Edition 848

September 25, 2020

20% OFF

Coupon Code: emini20

Day Trading Strategy with E-Mini S&P 500 eBook

The Day Trading the E-Mini S&P 500™ eBook will teach you:

Preparation – plan for success

Expectations – the right mindset is crucial

Tools of the trade – execute trades successfully

Timing – is everything

Trading without indicators – is entirely possible

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: What do you see?

Hey Joe! What do you see when you look at this chart?

Interesting question! I see a lot of things we could talk about, but I’m going to stick to the last group of bars on the chart.

The #1 point was and still is a Ross Hook. In fact, it couldn’t be labeled as a #1 until there was a #2 point. It required 2 bars to create the #2 point (the red inside bar, which gave a lower high, followed by the green outside bar, which gave a lower low.

To create a #3 point, we needed to make a higher high. That happened with the green outside bar, the very same one that was needed to create the #2 point.

The two red bars following the outside green bar could be considered for a Traders Trick Entry (TTE) because the high of #3 is the same as the high for #2. The red inside bar following the #2 point was also a Traders Trick.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Reader Question

"Hey Joe! I’m pretty new at this. Can you tell me the rules for buy and sell stops?"

When the market trades above a buy stop price order, it becomes a market order. The first down tick after the market order price is activated determines the highest price at which the buy stop order may be filled. The rule to remember placing stops is this...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

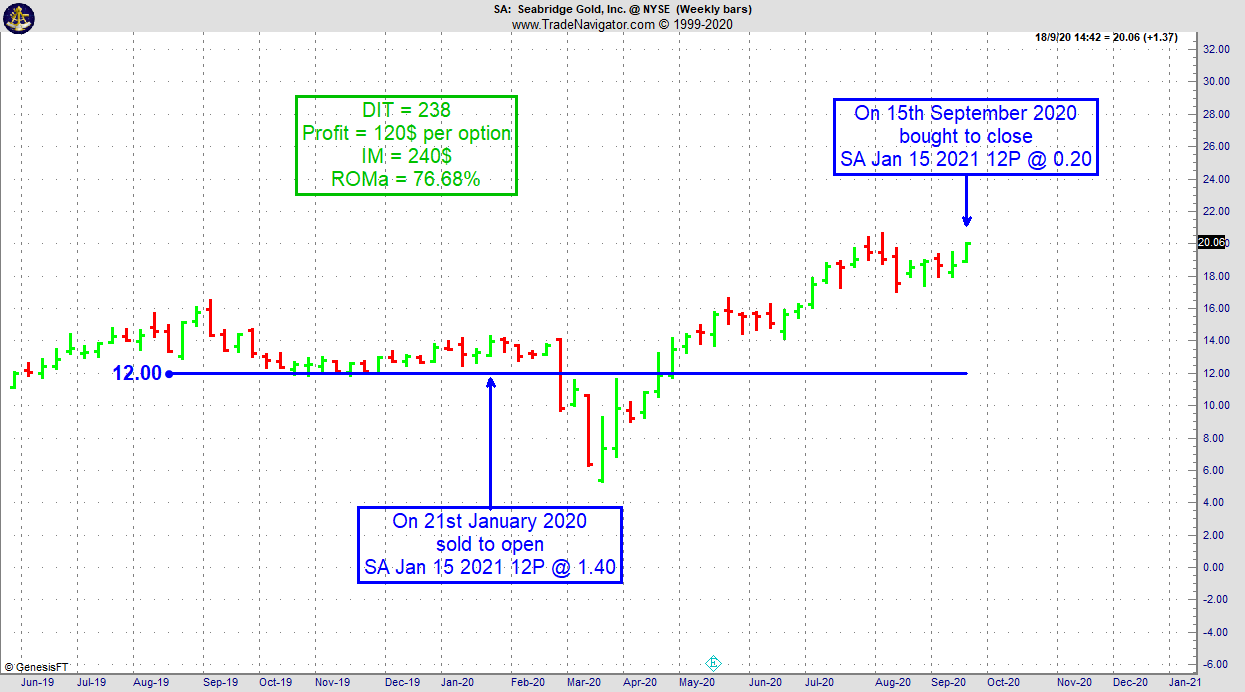

Instant Income Guaranteed - SA TRADE

At times we sell price insurance much further out in time, which allows us to be patient and go through extended periods when the underlying stock is trading below our short put strike. This was the case for Seabridge Gold Inc (SA) entered in January 2020, well before the sharp correction in March 2020:

- On 21st January 2020, we sold to open SA Jan 15 2021 12P at 1.40.

- On 15th September 2020, we bought to close SA Jan 15 2021 12P @0.20

As long as the option sold still has lots of extrinsic value and the expiration date is far out in time, the risks of early assignment are extremely low.

Days in the trade: 238

Profit: 120$ per option

Initial Margin: 240$

Annualized return on margin: 76.68%

Philippe

Receive daily trade recommendations - we do the research for you.

Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

Trading Article: Single-Lot-Strategy

Because some markets are very "expensive" and do not offer a mini or micro contract, many traders have to stick to a single contract once in a while.

In this case, you might trade a single-lot strategy. Finding the right target for a single-lot strategy is tricky and depends on your...read more.

Andy Jordan is the creator of Traders Notebook, a successful spread trading daily guidance advisory service. Do you want to receive how to manage trades and detailed trading instructions every day? Click here for additional information! Contact Andy Jordan with questions.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

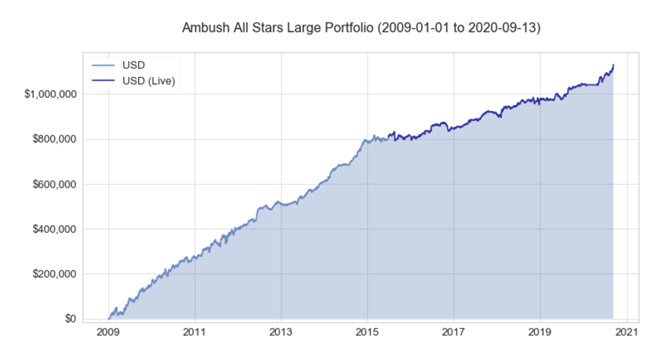

Ambush makes new all-time-highs again in 2020!

After having a blast in 2019, Ambush Traders are set up to have another great year as the Ambush performance is making new all-time highs again in 2020! I have to admit, it is really amazing to witness this year after year for over a decade now.

Previously I had reported how Ambush Signals subscribers managed to make it through the corona crisis relatively smoothly and how traders got informed well before the markets crashed in March. Since then the performance literally exploded!

Here's the long-term performance of the Ambush All-Stars large Portfolio featuring 10 markets consisting of stock indices, currencies, treasuries, and commodity markets:

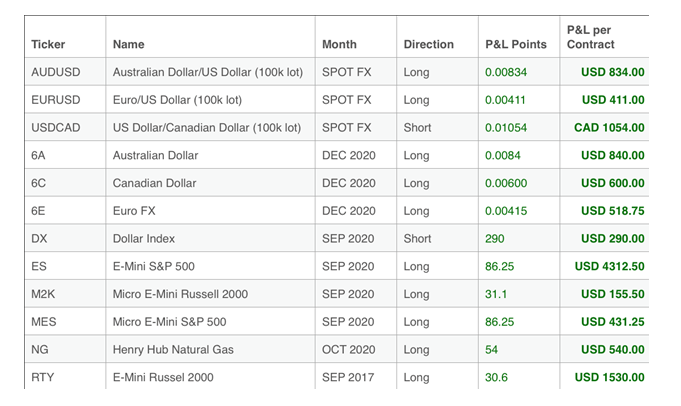

In case you're wondering about that sharp spike up at the end, we had one of our best days ever last week:

Didn't matter what you're into, currencies, stock indices, or commodities - as you can see, September 9th was a really happy trading day!

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and profit from the big intraday moves!

But a day is just a day and that is of course statistically completely meaningless. As all of the All-Stars Portfolios are making new all-time highs you might want to have a look at the updated performance report to get a better idea of the long-term performance.

Those of you who participated in the previous free trial could see for themselves day by day how easy and simple it is to actually take those trades. If you don't want to miss our on these trades anymore, sign up now to Ambush Signals.

Also if you're interested in the Ambush Method eBook, we have good news for you. There are still copies available and if you buy the eBook now, you get three months of Ambush Signals Pro for free. That's a $387 saving!

Happy Trading and Stay Healthy!

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.