Edition 972

March 31, 2023

Let's Learn the Art of Trading Joe Ross' Way!

"The Constitution gives every trader the inalienable right to make a damn fool of himself." -- Old Trader

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Are You a Loser?

Do you remember the life of Vincent Van Gogh? Good old Vincent discovered his girlfriend didn't like him, so he cut off his ear. Some of you don't like having money, so you cut yourself off from it by losing it in the market. You’ll never convince anyone you really like winning when you’re so eager and quick to lose it.

I’m going to give you a real-life example of how to mismanage your money and turn a winning trade into a loser. The trade took place earlier this year, when I witnessed a professional trader (PT) making a self-defeating move like the one I will show you.

First, I’ll show you how the chart looked. Then I’ll talk about what the trader did, what he would have done had I not been there, and what he should have done that he didn't do, despite the fact that he came to me to have me coach him in day trading.

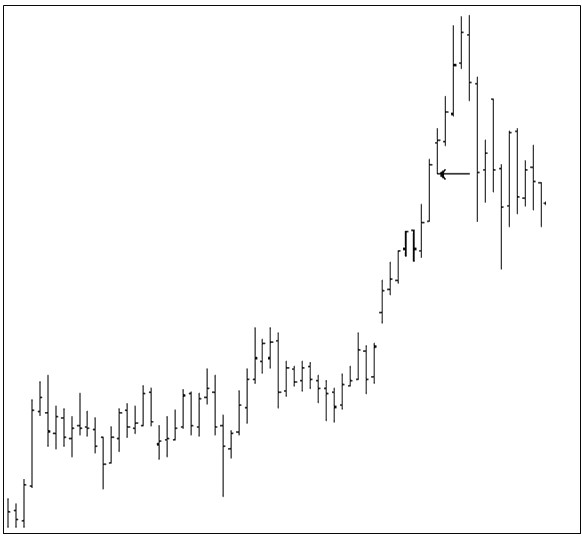

PT was day trading from a fifteen-minute chart. He also looked at hourly charts for perspective. The five-minute charts gave him a more minute vision of what was happening in the markets, and a way to optimize his entries. Let's have a look at his method of entry, his reasons for entry, and where he made his mistake. By the way, this man is an excellent trader. He came to me because he was experiencing a severe equity draw down.

The first arrow shows the sixty-minute period in question. It is the opening hour of stock index trading in the U.S.

The sixty-minute chart gave PT an overview of the market. The price bar shows that prices had been in and remained in an uptrend.

The same price bar shows that prices opened on a gap up from the previous day’s close. A gap opening usually means the insiders may initially attempt to trade to the short side. PT’s plan was to use the momentum of the insiders to fade (take the opposite side from the direction of) the open, figuring that the insiders might actually double their shorts based upon the gap.

PT then went to his fifteen-minute chart for verification of what he was seeing.

According to what he told me PT was looking for a pull-back of at least 3/8ths of the last upswing that had started the previous day. Although he doesn’t use the 1-2-3 low formation per se, I took the liberty of marking the chart so you could see the beginning of the upswing (arrow on the chart). I also marked the high of the opening fifteen-minute bar as a Ross Hook (Rh), which came into effect as the second fifteen-minute bar opened lower than the opening fifteen-minute bar, and went no higher.

PT’s plan was to short a breakout of the low of the opening fifteen-minute bar.

In order to optimize his entry, he went to the five-minute bar chart looking for an entry formation that might get him short ahead of the actual breakout of the fifteen-minute low. It was interesting to watch him because what he was looking for was the equivalent of a Trader’s Trick Entry, or the breakout of consolidation prior to the actual taking out of the low.

As it turned out, there was no Trader’s Trick Entry available prior to the taking out of the opening bar low. Nor was there a consolidation breakout to assist his entry.

The opening bar low (left) was violated (right arrow) in the time between twenty-five and thirty minutes after the open. You can see by the extra length of the bar that the market movers caught some stops resting just under the opening bar low. Those sell stops placed there as protective stops by those who had gotten long after the opening five-minute bar high was violated, as well as those who wanted to short a breakout of the opening bar’s low, caused an extra-long “thrust” type bar to occur as the opening bar’s low was taken out.

Earlier I wrote that PT had made a mistake. He had turned a winning trade into a loser. How did he do that? Good fortune actually got him into his short position two ticks better than a breakout of the low of the opening bar. Prices then moved down to a point where he was 3 points to the good in the trade. Because he was trading lightly during the coaching session, he entered the market with only fifteen contracts. He failed to take off 5 or more contracts after making a couple of points, $100/contract, or $500.

When the bar subsequent to his entry bar (35 minutes after the open) threatened his entry point and then closed in the lower half of the bar, I breathed a sigh of relief and encouraged him to take off the entire position. He would have had 3 points of profit on 15 contracts ($2,250). But he didn't cash in the trade. Instead, he wanted to discuss it. When the next bar (40 minutes after the open) failed to go any lower, and in fact was an inside bar that closed on its high, he finally set his stop at break even.

Ultimately, he was stopped out above breakeven for a ¼-point loss plus costs. What could have been a nice profit had turned into a loss. This error turned out to be what was wrong with PT’s trading. He had gotten off track. He was failing to take the money while it was there for the taking. We can all learn from his mistake. PT’s goal was to take at least five points out of a trade. But he was being stubborn. Prices were not going to give him that many points on that day. The market was telling him that the only thing that happened at the opening low was that the market movers had run the stops. When he saw that prices were not plummeting down from there, he should have had an alternative plan to take what he could get from the market while he could get it.

There was nothing wrong with PT’s plan to fade the open. In fact, it was a sound plan, one anyone one of us might frequently follow. It was his management that was faulty as well as his discipline.

© by Joe Ross. Re-transmission or production of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Trader Trick Advanced Concepts Recorded Webinar - Enjoy 30% Off

Use Coupon Code During Checkout: tte30

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Instant Income Guaranteed

Hi, Master. I have a few questions that I don’t quite understand, about Instant Income Guaranteed. Please explain to me, thanks.

Q: "Only take the trades you can afford, keeping your put cover ratio at the advised strict minimum of 50% (80% preferably)"----Could you tell us how this data (50%-80%) is measured?

A: If you have a $100,000 account you would use only $20,000 of it for trading IIG if you stayed with the 80% model.

Q: How to avoid the shortage of margin situation in the market slump in prices in February?

A: During a crash of stock prices or a price explosion, margin requirements may move...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, and Day Trading, and Editor for 20+ years with Traders Notebook, daily advisory newsletter.

Trading Article: Trading Enhancements - Meditation

As a professional trader, I try to enhance my trading on a daily basis. Learning how to trade is an ongoing process - a process that never stops. Those who know me or who have traded with me know that I am always looking for a simple and straightforward approach to trading. Yes, of course I am testing indicators, new chart patterns, new charting techniques, and anything else that is showing up on my desktop. But I have noticed that the main issue in trading is still...read more.

by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Video Online

The second Episode of my Q&A Series is uploaded to YouTube. I only managed to answer two questions this time, so I probably should be a bit briefer in the future...

Topics are disciplined trading and the lifetime of trading methods, and how to decide when to stop trading them. Enjoy...read more.

by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Ambush Trading System was created in 2009 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Even though Master Trader Joe Ross passed away September 7, 2021, his trading knowledge of over 60 years will carry a trading legacy and will live on. As you learn about Joe Ross and understand what he was trying to teach his students, you will find that within his writings, he had a very special gift. Most importantly, it was his students that kept him striving to provide comprehendable trading material to actually teach traders and become independent, to rely on anyone, but themselves.

Joe Ross has been trading and investing since his first trade at the age of 14, and is a well known Master Trader and Investor. He was able to survive all the up and downs of the markets because of his adaptable trading style, using a low-risk approach that produces consistent profits.

Joe Ross is the creator of the Ross hook™, and has set new standards for low-risk trading with his concepts of "The Law of Charts™" and the "Traders Trick Entry™." Joe was a private trader and investor for much of his life, but a serious health situation in the late 80's caused him to shift his focus, and that is when he decided to share his knowledge. After his recovery, he founded Trading Educators in 1988, to teach aspiring traders how to make profits using his trading approach.

Joe Ross has written twelve major books and countless articles and essays about trading. All his books have become classics, and have been translated into many different languages. His students from around the world number in the thousands. His file of letters containing thanks and appreciation from students on every continent is huge: As one student, a successful trader, wrote: "Your mastery of teaching is even greater than my mastery of trading".

Joe Ross holds a Bachelor of Science degree in Business Administration from the University of California at Los Angeles. He did his Masters work in Computer Sciences at the George Washington University extension in Norfolk, Virginia. He is listed in "Who's Who in America." After 5 decades of trading and investing, Joe Ross still tutors, teaches, writes, and trades regularly. Joe is an active and integral part of Trading Educators. He is the founder and contributor of the company's newsletter Chart Scan™.

Joe's philosophy for helping traders is:

"Teach our students the truth in trading - teach them how to trade."

"Give them a way to earn while they learn - realizing that it takes time to develop a successful trader."

Joe sets forth the mission of Trading Educators as follows:

To show aspiring futures traders the truth in trading by teaching them how to read a chart so that they can successfully trade what they see, and by revealing to them all of the insider knowledge they need in order to understand the markets.

To enable them to trade profitably by training them to properly manage their trades as well as their mindset and self-control.

To accomplish our mission for our students we educate them so that they know and understand:

Benefits for our Clients:

- Where prices are likely to move next.

- Independence from complicated trading methods, magic indicators, and black-box systems.

- Independence from opinion, anyone's opinion, including their own.

- Independence achieved through knowing how to read a chart.

- Independence through having knowledge of insider actions.

- Independence achieved by taking holistic and eclectic approaches.

- Independence coming from knowing how to manage both the trades and themselves.

- Independence because they understand and trade what they see.

- Independence because they have learned how and why prices move as they do, through studying the truth in trading and the truth about markets.

Students learn only proven methods and techniques, which helps them to preserve capital and create more consistent profits; they are offered simple methods that will assist them to earn while they learn.

- They learn to work smarter and more effectively.

- They learn to treat trading as a business; we offer no Holy Grail or magic systems.

- They learn to adapt to changing market conditions.

- They learn a systematic approach to trading rather than a mechanical system for trading.

- Why prices will move there.

- Who and what cause prices to move.

- How far prices are likely to move when they do move.

- Their own role in the movement of prices..

- How to take advantage of the knowledge they receive.

- How to properly manage and exit a trade which they have entered.

- How to manage themselves and acquire the discipline needed to become successful traders.

Read some personal testimonials which Joe has received.

WE APPRECIATE YOUR TRUST IN US AND THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please click on the "newsletter" button located at the top of our website.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2023 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

Dear Traders,

Master Trader Joe Ross passed away September 2021, and prior years he was continously sending me folders filled with Chart Scan and Trading Articles. The emails would be titled "More to follow" and I would reply, "Keep'em coming". I am calling these lessons "hidden vault" material because if Joe were still alive, this is exactly what would be shown in your inbox every Friday morning. This is not regurgitated material; this is new stuff written by Joe or as he would refer to it with such passion, "This is good stuff".

As we continue to receive newsletter sign ups, new students from every continent will start to learn trading Joe's way especially in this challenging market. This is where he would reinforce to his students, yes, that includes you, that learning to trade is possible even in this environment, "A chart, is a chart, is a chart". His writings will stand the test of time to provide teaching lessons and guidance.

The proceeds of Trading Educators will continue to support Joe's wife, Loretta, of 62 years of marriage, which she is our number one priority. We thank everyone with continued support and prayers for her well-being in late stages of dementia.

As expressed in the past editions, the trading world has lost a unique and passionate trader and his material will continue to be relevant. Let's start learning to trade Joe Ross' way with our future Chart Scan publications. I am here to help, so feel free to email me with any comments, questions or concerns.

This newsletter and future publications are created to keep Master Trader Joe Ross' lessons readily available to traders that want to learn and improve their skills. My father passed away on September 7, 2021 and will be greatly missed, but his writings will stand the test of time for generations to come. Take it to heart and learn from the best through Master Trader Joe Ross' trading examples and articles which have impacted thousands of traders on every continent for over 60 years.

Happy trading,

Martha Ross-Edmunds

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent