Edition 867

February 12, 2021

AMBUSH SIGNALS DOES IT AGAIN, SCROLL DOWN TO READ THE LATEST UPDATE!

This week’s chart scan continues a series of very basic technical analysis concepts. I’m not a big fan of technical analysis, but I have to admit that I cut my trading teeth using it. Eventually, I came to believe there is a time and place for any and all tools. If something can help you understand the markets and how to trade them, I’m all for it.

There are many beginning traders who read Chart Scan, and over the years I have had many questions from them concerning technical analysis. Instead of giving you an article on the psychological aspects of trading, the next several issues of chart scan will feature articles on technical analysis. My hope is that where and whenever possible, I will show you the right way to use this type of analysis.

Keep in mind, the only real truth on a price chart is price itself. With that in mind and keeping price always at the forefront, we can begin taking a look at some tools that fit into the category of technical analysis. ~ Enjoy, Master Trader Joe Ross

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Instant Income

Sometimes I am amazed at how few people try to take advantage of our Instant Income Program.

It takes so little time to execute the trades, and the instructions are so easy to follow. It’s easy money, with practically no worries. In fact, until we decided to allow for some losses in order to create more profits, we were over four years of trading without a single losing trade. In other words, if we choose to be correct one hundred percent of the time, as we were previously doing, we could still do it.

However, we reduced the win/loss ratio to 94% because testing showed us that doing so would make the program more profitable.

While you sit wearing out your eyes, you could be making solid gains by joining our Instant Income Program. Personally, it’s all I trade these days. It keeps me busy…making bank deposits J

EYE trade

On 13th June 2019, we gave our Instant Income Guaranteed subscribers the following trade on National Vision Holdings Inc. (EYE). Price insurance could be sold as follows:

- On 14th June 2019, we sold to open EYE Oct 18 2019 22.5P @ 0.70, with 124 days until expiration and our short strike about 26% below price action,

- On 17th July 2019, we bought to close EYE Oct 18 2019 22.5P @ 0.30, after 33 days in the trade

Profit: 40$ per option

Margin: 450$

Return on Margin annualized: 98.32%

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Swing Trading

When I began trading, no one had ever heard of such a thing as “swing trading.” Swing trading, as I recall, began when more and more people had the ability to day trade from a PC.

In this issue of Chart Scan, I'm going to provide you with some swing trading help that you need when just starting out. If you follow these rules you will avoid a great majority of mistakes made by beginners.

Swing Trading Help - Things To Avoid...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

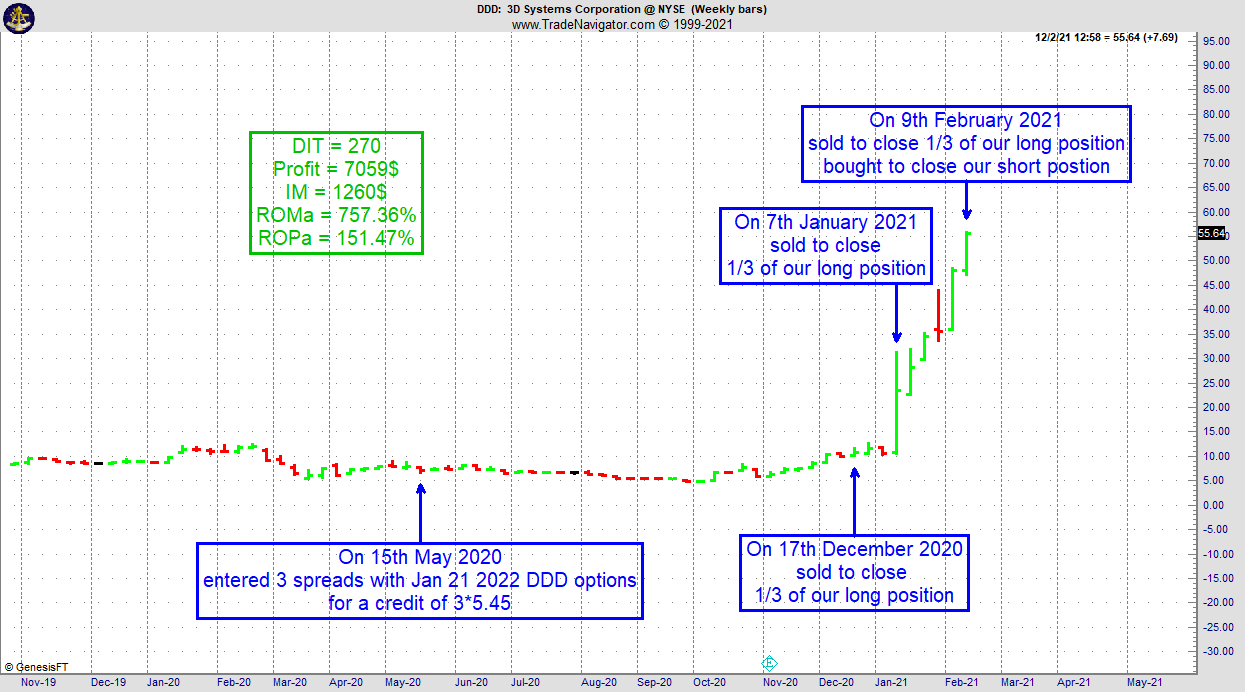

Instant Income Guaranteed - DDD

Selling price insurance has a very high probability of winning, when done correctly, but there is a major drawback: our profit is limited to the premium sold. Or is it really?

Not necessarily. We can use "complex positions", entered for a net credit, with an unlimited profit potential.

For instance, on 15th May 2020, we entered a spread on DDD (3D Systems Corporation) with January 21 2022 options for a net credit of 3*545 = 1635$, with 734 days until expiration, giving a lot of time for the trade to play out. We were anticipating a breakout to the upside at some stage after a gigantic consolidation period.

We sold our long position in thirds, on 17th December 2020, 7th January 2021 and 9th February 2021, applying a profit maximizing strategy.

We closed our short position on 9th February 2021.

We stayed 270 days in the trade, took a profit of 7059$ on our 3 positions (versus an initial credit of 1635$).

For an initial margin of 1260$, our annualized returns were 757.36% (return on margin) and 151.47% (return on principal).

Very low risk, low maintenance, low stress trade with lots of profit potential provided we were patient to let it playout.

Philippe

TRADING SUCCESSES EMAILED TO YOU DAILY!

~ WE DO THE RESEARCH FOR YOU ~

CLICK HERE TO Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, and Day Trading, and Editor for 20+ years with Traders Notebook, daily advisory newsletter.

Trading Article: Why we use a 15-year seasonal pattern for trading spreads

Much seasonally based information conforms to random probability generated data. Avoid trading seasonally based information without a fifteen year pattern, a minimum 80% win probability, profits twice losses, and a price action based entry. Price based trading information is...read more.

Andy Jordan wants you to learn trading and highly recommends that you invest in yourself. Private mentoring with Andy is the first step to improving your trading, his students find this very helpful to accelerate their trading successes.

Private Mentoring with Andy Jordan – Sign Up Today

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Performance Update

&

Crazy Specials

I hope you had a good and healthy start so far in 2021! Well, for sure the Ambush System did and I'd like to tell you more about this and celebrate this great start into 2021 with some really rare specials.

I guess I don't have to explain anything about the Ambush System to you. It is a legendary trading system by now, after being out there for more than a decade and still dominating in so many markets! I simply don't know of any other trading system that has kept on doing its job that well for such a long time. Honestly, most traders are more than happy if their system lasts for a couple of months before they have to come up with something new! Also, while most systems work in just one market, Ambush keeps on pushing to new highs in over 20 markets including a wide range of Futures and Forex markets!

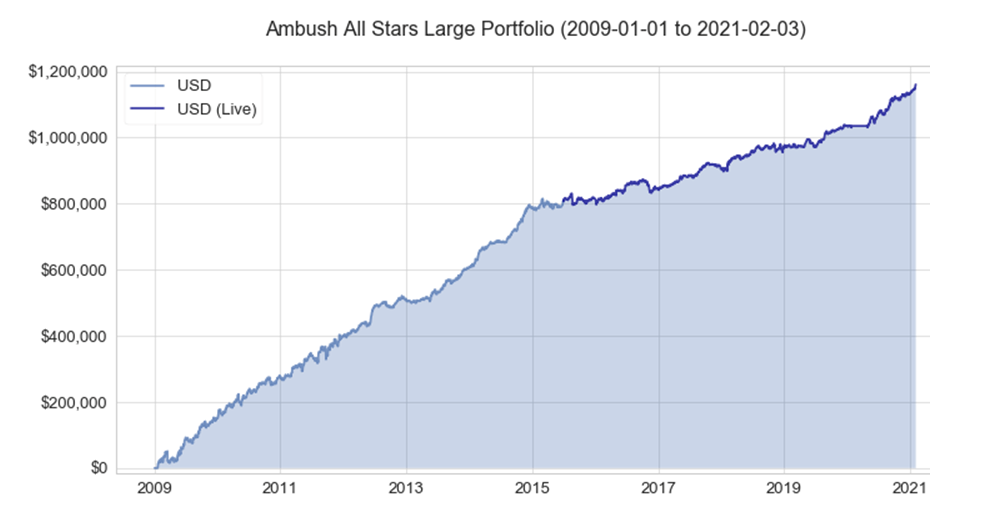

Performance

As they say, a picture says more than a thousand words, so I'll make this short, here's the updated performance graph of the Ambush All Stars Large Portfolio which includes a very well-diversified selection of markets from stock indices and commodities to currencies and interest rate futures.

Please have a look at the Ambush Signals Performance to learn more about the sample portfolios and see all of the updated performance reports. All of the portfolios look the same though, as all the graphs finish at the top right ;)

As you can see the Ambush did extremely well in almost all of the supported markets. Whether you're trading stock indices, currencies, commodities, or interest rate futures, you don't want to be on the other side of these day trades!

Those of you following us for a while now already know all of this. I've sent out pretty much the same email again and again. Looks like Ambush just does its job, boring right? Right, so here's something to get you really excited! As we barely run any specials for Ambush make sure you don't miss out on these.

I keep on hearing from our active subscribers about how surprised they are that it's so easy and simple to actually take those day trades. They simply had no idea you could actually day trade profitably with so little effort and time! As it just takes a couple of minutes a day you can day trade while still doing other things throughout the whole day and still have all the benefits day trading offers.

Specials

Ambush Signals:

Ambush Signals does all the work for you and simply sends you the Ambush signals for each of the markets that you subscribed to every day.

As many of you want to subscribe long-term you kept on asking for yearly discounts so here's a special that covers that. These won't be available on the regular Ambush Signals page and will be available only for a couple of days so don't miss out! These are one-time purchases, not auto-renewal subscriptions.

There are three different subscriptions based on which markets you need, to learn more simply go to the Ambush Signals Page and click on "Compare Plans":

- 1 year of Ambush Signals Forex for $399 ($828)

- 1 year of Ambush Signals Mini for $599 ($1068)

- 1 year of Ambush Signals Pro for $899 ($1548)

Ambush eBook:

The Ambush eBook contains all the trading rules of the Ambush System, so if you want to make it your own or know what's behind Ambush Signals this is for you. Get it now for just $999 instead of the regular $1799. But that's not all, if you buy the eBook you also get three months of Ambush Signals Pro for free to get you started on the right track. That is another $387 saving! All you have to do is use the coupon code "ambush999" during checkout.

I really can't tell you if and when there will be another special like this again so if you want to get the eBook, this is it!

Enjoy the specials and stay healthy!

Marco Mayer

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Joe Ross has been trading and investing since his first trade at the age of 14, and is a well known Master Trader and Investor. He has survived all the up and downs of the markets because of his adaptable trading style, using a low-risk approach that produces consistent profits.

Joe Ross is the creator of the Ross hook™, and has set new standards for low-risk trading with his concepts of "The Law of Charts™" and the "Traders Trick Entry™." Joe was a private trader and investor for much of his life, but a serious health situation in the late 80's caused him to shift his focus, and that is when he decided to share his knowledge. After his recovery, he founded Trading Educators in 1988, to teach aspiring traders how to make profits using his trading approach.

Joe Ross has written twelve major books and countless articles and essays about trading. All his books have become classics, and have been translated into many different languages. His students from around the world number in the thousands. His file of letters containing thanks and appreciation from students on every continent is huge: As one student, a successful trader, wrote: "Your mastery of teaching is even greater than my mastery of trading."

Joe Ross holds a Bachelor of Science degree in Business Administration from the University of California at Los Angeles. He did his Masters work in Computer Sciences at the George Washington University extension in Norfolk, Virginia. He is listed in "Who's Who in America." After 5 decades of trading and investing, Joe Ross still tutors, teaches, writes, and trades regularly. Joe is an active and integral part of Trading Educators. He is the founder and contributor of the company's newsletter Chart Scan™.

Joe's philosophy for helping traders is:

"Teach our students the truth in trading — teach them how to trade."

"Give them a way to earn while they learn — realizing that it takes time to develop a successful trader."

Joe sets forth the mission of Trading Educators as follows:

To show aspiring futures traders the truth in trading by teaching them how to read a chart so that they can successfully trade what they see, and by revealing to them all of the insider knowledge they need in order to understand the markets.

To enable them to trade profitably by training them to properly manage their trades as well as their mindset and self-control.

To accomplish our mission for our students we educate them so that they know and understand:

Benefits for our Clients:

- Where prices are likely to move next.

- Independence from complicated trading methods, magic indicators, and black-box systems.

- Independence from opinion, anyone's opinion, including their own.

- Independence achieved through knowing how to read a chart.

- Independence through having knowledge of insider actions.

- Independence achieved by taking holistic and eclectic approaches.

- Independence coming from knowing how to manage both the trades and themselves.

- Independence because they understand and trade what they see.

- Independence because they have learned how and why prices move as they do, through studying the truth in trading and the truth about markets.

Students learn only proven methods and techniques, which helps them to preserve capital and create more consistent profits; they are offered simple methods that will assist them to earn while they learn.

- They learn to work smarter and more effectively.

- They learn to treat trading as a business; we offer no Holy Grail or magic systems.

- They learn to adapt to changing market conditions.

- They learn a systematic approach to trading rather than a mechanical system for trading.

- Why prices will move there.

- Who and what cause prices to move.

- How far prices are likely to move when they do move.

- Their own role in the movement of prices..

- How to take advantage of the knowledge they receive.

- How to properly manage and exit a trade which they have entered.

- How to manage themselves and acquire the discipline needed to become successful traders.

Read some personal testimonials which Joe has received.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2021 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.