Edition 857

November 27, 2020

TO YOU AND YOURS FOR A SAFE AND BLESSED THANKSGIVING HOLIDAY

NEXT WEEK IS THE FINAL ARTICLE IN THIS SERIES!

Introduction to a Series on Technical Analysis

This week’s chart scan is a continuation of a series of very basic technical analysis concepts. I’m not a big fan of technical analysis, but I have to admit that I cut my trading teeth using it. Eventually, I came to believe there is a time and place for any and all tools. If something can help you understand the markets and how to trade them, I’m all for it.

There are many beginning traders who read Chart Scan, and over the years I have had many questions from them concerning technical analysis. Instead of giving you an article on the psychological aspects of trading, the next several issues of chart scan will feature articles on technical analysis. My hope is that where and whenever possible, I will show you the right way to use this type of analysis.

Keep in mind, the only real truth on a price chart is price itself. With that in mind and keeping price always in the forefront we can begin taking a look at some tools that fit into the category of technical analysis.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Working out a Seasonal Spread

Hey Joe! Can you step me through how you go about setting up a futures spread trade?

First, let’s consider a basic fact: Some seasonal strategies are longer than others. With the, longer ones you can afford to be patient and wait for them to either set up in a more tradable pattern or to offer a more opportune entry. Other strategies may be brief and require quick entry and exit — and a plan to minimize risk.

With that in mind let’s look at a live cattle seasonal trade.

Some basic research reveals that because feed is such a primary but variable cost, livestock producers want to feed as many animals as possible when feed is most available and typically, least expensive.

Cattle feeders, then, fill their feedlots with new animals most heavily during and immediately after corn harvest in October/November. Because those young animals normally require four to five months to reach market weight, slaughter normally begins to rise in March, surges in late April, and — because animals gain weight more slowly during the cold of winter — to peak in May/June.

Because beef consumption is low during the heat of summer, and feed prices can be high, feedlot numbers tend to reach their annual low in August. Slaughter tends to be at its annual low in December.

With slaughter already low and remaining low into December, do cattle prices rise as cooler temperatures arrive in autumn? Over many years, the cash market has tended to rise from August into December. Anticipating it to do so, however, December futures have tended to rise from mid-June into mid-September and then to decline into mid-November.

Why the decline? First of all, peak slaughter in May/June and low retail beef consumption during the heat of summer has left the market with plentiful supplies of beef. But perhaps of even greater importance is that grocers tend to feature competing meats during the holiday season — turkey for Thanksgiving in November, hams for the holidays in December.

As the cold of winter sets in, beef consumption rises along with the need for caloric intake. Futures for winter-delivery usually outperform those for December-delivery as autumn arrives.

Research shows that the Long February/Short December Live Cattle spread closes in favor of February on about November 7 than on about September 15. The percentages work out to be an 87% chance for success with this trade.

Private Mentoring with Joe Ross is so simple!

- Complete his questionnaire, click here.

- Indicate full day or per hour.

- Schedule your date(s) and time(s).

- Hold session(s) via Skype.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Short-Term Pullbacks

Short-term Pullbacks provide opportunities to enter trades in the direction of the longer-term trend. Trade set-ups like these occur against short-term momentum (the pullback) but are in alignment with the longer-term trend and typically offer high probability and low risk trade ideas with a 2:1 (or better) reward-to-risk ratio.

A great way to trade short-term pullbacks is to use a...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

GOOBLE! GOOBLE! GOOBLE UP!

THE SAVINGS!

WE ARE THANKFUL FOR MANY THINGS, BUT MOST IMPORTANT...WE ARE VERY THANKFUL FOR YOU!

YOUR CONTINUED SUPPORT IS WHY WE DO, WHAT WE DO

2021 IS YOUR YEAR, SO LET'S START OFF TRADING TOGETHER!

50% OFF

USE COUPON CODE DURING CHECKOUT:

iig50

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Instant Income Guaranteed - MRCY TRADE

On 4th November 2020 we gave our Instant Income Guaranteed subscribers the following trade on Mercury Computer Systems (MRCY). Price insurance could be sold as follows:

- On 5th November 2020, we sold to open MRCY Dec 18 2020 60P @ 0.75, with 43 days until expiration and our short strike about 15% below price action.

- On 9th November 2020, we bought to close MRCY Dec 18 2020 60P @ 0.35.

Profit: 40$ per option

Margin: 1200$

Return on Margin annualized: 304.17%

Philippe

TRADING SUCCESSES EMAILED TO YOU DAILY!

~ WE DO THE RESEARCH FOR YOU ~

CLICK HERE TO Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

Trading Article: The Break-Even Point

Once a trade is entered, there are two possible outcomes: Win or lose. Between the two is the break-even point, and because it is in-between, it’s psychologically significant. Losing is involved with fear and hope. Winning is involved with greed.

When on the losing side of a trade, the break-even point is a place that inspires hope. Being human we have a natural tendency to avoid risk and loss. When in the agony of a losing trade, we tend to hold on and hope that the losing trade will turn around and return to the break-even point, where there may be no profits, but at least there are no losses. But hoping often leads to losses in the end. Hope has no place in making trading decisions. The entry point and the protective stop should be determined before...read more.

Andy Jordan wants you to learn trading and highly recommends that you invest in yourself. Private mentoring with Andy is the first step to learning about trading, his students find this very helpful and accelerates their trading successes.

Private Mentoring with Andy Jordan – Sign Up Today

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Gold-Rush: Over $10,000 profit with a Day Trade in the Gold Future?!

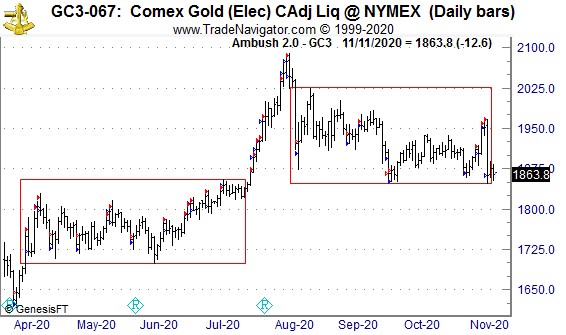

One of the top markets over the last couple of months for Ambush Traders has been the gold market. Whether it's the Gold Future, Micro-Future, or XAU/USD forex pair, Ambush Traders are in a crazy gold rush!

Here's a daily chart of the Gold Future (GC, traded at CME), showing the last couple of months of trading. As you can see this market did what markets do 90% of the time, which is why Ambush is such a great trading method. Markets move in boxes/ranges, break out for a few days and then start moving in the next box. Gold has been in huge boxes almost all of the time and so Ambush Traders had a lot of great opportunities!

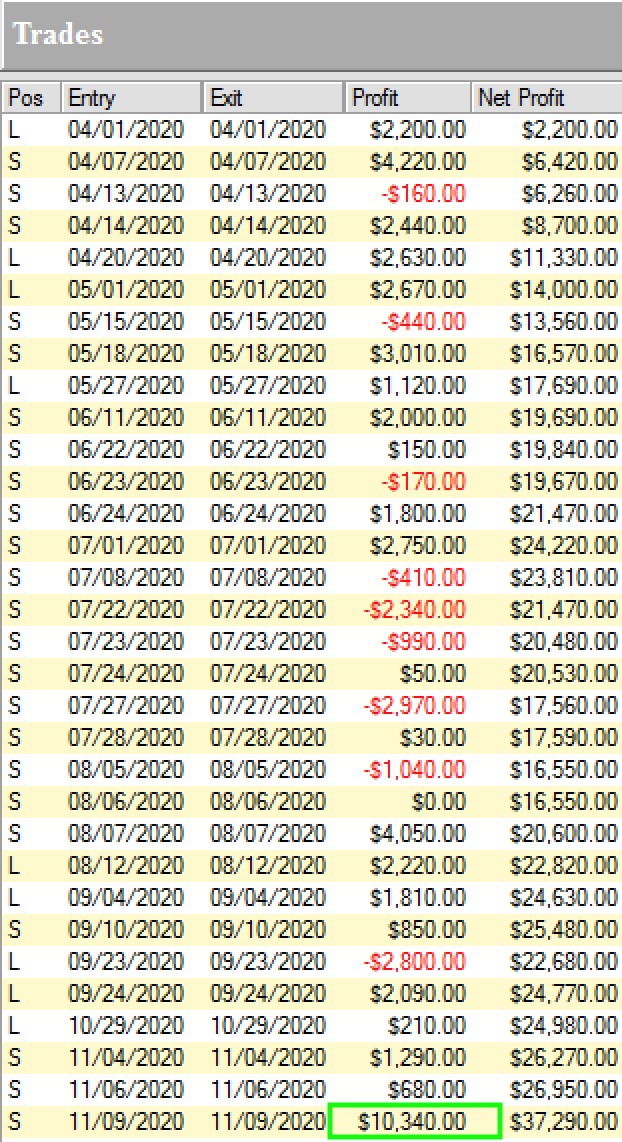

Here are the results of these trades, trading only one Gold Future (GC) contract:

Yup, that's almost $40k profits with almost no drawdowns in between within just a couple of months! And yes we did catch one of the largest moves ever in the gold market on 9th November making OVER $10k with a DAY TRADE!

Now the Gold Future is a large contract and not suitable for small accounts. But you can do these trades also in the E-Micro Gold which is just 1/10 the size or the XAU/USD forex pair.

That's what makes Ambush Signals so great, it works with any account size offering three subscription models depending on your goals.

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves!

Don't miss the next Gold trade and join Ambush Signals today!

Happy Trading!

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.