Edition 851

October 16, 2020

Introduction to a Series on Technical Analysis

This week’s chart scan is a continuation of a series of very basic technical analysis concepts. I’m not a big fan of technical analysis, but I have to admit that I cut my trading teeth using it. Eventually, I came to believe there is a time and place for any and all tools. If something can help you understand the markets and how to trade them, I’m all for it.

There are many beginning traders who read Chart Scan, and over the years I have had many questions from them concerning technical analysis. Instead of giving you an article on the psychological aspects of trading, the next several issues of chart scan will feature articles on technical analysis. My hope is that where and whenever possible, I will show you the right way to use this type of analysis.

Keep in mind, the only real truth on a price chart is price itself. With that in mind and keeping price always in the forefront we can begin taking a look at some tools that fit into the category of technical analysis.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Iron Condor: Teva Pharmaceuticals (TEVA)

Hey Joe! Can you give us an example of an Iron Condor?

Iron Condors are useful around earnings report days. They are very short-term trades which try to take advantage of an expansion of volatility before earnings are reported, and the subsequent crushing of volatility once the results of the report are known.

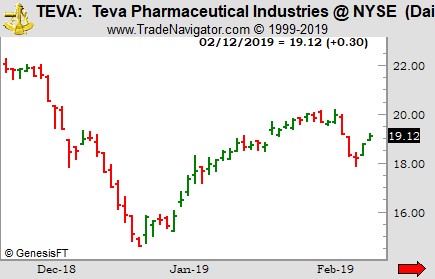

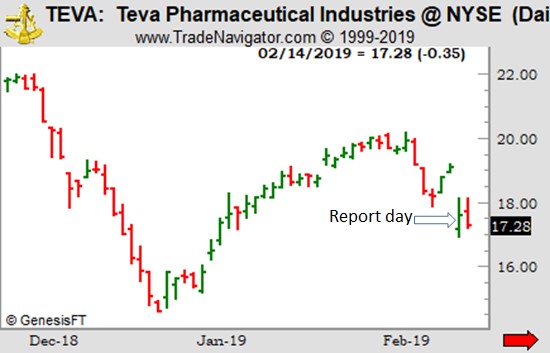

Following is a trade I made in a stock called TEVA. TEVA can be quite volatile following earnings.

You might call this an earnings-day trade. To be honest, I don’t attempt this kind of trade very often.

TEVA had an Implied Volatility (IV) rank of 57, which is a relatively high ranking. A high IV is what I typically like to see prior to making an Iron Condor trade. As soon as earnings pass, IV will typically fall, so this was a great time to sell some premium. The idea is to sell high premium, and buy back low premium!

With relatively high IV, TEVA allowed me a good opportunity to take advantage of the heightened levels of IV by selling some premium on a short-duration trade. By short-duration, I mean a single day.

I expected a move from roughly $17.25 to just about $20.75 for a range of approximately $3.50. If TEVA would stay within a $4-point range of $17-$21 I would make roughly 23.4% on the trade. Here is the trade:

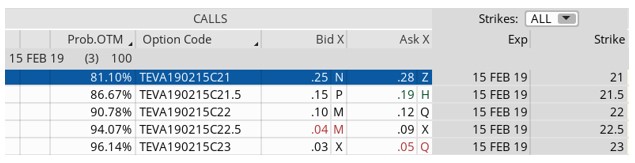

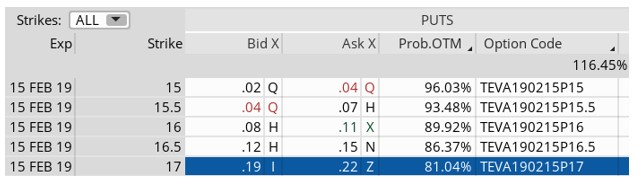

(The options listed below have only 3 days left until expiration. You can see the options code in the images below. Make sure you are looking at the right expiration cycle.)

Simultaneously using spreads:

Sell to open the TEVA February 2019 21 calls

Buy to open the TEVA February 2019 23 calls

Sell to open the TEVA February 2019 17 puts

Buy to open the TEVA February 2019 15 puts for roughly $0.38 Call Side of the iron Condor:

Put Side of the Iron Condor:

I would not accept less than $0.38 credit to enter this trade. I enter this kind of trade as a spread to avoid paying double commissions.

The goal of selling the TEVA iron condor (credit) spread is to have the underlying stock, in this case TEVA stay between the 17 and 21 strikes through the following morning. This would allow me to exit the trade for a profit.

The following were the parameters for the trade:

The Probability of Success – 81.10% (call side) – 81.04% (put side)

- The max return on the trade was the credit of $0.38 or 23.4% based on the required margin ($162) over the next 3 days.

- Break-even level - $21.38 - $16.62

- The maximum loss on the trade is $1.62 (that's actually $162 per contract,)

My intent was to take the trade off early the following day.

Prices the following day traded in a range. High was 18.14. Low was 17.21

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: The Squeeze

The Squeeze is the central concept of Bollinger Bands. When the bands come close together, constricting the moving average, it is called a squeeze. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

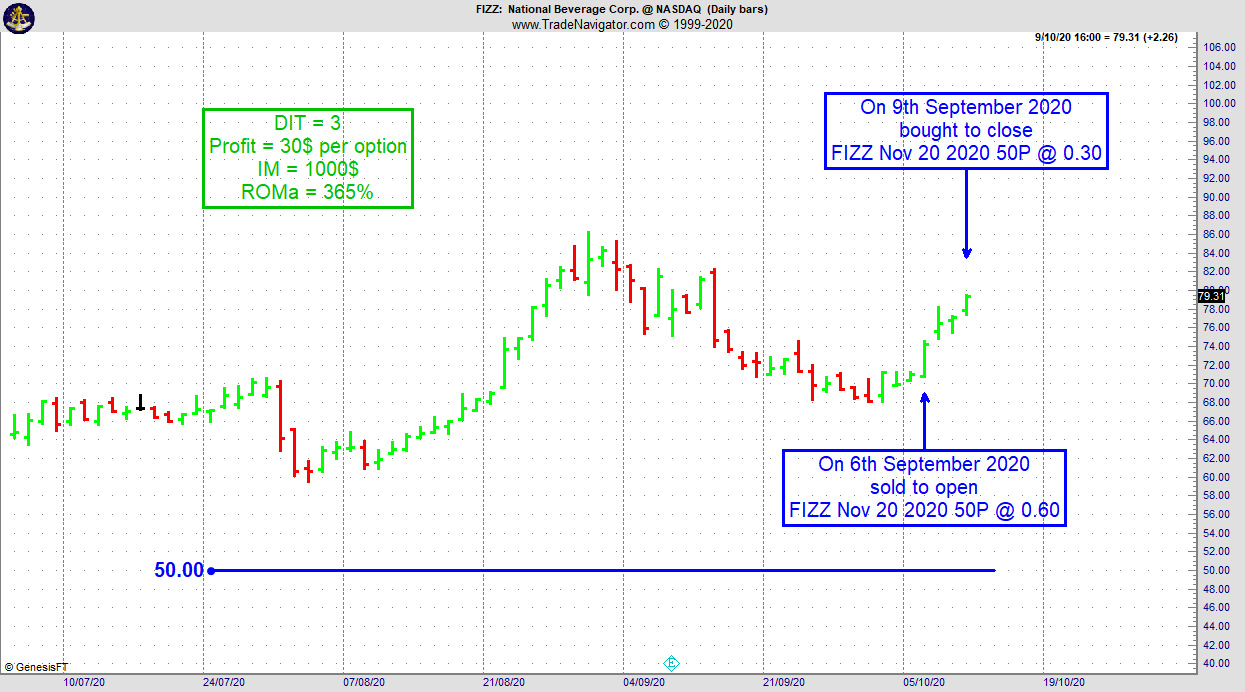

Instant Income Guaranteed - FIZZ TRADE

On 5th October 2020 we gave our Instant Income Guaranteed subscribers the following trade on National Beverage Corp. (FIZZ). Price insurance could be sold as follows:

- On 6th October 2020, we sold to open FIZZ Nov 20 2020 50P @ 060, with 44 days until expiration and our short strike about 30% below price action, making the trade pretty safe.

- On 9th October 2020, we bought to close FIZZ Nov 20 2020 50P @ 0.30.

Profit: 30$ per option

Margin: 1000$

Return on Margin annualized: 365%

Philippe

TRADING SUCCESSES EMAIL TO YOU DAILY!

~ WE DO THE RESEARCH FOR YOU ~

Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

Trading Article: Spread Trading vs. Day-Trading

Even if I do not want to generalize the following for each trader, there are some "general problems" in day trading. Here is a short list of why I personally think day trading is much more difficult than position or spread trading....read more.

Andy Jordan is the creator of Traders Notebook, a successful spread trading daily guidance advisory service. Do you want to receive how to manage trades and detailed trading instructions every day? Click here for additional information! Contact Andy Jordan with questions.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading the Euro is Easy if you have the right method!

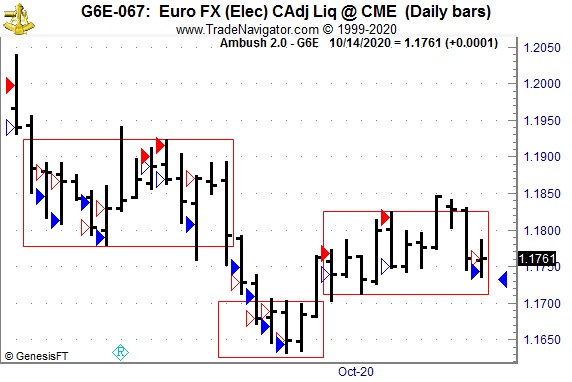

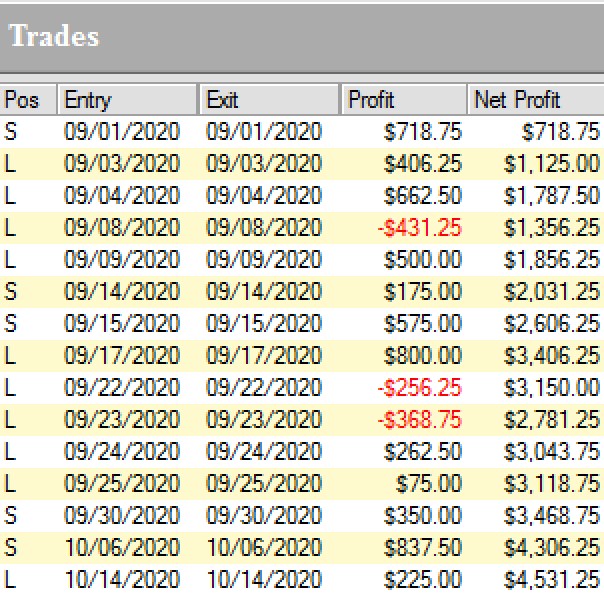

One of the top markets over the last couple of months for Ambush Traders has been the Euro. Whether it's the Euro FX Future or the EUR/USD Forex pair, Ambush Traders had real fun in that market!

Here's a daily chart of the Euro FX Future (6E), showing the last couple of months of trading. As you can see this market did what markets do 90% of the time, which is why Ambush is such a great trading method. Markets move in boxes/ranges, break out for a few days and then start moving in the next box. The Euro has been boxing a lot lately and so Ambush Traders had a lot of great opportunities!

Here are the results of these trades, trading one contract:

Yup, that's over $4k profits with almost no drawdowns in between, a winning rate of 80%, and a Profit Factor of over 5 within that period!

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves!

Don't miss the next Euro trade and join Ambush Signals today!

Happy Trading!

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.