Displaying items by tag: stocks

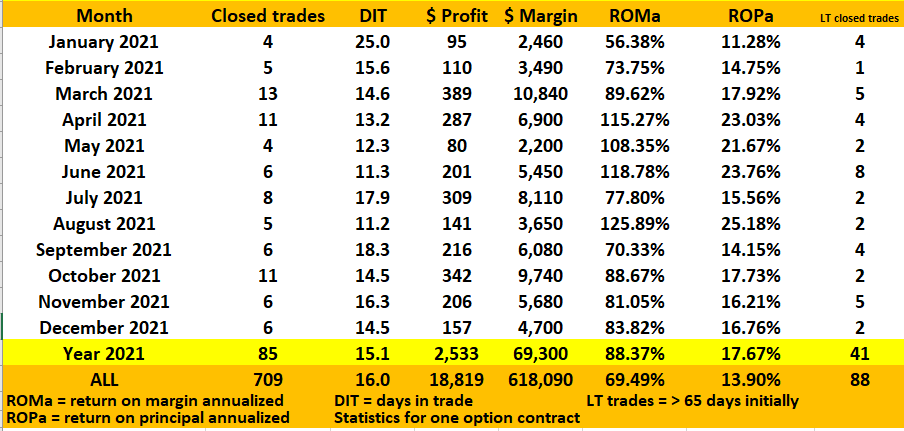

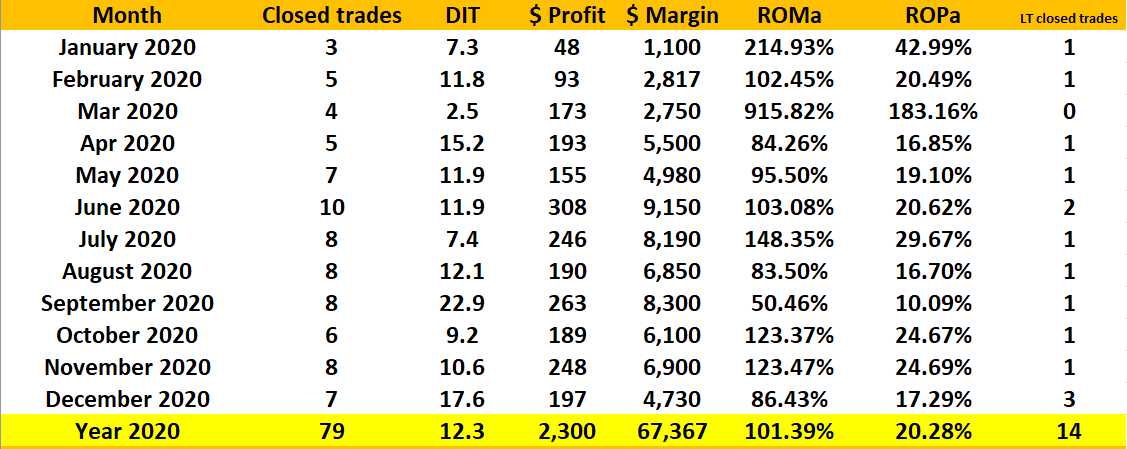

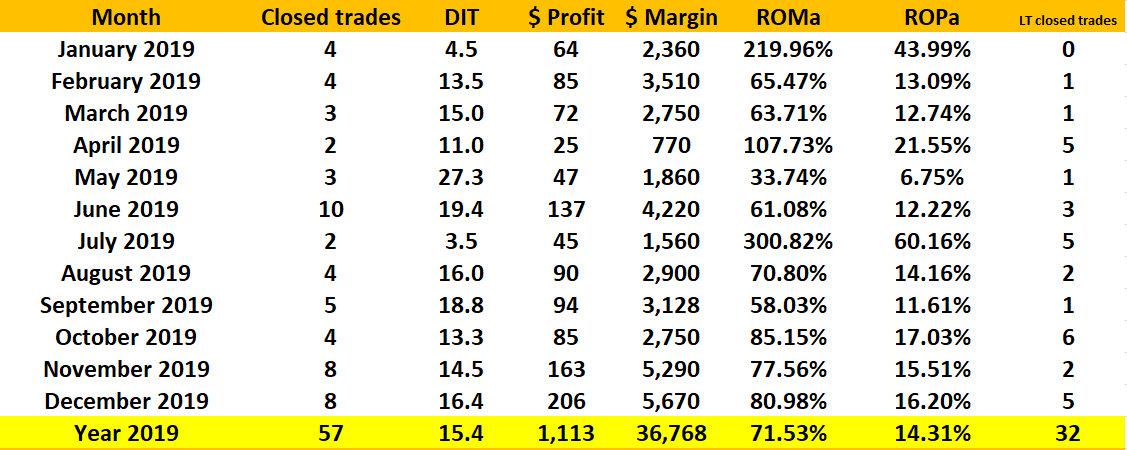

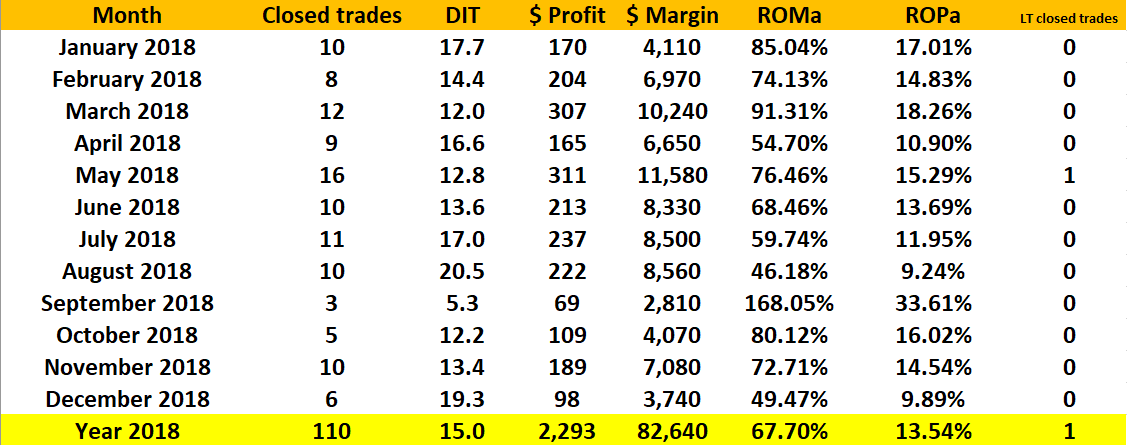

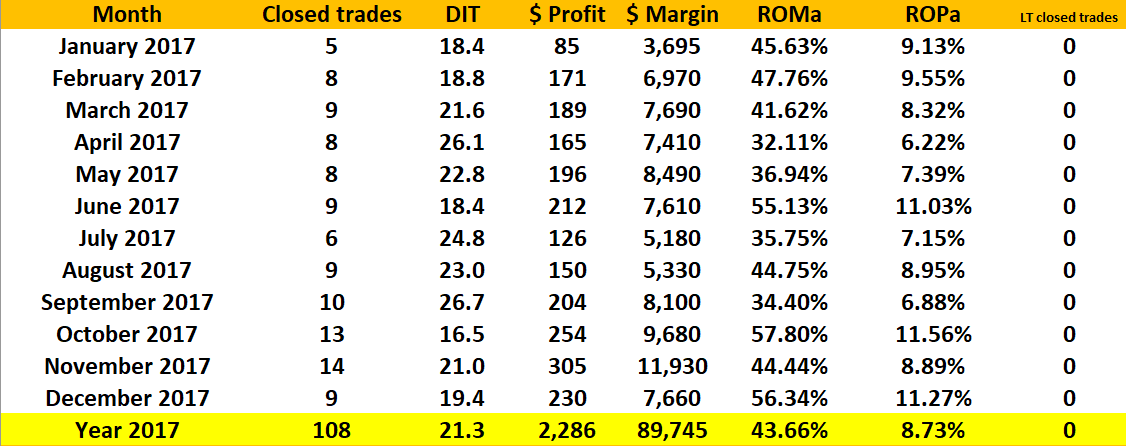

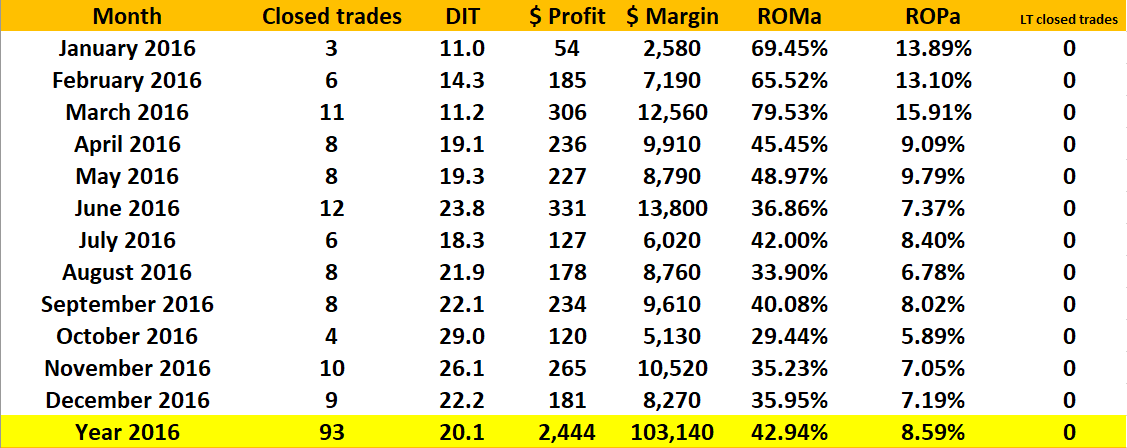

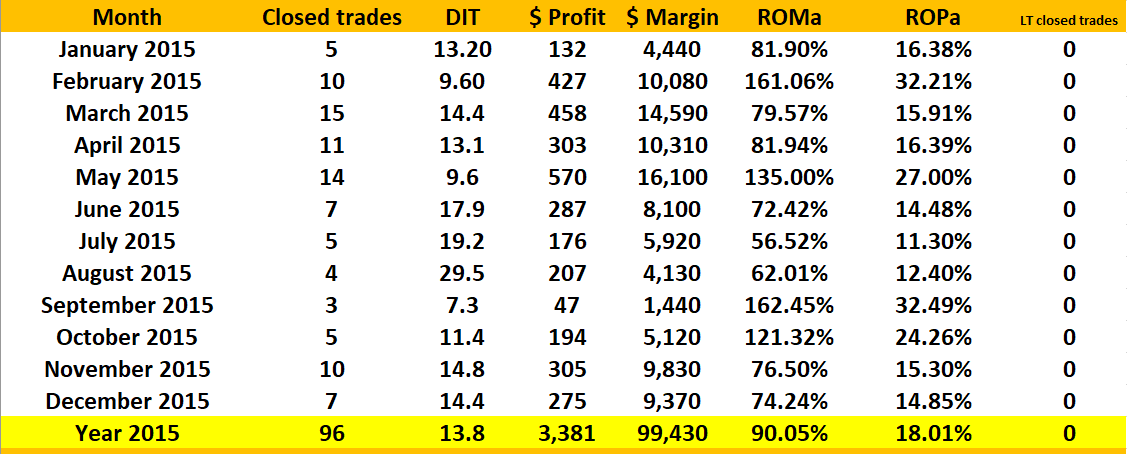

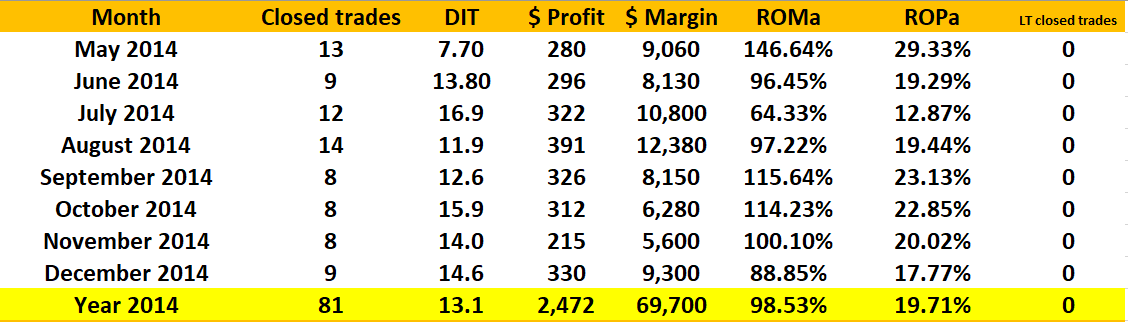

Option Performance Track Record Instant Income Guaranteed

Market: Stock Options

Check out our track record!

Those who know Joe Ross' Trading Educators and the success

we bring from Joe's products is highlighted which

shows our track record below:

Joe Ross shows you how trading

for instant income is indeed attainable!

Instant Income Guaranteed by Joe Ross

Start on the right path to Wealth Building!

Instant Income Guaranteed - A new way to look at trading

Hit and Run Trading

“Hit and run?” Sounds like maybe I did something wrong? But don’t think for one second that I’m admitting to some kind of wrongdoing, because everything I did was 100% within the law.

And on this web page I'm going to show how easily I picked up and got away with $67,500... from some of the most fearful, and often greediest, speculators and investors who participate in the stock market.

Now I know it sounds suspicious. But as you'll soon see, it’s not.

What I did has been legally possible for more than 39 years. And for ordinary people like you and me, it's the easiest way to pocket a few hundred, or even a few thousand dollars, without working very hard.

In fact, I've shown this to other people, and they have joined me in this extremely unusual activity.

Like research chemist S. Ruof, who grabbed $2,100 and told me, "This was my first time, and it was very easy!"

Or retired dentist Norma C., who says, "I had no problems learning it. I have made over $10,000."

One of the folks who joined us made over $50,000 since finding out about this. He said, "I have been using this for almost a year, and now I’m living on it."

These are everyday people like you and me, who have come from all walks of life. None of them have any specialized skills or training in this field. Yet each has learned how to do this simple action to supplement, or even replace, their monthly income.

In only 5 months, I picked up over $67,500 this way. Whenever I do this, it takes me only 2 to 3 minutes. I do it from my laptop, sitting comfortably in my home office. I have the use of the money right away. It’s mine to use any way I choose: to pay my bills - to take vacations - or buy a new car.

My name is Joe Ross. I’ve been trading in the markets for almost 6 decades. And I'm going to show you exactly how I pull off what I like to call "Hit and Run Trading."

My name is Joe Ross. I’ve been trading in the markets for almost 6 decades. And I'm going to show you exactly how I pull off what I like to call "Hit and Run Trading."

Now I understand that you may have moral reservations about doing this yourself. So let me put your mind at ease and show you exactly what it is - why it's been lawful for more than 35 years - and how you can use it to grab cash month after month in just a few minutes of your time. How you can use it to pay your bills... buy gifts, travel... supplement your income... or whatever you wish.

Then you can decide if it's something you could feel comfortable doing. And if so, you'll see how easily you, too, could pocket a bunch of money almost immediately after reading what I have to say...

Hit and Run Trading exploits people’s fear of losing money

The first thing you should know about this way to pocket money is that it's lawfully being done by huge investment banks and hedge funds every day.

Of course, the fact that they do it doesn't make it legal. But what they do was passed into law by Congress, signed by the President, and endorsed by the SEC and the U.S. Federal government - most likely at the urging of Wall Street's large hedge funds and investment banks, who make billions of dollars with it every year.

Now I'm not talking about any kind of regular investing, day trading, or anything like that. And when I say "pocketing money," I'm not describing any form of stealing or robbery.

As you probably know, Wall Street has many ways of making money which have nothing to do with buying or selling stocks. In fact, what I will show you if you join me is how to not buy stocks, unless for some reason you want to own them.

The actions of the big money traders make money for them in seconds, time and time again. In most cases with little risk, because they create situations in which they almost always make money.

Perhaps you've heard of some of them, like high-frequency trading or arbitrage, a tactic that lets Wall Street pros buy up investments at one exchange at a lower price, and immediately sell them at another exchange at a profit.

They can do this over and over again, with little chance of losing money. With high-frequency trading, they can do a thousand trades in a second or two.

Tactics like these are not available to people like us. But they generate piles of cash for the professionals who use them.

Maybe you've heard of the specialized investments Wall Street creates, which let the pros exploit existing market situations at huge profits, but with little or no risk.

These Wall Street insiders use strange-sounding names like “credit default swaps,” and “collateralized debt obligations” to snatch billions of dollars from the markets.

These tactics may be lawful, but in my opinion they are unethical.

Yes, there are many tactics used on Wall Street which, in reality, add up to legalized theft - unfair tactics that allow them get away with a fortune, but aren't available to individuals like you and me.

I don't agree with these tactics, no matter how lucrative they are, because I don't believe in making money by hurting or exploiting someone else financially. I have always made my money by performing a service or producing a product. It’s no different with Hit and Run Trading, I want to create new value.

Yes, there is one type of “clever” trading which is both ethical and within the law. I use that kind of trading all the time, and have no reservations in using it (and neither should you) because by using it I perform a service that others want.

A similar service is heavily used on Wall Street by their taking advantage of their mountains of cash. But in the case of what I do, it isn't complicated and doesn't require large sums of money. It’s a form of price insurance - and it's available to regular folks like you and me.

I've adapted the service for my own use, making it possible to use with almost anyone’s limited resources.

In fact, what I do often lets me jump ahead of the big Wall Street firms and get away with a cut of their profits before they even know what happened. And that's why I call it Hit and Run Trading.

It's easy to do, and you don't need any specialized training or skill to do it.

But it wasn't always like this...

Computer technology gives us access to this Wall Street secret

Years ago, when this way of trading was made lawful, it wasn't available to ordinary investors. Only Wall Street professionals could take advantage of it.

But all that changed in the 1990's when the combination of the personal computer and the Internet made the markets accessible to all. That's when regular folks like you and me gained access to the markets through online discount brokers. And for the first time, we were able to directly get at the same pools of money as the pros. And for the first time also, we could use Hit and Run Trading to pull in money just as the pros do.

"I was able to pay off my car almost 2 years early!" says Lori B. in Austin, TX, after grabbing $13,250.

“I’m taking my family on a long hoped-for vacation, says Michael Ems of Cape Town, South Africa.

These folks are grabbing the easiest and safest income possible.

As John Vacani, an investment analyst said; "It's really doing a service for those who need to protect the value of their investments. It’s truly a win-win situation for those who provide the service and those who need it."

And once you try it for yourself, you'll see exactly why. Because with Hit and Run Trading, you can pocket money every day the markets are open, while at the same time providing a real service to those who need it.

So how do you do it?

It works through your online brokerage account by accessing money lying around in the financial markets.

Now I realize you may not think the markets have money lying around for you to simply grab.

But that is how Wall Street does it. Let me show you...

Providing insurance against fear

Many stock market investors, as well as many stock market advisers, live in fear of falling stock prices. Investors, especially, fear losing money on their stock investments through a stock market crash or falling prices in what they call “a bear market.”

Stock market psychology erroneously equates rising prices with being “good” and falling prices with being “bad.” Therefore the markets are heavily biased towards rising prices. But nothing, not even stock prices, goes up forever, so stock prices are said to “climb a wall of worry.”

Most investors can withstand the normal ups and downs of the stock market, but they are terrified of suddenly falling (crash) or steadily falling (bear market) stock prices. To protect against falling prices, investors are advised to purchase a form of price insurance. That insurance protects them against falling prices.

Said another way, an investor can purchase insurance against falling stock prices by purchasing an insurance contract that will grow in value at the same time the value of shares of stock is lost due to falling prices.

Insurance is no doubt one of, if not the best, business in the world. Insurers receive money up front for perceived risks that may never take place. That upfront money is what they call “the float,” and they use it to invest for profits. But unlike other businesses that have to pay interest on money they borrow, insurers get their investment capital for free via the premiums people pay for insurance. What a racket, huh?

When you purchase accident insurance, you immediately cough up the money to protect against an accident, but hope you never have one. The insurer has the exact same hope. Your protection is from month to month, quarter to quarter, semi-annually, or year to year, depending on how you pay for it.

When you buy health insurance, you come up with the money, “the premium”, to pay for an insurance you hope you will never have to use. Again, you pay for it each month, each quarter, semi-annually, or perhaps on a yearly basis.

If a person buys a one-year term life insurance policy, the insurance expires at the end of one year, and has to be renewed for another year, usually at a higher price. If not renewed at the end of one year, the insurance policy expires worthless. Strange! The only way to collect on that kind of insurance is to die. Still, it serves an economic purpose for those who survive the person insured.

Buyers of price insurance are insuring against something they hope they will never have to use. Sellers of price insurance share the same hope. Price insurance against falling prices is sold for one week, one month, one quarter, several months, or even one year and beyond. The longer the insurance period covered, the higher the price for protection, since the insurer will be at risk for a long period of time.

The buyer of price insurance wants the insurer to take the risk of falling stock prices by agreeing to buy the insured’s stock when prices have fallen to the point of loss. For that insurance, the buyer pays a premium.

The seller of price insurance receives immediate income in the form of the premium paid by the insured. The seller agrees to buy devalued shares of stock from the buyer of the price insurance, and statistics show that at the end of the insurance period 8 out of 10 insurance contracts have no value whatsoever. They expire worthless, without the insured’s collecting anything. Price insurance is the cost paid for protection against a fall in the price of the underlying shares of stock.

The seller of price insurance pockets the contract premium and gets to keep it on average 80% of the time, but what about the other 20% of the time? Does the insurer, the person selling the insurance, have to pay up? Does the seller of price insurance actually have to pay up, and purchase the devalued shares of stock as set out in the insurance contract? Not with Hit and Run Trading.

With Hit and Run Trading, you will find out how to pocket guaranteed option premium, i.e., guaranteed income, without ever having to buy a single share of stock. A Hit and Run trader never has to fear falling stock prices, because a Hit and Run trader will never have to own shares of any stock. If you never own shares, you will never fear a falling stock market, and never lose money by owning shares.

Just click "submit" and access unlimited cash

The most money made by the professionals in the stock market is not made by buying and selling stocks. The real money, the big money, is made by dealing in derivatives. Price insurance is a derivative. And derivatives comprise the largest financial market in the world.

The word derivative means that the financial instrument, (in this case the price insurance contract) is derived from an intangible — the intangible in this case is fear of losing money on the price of shares of stock. Every derivative must have an underlying asset. In the case of price insurance, the underlying assets are the shares of stock.

Derivatives have many different names such as:

Forward rate agreements...

Money market instruments...

Stock options...

Swap options...

Interest rate caps...

Property index notes...

Futures...

and many additional names, most of which we’ve never even heard.

Their names might sound confusing, but basically these are all just various types of bets. Insurance, too, is a bet.

Derivatives are bets on anything to do with money. Like bets on what interest rates will be next month - bets on fuel prices – or, as in the case of price insurance for stocks, bets on share prices. If you buy insurance of any kind, you are placing a bet.

If you buy life insurance, you bet the company that you might die tomorrow, and the insurance company says, “Yes! You will die, but not yet.” When you buy health insurance, you bet you will get sick, but the insurance company says, “We don’t think so.” With accident insurance, you bet you will have an accident, but the insurance company says, “We don’t think you will.”

Hit and Run Trading has nothing to do with your making any of these bets. With Hit and Run Trading, you take the insurance company’s side of the argument. You don’t make a bet, you take a bet, but it’s a bet you cannot lose if you are careful in underwriting the risk.

I got the Hit and Run Trading idea by finding out how Wall Street makes its money, which led me to the secret I want to share. I learned how to underwrite risk, so that I never have to buy the devalued shares of stock. Wall Street makes money by unfairly collecting the money being lost on bets. I learned to make money by performing a much-wanted service.

Let me show you what I mean...

Investors lose money betting that prices will fall

The money they lose is yours for the taking. Many of the bets placed in the stock market are highly speculative. For instance, I recently saw bets being made that Microsoft's stock price would drop. People who simply don’t understand Microsoft’s business, were buying price insurance to hedge against expected falling prices. Wow! Were they ever wrong! Within a week, Microsoft’s prices soared 2 ½% in a single day.

In other words, some people were using the stock market to bet that Microsoft's stock price would collapse in the next few weeks. To me, that's just ridiculous. But what's even crazier is that these people had put up $2,320 betting this would happen.

To show you how unlikely this bet is, just consider that Microsoft has been around for decades and is the world's number 1 software company. They make multiple billions a year from their software business. Microsoft actually has 16 businesses that make over a billion dollars a year each. And their money from this has been going up every year without any signs of stopping. Even during the last financial crisis, Microsoft's stock didn't drop by as much as these people were betting on.

So short of an unprecedented global disaster, I don't see how its share price could possibly drop an anticipated 60% in a few weeks.

But for whatever reason, there were some people out there who've placed bets on this happening.

Who are these people?

They are speculators, and fear-driven investors. In fact, they may be some of the insiders... or Wall Street's wealthy clients. Often they are people with perhaps more money than common sense.

To them, the stock market is just a huge casino where they can place bets in the off chance of hitting a large jackpot. These people just love taking risks, and would feel equally at home in a casino. Losing on speculative bets like this is normal in their pursuit of that one lucky bet that may pay off. It comes with the territory, similar to losing your bet on a spin of the roulette wheel.

Lots of people gamble in the stock market. They do it for the adrenaline rush, and the euphoria that comes with it. Others, who are fearful investors, are often just plain ignorant of the realities of the markets.

And that's why they're placing bets on things like Microsoft's stock dropping so far in such a short time. It's trying to attain the thrill of getting rich quick, or to protect against unlikely losses.

Of course, Microsoft's stock price will go up and down over the next few weeks as it always does. But it's virtually impossible for it to drop as much as those speculators were betting on. Too bad for them, because they'll lose the $2,320 per contract they've put on this wager. And in most cases, some Wall Street firm will pick up this money like a casino collecting bets from its gambling table.

And this is where the Hit and Run Trading comes in. Because with Hit and Run Trading, you can grab this money before Wall Street does.

"I couldn't believe how easy it was. Last year I made $78,000," says Denise H. in Albany, NY.

And Bahamas retiree, Don W., is collecting $1,300 EACH WEEK.

Let me show you how you could do it...

How to "steal" from Wall Street's income

What Hit and Run Trading enables you to do is spot these ridiculous bets, and collect the money being lost by those impulsive speculators and fearful investors.

As I mentioned, I don't believe in taking money from people without their consent. And I certainly don't believe in hurting someone else financially while my own wealth is growing.

When you use this tactic, you are simply collecting the money lost by impulsive (and often wealthy) gamblers who make wildly speculative bets in the derivatives market. They are willing to pay for price insurance, which will result in limiting their losses. They are placing a bet, and I’m willing to take that bet knowing I will win.

That's what the Hit and Run Trading allows you to do. It helps you to run ahead of Wall Street and pick up the money being lost before they do, while at the same time performing a needed service.

That's why I call it a "hit and run". Because when you do this, you're "snatching" some of Wall Street's profit.

And as I said, I'm completely comfortable with a legal strategy that earns me money while I perform a service others are willing to pay for.

To give you an idea of how easily you can pick up this kind of money, just look at the vast number of bets and the money in the market right now...

Millions of bets losing money means millions of dollars for the taking

Today, as I write this, TransCanada Pipeline Company is selling for $45.52. In the last 4 days the price has risen $0.85, and rose more than $2 in the past 3 weeks. Yet there are 1,402 crazies and fear-driven holders of TransCanada who are willing to bet that prices will fall back 87% in the next 6 weeks.

Johnson & Johnson, a global dominating blue chip company, just hit $98.23 per share, up from $85.47 per share in less than 2 months. There are 2,824 owners of Johnson & Johnson who are willing to pay someone to take their shares off their hands if prices fall back to $85 in the next 19 days!

Earlier I showed you some of the ridiculous bets people have placed on Microsoft’s stock. Now, I’ve shown you two more insane bets. But the truth is, it's like that with nearly every large stock on the New York, AMEX, and NASDAQ stock exchanges - on everything from stock symbols AAPL to ZZZ.

Your online brokerage account holds the key to collecting money in less than 5 minutes

Doing these "hit and run trades" is very easy. In fact, it involves steps that are not unlike placing a regular order to buy or sell shares of stock, except that in this case you don't use the stock order section of your account.

Instead, you access another account feature of which most people simply aren't aware. It gives you direct access to the money you'll be extracting with the Hit and Run Trading.

If you deal with any of the large online brokerages like Fidelity... E*Trade... Charles Schwab... TD Ameritrade... or Scottrade, you most likely have this feature in your account. Personally, I use Interactive Brokers to do the job.

The key to access the money is easier to find on some brokerage websites than others. And some accounts have the feature locked out or disabled by default. But don't worry. With a few clicks or a phone call, you can usually unlock this feature in your existing brokerage account. I'll show you exactly how.

Once you've enabled this account feature, you simply enter a specific code into the account. I'll show you how to generate the code. This code is used to place the "transfer request" that extracts a given amount of money out of the market.

And then, you just click "submit" to watch the money get transferred into your account.

How much you collect varies each time. But most people I've shown this to can withdraw a few hundred to a few thousand dollars at a time.

So where do you get these "transfer request" codes?

That's easy - I'll teach you how they are constructed. Putting them together is child’s play. I’ll also give you simple step-by-step instructions on how to use them. All you have to do is follow the directions I give you in my online seminar, workshop, and two months of daily guidance.

Start profiting by joining my next group of insurers...

During the period of daily guidance I’ll give you details on how much you can expect to grab, and how to go about collecting the money.

If you're interested, I'll add you to the list for my next course immediately.

You see, I've been a trader for almost six decades, and an educator for more than half that time. I love to show people how they can make money. In the early 1990s I formed Trading Educators. Trading Educators has grown to have representation in numerous countries around the world. We have students on every continent.

I’ll show you how to find the bets most likely to lose, so you can then collect them.

And once you've taken my online seminar and workshop, I'll not leave your side for two full months — and beyond that if you wish. I'll guide you every day with all the information you could possibly need.

I am so confident that you will not lose money selling price insurance that I guarantee to give back your seminar and guidance fee if you incur even one loss during the two-month guidance period. What I will show you is not for novices who are happy with mediocre gains...

Collecting a steady income this way is not for everyone. And I find that the people who benefit most from my program usually meet two specific qualifications:

First, I recommend you have at least $2,000 in investing capital set aside. $2,000 will severely limit what you can do, but it will enable you to learn the technique and rather quickly build your capital so that you can snatch more and more money away from Wall Street, and help those who need your service.

Of course, whether or not you choose to follow my advice, and how much money you commit to any single bet, is entirely up to you. But it's a good idea to have at least this much capital at your disposal so you get the maximum benefit of the techniques I'll be showing you.

And second, you must be open to embracing a new way of seeing things. I will be showing you a highly profitable way to make money.

In my experience as a trader and educator, I’ve seen that most people are afraid to try anything that looks in any way "unusual." Especially when it comes to the financial markets.

If that sounds like you, I regret wasting your time.

I have no interest in showing you a conventional way of making money. If all you want to do is buy stocks and collect a few dividends, there’s no point in continuing because my technique relies completely on money to be made from the highly lucrative derivatives market.

In other words, you'll be using tactics that might be entirely new to you, unlike anything you imagined would be legal or even possible. Let’s be honest. Have you really ever heard of price insurance? Where would you go to buy such a service?

As a result, you must be willing to use the investments found in the derivatives market, including stock options. They are the best way to collect the money being lost in this market.

That's why with Hit and Run Trading, we'll be using stock options to collect other people's wild bets. Those stock options are the financial vehicle the government provided to the market insiders over 35 years ago.

To reiterate, we're NOT making any bets ourselves. We're only going after the money being lost on those crazy gambles and fear-driven hedges.

So, if you're comfortable with mutual fund gains or a typical buy-and-hold approach, Hit and Run Trading most likely isn't suited for you.

On the other hand, if you're still interested and ready to collect a safe, consistent guaranteed income, then I think you'll love Hit and Run Trading.

And don't worry, you don't need any special skill or prior experience. Just a willingness to try something you may have never done before.

If you're excited by the idea of making an extra $1,000 or more each and every month, I think you're going to love this!

California insurer, Jose M., says, "I am averaging about $4,000 per month."

And listen to this one: Lukas Z. was so excited with his results, he sent me an email saying, “I'm buying a new BMW since everything else is paid off.”

So how much does it cost to join me on my Wall Street "raids?" How much is it worth to know you have guaranteed income for life, with a money-back guarantee that you will not lose any money if you do as I say?

Would $100,000 be too high? What about $50,000? Would you give a year’s pay to know you are set for life?

Well, I don’t charge anywhere near that kind of money. I will reserve a seat for you at my online seminar. Before the seminar you will receive a PDF copy of the seminar content so that you can look it over and prepare yourself for what I will show you.

I will also reserve a seat for you at the online workshop. You will receive a PDF copy of the workshop material as well. Two-days later, you will be ready to start hauling in the money. From that point on, I will hold your hand and guide you for 2 months, during which time I guarantee you will have had no losses. Two months of guidance is more than enough for most to completely master my strategy and technique. The price for all that is $2,900, no ups, no extras, no discounts. It’s more than a fair price for knowledge that can make you financially independent.

Here's how you can start collecting income now:

How to get started...The money from your 1st "insurance premium" could cover your cost

The fact is, you could easily collect 2 to 3 times that amount in the next few days if you have sufficient starting capital.

The bottom-line is that I believe that what I show you will change your life for the better as soon as you start using it. And it could easily help you make a retirement fortune, as it is already doing for so many other people who are selling price insurance.

IMPORTANT: If you intend to sell price insurance from an IRA or other controlled pension plan, you may need to obtain permission from the broker to do so.

You can sign up right here. This will take you to a secure order page, where you'll be able to review everything before submitting your order.

Wishing you all the best,

Joe Ross

DISCLAIMER: Trading Educators, Inc. is a publisher of Educational material, and NOT a securities broker/dealer or an investment advisor. You are responsible for your own investment decisions. All information contained in our publications or on our web site(s) should be independently verified with the companies mentioned, and readers should always conduct their own research and due diligence and consider obtaining professional advice before making any investment decision. As a condition to accessing Trading Educator’s materials and websites, you agree to our Terms and Conditions of Use, including without limitation all disclaimers of warranties and limitations on liability contained therein. Owners, employees, and writers may hold positions in the securities that are discussed in our newsletters or on our website.

These have to be changed -àDisclaimer | Privacy Policy

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Please read below for access information

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Option Strategies with Instant Income Guaranteed

Earn While You Learn to Trade!

Can you imagine discovering a way to trade that promises instant income? If you think such a method is impossible, think again. Instant Income Guaranteed trading education it is definitely achievable, and everything you need to know is available online for one low price in a special three-part online recorded webinars.

Instant Income Guaranteed provides stock trading courses for beginners and experienced traders alike. Developer and Master Trader Joe Ross along with Expert Instant Income Trader Philippe Gautier have spent the last several years perfecting a way to earn instant guaranteed income.

- Special Three-Part Webinars

-

Detailed Q&A

- Wealth building over time (requires patience)

- Opportunity to create current income

- Utilize other peoples money to finance your growth

- The highest level of safety we have ever seen

- Three-part webinar - In Part I, Joe Ross outlines the strategy. Beginning and experienced traders will discover new information! In Part II, Joe Ross walks you through various trades and scenarios. In Part III, Philippe Gautier explains updates and improvements to the strategy. In just a few hours, you will be prepared for actual trading, which can begin as soon as you feel ready. As an added bonus, these webinars are available to access anytime you want to view again.

- How to select the right stocks for the strategy.

- How to manage the trade.

- How to compute returns on both margin and principal, and how to annualize your returns.

- Trades offered for your consideration will range from around $20 to around $100, sometimes a bit more per share. Trades available at each price vary; however, it is possible to create one or more positions daily, provided you have sufficient funds.

- Most brokers require a margin of 20% of the cost needed to buy shares per option sold. It can vary. For example, one known broker requires margin of only 15% on accounts over $100,000.

- The length of trades varies. Trades average 17 days, but some trades may last longer during the two months of guidance, you will see why certain strategies are used, and you will realize that, if handled properly, you will be trading profitably.

- You should be able to follow the strategy using any stockbroker. If you need a broker referral, Trading Educators can recommend one.

- You can always “paper trade” what does not fit you account size: we recommend not to take positions exceeding 50% of your available cash in terms of underlying value. For instance, if you sell 1 XYZ 10P, with an underlying value of 10*100 = 1000$, do not sell more than 5 puts (or 50% of 10 000$ = 5000$) initially.

- You can probably take all debit spreads trades we give from time to time

- There are ways to limit margin requirements for the trades you take by buying cheap protection (i.e. buying a further out of the money put that will limit your margin requirements/total risk in the trade)

- You may be required to put up full margin on some of the strategies. However, don't worry about that, because even with putting up full margin, the strategies make much more money than you can get from your bank, a money-market mutual fund, or from government bonds and notes.

- You may have to receive permission from your broker to make the transactions from an IRA account. Some have told us they are able to trade the strategie from their IRA account.

Option trades vary.

Learn strategies to manage them.

What if I only have $10,000 to trade?

YES, you can do it, but you will be limited in the number of positions you will be able to take initially, the time for you account to grow. However:

IMPORTANT! If you intend to participate in the program using an IRA or any controlled pension plan, there are two things you need to know:

- You may be required to put up full margin on some of the strategies. However, don't worry about that, because even with putting up full margin, the strategies make much more money than you can get from your bank, a money-market mutual fund, or from government bonds and notes.

- You may have to receive permission from your broker to make the transactions from an IRA account. Some have told us they are able to trade the strategies from their IRA account.

Joe Ross and Philippe Gautier bring you proven trading expertise!

"About a year ago, I traveled down to Uruguay and spent a week with Joe doing his Instant Income Guaranteed seminar. Since that time, I was able to quit my regular job and now I trade full time. I couldn't have asked for a more amazing experience and I am thankful for the kind of lifestyle I can have without a 9 to 5." ~ Paula T., U.S.A.

"Hi Joe, Instant Income Guaranteed training has been, by far, the best investment in trading I have made (and believe me there has been some earlier investments...). I can strongly recommend this training to people who are not looking for unnecessary excitement but rather want to make money steadily by trading the way Joe teaches. My warmest thanks to you, Joe!" ~ Juha Y., Finland

"The strategy was nicely explained and demonstrated on daily guidance podcast every working day. Joe explained some other important issues (psychology, when and why to take profit, how to deal with the deal when you under fire - roll out and down). During the 2 months daily guidance I had no loss. I find it very useful." ~ Petr Oliva, CZ

"It's been around a year since I enrolled in the Instant Income Guaranteed program. Probably the best trading decision I have ever made. It is amazing the annualized return you can produce if you keep flipping your money. I have taken shares on a couple of stocks because I chose to do so, I don't consider that a loss." ~ Thanks, Randy C.

$1,500.00 - Instant Income Guaranteed

Trading with MORE Special Set-ups - Recorded Webinar

Learn interesting and profitable ways that go above and beyond when two simple, every-day indicators are combined in the right way.

We reveal a complete strategy for making money in the markets. You will be able to use it in any market and in any time frame that provides enough price movement for you to come out a winner.

These techniques have been used for many years with great success. While taking years to produce this webinar, five traders were involved in this process and their testimonials confirm that it worked for them, and it'll work for you.

We will show you how to adapt these techniques to your own personality and trading style that only benefits a very high percentage of winners.

Let us put you over the top, be at the best advantage point, and on your way to truly profiting as a trader.

It's easy to learn, and after a few tests is when you will prove to yourself that learning a way to win in the markets is possible.

Trading with MORE Special Set-ups

Recorded Webinar - $247.00

2 Hours 38 Minutes

Orders Filled Within 24-hours*

All Sales Final

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Money Master - Advanced Strategies Webinar™

You must read the Money Master eBook first, it's a prerequisite for fully understanding "Money Master Advanced Strategies™" Recorded Webinar.

Money Master strategies are profitable, consistent, and can safely manage your money.

Everyone should learn to use them.

You must read the Money Master eBook first, it's a prerequisite for fully understanding "Money Master Advanced Strategies™" recorded webinar.

This recorded webinar was inspired by actual customers who had read Joe Ross' eBook "Money Master" and their feedback expressed needing more about our advanced strategies - concepts that make the original strategies even more powerful. We demonstrate these strategies using real trades - trades that Joe Ross actually made, so you can see step-by-step exactly what we did, and how we did it.

Money Master Advanced Concepts shows you:

-

How to "fine tune" some of your trades for even greater profitability with only minimal additional effort.

-

How to protect yourself and your money.

-

How to learn concepts that will turn you into an extremely mature master of your money.

The Money Master strategies are exciting, safe, and profitable. They are so important that we believe the strategies should be taught in the schools, and that you should teach them to your children and grandchildren if you want them to be financially independent early in their lives. No matter what your age, it is not too late to learn how to make money wisely, safely, and consistently by using the Money Master strategies. You'll benefit from these strategies to strengthen your trading plan, and become more in control with your trading.

"The seminar was great, reinforced the methods taught in the ebook. Joe was great, down to earth, easy to understand methods. Not too complicated, great for beginners or advanced traders, and the Q&A at the end answered specific questions many of us had. Thanks Joe, for caring and sharing!" ~ G Michael T., USA

"It is a pity I didn't know these strategies 10 years ago before I lost a lot of money" ~ Aleksander D., Canada

"If you are really looking for a safe way to invest your money with minimal time and effort what joe teaches you is extremely practical and valuable. If you have been chasing all kinds of trading techniques relax this is one you can retire on." ~ Charles R., USA

"Pragmatism and experience. The strategies are explained with detaited examples which were trades. I learned a lot. Congrats Mr Ross." ~ L. G., France

$247.00

Money Master Advanced Strategies™ Recorded Webinar - $247.00

1 Hour and 48 Minutes

Orders Filled Within 24-hours*

All Sales Final

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Trading All Markets - Recorded Webinar

Become A Winning Trader - Regardless Of What You Trade

Stock Indices, Currency Futures, Forex, Commodities, and Stocks

Apply What You Learn In This Webinar and Your Trading Successes Have A Potential Rate of 70% - 80% Winning Trades

TRADING TECHNIQUES WORK

The truth is the truth, and it does not change. If it did, it would no longer be truth. The truth is that all markets are a reflection of human emotions, and that market movers take advantage of traders’ reactions to the price movement. It is really no more complicated than that. Our trading techniques and methods work, mainly for two reasons:

We don’t make predictions, but we do make trading decisions based on The Law of Charts™.

Price forecasts in the trading and investment world rarely work. Nevertheless, a majority of traders base their decisions on such forecasts. Our techniques are different. We don’t use forecasts or make predictions, but instead look at charts and read what is in front of our eyes.

Only take trades when we "read" a high probability for prices to move. Using The Law of Charts formations and other chart setups that we have developed during more than five decades of trading. The result is that shortly after entering a trade, the price moves to our first profit objective in 7 – 8 out of ten trades.

We use "Market Dynamics™" to our advantage; that is, understanding WHO move prices, and WHERE, WHY, HOW, and HOW FAR prices move when they do so.

Joe Ross' quotes "Trade what you see, not what you think", and "Get paid to trade" have become well known. Our students trade profitably because they have learned what to see by really understanding the reasons behind price movement. This recorded webinar goes into lessons on Market Dynamics that show how insiders are able to manipulate the market.

The combination of the unique concepts of The Law of Charts™ and of Market Dynamics™ will give you incredible confidence to act, which is even more important than the trading technique itself. These two concepts are changing the paradigms about relative terms such as "failures," "retracements," "support," or "resistance". They actually change your trading life forever.

Message from Joe Ross

"What you learn from this recorded webinar will enable you to not only day trade any market in any time frame, but also to position trade, swing trade, intermediate-term trade, or long-term trade any market, anytime, anywhere in the world, as long as you have a source of data and a way to place orders.

I know that you are bombarded every day with proofs of unmatched trading performance of many self-called trading gurus. Please don’t get trapped into believing everything advertised, regardless of how tempting it may sound. Even if part of those affirmations were true, you still need to have your own trading skills and a certain mindset in order to trade the markets profitably in the long run.

Trading is a business. In this webinar, I teach you how to make sound trading decisions, so that you run your trading life the way a successful businessman runs his own business. You will learn both outstanding trading techniques and how to develop the mindset of a successful trader. The right skills and the right mindset will reinforce each other, and will keep you growing in both areas of development into a successful trader. Their powerful combination will make you trade like a professional, with a rate of 70% - 80% winning trades."

OBJECTIVES

The webinar's objective is to direct you towards becoming a winning trader, regardless of what you trade, in any market, in any time frame, by teaching you:

- the Market Dynamics concept of how to take advantage of the insiders’ actions

- the 5 chart setups that can increase the rate of your winning trades to 70% - 80%

- the Law of Charts™ and how to recognize the best chart formations

- the steps of a complete trading plan, and the trade management rules

- the key technical and psychological components of a defensive trading style

- how to treat trading as a business that you manage properly and enjoy at the same time

CONTENT

We will teach you everything you need to know in order to succeed in trading, by sharing with you all of Joe's experience. He has been where you are now in your trading. He knows your pain. He understands your confusion. Joe Ross has traded actively for more than sixty years.

Important Webinar Modules

1. The Market Dynamics

In this module you discover how markets really work, and who is mainly responsible for moving prices. You will understand why supply and demand has actually such a little impact on price movement, especially in intraday trading. You will learn to discover where the orders are, and what that means to your trading. We will show you how to get an edge in the markets. You will be given examples of insider engineering and ways to recognize the moves by insiders.

It is an absolutely revelatory experience to see, proved on the chart, that the ones who manipulate the markets play their own game over and over again, trading session after trading session. Once you understand and are able to spot their actions, you are ready to reap the benefits and get your profits out of the markets.

By using Joe Ross’ techniques described in Market Dynamics, you will learn WHERE prices are most likely to move next. You will understand WHY prices move when they do so, and why supply and demand have almost nothing to do with these moves. You will find out WHO moves prices, and HOW FAR they are most likely to move them.

What you understand from this module is probably the single most important thing you will ever learn in trading. You will get the knowledge of your role in the market. You will understand why it is important to learn how to “swim along with the sharks” and get fed by doing so, instead of being eaten alive. We will demystify what they teach you at prestigious universities and finance schools about the market roles of “being efficient” and the concept of “price discovery”.

2. Five of the Joe Ross’ favorite setups

You will learn five chart setups that give you clear entry signals and make profits fast. Joe has developed these setups during his more than five decades of trading. By combining the knowledge of Market Dynamics and these powerful setups, you will be able to select some of the best setups that generate very high probability trades. Be prepared for a shock when you see the simplicity and effectiveness of these setups.

3. The Law of Charts™ and The Traders Trick Entry™

In this module, you will benefit from a review of the famous Law of Charts™ and the Traders Trick Entry™, presented in Joe's own unique way that will enable you to read a chart and recognize the best formations of The Law. This skill in itself will increase your chances of selecting very high probability trades.

We'll teach you how to take advantage of the Fibonacci, Gann, and Golden Ratio traders. You will be amused at how he does it, and you will see where the Fib traders make their biggest mistake. You will learn how to take advantage of momentum. In fact, you will learn that you shouldn’t trade unless you see the potential for momentum.

Let us show you insights about so-called breakouts and retracements, and other concepts such as support and resistance, oversold and overbought. You will understand why these terms are just a matter of convenience on how you see and interpret them. They work only until they don’t work anymore, so you will learn how to avoid getting trapped by relying on them in your trading.

4. The step by step complete trading plan

You will learn how to design your own complete trading plan, the same way a businessman makes his own market research and writes a detailed business plan ahead of actually starting a business. All the details are established in advance in the trade planning phase, so that even before you enter a trade you will know what to do in any situation in which you find yourself during the trade.

You will learn how to determine which market to be in, in which time frame to trade, and how many contracts to trade, in accordance with your risk tolerance and your account size. Joe will teach you where to place your stop loss, where to set your profit objectives, and even how to determine at what time of the day you should be trading.

The advantage of having a trading plan is that you will know exactly what to do at any time during the trade, which gives you confidence to act and execute the plan. Confidence to act effortlessly and the results coming from flawless execution of the plan will reinforce each other. You will be able to trade any market in any time frame once you learn the truths Joe teaches: trade stocks, futures, options, or forex.

5. Trade management and general management techniques

You will learn to determine the best trade management method for your personality and style of trading. Trading has to become your own, within your own level of comfort. We will show you how to get there. You will learn to take only the trades "that have your name on them," and feel that trading is an enjoyable endeavor.

Besides trade management, you will learn general management rules and procedures that you have probably never thought of applying to your trading. The personal management is the most important of all, but we'll also take you through the other management areas, such as money management, risk management, and business management.

6. A defensive trading style

Unless you are a financial force in the market, you must learn how to trade defensively. We teach you exactly how to do that. You learn why it is necessary to trade defensively if you want be profitable in today’s markets. You will learn your internal and external enemies, as well as the mistakes you can make and how to avoid them.

Trading is a business, one in which different market participants have different roles. We'll provide you with real examples of market manipulations. You will understand your role, learn with whom you swim in the markets, and what your chances of survival are. You get to understand that your only chance of winning is to trade defensively by using a trading plan and flexible rules.

THE RESULTS = YOUR BENEFITS

After the webinar you will greatly benefit from adapting your personal trading preferences and style to the realities of the markets you wish to trade. You will trade with knowledge of:

-

how to set realistic trading objectives based on market characteristics, regardless of news, opinions, "expert" analysis, market theories, or even your own strong human emotions like greed, hope, and fear p>

-

the insider knowledge of who move the prices, and where, why, how, and how long prices move when they do move, so that you can take advantage and trade profitably

-

how to identify markets, timeframes, and daytime periods when probabilities of trading profitably are favorable to trading; you will also know when the opposite is true, when you must stay away and not trade

-

how to establish a complete trading plan that includes planning, identifying powerful setups for entries, and trade management; you will also know how to apply combined techniques for risk management (stop loss placement) and exiting (profit objectives setting)

-

the most common traders’ mistakes and how to avoid them

This webinar will give you the realistic perspective of trading as a business. You will know what to do and what to expect so that you can have a long and successful trading career.

INVESTMENT

Many traders lose far more money in a few days than the price of this online webinar. When you trade using the techniques you will learn your losses will be considerably less, and your trading account will continue to grow as you apply what you learn.

$1,499.00

Trading All Markets

Recorded Webinar - $1,499.00

8 Hours and 25 Minutes (7 Part Series)

Orders Filled Within 24-hours*

All Sales Final

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

- stock indices

- currency futures

- forex

- commodities

- stocks

- winning trades

- trading techniques

- price movement

- high probability

- price moves

- profitability

- day trade

- position trade

- swing trade

- intermediate term trade

- long term trade

- futures

- ETFs

- stock

- the law of charts

- trading style

- entry signals

- trading plan

- trade management

The Law of Charts In-Depth - Recorded Webinar

Go Deeper into "The Law of Charts™"

Master Trader Joe Ross explains the way he stacks up profits with tips and tricks that make it easy for you to apply "The Law" to YOUR trading!

Through this recorded webinar The Law of Charts, we will show how YOU how to win consistently in any market and in any time frame. What it takes to create charts that exactly fit your trading style and level of comfort. The content of this intensive, in-depth recorded webinar takes the "The Law of Charts" to the next step. You will feel like you are attending a private seminar with Joe Ross himself. Many traders have expressed that this is the next best thing to Joe private tutoring when it comes to The Law of Charts. Learn from the BEST!

PURE SIMPLICITY

This recorded webinar on The Law of Charts brings you the pure simplicity of what the markets are all about. Trading does not have to be complicated. Everything you need to know in order to make money in the markets is right there in front of you when you look at a price chart. It's much easier than you've been led to believe.

Why is it so important to have a trading concept?

Because of a known fact that is pretty scary: The majority of traders lose money in the markets, or barely make it.

But what about those who are successful?

Imagine the following situation: 10 people are sitting around a table and everybody puts $100 in the middle. After a few minutes, one person stands up, takes most of the money, and leaves. 9 people remain sitting at the table fighting over what's left.

Which of these people do you want to be?

If you decide to be the one who takes it all away, we have good news for you:

- You don't have to wait for a miracle - trading skills can be learned, but you have to let Master Trader Joe Ross show you how it is done!

Find out why you already have an edge over everyone else, and learn more about an easy way to enhance the advantage.

Believe it or not, you already have an edge over the other people at the table who are still fighting for the leftovers. Why? Because you have decided to trade with a concept that can lead you through the markets and guide you along to consistent success in your trading!

You have no idea how many emails we receive every day in which traders ask for help because they have lost in the markets, and have to deal with yet another loss.

Our answer to each and every one of these emails is the same:

If you do not want to experience loss after loss, and if you really want to become a successful trader, then you definitely should start trading with a defined concept.

We have seen a lot of trading systems come and go. Often they are called "Killer" or "Monster" or even "Hyper" trading systems that say they will "make you rich in just three months." You know exactly what we are talking about.

Joe Ross’ original trading concept "The Law of Charts," which is the first eBook you can or already recieved when signing up for the Free Trading Materials that does not need any kind of hype. It has helped many to trade successfully and profitably for years. It doesn´t need any power words like "monster" or "killer" because it has proved its worth.

You may have read about this simple concept on our website, and you have seen it "in action" in our free weekly newsletter, so you know that The Law of Charts can be used in any market and in any time frame, and it doesn´t matter where you apply it to produce consistent profits.

HOW DOES THE TLOC WEBINAR DIFFER FROM THE LAW OF CHARTS EBOOK?

The free Law of Charts eBook presents details of the formations that make up The Law of Charts. That's it! The content of the free material goes no further than that.

The recorded webinar, presented by Master Trader Joe Ross himself, will give you a very brief presentation of the Law of Charts formations and a very detailed explanation of how to implement the Law of Charts for making profits. Joe Ross wants to teach you to understand and show how to take advantage of the markets. It also reveals one of the most essential factors in trading called "Market Dynamics".

The Law of Charts™ In-Depth

Recorded Webinar - $947.00

Market Dynamics answers the questions:

- Where are prices most likely to move next?

- Why do prices move to where they move?

- How far are prices likely to move when they do move?

PLUS: Let us show you some of the best ways to follow market momentum and thrust: the source of market momentum, the cause of market momentum, and how to take advantage of it, to put profits into your pocket. It takes you through some very interesting uses of indicators that will assist you in filtering Law of Charts formations. Typically, we're not users of indicators the way they were created to be used, but using indicators in unconventional ways to determine when to use Law of Charts formations, and to filter out the best of the best prior to entry.

In addition, we give you the rationale behind the Traders Trick Entry™. You will learn what causes Ross Hooks™, and how to trade them. You will see how and when to use the Law of Charts when prices are in consolidation.

There is more, much, much more in this webinar with slides showing you information that you haven't read even in our free Law of Charts material, nor in any of his other books.

We want you to fully experience the dynamic POWER of the The Law of Charts™

As mentioned, Trading Educators offers the concept at no cost when you subscribe to get our Free Trading Materials and, as you may have recognized, it is easy to understand; and once understood, it is also easy to apply in the markets. But sometimes it takes just a little bit "more" to completely experience the full power of The Law of Charts - the power that helps you trade with such incredible insight.

Every time you view a price chart, the truth you need for making money is staring you in the face. It is looking right back at you.

Our students have verified that once you understand the markets, all you’ll ever need to trade them profitably is an understanding of the Law of Charts along with the dynamics of the market.

We present some indicators, but they are used in an unorthodox manner. People think that the more complicated something is, the better it is, but the truth of the matter is just the opposite.

Look at the truth of the markets in virtually every scene. There is truth in every price bar you see, and in every group of price bars there is additional truth. It doesn’t matter whether you use traditional or candlestick price bars. You can see the truth with line or point and figure graphs. The truth is the truth, and you will find it on the charts. You will come to see the truth as we guide you with additional valuable comments and which are not found in an indicator, a mathematical formula, Fibonacci ratios, Elliott Waves, or Gann theory.

We don’t mean that people cannot make money using those things. What we do mean is that if you are able to throw off all the complications of theories, indicators, and mathematical ratios, you can come to see what is really there on the chart when you look at it. The truth is simple, and the charts follow a law which Joe named a long time ago "The Law of Charts."

Explore the depths of "The Law of Charts™" created by Master Trader Joe Ross

Learn how to apply the law to your trading so that you can start trading more deliberately and more successfully the next time you trade.

Master Trader Joe Ross will answer the important and essential questions of every trader:

- Where will prices move next?

- Why will they go there?

- How far will they go?

Learn how to identify a trend before everyone else sees it, and how to enter the market ahead of most other traders.

You will see exactly how a master trader conquers the market.

This recorded webinar is his most requested recorded webinar, The Law of Charts will completely change the way you look at the markets. You will never see the charts as you did before - you will be able to read them like an open book. Many former seminar attendees / viewers told us that what they learned in the first hour was worth the price of the entire webinar. Master Trader Joe Ross created Trading Educators to teach those who want to learn trading, even though he has passed on, his writings will stand the test of time. Let Joe teach you how to trade.

The Law of Charts™ In-Depth

Recorded Webinar - $947.00

5 Hours and 30 Minutes (5 Part Series)

Orders Filled Within 24-Hours*

All Sales Final

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Trading Options and Futures

Trading "Optures and Futions" to Combine the Best of Both Worlds

A complete course on trading with combinations of Options and Futures.

"With this course, Joe Ross boosts our awareness. There is a world of possibilities out there that many of us knew very little about prior to this book, which is a true masterpiece of trading intelligence. To be aware of other instruments and to know how and when to use and to combine them is essential knowledge every trader should make a sincere effort to acquire." ~ Manfred Wurr, Germany

In this book, Master Trader Joe Ross reveals the options "secret" and unmasks the mystery players in the options industry. It may, and should, change your entire career and outlook as a trader. If you have been a purchaser of options, it should change your entire mindset about buying options.

Over time, successful traders change strategies as the nature of the markets change. By learning about options and how you can use them, you will be finding it easier to trade and win. Options will simply become another tool to place in an ever-growing repertoire of implements you need to survive in today‘s markets.

This book is a complete course on how to put money in your pocket through trading with combinations of futures and options. The ideas and concepts revealed in the book work equally well with stock options. People think they risk less when trading stocks, as they rarely see a stock going down to zero, but actually they risk a lot without having hedged their position. When trading the right options or combination of options, you greatly reduce that risk. More than that, you have your risk defined before you enter the trade.

Highlights and Benefits

Combining Options and Futures, or Options and Stocks

Combining the best of both worlds is what makes you a winner, that's how we came up with Optures and Futions. Joe Ross teaches you the strategies for trading virtually any situation you can encounter in the market. You will learn how to trade with much less capital, and thus dramatically increase the return on the capital you actually use. You will make your trading life a lot easier by trading with a lot less risk.

You will learn how to increase your probability of success, and you will actually know your risk before getting into the trade. You can forget about getting into a stock or a futures position with a 50% probability of success. You will learn how you can make money even if you are initially wrong about the direction of the market. Joe teaches you what to do with the trades that go your way, and how to defend the ones that do not.

The Options Mystique and the Secret that Makes Them Easy

Why mystique? Options books as a rule tend to be long on theory and short on practical application. They also tend to be either too elementary, including 50 pages of definitions, or too complicated, written for a PhD mathematician. Joe teaches you how to use options as a tool, not as a separate entity having its own jargon. You will be not an options trader, an equities trader, or a futures trader, but a complete trader who uses all markets in balance - and wins.

What secret? You are discouraged in many ways from becoming an options seller. Option selling is often presented as a complicated, mysterious, highly mathematical process reserved for only those with huge amounts of money who are able to take enormously dangerous risk.

Joe reveals to you not only the entire options secret, but also the identity of the mystery participants in the markets who at times manipulate the markets. It is their influence that causes the markets to become as frenzied and chaotic as they do. The mystery players also hold the options secret. They do their best to prevent you from ever learning what it is all about. Joe tells you all that they keep secret; the real story behind successful options trading, and why they want to lure you into subscribing to various magical advisory services.

Learning About the Markets and How to Use Options to Assist You in Trading

Most traders have no desire to be pure options traders, and the mathematics of options is mostly unnecessary information. Joe teaches you how you can benefit from options using the trading experience you have already attained. You will learn how to read a chart of the underlying futures or stock, and thus you will have a distinct advantage over options traders, the majority of whom are ignorant of how to read a simple bar chart.

Joe goes into detail, and shows you four simple patterns that are all you need to recognize in order to profitably trade options. As you progress through this course, you will learn other easily recognizable market phenomena, any one of which can make you a fortune by applying the correct options strategy at the correct time.

Getting Paid to Trade in the Business of Trading Options

Joe shows why the trading of options in combination with the underlying instrument is such a fantastic way to trade. You will understand why traders of strictly futures or stocks for so many years suddenly want to trade options. The reasons are many and varied, but one of the most important is that markets have changed so drastically that trading purely futures or stocks has often gone beyond the risk tolerance of most traders.

It may shock you when Joe tells you how options enable you to use OPM (other people's money) in your trading. Can you imagine going into a bank or lending institution and telling them that you want to borrow money for purposes of trading in the markets? Yet with options, you don‘t even have to fill out a form in order to get tons of OPM with which to trade. The options markets allow you to be paid for trading, and to get your money up front. It's yours to keep forever.

Using Patterns for Success, and Taking What Market Gives You

One of the most difficult situations traders ever have to deal with is in trading inside a Trading Range. Joe teaches you two strategies to trade inside trading ranges that result in your survival in the marketplace while others lose fortunes. You will also learn strategies using a combination of the underlying instrument and options for trading the breakout of a trading range and strategies for trend following with 1-2-3s, Ledges, and Ross Hooks.

Nobody knows what a market will do next. Joe teaches you strategies to enter a market that is not trending and on which you have no opinion, or you are slightly bullish or bearish about. Then he shows you powerful strategies you can apply when a market is trending and you have no problem having an opinion.

"The best of the best" comes when Joe shows you four of his favorite strategies for trading Optures and Futions. These have all stood the test of time. If a trader did nothing more than wait for the right market conditions to apply these, patience would have its high reward.

Trading Optures and Futions reveals the innermost secrets of options traders

If you want the best chance of success as a trader in the futures markets, or even the stock markets, YOU MUST LEARN TO TRADE OPTIONS.

"Dear Joe, I have read many books on trading, then I purchased your book about Spreads Trading then the Day Trading and Trading Is A Business. I was so impressed with each one. The best part of the book "Trading Optures and Futions" is the whole concept of the book about using options and futures as hedges, and the truth about being a writer of options." ~ Andy Edmans

$195.00

Trading Optures and Futions Hardback Book

Dimensions: H 11 1/4" x W 8 5/8"

502 pages

30-Day Money Back Guarantee*

Hardcover Only

*If you aren't thrilled with Trading Optures and Futions, just send it back within 30 days and we'll refund 100% of your purchase price (less s&h).

- trading options

- trading futures

- options trading education

- options

- futures

- futures trader

- buying options

- trading education

- stock options

- options and stocks

- options and futures

- stock position

- futures position

- chart reading

- options strategy

- trading range

- 123s

- ross hook

- ross hooks

- ledges

- winning strategy

- identifying congestion

- ratio spreads

- trend trading

- Long Term Trading

- ETFs

- stocks

Trading Spreads and Seasonals

Discover One of the Best Kept Trading Secrets in the Markets

EBOOK VERSION COMING SOON!

"In trading, you're not paid for analyzing charts. You're not paid for calling in the order. What you are paid for is successfully managing the position while it's on." ~ Marshall Sass

Message from Joe Ross

"In Trading Spreads and Seasonals, it is my purpose to teach you everything I can about the wonderful trading vehicles created by seasonality. I hope to go beyond anything you may have encountered in the past. This course is organized according to degree of risk rather than order of complexity. The first part of the course deals with seasonal spreads, the second part with outright seasonal trades in futures. You will discover the trading secrets many full-time traders use on a daily basis to exploit the markets for their own financial gain, at the expense of the "little guys." In my opinion, spreads, when traded properly, carry considerably less risk than do other forms of trading."

Spread trading is quietly kept secret. Why? Because spread trading completely eliminates stop running. Do you think the insiders want you to know that? What would they do if they didn't have your stops to run?

Spreads and seasonal trading are like "insider trading" because that's what traders in-the-know do! What I'm talking about is a different kind of "insider trading" – trading based on the knowledge, experience, and expertise of successful traders who know the inside story of how markets work, and how to get the best out of them. They've done exactly that - time and time again.

Highlights and Benefits

Avoiding the worst nightmare of all traders, and landing in a trading paradise

Did you know that you can considerably minimize the risk of a position so that you might hold it overnight? What about the luxury of being able to avoid the worst nightmare of all traders - stop loss running?

You will learn how to achieve both of these results, and more than that, how to do it using as little as one-tenth the margin required for outright futures trades. You will also learn how to trade during periods of extreme volatility, and be much less concerned with liquidity, by using spreads. You can trade spreads in markets where you dare not go in outright futures.

By learning how to trade spreads, you will feel as if you have landed in a "trading paradise" because you will not be worried at all about the direction of prices. And if you do care about the direction of prices, you will find out that spreads trend more often, more steeply, and much longer than do outright futures.

How to select and filter seasonal spread trades

Seasonal spreads are among the best possible trades for those who are willing to wait for these excellent opportunities to come along. And, they come along often. Many spread trades work 100% of the time, for periods spanning 15 years or more. You will learn that over the years, spreads have a huge advantage of a very high degree of reliability.

You will also learn how to filter seasonal spreads in order to obtain the very best results. A lot of money can be lost by blindly taking these trades based upon computer-generated dates for entry and exit. Seasonal spreads can be heavy losers in those years when they fail to work as predicted by computer-generated studies. However, you will filter your trades so that you get the ones that work 80% or more of the time.

Using technical indicators to trade spreads

Not all traders enjoy trading based only on chart patterns. That’s why Joe shows you how to use technical indicators that are able to help you see forces in the market that are unlikely to be clear without some sort of visual aid. You will learn how to use technical indicators that Joe has found useful in trading spreads, whether they are seasonal or non-seasonal in nature.

You will be able to graphically display certain market properties not otherwise easily seen. You will see how to use these indicators, how to select, and keep them simple, and how to make sure you use no more than two that represent different aspects of the market.

Why and how to trade seasonal futures

In their anxiety to get rich quickly, most traders ignore seasonality in trading futures. Few have the patience to wait for seasonal windows to benefit from an enhanced opportunity for success. Joe teaches you the advantages of seasonal trading deriving straight from the battle of the giants: the commercials and the producers.

You will learn who has power, and how these forces can affect seasonality in various commodity markets. You will see how you can benefit from producer cartels that attempt to control prices. You will see how to offset the effects of commercial domination. As a wise trader in the market, you will be aware of seasonal tendencies, and trade accordingly.

Reality trading

Trading is not a problem for most of the participants in the market. You will find out that it is not your lack of knowledge about trading that keeps you from succeeding in the markets. You will be given a realistic look at the spreads and seasonal concept of "how to trade the trade."

You will understand why entry technique is all well and good, but it is only a small part of trading. A much more important aspect of trading is that of having a strategy, and then deploying the tactics that will fulfill the intent of that strategy.

You will learn the answer to "What do I do next?" Once you’re in the trade, you have to know what to do next. You will be amazed about what can be discerned from careful inspection of a chart as the trade progresses. You will find out the problems you might run into during the course of a seasonal trade. Finally you will learn when and how to bend a few rules, or even throw a few out, because in real trading rules don’t always work.

Seasonal trend and seasonal spread trading have been around for many years, and are wonderful ways to trade in today’s frantic markets. The art of using these trades has recently disappeared from the public eye. Amazingly, this knowledge is just as valid in today’s markets as it has ever been, and can be quite profitable for the trader who is willing to pursue it.

Trading Spreads and Seasonals is a truly complete trading guide

"Spreads and Seasonals are simple but require a skill set and knowledge to maximize profits and minimize losses. This book outlines to the point on when to enter a trade, how to manage and exit. Risk control and market assessment is there in easy to understand language throughout. You would be a foolish trader to ignore these set ups and even more foolish if you fail to apply them! Risk is one thing but this book isn't a risk to your pocket."

~ DK

"Joe defines spreads, describes their various types, points out in which markets they are most viable, and discusses their advantages and disadvantages. This book is not a theoretical, conceptual treatise, however. It takes a hands-on how-to approach in not illustrating only those spreads which succumb to his theories. He wants to educate readers for real-time trading – how to find spreads, filter them, analyze them, and place orders. He also shows how just a couple of well-known technical indicators can further filter and enhance entry and exit."

~ Jerry Toepke, Editor Moore Research Center, Inc.

"The book gives a very clear, step by step explanation of spread trading. Plenty of examples and a huge quantity of wisdom."

~ Marc d.M., Netherlands

EBOOK VERSION COMING SOON!

- managing positions

- spreads

- spread trading strategies

- spread trading

- trading seasonals

- seasonal spreads

- trading secrets

- financial gain

- spreads less risk

- eliminate stop running

- futures trading

- technical indicators

- seasonal futures

- commodity markets

- entry technique

- maximize profits

- minimize losses

- Long Term Trading

- futures

- commodity futures

- ETFs

- stocks