Edition 868

February 19, 2021

AMBUSH SIGNALS SPECIAL HAS BEEN EXTENDED!

MARCO MAYER DOES IT AGAIN, SCROLL DOWN TO READ THE LATEST UPDATE!

We hope you learned a lot with this series of very basic technical analysis concepts. Feel free to contact us with your questions. Next week's Chart Scan along with future editions will continue with lessons about using the Ross Hook and Traders Trick Entry to apply in your trading. Enjoy and happy studying! ~ Master Trader Joe Ross

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Open Interest

Hey Joe! What’s with Open Interest? What good is it, and how might you use it?

I’ve always said that Open Interest shows you what’s not trading, so in some respects it’s meaningless. That doesn’t mean it’s not important. I use it all the time when trading stock options.

When you examine an options chain, there will be a column that's titled open interest, which can be a very useful tool for options traders.

The open interest shows all open options contracts that are available for exercise have not been closed out. For example, if you opened or initiated a trade by purchasing 10 IBM call options from an options seller who was also opening his position, the open interest column would increase by 10 contracts, in other words 10 contracts would be added to today's open interest.

If you decided to sell or liquidate your position and sold your 10 IBM contracts to someone who was also closing out their position, open interest would be reduced by 10 calls.

Arrow points to the contents of the column OPTN… This is the open interest for the various Call strike prices seen at the right. Notice these figures are for the October 18 option expiration.

One way that traders use open interest is to determine supply and demand levels for the underlying asset.

For example, let's assume that you are looking to buy a call option for ABC stock that's priced at $50.00 per share and you believe that the stock is going to go up to $70.00 per share within the next 3 months.

When you look at the call options that expire four months from now, you find that the open interest on the 70 strike price call option is only 10 contracts, while the open interest on the 60 strike price call option is 500 contracts.

This tells me that the majority of speculators don't believe that the underlying stock is going to move up to $70.00 in the next three months and I may want to consider buying a lower strike price call option or reconsider the trade because the sentiment is against the stock moving up to $70.00 per share during the next few months.

Another very simple way to use open interest is to determine whether the overall sentiment on the underlying assets that you are analyzing is bullish or bearish. Let's say that you are looking at ABC stock and once again the stock is priced at $50.00 per share. When you look at the open interest column, the 50 strike price call option has open interest of only 100, while the 50 strike price put option has open interest of 500.

This would tell me that the current market sentiment for this stock is bearish, since open interest is 10 times higher for the at-the-money put option compared to the at-the-money call option, this would tell me that the current sentiment favor ABC stock moving lower.

If on the other hand the at the money call options had higher open interest than the at the money put options, then I would conclude that the sentiment is bullish.

If on the other hand you find that open interest for the at-the-money call option and the at-the-money put option to be similar to each other, then I would avoid using open interest as a directional sentiment indicator. I find that it works best when the open interest numbers favoring either the calls or the puts outweighs the other side by a very large margin.

Lastly, another very common way of utilizing open interest is to monitor for unusual options activity. For example, if ABC stock is trading at $50.00 and the $60 strike price call option that expires in 1 month has open interest of 10,000 contracts and within the next few trading sessions the open interest dramatically rises, this would imply that speculators are accumulating that option because they believe that ABC stock is going to move higher within the next few weeks. Similarly, if the open interest drastically increased in a short period of time in an out of the money put option, the $40 strike price for example, it would imply that speculators believe that ABC stock is going to move lower.

Screening for unusual rise in open interest is so popular that several financial analysis firms specialize in screening for options with major changes in open interest in a short period of time.

I personally find that keeping an eye on stock index open interest levels, for different options strike price levels, offers me an excellent analysis tool for short term price swings as well as support and resistance levels. Many traders miss important options activity every single day, activity that could have rewarded them.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Technical Analysis….

Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Unlike fundamental analysts, who...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

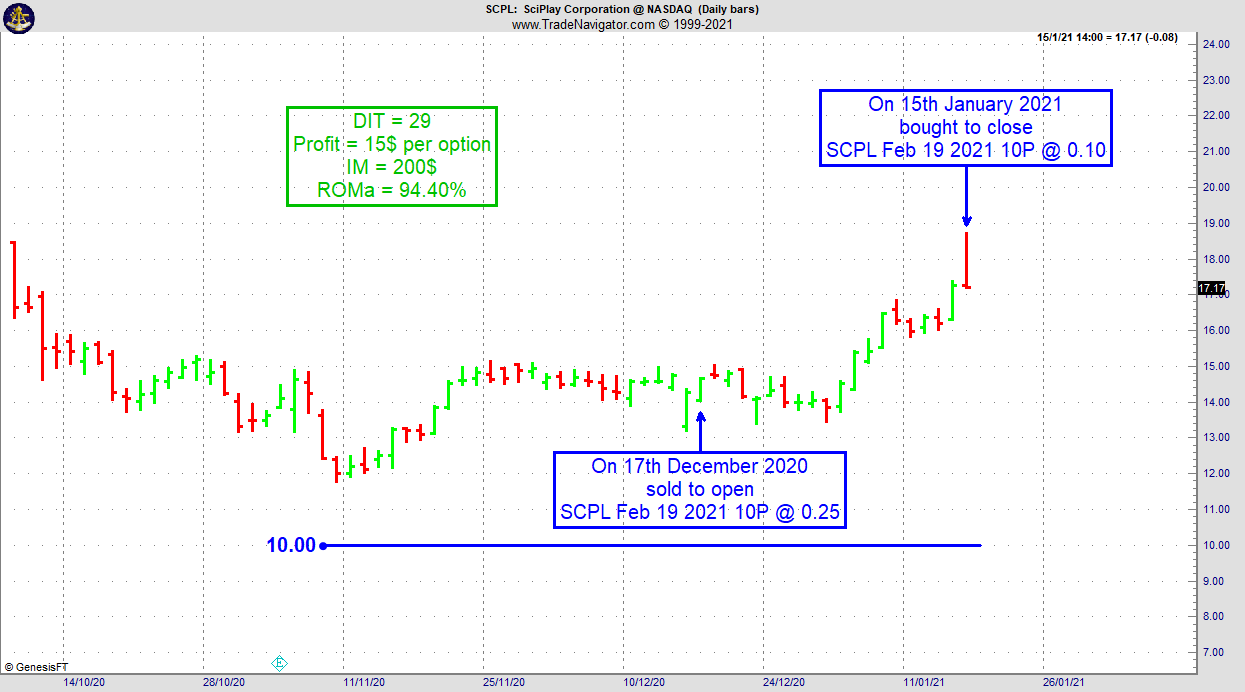

Instant Income Guaranteed - SCPL (SciPlay Corporation) Trade

Being selective and choosing low risk entries around major support zones is vital for price insurance selling: this maximizes premium levels and reduces drawdowns (if any).

With VIX at 20 and above, we can still find decent premium levels with short strikes well below price action, for extremely safe trades that could easily survive a sharp pullback.

On 17th December 2020, we sold SCPL Feb 19 2021 10P at 0.25, with our short strike 30% below price action, and with 62 days until expiration.

We could buy to close our short put at 0.10 on 15th January 2021, after 29 days in the trade, and an annualized return on margin of 94.40%. This option being a bit illiquid, we needed a spike to the upside to get our exit fills.

Philippe

TRADING SUCCESSES EMAILED TO YOU DAILY!

~ WE DO THE RESEARCH FOR YOU ~

CLICK HERE TO Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, and Day Trading, and Editor for 20+ years with Traders Notebook, daily advisory newsletter.

Trading Article: Rationalizing Actions when Trading

One of the most important things to learn in this life is how we ourselves behave, not only when we are acting on our own, but when we are part of the crowd. And what few of us understand is how many of our important daily actions are not thought out in advance. We are all attempting to survive in...read more.

Andy Jordan wants you to learn trading and highly recommends that you invest in yourself. Private mentoring with Andy is the first step to improving your trading, his students find this very helpful to accelerate their trading successes.

Private Mentoring with Andy Jordan – Sign Up Today

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Performance Update

&

Crazy Specials

Specials Extended until February 25, 2021

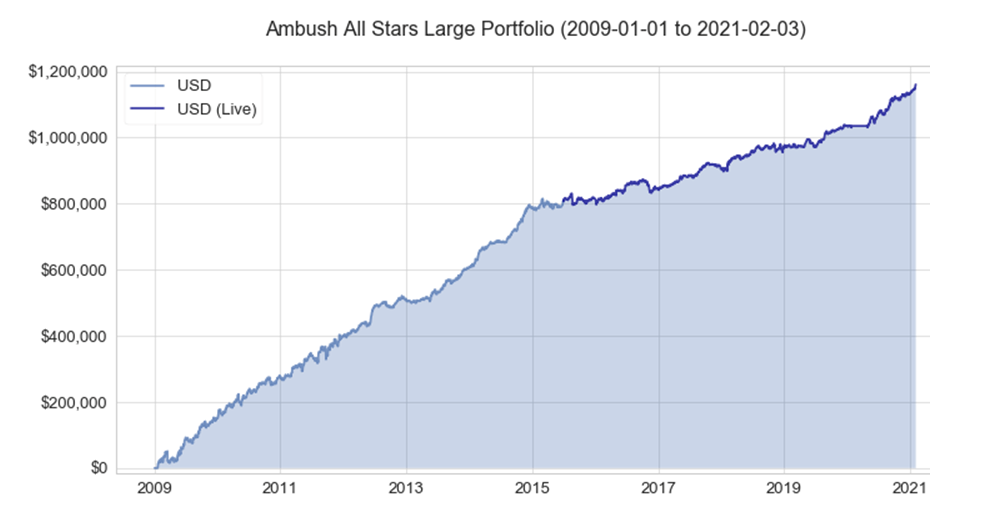

I hope you had a good and healthy start so far in 2021! Well, for sure the Ambush System did and I'd like to tell you more about this and celebrate this great start into 2021 with some really rare specials.

I guess I don't have to explain anything about the Ambush System to you. It is a legendary trading system by now, after being out there for more than a decade and still dominating in so many markets! I simply don't know of any other trading system that has kept on doing its job that well for such a long time. Honestly, most traders are more than happy if their system lasts for a couple of months before they have to come up with something new! Also, while most systems work in just one market, Ambush keeps on pushing to new highs in over 20 markets including a wide range of Futures and Forex markets!

Performance

As they say, a picture says more than a thousand words, so I'll make this short, here's the updated performance graph of the Ambush All Stars Large Portfolio which includes a very well-diversified selection of markets from stock indices and commodities to currencies and interest rate futures.

Please have a look at the Ambush Signals Performance to learn more about the sample portfolios and see all of the updated performance reports. All of the portfolios look the same though, as all the graphs finish at the top right ;)

As you can see the Ambush did extremely well in almost all of the supported markets. Whether you're trading stock indices, currencies, commodities, or interest rate futures, you don't want to be on the other side of these day trades!

Those of you following us for a while now already know all of this. I've sent out pretty much the same email again and again. Looks like Ambush just does its job, boring right? Right, so here's something to get you really excited! As we barely run any specials for Ambush make sure you don't miss out on these.

I keep on hearing from our active subscribers about how surprised they are that it's so easy and simple to actually take those day trades. They simply had no idea you could actually day trade profitably with so little effort and time! As it just takes a couple of minutes a day you can day trade while still doing other things throughout the whole day and still have all the benefits day trading offers.

Specials

Ambush Signals:

Ambush Signals does all the work for you and simply sends you the Ambush signals for each of the markets that you subscribed to every day.

As many of you want to subscribe long-term you kept on asking for yearly discounts so here's a special that covers that. These won't be available on the regular Ambush Signals page and will be available only for a couple of days so don't miss out! These are one-time purchases, not auto-renewal subscriptions.

There are three different subscriptions based on which markets you need, to learn more simply go to the Ambush Signals Page and click on "Compare Plans":

- 1 year of Ambush Signals Forex for $399 ($828)

- 1 year of Ambush Signals Mini for $599 ($1068)

- 1 year of Ambush Signals Pro for $899 ($1548)

Ambush eBook:

The Ambush eBook contains all the trading rules of the Ambush System, so if you want to make it your own or know what's behind Ambush Signals this is for you. Get it now for just $999 instead of the regular $1799. But that's not all, if you buy the eBook you also get three months of Ambush Signals Pro for free to get you started on the right track. That is another $387 saving! All you have to do is use the coupon code "ambush999" during checkout.

I really can't tell you if and when there will be another special like this again so if you want to get the eBook, this is it!

Enjoy the specials and stay healthy!

Marco Mayer

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Joe Ross has been trading and investing since his first trade at the age of 14, and is a well known Master Trader and Investor. He has survived all the up and downs of the markets because of his adaptable trading style, using a low-risk approach that produces consistent profits.

Joe Ross is the creator of the Ross hook™, and has set new standards for low-risk trading with his concepts of "The Law of Charts™" and the "Traders Trick Entry™." Joe was a private trader and investor for much of his life, but a serious health situation in the late 80's caused him to shift his focus, and that is when he decided to share his knowledge. After his recovery, he founded Trading Educators in 1988, to teach aspiring traders how to make profits using his trading approach.

Joe Ross has written twelve major books and countless articles and essays about trading. All his books have become classics, and have been translated into many different languages. His students from around the world number in the thousands. His file of letters containing thanks and appreciation from students on every continent is huge: As one student, a successful trader, wrote: "Your mastery of teaching is even greater than my mastery of trading."

Joe Ross holds a Bachelor of Science degree in Business Administration from the University of California at Los Angeles. He did his Masters work in Computer Sciences at the George Washington University extension in Norfolk, Virginia. He is listed in "Who's Who in America." After 5 decades of trading and investing, Joe Ross still tutors, teaches, writes, and trades regularly. Joe is an active and integral part of Trading Educators. He is the founder and contributor of the company's newsletter Chart Scan™.

Joe's philosophy for helping traders is:

"Teach our students the truth in trading — teach them how to trade."

"Give them a way to earn while they learn — realizing that it takes time to develop a successful trader."

Joe sets forth the mission of Trading Educators as follows:

To show aspiring futures traders the truth in trading by teaching them how to read a chart so that they can successfully trade what they see, and by revealing to them all of the insider knowledge they need in order to understand the markets.

To enable them to trade profitably by training them to properly manage their trades as well as their mindset and self-control.

To accomplish our mission for our students we educate them so that they know and understand:

Benefits for our Clients:

- Where prices are likely to move next.

- Independence from complicated trading methods, magic indicators, and black-box systems.

- Independence from opinion, anyone's opinion, including their own.

- Independence achieved through knowing how to read a chart.

- Independence through having knowledge of insider actions.

- Independence achieved by taking holistic and eclectic approaches.

- Independence coming from knowing how to manage both the trades and themselves.

- Independence because they understand and trade what they see.

- Independence because they have learned how and why prices move as they do, through studying the truth in trading and the truth about markets.

Students learn only proven methods and techniques, which helps them to preserve capital and create more consistent profits; they are offered simple methods that will assist them to earn while they learn.

- They learn to work smarter and more effectively.

- They learn to treat trading as a business; we offer no Holy Grail or magic systems.

- They learn to adapt to changing market conditions.

- They learn a systematic approach to trading rather than a mechanical system for trading.

- Why prices will move there.

- Who and what cause prices to move.

- How far prices are likely to move when they do move.

- Their own role in the movement of prices..

- How to take advantage of the knowledge they receive.

- How to properly manage and exit a trade which they have entered.

- How to manage themselves and acquire the discipline needed to become successful traders.

Read some personal testimonials which Joe has received.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2021 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.