Edition 606 - January 22, 2016

The new year has ignited us to create new ways to reach out to our traders to meet your needs. We don't specialize in just one market, we are able to cover the majority of them because of our experienced traders who make up Trading Educators. In order to continue the highest standard of teaching, we have created a trader survey in which we would appreciate your participation. Thank you to those who have already submitted their valuable input. Click here to participate, it takes about five minutes, and receive a 30% off coupon and an entry into a drawing for one-hour mentoring.

Strategy

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading Educators suggests trading with at least two contracts, and preferably three. The reason for this, except when we are scalping all contracts at once, is to use one contract to cover costs and take a small profit, and then allow the others to ride to a reasonable profit level. We believe in never trying to "take" or force the market, only "accept" what it gives you.

This differs considerably from the mind-set of most traders who are driven by greed to seek to squeeze every last penny from each and every trade.

We use a three contract concept: One contract is cashed as soon as possible to cover costs, with at least a small profit. The stops for two contracts are then pulled up to breakeven as soon as is practical.

When the market yields a few more ticks, the second contract is cashed, thereby locking in a greater profit for the trading effort. The third contract stop is held back at breakeven for as long as possible, to allow the trade to earn the most profit.

As profits are earned, a stop is trailed according to any one of a number of acceptable methods. The stop is never allowed to do any worse than breakeven.

This management technique derives from a different attitude towards the markets than is commonly taught and practiced by the majority.

You probably have heard and read that a trader should learn to “love small losses.” Such an attitude is pure nonsense. My philosophy of trading is to learn to hate losses, and reluctantly settle for break-even. It yields a totally different result from learning to love losses. The trader who learns to love small losses expects to have them, and so he does.

Conversely, the trader who learns to love to win, and at worst to break even, begins to manage his trades, risk, and money in such a manner as to not lose.

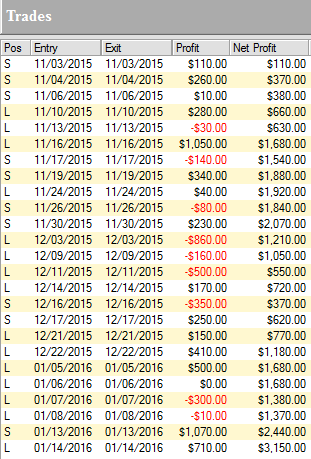

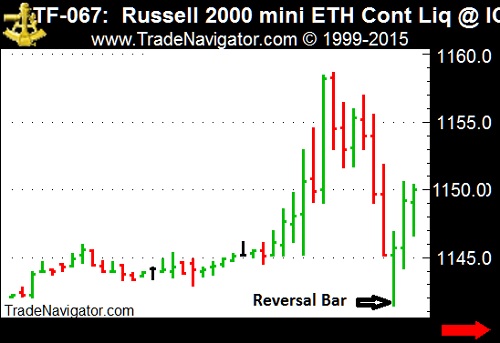

Let's now take a look at a day trade. Above you see the 30-minute chart of the e-mini Russell 2000. I went long at 1147.0 using a reversal bar technique that is taught during private tutoring. My risk was $300. I cashed first profits, 1 contract at +$100, and moved my stop to breakeven. Next profit was 1 contract at $200. The final contract was cashed for a $400 profit, making a total of $700 in profits. I realized enough profits to cover costs for all contracts, and to enjoy a satisfactory win.

This concept is described in my book "Day Trading."

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Getting Family Support

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

If there are people in your life who do not support your efforts to become a successful trader, avoid them. Avoid those who express negative energy on a regular basis, and vent their hostilities towards you. Wherever possible, terminate unhealthy emotional relationships that cannot be repaired, and if necessary, do it immediately.

Negative energy has a cumulative effect that eventually wears down your positive attitude and energy to be successful. Life is too short to be with those who do not believe in you or your abilities to achieve success. A loving partner takes an interest in your work, encourages your efforts, expresses compassion during difficult times, and always tries to help you grow.

Sometimes it helps to find a trading office where, instead of getting a bunch of flack from those around you, you can find support, encouragement, and perhaps learn a few tricks from successful traders. I did say a trading office, not a newsgroup or chat room. All you will find in those places is a lot of negative energy, gossip, rumors, and most people who are so confused they can’t see the forest for the trees. For the most part, people who frequent those places are no better off than you are, and in many instances are a lot worse off. You cannot believe much of anything you hear in chat rooms. Sorry about that, but it’s true.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

This week we're looking at the 30-Yr US Treasury Bonds in order to develop an idea of how to trade them.

.png?i=620)

The bonds have been trading in a wide range for a long time, as you can see on the weekly chart above. Right now we are almost reaching the August 2015 high, and after that we might even go for the high of March 2015. We like the idea of going counter-trend by selling far out-of-the-money March calls, with a strike around 169 or 170. The March 2016 options expire in less than a month on 02/19.

As an added value for our customers, Andy Jordan has provided a 3-minute video that delves deeper into understanding what is on the chart above.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Ambush Method Trade and Performance Report

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

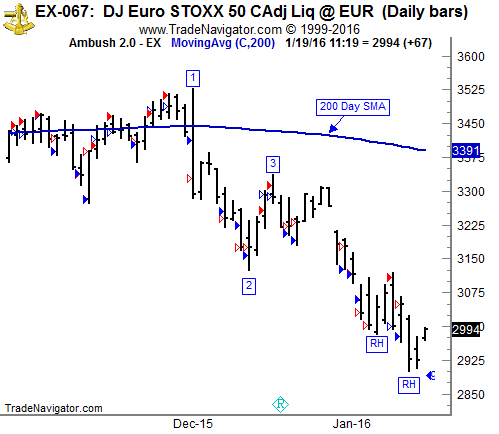

A lot has happened since November, the last time we looked at the EuroSTOXX 50 traded at Eurex. We are now looking at a completely different picture.

On the last update, we were close to reaching the point that is marked on the chart with [1]. Then there was a sideways market within a battered bull market, but since then the picture has cleared up significantly.

We’ve seen a strong price drop within a single day [1], which also marked a medium term high, and point 1 of a 1-2-3 high. From there, the price went straight down to create a significant point [2]. After a brief rally to point [3], the market continued to move lower, completing our 1-2-3 high pattern. Around the same time, the 200-day moving average started to decline, which is often a signal for a longer term trend change for which many traders are watching.

Since then, price is trading in a clear downtrend, giving us trading opportunities with Ross Hooks (RHs). On a larger picture though, we’re now trading around the lows of August/September 2015, which could give some support to the market.

As you can see, Ambush performed very well during all of these market phases by taking trades in both directions at extreme price levels.

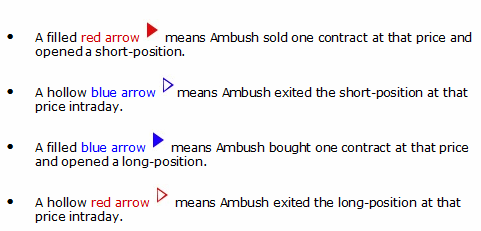

On the chart above are four different kinds of arrows:

Let's examine the results of those trades (including $10 for commissions and slippage round-turn) trading just one EuroSTOXX 50 Futures (FESX) contract:

As you can see, Ambush managed to make a total of $3,150 profit (including $10 for commissions and slippage round-turn) trading just one contract, without keeping any positions overnight!

Click on the link below and look at the menu on the right to see the long-term performance of the EuroSTOXX 50 Futures (FESX) and all other markets supported by Ambush:

View The Reports Now

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trader Survey

Complete it on or before February 5, 2016 to receive a 30% off coupon

and an entry into a drawing for one-hour mentoring.

To view previous published Chart Scan newsletters, please log in or click on "Join Us," shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.