Edition 898

September 17, 2021

Dear Traders,

I hope this edition finds your heart a little lighter with memories that bring laughter and smiles about the passing of Master Trader Joe Ross. The trading world has lost a unique and passionate trader. He explained to me that his material will never go out of date, only the technology. Recently, we updated several of his hardback books into eBooks and he was right. From making trades over the phone to the "pit" then to opening an online acccount, my how things have changed. But he is correct about his methods, they will continue to apply to the markets regardless of how technolgy advances. And if you did not pick up on it, I announced a little teaser and plan on offering his revised material by the first part of next year. As stated in our last memoriam edition, our priority is directed toward Loretta.

Hard to believe that this will be the first edition without Master Trader Joe Ross contributing, but guess what? It actually isn't. Oddly enough, Joe had been sending several folders of Chart Scans with Commentary and Trading Articles since earlier this year. I just kept responding, keep'em coming Joe. Our future publications will be new, never seen before material. I hope you realize that he put you, his students, as a priority and at times, it seemed that is what kept him going.

For those of you wondering, who is typing? I am Joe's daughter, Martha and joined forces with Trading Educators about five years ago and have been behind the scenes, at least up until now. My promise to him, as we had many in-depth conversations about the direction of Trading Educators, was to carry on his knowledge and writings to continue teaching the truth in trading. I am honored and excited to take on this role and am aware of the integrity that is needed to continue. My sincerest "thank you" to everyone that has reached out offering support and condolences. It is a shared emptiness, but we will get through this together. God bless each and everyone of you.

Please enjoy Master Trader Joe Ross' final thoughts and lessons as we continue to "Teach our students the truth in trading - teach them how to trade", and "Give them a way to earn while they learn - realizing that it takes time to develop a successful trader". Now, let's start to learn trading, Joe's way.

All the best,

Martha Ross-Edmunds

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

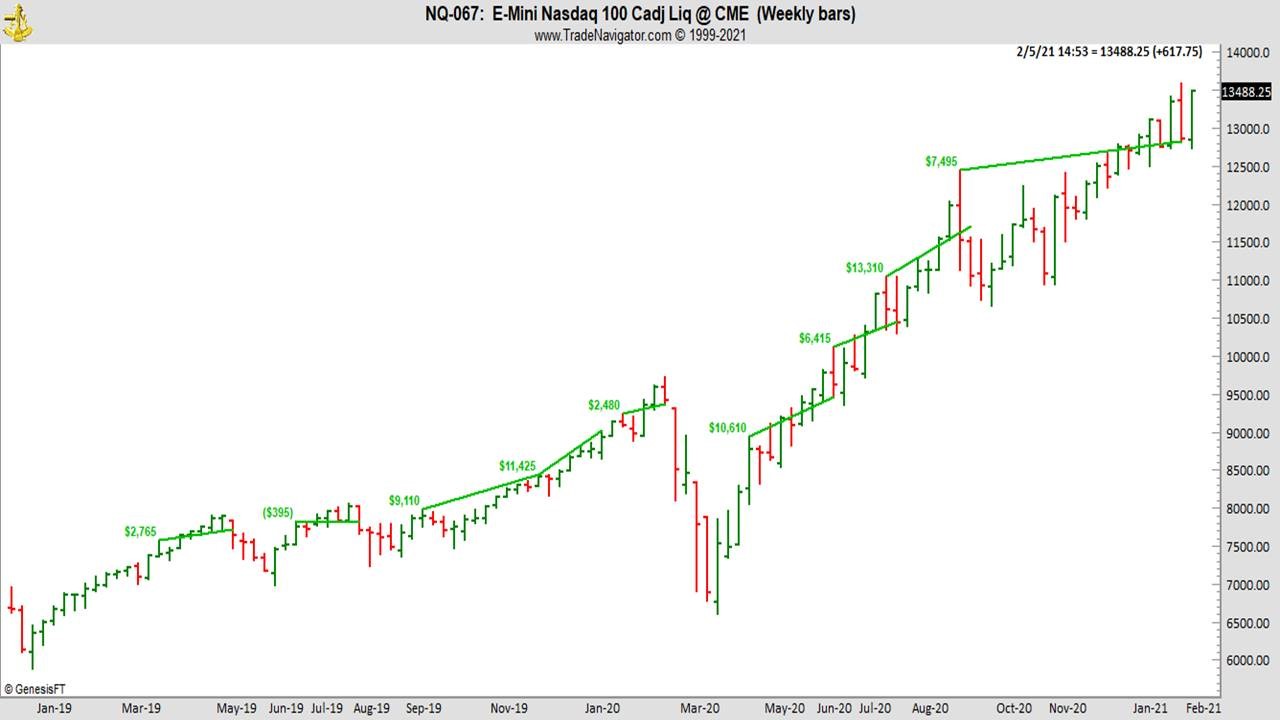

Chart Scan with Commentary: Ross Hooks

Joe! It appears that ross hook is only suited for reversal setups, but I’m curious if it also can be used for continuation? If so, please send me 1 example.

I can show you bunches of charts, but whether or not your time frame is sufficient enough to make money from the movement by prices towards the Ross Hooks. For example, a Ross hook breakout of any daily bar’s high or low is more likely to have the momentum to carry prices to a win, than the breakout of a 3-minute chart.

In the chart above where you would have placed your profit objective stop and your stop loss are the deciding factor. I drew lines from Rh across to where felt I would have gone out. Notice, I did not use the Traders Trick Entry, which would have been even more profitable. I bought at exactly the price of the high of the Rh. I used a weekly chart and had one small loss ($395). My stop losses were calculated loss as shown in my eBook Stopped Out.

I will say this, using the TTE will almost always give better results because it gets you into the trade sooner so you can take advantage of the momentum of the market movers.

© by Joe Ross. Re-transmission or production of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Getting Credit

Thanks for your prompt reply and explanation Joe. I was thinking to do straight call/put to pre-define my risk. Follow up question please.

If I buy a call for 30 days and close out the option in 15 days, Do I get credit for 15 days that I did not use?

The answer to your question is...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Instant Income Guaranteed - Joe Ross' FIRST IIG Trade

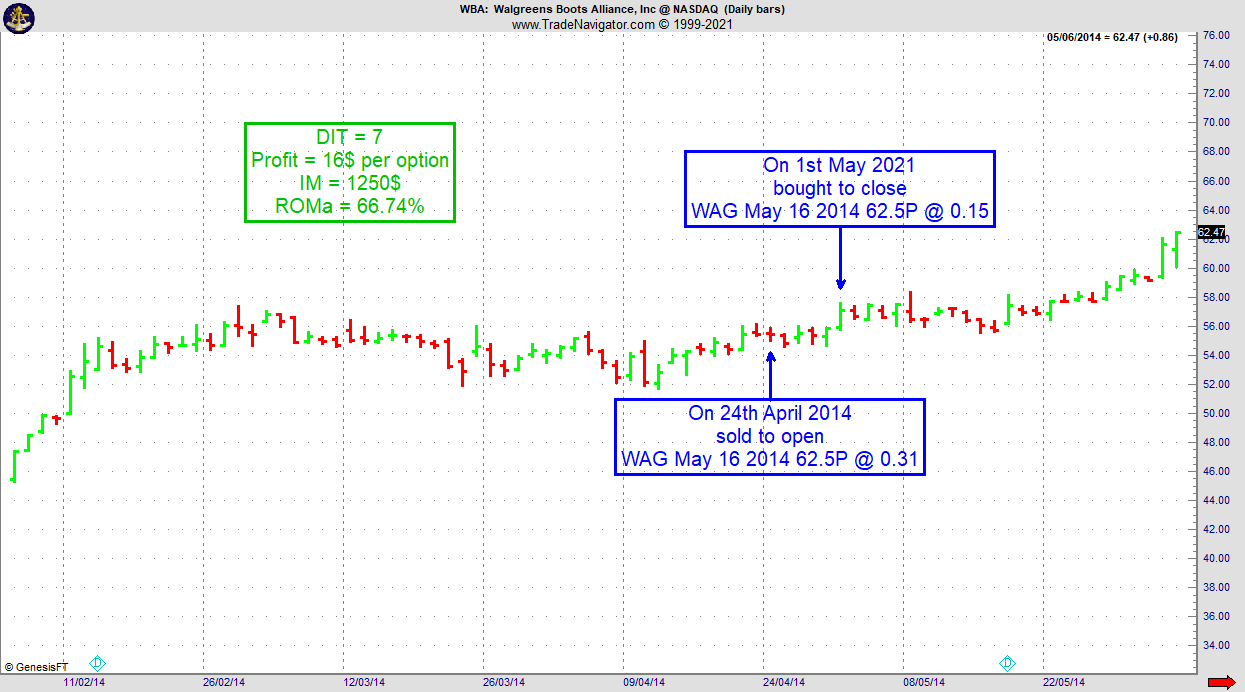

We have lost a mentor and a friend, Joe Ross, this week. The only trader and mentor I know of who was teaching the spiritual side of trading.

In his tribute, we will rediscover his first Instant Income Guaranteed trade he gave his subscribers in April 2014, when he started this service.

This was for the ticker WAG, now WBA, Walgreens Boots Alliance Inc. ("ignore" back adjusted prices, the short strike price is no more relevant here).

On 24th April 2014, he sold to open WAG May 16 2014 62.5P at 0.31, with less than 30 days until expiration.

7 days later, on 1st May 2014, he bought to close this put at 0.15, for an annualized return on margin of 66.74%.

Joe, may you rest in peace.

Philippe

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, and Day Trading, and Editor for 20+ years with Traders Notebook, daily advisory newsletter.

Joe Ross was my mentor since 2002 so there are many trading memories. The first picture was taken during a 2007 seminar in Prague and the second picture is Joe mentoring me. He was not just a mentor, but a father-figure and that is what I will miss the most.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The first lesson that Joe taught me that I still remember was on the first seminar I attended about 15 years ago in Munich, Germany. He started the seminar by making it absolutely clear that trading is a business and that's what the seminar will be about, not about gambling or entertainment. This included doing one's homework as a trader and why it’s so important.

When I started out trading I thought this is going to be just exciting and fun and I’ll never have to do any boring, repetitive stuff again. Truth is that even trading itself is actually almost nothing, but routine: you do the same thing over and over again. And most of the time you just sit there and wait and do nothing. It’s exciting when you start out but after a few years, the trading itself is really a dumb thing to do. What’s fun is the research and working on yourself as a trader.

Now, what’s the actual homework as a trader? For example, you need to write down the trades you did, keep a record. Especially if you did anything wrong, write it down so you can improve on it.

Here’s another one: Go through your trades regularly to look out for anything you can do better. Maybe there’s a setup/situation where you lose money most of the time. Find it and stop doing it. Oh, you didn’t do your job and don’t have any records of your trades? Too bad, back to step one!

Do you wonder where to put your stop on a specific setup? Or in a specific market? Don’t guess…either backtest it automatically or if you can’t do that sit-down and do it on your own. Setup by setup…boring? Yes, but absolutely necessary.

And of course, you need a daily routine. Write down any important news that might come out. How often did not doing this cost you money in the past? Do you really want to have this happen again? Look at the markets before you start trading and note important levels, get an idea of the big picture, is there a trend? Where’s it going?

There’s a lot more and one of the best books on that topic is "Trading is a Business" by Joe. It’s one of the very few trading books I still have and didn’t sell again after reading it.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Joe Ross has been trading and investing since his first trade at the age of 14, and is a well known Master Trader and Investor. He has survived all the up and downs of the markets because of his adaptable trading style, using a low-risk approach that produces consistent profits.

Joe Ross is the creator of the Ross hook™, and has set new standards for low-risk trading with his concepts of "The Law of Charts™" and the "Traders Trick Entry™." Joe was a private trader and investor for much of his life, but a serious health situation in the late 80's caused him to shift his focus, and that is when he decided to share his knowledge. After his recovery, he founded Trading Educators in 1988, to teach aspiring traders how to make profits using his trading approach.

Joe Ross has written twelve major books and countless articles and essays about trading. All his books have become classics, and have been translated into many different languages. His students from around the world number in the thousands. His file of letters containing thanks and appreciation from students on every continent is huge: As one student, a successful trader, wrote: "Your mastery of teaching is even greater than my mastery of trading."

Joe Ross holds a Bachelor of Science degree in Business Administration from the University of California at Los Angeles. He did his Masters work in Computer Sciences at the George Washington University extension in Norfolk, Virginia. He is listed in "Who's Who in America." After 5 decades of trading and investing, Joe Ross still tutors, teaches, writes, and trades regularly. Joe is an active and integral part of Trading Educators. He is the founder and contributor of the company's newsletter Chart Scan™.

Joe's philosophy for helping traders is:

"Teach our students the truth in trading — teach them how to trade."

"Give them a way to earn while they learn — realizing that it takes time to develop a successful trader."

Joe sets forth the mission of Trading Educators as follows:

To show aspiring futures traders the truth in trading by teaching them how to read a chart so that they can successfully trade what they see, and by revealing to them all of the insider knowledge they need in order to understand the markets.

To enable them to trade profitably by training them to properly manage their trades as well as their mindset and self-control.

To accomplish our mission for our students we educate them so that they know and understand:

Benefits for our Clients:

- Where prices are likely to move next.

- Independence from complicated trading methods, magic indicators, and black-box systems.

- Independence from opinion, anyone's opinion, including their own.

- Independence achieved through knowing how to read a chart.

- Independence through having knowledge of insider actions.

- Independence achieved by taking holistic and eclectic approaches.

- Independence coming from knowing how to manage both the trades and themselves.

- Independence because they understand and trade what they see.

- Independence because they have learned how and why prices move as they do, through studying the truth in trading and the truth about markets.

Students learn only proven methods and techniques, which helps them to preserve capital and create more consistent profits; they are offered simple methods that will assist them to earn while they learn.

- They learn to work smarter and more effectively.

- They learn to treat trading as a business; we offer no Holy Grail or magic systems.

- They learn to adapt to changing market conditions.

- They learn a systematic approach to trading rather than a mechanical system for trading.

- Why prices will move there.

- Who and what cause prices to move.

- How far prices are likely to move when they do move.

- Their own role in the movement of prices..

- How to take advantage of the knowledge they receive.

- How to properly manage and exit a trade which they have entered.

- How to manage themselves and acquire the discipline needed to become successful traders.

Read some personal testimonials which Joe has received.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2021 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.