an option that has only one week to live and be at risk for only the life of the option.

However, on January 1, I can trade a weekly option that will not expire on the following week in January. It may be an option that can expire on the 15th of January, the 28th of January, or expiration is in any following month. If expiration is in April, I would be at risk for all the rest of February, March, and part of April. Naturally, the premiums for an option will be higher, the longer the time until the option expires.

Why does this change the playing field for options? First, the expiration dates have multiplied from 12 to 52 (or slightly less depending on how they handle holidays). This creates enormous opportunities for anyone who understands how to use option strategies. Additionally, selling options has a very high profit probability, and you can realize that profit in one week now if you allow the option to expire. Don’t expect huge returns, but small consistent weekly returns can turn into very nice profits over time.

Strategies such as covered calls and puts, calendar strangles and straddles, bear calls and puts, bull calls and puts, synthetics, short term hedging, and many more, will grow in volume. You will also see the use of volatility option strategies such as straddles and strangles around earnings time become very popular and potentially profitable.

The best part is that after one week your profits are in your pocket and out of the market, and you can do it again, unless you trade the option for a deferred date. In any event, the seller of an option pockets the premium immediately.

Above you see under “STRIKE,” a current list of available option. Dates currently listed are from Dec 6th through February 21, 2021.

Continuing with what has changed, consider combinations of longer term options. The possibilities with weekly options are endless. As long as you know how to calculate the risk – reward numbers for options, and the proper use of the Average Trading Range. BP is a very volatile stock lately, and inexpensive weekly straddles, strangles, and calendar spreads can be profitable.

The first weekly options were all on well-known stocks, futures, and ETFs. There were only a few, 16 total, as I recall. From week to week, the number of weekly options can vary. Today, as I write this issue of Chart Scan there are 478 symbols listed for only the stock market. Futures have weekly 0ptions as well.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Can you really make it as a trader?

You alone determine whether you will succeed or fail at trading. You alone are in control; take responsibility for your performance and your life. There are always tremendous opportunities in the markets. It is not what happens, it is what you do with what happens that makes the difference between profit and loss.

You cannot marry a market or a single trading style. You have to...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Instant Income Guaranteed - AOSL TRADE

On 13th August 2020 we gave our Instant Income Guaranteed subscribers the following trade on Alpha and Omega Semiconductor (AOSL). Price insurance could be sold as follows:

- On 14th August 2020, we sold to open AOSL Sep 18 2020 10P @ 0.10, with 35 days until expiration and our short strike about 28% below price action.

- On 17th August 2020, we bought to close AOSL Sep 18 2020 10P @ 0.05

This trade was ideal for very small accounts (pretty safe and very low margin requirements).

Profit: 5$ per option

Margin: 200$

Return on Margin annualized: 304.17%

Philippe

Receive daily trade recommendations - we do the research for you.

Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

Trading Article: Passion for trading

I believe that to be a truly successful trader you have to have a true passion for trading. This is probably true for any field of endeavor. I believe that the people who do best are not primarily motivated by fame, glory, respect, or status. They are driven by the pure love of the what they do. Winning traders, similarly, have strong interests in the markets, and this passion is the...read more.

Contact Andy Jordan with Questions

Private mentor with Andy Jordan - Invest in yourself!

Read a testimonal from one of Andy's most recent session with a student:

“Andy helped me to improve my own strategy and while doing this he taught me how to correctly read a chart, choose the right time frames to watch and how to try to filter possible bad trades. In the mentoring we talk also about the psychological aspect of trading and how to manage the risk. Great experience.” Alex Bertolino

Andy Jordan is the creator of Traders Notebook, a successful spread trading daily guidance advisory service. Do you want to receive how to manage trades and detailed trading instructions every day? Click here for additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

NEW PRODUCT BY ANDY JORDAN

IT'S HERE - SIGN UP TODAY!

JOIN ANDY'S TRADING TEAM

Introducing: Traders Notebook Seasonal Spread Trading (TNsst)

LEARN MORE - WATCH THIS INFORMATIVE VIDEO

Contact Andy Jordan

Click Here to Learn more!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

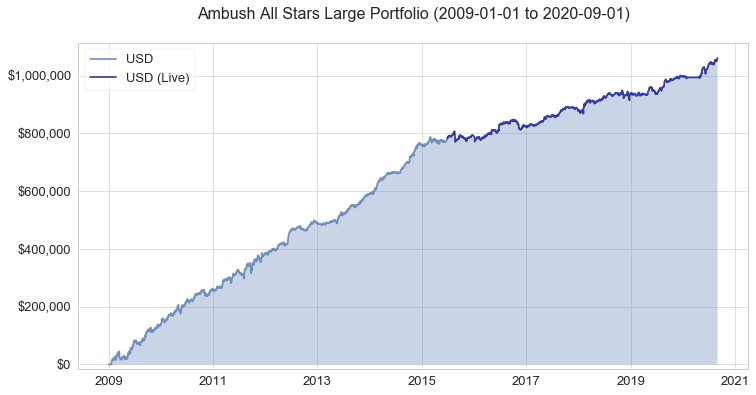

Ambush makes new all-time-highs again in 2020!

After having a blast in 2019, Ambush Traders are set up to have another great year as the Ambush performance is making new all-time highs again!

And I have to say, it is really amazing to witness this year after year for over a decade now. And all the time I get the same kind of questions which are all versions of "will Ambush keep on performing well in the future?!". And obviously I don't know for sure, because like everyone else I also can't look into the future.

But I can make some guesses and one of them is that unless a lot of markets start to behave very irregular and go all crazy, odds are that the very robust idea that makes Ambush work will continue to do great. Now talking about crazy years how much crazier can things get than in 2020 so far? I don't know about you but if that's not a serious stress test of a system I don't know what is. Yes it's been a bit of a rough ride for a couple of weeks but here we are again at new all-time highs!

Here's the long-term performance of the Ambush All-Stars large Portfolio featuring 10 markets consisting of stock indices, currencies, treasuries and commoditiy markets:

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves!

Ask yourself whether you want to miss out on such trades or at least not be aware of the signals while trading these markets.

I don't think you want to, so if you didn't already, join Ambush Signals today! For traders who prefer to trade the Micro contracts, we have a special Mini-Version of Ambush Signals that's a lot cheaper.

Also, the Ambush System itself is still for sale as an ebook at a bargain price for a system that keeps on performing for so many years now: Have a look.

Happy Trading and stay healthy!

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.