Edition 872

March 19, 2021

We would like to welcome our newest newsletter subscribers, glad you joined our trading team! In each Chart Scan edition, we provide invaluable trading examples and lessons, so take the time to read and reread the material provided to you. We do not promote holy grail or get rich quick schemes, only examples handed down by our professional traders. Slow and steady wins the trading race so as you begin diving into our material, feel free to send questions and let's learn trading together.

On a more serious note, there could be traders and companies posing as me. If you receive any marketing emails that include my name, Trading Educators or similar products mentioned on our website, please, please send us a quick note to verify. We take pride in not selling, renting or trading your personal information to individuals or organizations. Trust me, we are contacted almost daily with requests to partner and share our database. I am here to tell you, it won't happen, even after I am long gone. Thank you for starting or continuing your learning journey with Trading Educators. ~ Master Trader, Joe Ross

50% OFF

THE LAW OF CHARTS (TLOC)

IN-DEPTH RECORDED WEBINAR

USE COUPON CODE DURING CHECKOUT: TLOC50

BUY NOW - CLICK HERE!

Valid thru March 23, 2021

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Basic Chart Reading

Above, we see a Long Bar (bar 1) leading into what became a Trading Range consisting of 20 bars, followed by a breakout to the downside (bar 21).

At Trading Educators, we call "Congestion" any Consolidation of 11 bars to 20 bars. We call a "Trading Range" any Consolidation of 21 bars and greater.

The Law of Charts tells us that on a statistical basis, breakouts from Congestion or Trading Ranges most often occurs on bars 21-29. The breakout to the downside came on the 21st bar of the Congestion area.

The Law of Charts also states a Ross hook is the first failure of prices to move lower after a downside breakout from a consolidation area of any length. (The opposite for upside breakouts.)

We then see that a Ross hook formed according to the definition stated in the Law of Charts. This initial Ross hook was quickly followed by a second and lower Ross hook. Once the first Ross hook is identified on a chart, each subsequent failure by prices to move lower creates an additional Ross hook. This goes on until all Ross hooks have been exhausted due to a change in trend.

An entry at or ahead of a violation of the point of the second Ross hook turned out to be a good trade.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

"This is by far the best book I've read about trading. And I have many books by some of the best known, so-called "experts". The author takes you step by step through a trading methodology called the "Ross Hook". There is no "fluff". Only real life, usable information. I really learned a lot from reading the sections on trade management. What an eye opener! I highly recommend this book to anyone who is tired of all the hype and misleading advertising that is done in this industry, and wants a real trading system to work with. It is very refreshing to read a book on trading that actually shows you, in precise detail, how to trade. Forget about vague and general "rules". You will learn techniques that you can take to the bank!”

~ Mark H.

ADD JOE ROSS' S HARDBACK BOOK TO YOUR LIBRARY TODAY! CLICK HERE!

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Compendium?

Hey Joe! Has anyone that you know put together a compendium of what to look for when you first start out trading?

Not that I know of. But consider the following: As a trader, you are in a contest. Your strongest opponent has plenty of...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

50% OFF

THE LAW OF CHARTS (TLOC)

IN-DEPTH RECORDED WEBINAR

USE COUPON CODE DURING CHECKOUT: TLOC50

BUY NOW - CLICK HERE!

Valid thru March 23, 2021

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

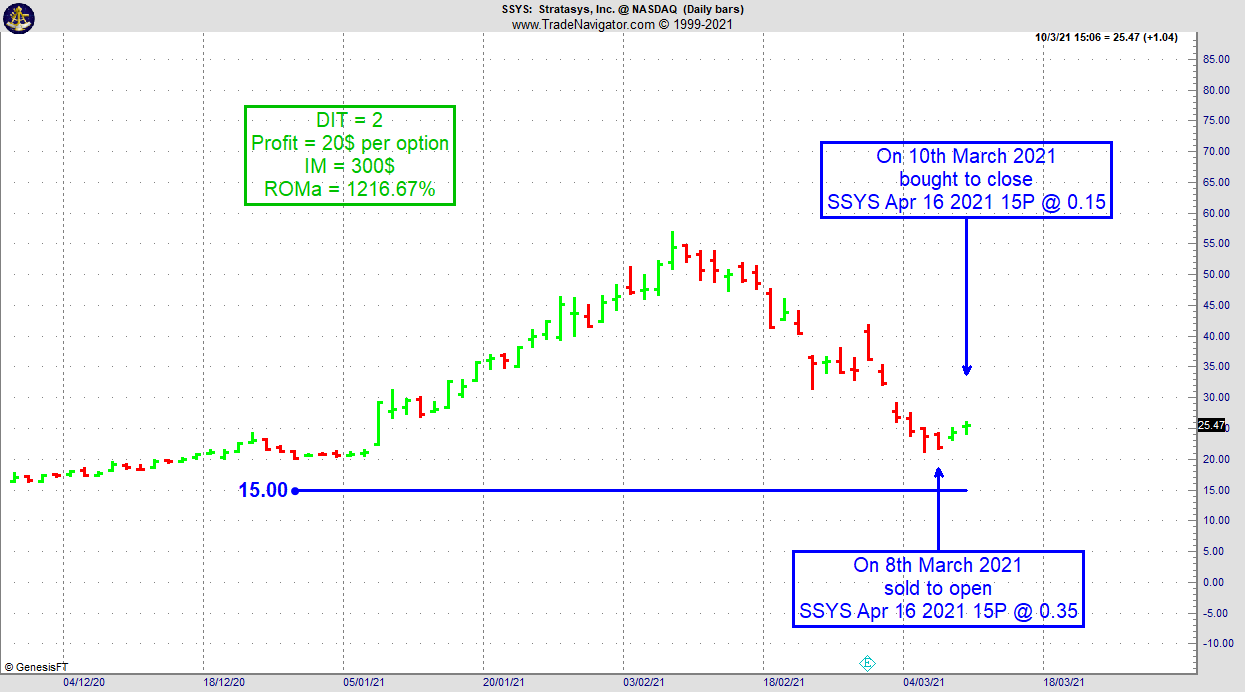

Instant Income Guaranteed - SSYS Trade

When a stock falls like a rock into a major support area, it can be scary but this is an excellent spot to sell price insurance with short strikes far away from price action, as premium levels are on the high side.

For instance, as SSYS (Stratasys Inc) had a sharp down move into a major support area, on 8th March 2021, we sold SSYS Apr 16 2021 15P at 0.35 (with 38 days until expiration and our short strike about 37% below price action, giving us lots of protection).

Only 3 days later, including a weekend, we bought to close SSYS Apr 16 2021 15P at 0.15 for a profit of 20$ per option and an annualized return on margin of 1216.67%.

Philippe

TRADING SUCCESSES EMAILED TO YOU DAILY!

WE DO THE RESEARCH FOR YOU

CLICK HERE TO Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, and Day Trading, and Editor for 20+ years with Traders Notebook, daily advisory newsletter.

Trading Article: How much capital do I need to start trading?

I cannot count the number of times I've been asked this question. It seems as though every person who is new to trading asks this question, and sometimes it is asked by people who should know better. It's often the first question that pops up in my email, at seminars, and private tutoring sessions. Right up front I'm telling you...read more.

Andy Jordan wants you to learn trading and highly recommends that you invest in yourself. Private mentoring with Andy is the first step to improving your trading, his students find this very helpful to accelerate their trading successes.

Private Mentoring with Andy Jordan – Sign Up Today

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

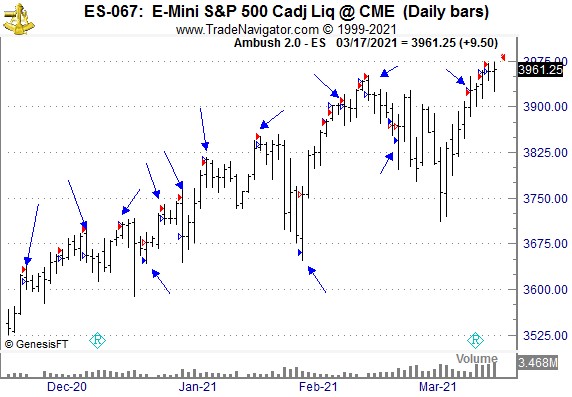

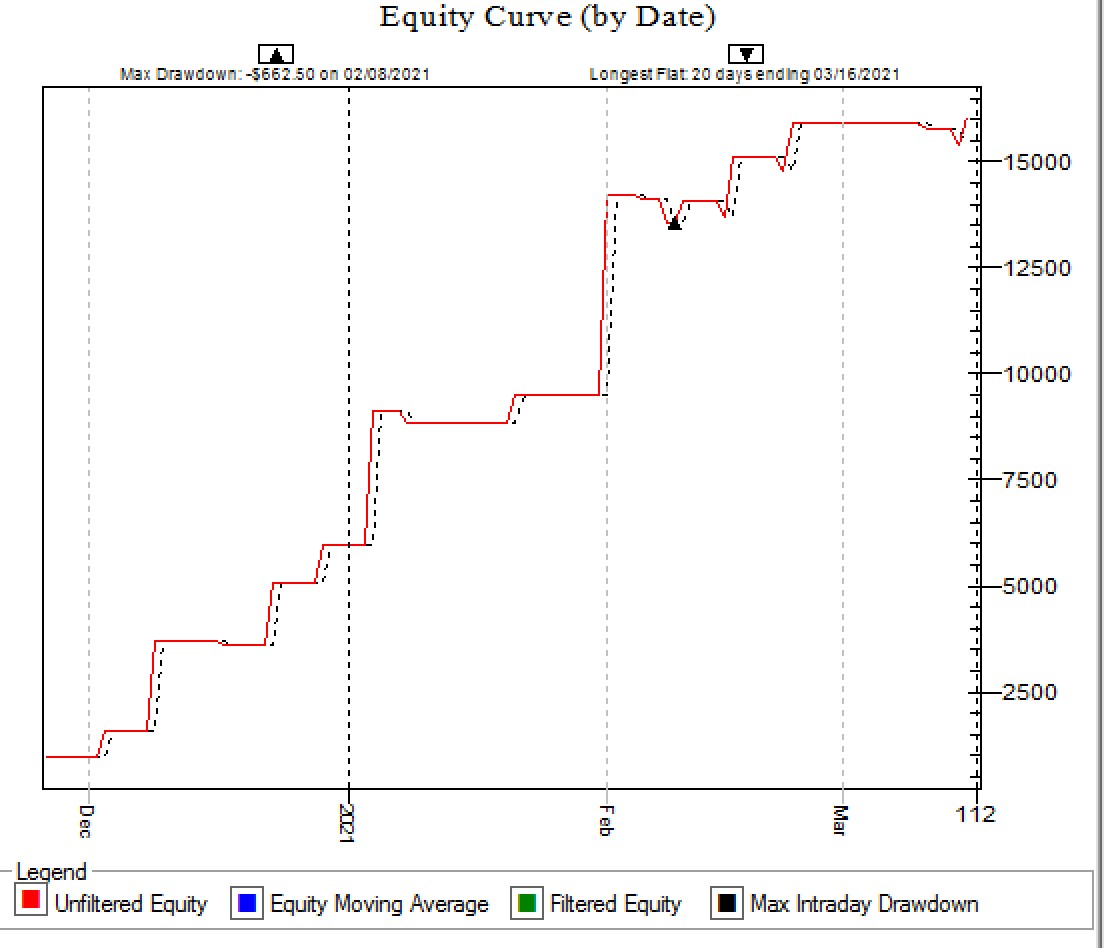

A quarter of Ambush trading the E-Mini S&P 500

One of the top markets over the last couple of months for Ambush Traders has been the E-Mini S&P 500 future. Doesn't matter whether you traded the E-Mini or the E-Micro contract - you surely had a really good time!

Here's a daily chart of the E-Mini S&P 500 (ES, traded at CME), showing the last couple of months of trading. As you can see this market did what markets do 90% of the time, which is why Ambush is such a great trading method. Markets move for a few days and then swing back in the other direction. It amazes me all the time how great Ambush is in getting in at exactly these swing-points. Have a look for yourself:

The edge of Ambush is that we get in on such days BEFORE everyone else does when the swing-point is already in place. We participate and profit from those coming in later when the move is often already over (thank you guys!).

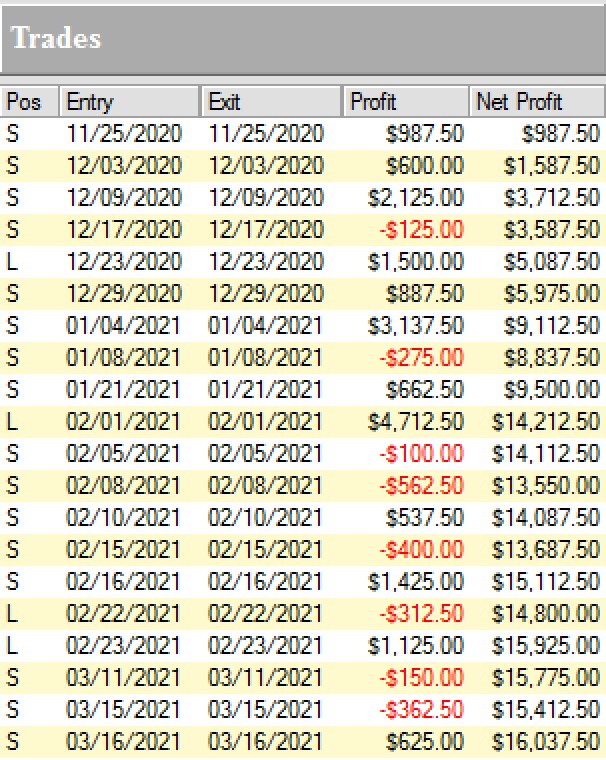

Here are the results of these trades, trading only one ES contract:

Yup, that's over $15k profits with almost no drawdowns with just 20 trades. This gives us an average trade profit of $800 and a profit factor of 8! This means we had 8 times as much profits as losses within that period. That's literally insane!

Now the E-Mini S&P 500 Future is a large contract and not suitable for small accounts. But you can do these trades also in the E-Micro S&P 500 which is just 1/10 the size and more than liquid enough for Ambush Trading. Remember we don't get in and out of the market 10 times a day and make our brokers rich. We place our order once a day and walk away till the close!

That's what makes Ambush Signals so great, it works with any account size offering three subscription models depending on your goals.

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves!

Don't miss the next trade and join Ambush Signals today!

Happy trading,

Marco Mayer

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

"This is by far the best book I've read about trading. And I have many books by some of the best known, so-called "experts". The author takes you step by step through a trading methodology called the "Ross Hook". There is no "fluff". Only real life, usable information. I really learned a lot from reading the sections on trade management. What an eye opener! I highly recommend this book to anyone who is tired of all the hype and misleading advertising that is done in this industry, and wants a real trading system to work with. It is very refreshing to read a book on trading that actually shows you, in precise detail, how to trade. Forget about vague and general "rules". You will learn techniques that you can take to the bank!”

~ Mark H.

ADD JOE ROSS' S HARDBACK BOOK TO YOUR LIBRARY TODAY! CLICK HERE!

Joe Ross has been trading and investing since his first trade at the age of 14, and is a well known Master Trader and Investor. He has survived all the up and downs of the markets because of his adaptable trading style, using a low-risk approach that produces consistent profits.

Joe Ross is the creator of the Ross hook™, and has set new standards for low-risk trading with his concepts of "The Law of Charts™" and the "Traders Trick Entry™." Joe was a private trader and investor for much of his life, but a serious health situation in the late 80's caused him to shift his focus, and that is when he decided to share his knowledge. After his recovery, he founded Trading Educators in 1988, to teach aspiring traders how to make profits using his trading approach.

Joe Ross has written twelve major books and countless articles and essays about trading. All his books have become classics, and have been translated into many different languages. His students from around the world number in the thousands. His file of letters containing thanks and appreciation from students on every continent is huge: As one student, a successful trader, wrote: "Your mastery of teaching is even greater than my mastery of trading."

Joe Ross holds a Bachelor of Science degree in Business Administration from the University of California at Los Angeles. He did his Masters work in Computer Sciences at the George Washington University extension in Norfolk, Virginia. He is listed in "Who's Who in America." After 5 decades of trading and investing, Joe Ross still tutors, teaches, writes, and trades regularly. Joe is an active and integral part of Trading Educators. He is the founder and contributor of the company's newsletter Chart Scan™.

Joe's philosophy for helping traders is:

"Teach our students the truth in trading — teach them how to trade."

"Give them a way to earn while they learn — realizing that it takes time to develop a successful trader."

Joe sets forth the mission of Trading Educators as follows:

To show aspiring futures traders the truth in trading by teaching them how to read a chart so that they can successfully trade what they see, and by revealing to them all of the insider knowledge they need in order to understand the markets.

To enable them to trade profitably by training them to properly manage their trades as well as their mindset and self-control.

To accomplish our mission for our students we educate them so that they know and understand:

Benefits for our Clients:

- Where prices are likely to move next.

- Independence from complicated trading methods, magic indicators, and black-box systems.

- Independence from opinion, anyone's opinion, including their own.

- Independence achieved through knowing how to read a chart.

- Independence through having knowledge of insider actions.

- Independence achieved by taking holistic and eclectic approaches.

- Independence coming from knowing how to manage both the trades and themselves.

- Independence because they understand and trade what they see.

- Independence because they have learned how and why prices move as they do, through studying the truth in trading and the truth about markets.

Students learn only proven methods and techniques, which helps them to preserve capital and create more consistent profits; they are offered simple methods that will assist them to earn while they learn.

- They learn to work smarter and more effectively.

- They learn to treat trading as a business; we offer no Holy Grail or magic systems.

- They learn to adapt to changing market conditions.

- They learn a systematic approach to trading rather than a mechanical system for trading.

- Why prices will move there.

- Who and what cause prices to move.

- How far prices are likely to move when they do move.

- Their own role in the movement of prices..

- How to take advantage of the knowledge they receive.

- How to properly manage and exit a trade which they have entered.

- How to manage themselves and acquire the discipline needed to become successful traders.

Read some personal testimonials which Joe has received.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2021 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.