Marketing (13)

Trading Educators presents

An Evening With Adrienne

Tuesday - August 21, 2018 at 4:30 P.M., US ET

CLICK HERE TO REGISTER!

Adrienne Toghraie, Trader’s Success Coach

www.TradingOnTarget.com

In this one-hour workshop you will be given a choice of 70 typical questions that traders have frequently asked in workshops and seminars all over the world. You can either choose to ask these questions of Adrienne, ask questions in your own way or ask entirely different questions.

The benefits of this workshop are:

- You will have an opportunity to have a world renowned trader’s coach answer your questions about the psychology / discipline of trading.

- You will have an opportunity to hear other traders’ questions and issues that could trigger a breakthrough in understanding about some of your own issues.

ADRIENNE TOGHRAIE, a Trader’s Success Coach, is an internationally recognized authority in the field of human development for the financial community. Her 13 books on the psychology of trading including, The Winning Edge series 1-4 and Traders' Secrets, have been highly praised by financial magazines. Adrienne’s latest book published by Wiley, Trading on Target, is available at Amazon.com. Adrienne's public seminars and private coaching have achieved a wide level of recognition and popularity, as well as her television appearances and keynote addresses at major industry conferences.

919-851-8288

This email address is being protected from spambots. You need JavaScript enabled to view it.

Trading On Target - Evolution of a Master Trader by Adrienne Toghraie

Written by Martha Ross-Edmunds

THIS WEBINAR WAS ATTENDED WORLDWIDE!

Thank you to everyone who either participated or registered.

Be sure to sign-up for our FREE weekly newsletter emailed to you every Friday and you'll recieve two FREE eBooks!

Note, WebEx must be downloaded on your device in order to view it.

We hope you enjoy our recorded webinar:

Before clicking on "Play Recording" remember this password: Toghraie

Play recording (1 hr 2 min)

Recording password: Toghraie

We would like to hear from you!

Feel free to email us with questions regarding this webinar or any other trading related areas of interest:

This email address is being protected from spambots. You need JavaScript enabled to view it.

OR

This email address is being protected from spambots. You need JavaScript enabled to view it.

If you're having trouble viewing WebEx, please use the below video.

We apologize in advance for the lesser quality!

TRADING EDUCATORS FREE WEBINAR

IS PROUD TO HOST

ADRIENNE TOGHRAIE, TRADER'S SUCCESS COACH

PRESENTS

"EVOLUTION OF A MASTER TRADER"

www.TradingOnTarget.com

TUESDAY - JULY 18, 2017

4:30 PM EST

Webinar Details

In this webinar you will learn the five categories towards attaining Trading Master and what it takes to get there. From the Into-Wishing Trader to the Master Trader there are challenges to overcome to get to each next new level of success. In this webinar Adrienne Toghraie will discuss each trader category & what is necessary to face the challenges towards becoming a Master Trader.

ADRIENNE TOGHRAIE, a Trader’s Success Coach, is an internationally recognized authority in the field of human development for the financial community. Her 13 books on the psychology of trading have been highly recommended by the financial magazines. Adrienne’s public seminars and private counseling have achieved a wide level of recognition and popularity, as well as her television appearances and keynote addresses at major industry conferences.

Contact Information

Contact Name: Adrienne Toghraie

Company: TradingOnTarget.com

Website: www.Tradingontarget.com

Phone: 919-851-8288

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

|

THIS WEBINAR HAS EXPIRED THANK YOU TO THOSE WHO ATTENDED! CHECK YOUR EMAIL OR HOME PAGE FOR

TRADING EDUCATORS FREE WEBINAR IS PROUD TO HOST

PRESENTS "EVOLUTION OF A MASTER TRADER" www.TradingOnTarget.com

TUESDAY - JULY 18, 2017 4:30 PM EST

|

Webinar Details

In this webinar you will learn the five categories towards attaining Trading Master and what it takes to get there. From the Into-Wishing Trader to the Master Trader there are challenges to overcome to get to each next new level of success. In this webinar Adrienne Toghraie will discuss each trader category & what is necessary to face the challenges towards becoming a Master Trader.

ADRIENNE TOGHRAIE, a Trader’s Success Coach, is an internationally recognized authority in the field of human development for the financial community. Her 13 books on the psychology of trading have been highly recommended by the financial magazines. Adrienne’s public seminars and private counseling have achieved a wide level of recognition and popularity, as well as her television appearances and keynote addresses at major industry conferences.

Contact Information Contact Name: Adrienne Toghraie

Free Webinar - Register Here!

|

Note:

You are being redirected to Marco Mayer's AlgoStrats.com website.

Click Here to Continue - Ambush Signals

Marco Mayer is a professional trader with Trading Educators, please contact us if you should have any questions.

SNEAK PEEK

Our books are actually full-blown courses for traders. Each is designed to deal with a different aspect of trading.

These are not books that try to teach you some magic indicator. They teach you how to trade the reality of the markets.

You're looking right over Joe Ross' shoulder at real trades made in real markets. You are told when, why, and where the trade was made. You are shown his thinking when the trade was made. You see how, when, and why he entered a trade and how, when, and why he exited the trade.

We receive emails all the time telling us that our courses are worth their weight in gold, and we offer a no questions asked, money-back guarantee on every book still in saleable condition.

Trading Educators, Inc. (formerly Ross Trading International, Inc.) was founded in 1988, and has thousands of satisfied customers who have used the Joe Ross methods to produce significant positive results in the markets.

CHAPTER 22

BUILDING CHARACTER

What is character? Can you tell me? You need it to trade. Without it you are a ripe for disaster, and believe me, the market will pick you apart if you don’t have it.

Character is what? Think, what is character?

I’ll tell you what it is – it’s the development within yourself of everything that I’ve been writing about ever since I started putting you back together. Character pertains to your very makeup, the essential fiber of your being. It is your integrity, your honesty, your self-discipline, and, consequently, your self-control.

It has everything to do with your success as a trader.

Character is so important that you have to be persistent and diligent in developing it. There is no room for slop in your trading. The markets have enough slop in them without your adding to the pile.

My main objective in this book is to help you build the right character and have the correct mindset to be a successful trader.

I’ve raked many of you over the coals, but I’ve been careful to put you back together again. If you were angry or insulted when you read the sections about what you do wrong, then you need to examine your own level of maturity as a trader and as an individual. Hopefully, as you read certain of those sections, you were angry with yourself, not me. All I did was to point out the problems and state that “if the shoe fits, wear it.” It’s up to you, not me, to change yourself.

Over the years, I have gone through the steps of self-flagellation needed to make me a better – not perfect, trader. I, too, am still growing and learning. I have had to do this consistently over the years. “Change”, “modify”, and “grow” are bywords of sound trading.

Now, I’m going to give you a tool I developed to help me build the right kind of character for trading futures. Feel free to adapt it in any way you want, to conform to your own needs. It’s called the Life Index.

THE LIFE INDEX

The Life Index is a tool you can use to help form the habits you want to acquire. It is the organization of a plan that will aid you IN CAPTURING your thoughts and bringing your actions under control. The Life Index is a simple concept that, if applied diligently, will serve as a navigational device to help you stay on course towards becoming a successful trader.

You may use the Life Index to monitor your daily life and to chart your progress as you work to stay on course with your plan. Feel free to make as many copies of it as you desire. It’s OK to change its categories to fit your own situation. Add, subtract, rename categories as you see fit.

Many people who have diligently and consistently used this Life Index have told me it has improved the quality of many aspects of their lives, including their trading.

Now let’s look at each question so you can understand how to keep score of each day and week, and how to chart your course.

Your answers will, of course, be subjective. Your honesty is crucial.

You will chart your scores (0-4) daily, Monday through Friday throughtout the year by using four Life categories. Within these Life categories, we will explain how you scored and where you are in your trading. For example:

Exercised Today? Most labor is not exercise, so don't count it. Did you walk, jog, do calisthenics, rebound, dance, particpate in a sport, ride a bike, or have an exercise workout today? If not, your score is 0. If you did exercise, score 1. If you had a great workout, score 2. To be fit for trading and the market wars, you need a soud mind in a sound body.

Along with the book, you can purchase "Life Index for Traders" which includes a spreadsheet to help you chart your daily outcomes. We have done the work for you, so all you have to do is reach your potential trading abilities. Limited time, receive 20% off this product through the month of March! Use coupon code during checkout: tiab20

You will chart your answers to determine either a downtrend or uptrend. With each of these outcomes, there is a certain course of action that needs to be taken. Where do you fall and what will be your course of action?

Take advantage of our special offer! 20% off through March 31st on either product "Trading is a Business" and "Life Index for Traders".

Don't miss out! Use coupon code during checkout: tiab20

$150.00

Trading is a Business Book

$147

Life Index and Equity Evaluator

EBook

INTRODUCTION TO PART II

This book is about making money in the markets.

This book is the result of my coming across an amazing piece of information: on any given trade in the markets, eighty percent of the traders who enter the trade enter it on the correct side. Yet overall, some ninety to ninety-five percent of traders lose money.

This simple reality is devastating. At first I found it hard to believe. I was stunned and shocked by the revelation. My first question was, “How can this be? How can so many people be correct in calling a trade and still not be able to lock in profits?”

In Part I of this book I delved into the mental, emotional, and psychological factors that cause people to fail as traders, and I tried to show how to overcome such factors. I tried to tear you apart, and then offered a specific methodology to help you become a better trader by adjusting your trading to your individual personality.

About the time I began writing about trading, I started sampling the writings of others in this field. Without exception, they try in some way to reveal what they have been doing, or what might work in the markets. There are scads of books, articles, manuals, and courses – all of which are an attempt, genuine or not, to teach people how to trade.

However, in all my searching for market “goodies,” one thing stood out: there have been FEW, if any, who TEACH OTHERS HOW TO MAKE MONEY IN THE MARKETS! If such a book, manual, or course exists, I have not personally come across it. If any one knows of one, I’d like to know what it is and where to find it.

Yes, you can find plenty of books on HOW TO TRADE, but try to find one on HOW TO MAKE MONEY TRADING! Even the ones who claim to show you how they made a fortune in the markets, in the final analysis, never do show you how to do it.

Some books have such illustrious titles and hold forth such promise that people rush forward to snap them up when they are published. Then follows the sad realization that comes from an unfulfilled expectation. All too many of these books turn into a case of breach of promise.

I wondered what I could do about it. That’s when I decided that, in whatever time remains in my life, I will teach to others what has been so profitable for me.

In this part of this book, I attempt to teach you how to make profits from your trading. Some of it you may have heard before from others, some of it you have read in Trading by the Book, some of it was contained in Day Trading (formerly Trading by the Minute). Trading the Ross Hook contains a complete methodology and management program for making money through trading hooks.

Most of what you will read you have never seen before, or at least you have never previously seen it put together in the way I present it here.

I’ve called this book Trading Is a Business because my purpose in it is to teach you what I know about the business of making money in the markets. My goal is to show you how to make your trading profitable.

It is clear that just teaching others how to trade is not sufficient. Nor is it sufficient to teach you the proper mindset for trading. I also have to teach you how to make money. The three – trading, mindset, and making money – are all parts of a whole. You must be a good trader first and foremost. You must have a proper mindset. You must also be a good businessperson. They all go together – they are inseparable.

I believe that if you learn how to make money from your trading, you can make money in the markets whether or not you follow the methodology shown in Trading by the Book, Day Trading, Trading the Ross Hook, Trading Optures and Futions, Trading Spreads and Seasonals, or by reading this book. Since eighty percent of the traders are correct when they first enter a trade, it is not important to trade exactly as I do. It is more important that you trade in a way and with a methodology that is the most comfortable for you.

Obviously, for some people, waves, phases of the Moon, cycles, seasonals, oscillators, and moving averages, etc., are sufficient to make a correct entry into a market. It’s what happens after the entry that causes people to lose when they are trading.

Subsequent to publishing the first edition of this book, I am pleased to say that I received numerous letters and telephone calls stating in essence that the concepts shown in this book have made scads of money for traders using otherwise mediocre methods and systems.

Professional traders have contacted me to tell me that the material you are about to read has substantially increased the bottom line profits of their trading – they are consistently making more money than they ever have before.

I have been told by some, that otherwise losing mechanical systems have become profitable by incorporation of my management concepts.

Please pay close attention to the remainder of this book. Both Parts I and II have been changing people’s lives. To have had such a great impact on the lives of others is a great honor.

Take advantage of our special offer! 20% off the month of March on either product "Trading is a Business" and "Life Index for Traders".

Don't miss out! Use coupon code during checkout: tiab20

$150.00

Trading is a Business Book

Dimensions: H 11 1/4" x W 8 5/8" - 383 pages

30-Day Money Back Guarantee*

Hardcover Only

*If you aren't thrilled with Trading is a Business, just send it back within 30 days and we'll refund 100% of your purchase price (less s&h).

$147

Life Index and Equity Evaluator

EBook

Digital Delivery Via E-Mail

Download for Windows Users Only, No Mac Users

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

OTHER BEST SELLERS FROM JOE ROSS' COLLECTION

SNEAK PEEK

Our books are actually full-blown courses for traders. Each is designed to deal with a different aspect of trading.

These are not books that try to teach you some magic indicator. They teach you how to trade the reality of the markets.

You're looking right over Joe Ross' shoulder at real trades made in real markets. You are told when, why, and where the trade was made. You are shown his thinking when the trade was made. You see how, when, and why he entered a trade and how, when, and why he exited the trade.

We receive emails all the time telling us that our courses are worth their weight in gold, and we offer a no questions asked, money-back guarantee on every book still in saleable condition.

Trading Educators, Inc. (formerly Ross Trading International, Inc.) was founded in 1988, and has thousands of satisfied customers who have used the Joe Ross methods to produce significant positive results in the markets.

Chapter 1

What Is a "Spread?"

If you already know what a spread is, you may be tempted to skip this initial chapter. However, I advise against it. Besides being presented for those who know, it is presented here for those who are not sure, and also for those who know that they know that they don’t know.

I have been amazed at the number of traders who show up at my seminars who do not know what a spread is. Additionally, they do not know its numerous purposes or its many uses.

A Spread is...

For purposes of this book, a spread is defined as the sale of one or more futures contracts and the purchase of one or more offsetting futures contracts. You can turn that around and state that a spread is the purchase of one or more futures contracts and the sale of one or more offsetting futures contracts. A spread is also created when a trader owns (is long) the physical vehicle and offsets by selling (going short) futures. However, this course will not cover the long physicals, short futures types of spreads.

Furthermore, for purposes of this course, a spread is defined as the purchase and sale of one or more offsetting futures contracts normally recognized as a spread by the futures exchanges.

This explicitly excludes those exotic spreads that are put forth by some vendors but are nothing more than computer generated coincidences which will not be treated as spreads by the exchanges. Such exotic spreads as long Bond futures and short Bean Oil futures may show up as reliable computer generated spreads, but they are not recognized as such by the exchanges, and are in the same category with believing the annual performance of the US stock market is somehow related to the outcome of a sporting event.

Either way, for tactical reasons in carrying out a particular strategy, you want to end up with simultaneous long futures and short futures positions or, if you prefer, simultaneously short futures and long futures positions.

The primary ways in which this can be accomplished are:

1. Via an intermarket spread.

2. Via an intramarket spread.

3. Via an inter-exchange spread.

Intermarket Spreads

An intermarket spread can be accomplished by going long futures in one market and short futures of the same month in another market. For example: Short May Wheat and Long May Soybeans.

Intermarket spreads can become calendar spreads by using long and short futures in different markets and in different months. These spreads are specialized and uncommon, but it may be profitable for you know they are available.

Intramarket Spreads

Officially, intramarket spreads are created only as calendar spreads. You are long and short futures in the same market but in different months. An example of an intramarket spread is that you are long July Corn and simultaneously short December Corn. Other unofficial methods for creating intramarket spreads are beyond the scope of this course.

Inter-Exchange Spreads

A less commonly known method of creating spreads is via the use of contracts in similar markets but on different exchanges. These spreads can be calendar spreads using different months, or they can be spreads in which the same month is used. Although the markets are similar, because the contracts occur on different exchanges they are able to be spread. An example of an inter-exchange calendar spread would be simultaneously long July Chicago Board of Trade (CBOT) Wheat, and short an equal amount of May Kansas City Board of Trade (KCBOT) Wheat. An example where the same month is used might be long December CBOT Wheat and Short December KCBOT Wheat.

Offsetting Contracts

Although both the long and the short futures may be entered simultaneously through a “spread broker,” it is often advantageous to enter a spread one “leg” at a time. However, until both the long and short futures are in place, there is no offset and consequently no spread exists. Offsetting merely defines the difference between the futures contracts, i.e., simultaneously both long and short futures. A spread consists of two “legs.” Each side of the trade constitutes one leg. Long futures is one leg and short futures is the other leg.

There are times when offsetting may be accomplished by using inter-exchange spreads employing differing numbers of contracts. Let’s say, for instance, you are short 5,000 ounces of July Comex (CMX) Silver and would like to offset with an equal amount of June Silver. You could create the necessary inter-exchange calendar spread by purchasing five Mid-America Exchange (Mid-Am) June, 1,000 ounce Silver contracts. Currency positions at the Chicago Mercantile Exchange (CME) can be similarly offset by contracts at the Mid-Am. I can offset a long CME D-Mark contract with two Mid-Am D-Mark contracts.

Sources of Spread Information

All the major US exchanges publish materials on seasonal spreads. Generally this material can be had free or, at most, for a nominal charge.

For example, the CBOT and the CME are happy to send you lovely color brochures showing charts of their exchange-recognized intermarket and intramarket spreads dating back over a period of 12 years. If you call and ask, they will send them at little or no charge. Don’t forget to ask for both their commodity and financial futures material.

Years ago, before the advent of computerized data bases, I used to obtain the CBOT’s “Year Book.” I am not aware if they still publish it, but it was chock full of tables giving actual prices for every contract for an entire year. It provided me with a complete data base of prices that at the time was incomparable. I used that data as a historical base for creating a history of which spreads worked best seasonally. It was laborious and tedious work, but I manually entered much of the data into my old Epson QX-10 computer so I could produce an historical graph. The public library where I lived carried the Year Book on its reference shelf and I made an arrangement with the head librarian to pick up last year’s volume as soon as they received the latest, newest volume. Seasonal tendencies in futures change little, if any, over the years. I still trade the same seasonal spreads today as I did decades ago.

There are more seasonal spreads today than there were then because there are more markets in which to trade, and because computers are able to spot very short term trends in spreads that would have been difficult and impractical, if not impossible, to detect by manual methods. Today, you can trade not only agricultural spreads, but also exchange-recognized spreads in the currency, financial, energy, and metals futures.

There is also an abundance of non-seasonal, intermarket and intramarket exchange-recognized spreads. Many of these non-seasonal spreads do have some seasonal tendencies and can be traded as seasonal spreads as well as outright spreads based on an event, fundamental knowledge, or some observable chart pattern.

In addition to the material provided by the exchanges, there are also private sources of information on spreads. Some of these sources, with a brief description of each, are listed in the Appendix B of this course.

Markets Suitable for Spreads

When trading spreads, I am careful to trade in liquid markets and generally reject spreads in very thin markets. However, because there is essentially no such thing as “stop running” when trading spreads, I can afford to take them in markets that are a bit more illiquid than what I normally would consider appropriate for trading.

I consider the following markets suitable for trading spreads:

Currency:

British Pound, D-Mark, Swiss Franc, Japanese Yen. Any of these, one versus the other, on an intermarket basis.

Energy:

Crude Oil, Heating Oil, Unleaded Gas, Natural Gas. Any of these on an intermarket or intramarket basis, along with the “Crack Spread.”

Grain:

Corn, Chicago Wheat, Soybeans, Chicago Oats on an intermarket or intramarket basis.

Chicago Wheat and Kansas City Wheat on an intermarket or intramarket basis.

Soy Oil and Soy Meal on an intermarket or intramarket basis, and the Soybean "Crush" spread.

Financial:

US Treasury Bonds, Treasury Ten Year Notes, Treasury Five Year Notes, and Municipal Bonds on an intramarket basis and on an intermarket basis. (MOB spread, NOB spread, etc.)

Two year notes on an intramarket basis.

Eurodollars on an intramarket basis.

T-Bills and Eurodollars on an intermarket basis. (TED Spread).

Meat:

Live Cattle and Live Hogs on an intramarket basis. Feeder Cattle on an intermarket basis with Live Cattle entered only as a spread.

Metal:

Gold, Silver, Copper on an intramarket basis, and Gold, Silver on an intermarket basis.

Softs:

Cocoa, Coffee, Cotton, Orange Juice on an intramarket basis. (Caution: Coffee, Cotton, and Orange Juice in particular are among the world’s most treacherous markets and I never trade outright futures positions in any of them. In this writer’s opinion, trades in Cotton and Orange Juice should be avoided by non-commercial interests.)

Of the above named markets, I will not take any trade that involves legging into a spread in any of the following markets: Orange Juice, Heating Oil, Unleaded Gas, Copper, Coffee, Cotton, Live Hogs, T-Bills, and Feeder Cattle. I will leg out of any of these only in dire emergencies, preferring to liquidate the trade intact, as a spread, both legs at the same time at a specified spread differential. “Legging in” refers to a situation in which both sides of the spread are not put on simultaneously. “Legging out” refers to exiting the spread one side at a time and not exiting both legs simultaneously.

I will not take any trades that involve Lumber, Value Line, Canadian Dollar, or Pork Bellies. I tend to reject spreads in very thin markets or delivery months.

As a rule, I will not take any trades that involve spreads that are not recognized by the exchange as being a spread. However, I may take a non-recognized spread if it occurs in related markets such as Soybean Oil and Soybean Meal.

Indices:

S&P 500 Stock Index, Dow Jones Industrial Average Stock Index, NASDAQ 100 Stock Index, New York Stock Exchange Index.

Chapter 2

Why Use Spreads?

There are certain advantages to using spreads. Stop for a moment and think about what they might be. I’ll list them here and you will also see them discussed as appropriate throughout the course.

Advantages of Spreads

Spreads can be insensitive to the trend or lack thereof in the outright futures. Of course, there are exceptions. In a bull market, the front months usually outperform the back months, and in a bear market, the back months usually outperform the front months. Generally, the absolute direction of the underlying futures is of little concern. The important thing is whether or not the trend of the spread differential moves favorably in the direction you would prefer.

Exchange-recognized spreads carry lower initial and lower maintenance margin requirements. This is because spreads involve lower volatility. Most of the time true spreads do not move as frantically as do the underlying futures. A spread position is automatically a hedged position most of the time and therefore usually involves less risk. Some cases of “old crop” vs. “new crop” can refute this. They sometimes look like different animals.

Spreads serve to reduce the volatility impact of the underlying futures. In an intramarket spread, if the front month of a contract suddenly comes crashing down, it is highly likely that all the remaining months will also crash down.

The only thing the spread trader is interested in is whether or not a change in the spread differential has helped or hurt his position.

Spreads allow a trader to take a fractional approach when putting on a futures position. Did you think you could do that only with options? Let’s say you want to get long Treasury Bond (T-Bond) futures. After speaking with your broker, you realize that the margin for a single T-Bond trade is greater than you feel you can handle in your account. You notice that on most days, Treasury Note (T-Note) futures generally move some fraction of the amount of T-Bond futures. You also notice that the long T-Bonds, short T-Notes spread is widening.

By going long T-Bond futures and short T-Note futures, you have created a fractional position in the interest rate futures. If T-Notes are moving 80% as much as T-Bonds, then your spread renders a move that is 20% of a long position in T-Bond futures. For example, if T-Bonds move up 10 points ($312.50), and at the same time T-Notes move up 8 points ($250), then the spread, T-Bonds/T-notes will have widened by 2 points ($62.50) i.e., 20% ($62.50 / $312.50).

Spreads have yet another advantage: they are convertible. It is possible to “leg out” of a spread, leaving yourself with an outright futures position. Conversion can work both ways, outright futures may be convertible to spread positions, and spreads are convertible to outright futures positions. Convertibility adds a great amount of flexibility to your futures trading. Don’t tell them, but options traders think they’re the only ones who can do this.

Spread trading helps the trader to avoid a lot of the noise created during the intraday market trading. Much of the intraday noise is that of stop running by the locals on the floor. There are no stops in the traditional sense with spread trades. There is no stop running available when there is no stop order in the market. Why is there no stop running in spreads? Because the stop exists in the spread differential, and can be obtained by a combination of any number of futures prices. This leads to another feature of spread trading, confidentiality.

When you are in a spread, and both long and short at the same time, you have no exit order in either market. If you are long Corn and short Beans, there is no exit order in place other than to exit at a certain difference between the contracts. Your trade is confidential. The locals have no idea of your true position or intent. They can’t see both of your positions and have no reason to look.

Spreads, by their very nature, constitute a hedge. The economic rationale for the futures markets is to provide an arena in which risk may be hedged. A futures speculator can also hedge. His hedge is created by using an offsetting position. He creates the offset by putting on a spread. Have you ever wanted to hedge your position but didn’t know how? Spreading can, at least temporarily, stop or lessen the pain of a bad trade.

There is one further, somewhat obscure advantage of spreads. It is possible in some markets to use far distant back months for the offsetting position. In other instances, where you might be involved in a back month, you can use closer-in months for the offsetting position. In a later chapter, I will show you an example of how this advantage could have been utilized to save what would have otherwise resulted in a disastrous situation in the Coffee futures.

Uses of Spreads

There are numerous reasons to use spreads. You might want to pause a moment to think about what they might be. Spreads are usually, but not always, used by speculators to reduce the risk of holding a position overnight or, indeed, to lower risk at any time at all. Spreads are used by traders to take advantage of historical seasonal tendencies.

Spreads are used by traders to trade sideways markets where the futures spread is trending at the same time outright futures prices are seemingly moving sideways within Trading Ranges. Spreads are also used to convert an outright futures position to a combination futures position where the trader feels for any number of reasons that it is better to carry the offsetting positions available by spreading.

Spreads are also used as outright intermarket and intramarket speculations. Spreads are used when there is a desire to remove the effects of futures directionality or trending from a trade. Spreads can be employed to reduce the amount of initial margin and maintenance margin required to trade a particular contract. Finally, spreads can be used to reduce and greatly eliminate the effects of volatility and the resulting uncertainty from a trade.

Let’s briefly look at each of the above situations in order to gain an overview and somewhat deeper insight into the reasoning behind each.

In later chapters, when I show how I trade the various spreads, I will probe the depths of the reasons for taking spread trades. In conjunction with the reasons, I will also show you my strategies and the tactics by which I carry them out. Keep in mind, it is entirely possible to lose on both sides of a spread.

Reducing the Risk of Holding a Position

It is not uncommon in liquid or illiquid markets for a floor trader to hedge his position by “spreading off” against the same market in another month, or against a related market in the same month. I have seen this kind of floor trading tactic in such illiquid markets as the Value Line, and even in more liquid markets such as Soybeans, Eurodollars, and Bonds. In fact, arbitraging through spreads in distant back months by financial traders is commonly done while greatly reducing risk. If floor traders think it’s important to “spread off,” don’t you think it’s important for you to do the same thing?

Value Line floor traders, in an effort to make a market, will take the opposite side of an entry order coming in from off the floor. Then, because volume and liquidity are so terribly low in this market, the Value Line floor trader will offset his position by taking an opposite position in the S&P 500. By doing so, he has hedged his risk. It is not uncommon for a floor trader in the Soybean pit to offset and hedge his risk by taking an opposite equity position in Soybean Oil or Soybean Meal.

Financial floor traders will hedge risk by spreading intermarket contracts and intramarket back month contracts. Often these are not perfect spreads and often they are not spreads recognized by the exchange as such. Nevertheless, they are regularly used by floor traders and are illustrative of the use of spreading off as a means to reduce risk and thereby create a hedge.

Off-the-floor traders can also hedge risk by use of offsetting positions to be held overnight. Both daytraders and position traders can create spreads that considerably minimize the risk of a position that might be held overnight. Day trades can be converted to position trades by spreading. Position trades can be held considerably longer at less risk by spreading.

Taking Advantage of Historical Seasonal Tendencies

Probably the most common use of outright spread trading is for the purpose of taking advantage of the seasonal tendencies that occur in various futures markets. Trades with a high probability of being profitable can be entered this way. Trades with success probabilities in the 80th and 90th percentiles are quite common among seasonal spread trades.

Seasonal spreads are not exclusive to consumable commodity futures. They occur in the currency and financial futures markets as well. The proof of the reliability of seasonal trading is extensive. In fact, not that many years ago it was the mainstay of many a successful trader. Knowing when the markets are following their normal seasonal behavior and taking advantage of the fact is one of the safest and surest ways to trade the futures markets. One has to be patient and restrained from greed when trading seasonals. The reward is well worth the effort.

Trading in Sideways Futures Markets

It is not unusual for a particular futures market to be moving sideways. Experts have stated that markets spend approximately 85% of their time with their prices moving sideways and not trending. Whereas overall markets may be moving sideways, there is often a trend occurring between different months of the same underlying futures or the same or various months of related futures. Markets that tend to incur long periods of congestion may very well be trending when a front month is offset against a back month. One month may be moving sideways with an upward bias while another month is moving sideways with a downward bias. The difference gives rise to a spread trend and an opportunity to profit from the spread differential.

Converting an Outright Futures Position to a Spread

Quite often an outright futures position can be converted to a spread position. The result can be less risk and will require less margin. I have entered such conversions in my trading and have witnessed what would have been a loss, had I held outright futures, turn into a profit by way of conversion to a spread. Trades of this sort will be illustrated later in this course. Ending up in a spread has usually been the result of a need or willingness to hedge. The resulting profit has often been greater from the spread than it would have been had an outright futures position been maintained. Have you used this privilege in your trading?

Outright Inter-Exchange, Intermarket, and Intramarket Speculations

A spread trade is often entered without the benefit of seasonality as an outright spread position. This may be done as a counter-seasonal trade due to backwardation in a market. Any news event, rumor, fundamental fact, or technical formation can cause a trader to enter a spread based on the merits of his ascertaining that a spread trade would be in his best interests. Outright spread trades may be entered when it is unknown which way a market will break from congestion. Once the break has occurred, the losing side of the spread is dropped and the winning side is maintained. Entire strategies and the resulting tactics needed to carry them out can be built around outright spread trades.

Any time a spread is trending, sufficient reason exists to consider entry via the spread method of trading futures. Should it become advantageous, any spread position can at any time be converted to an outright futures trade by simply dropping the losing side of the spread.

Removing the Effects of Directionality

Spread trades are not fully dependent upon the trend or lack thereof of the individual futures of which they are comprised. Rather, they are dependent upon the trend of the spread differential itself. This is why, even when markets are not trending, a spread trade can make money from the trend in the spread differential. However, spreads can also make profits in trending markets. If the long side of a spread trade trends higher and faster than the short side of that same trade, profits will be acquired by virtue of the upward trend in the spread differential.

In like manner, if the short side of a spread trends lower and faster than the long side of that same trade, profits will be acquired by virtue of the upward trend in the spread differential. This may seem confusing, but it points out the fact that the trend of a spread can be up even while the two legs of the spread contract are plunging down.

Both Sides of a Spread Can Win or Lose

While on the subject of directionality, keep in mind that directionality of profit or loss is another matter. It is entirely possible to be profitable on both sides of a spread as well as to be unprofitable and actually lose on both sides of a spread.

Reducing the Amount of Initial and Maintenance Margin

Exchanges recognize the reduced risk of spread trades and the corresponding reduction in the effects of volatility by making the margin requirements necessary to carry spread trades much lower than those for outright futures trades. Spreads are generally fractionally less volatile than outright futures positions.

Every spread trade carries in it the elements of hedging, and the elements of risk. Hedgers require less margin to trade because they are both long and short the same or a related commodity. That is one reason why, with a few exceptions involving related markets, we do not advocate exotic, exchange-non-recognized spreads for purposes of this course. Lowered margin requirements are a major positive reason for entering spread trades. Lower margins can mean more opportunities to enter or add to positions in the same market or to diversify through additional positions in other markets. If you are trading a small account, are you aware that spread trading may offer a way to obtain more trading opportunities?

Reduce and Greatly Eliminate the Effects of Volatility and Uncertainty

As stated above, it is the hedging nature of spreads that can reduce risk and margin. This reduction is directly related to the lessened exposure to volatility that may be carried by spread trades. If you are both long and short the Japanese Yen and it explodes into a 500 point price rise in a single day, you may profit if the long side of the trade moves up more than the short side. If the opposite is true, you will lose only fractionally the amount you would have lost if you were holding an outright short futures position. The long futures will always mitigate the effects of any loss you might be taking on the short side of the spread trade.

Disadvantages of Spreads

Since I’ve been listing the advantages of spreads, it is only fair that I list the disadvantages of spreads. Nothing in life is perfect. Spread trading is not totally without some drawbacks. You wouldn’t want me to pretend there are none, would you?

Probably the greatest disadvantage in the minds of some traders is that trading spreads limits profit potential. Of course, this is true. When you limit the risk in a trade, you usually end up limiting the amount of profit available in that trade. Limited profit potential must be weighed against the benefits and advantages that accrue to a trader who utilizes spreads.

Another disadvantage in spread trading is the limited amount of written information about spreads. There are few books indeed that cover the subject. One of the reasons for my preparing this course is to provide an in-depth treatment of the subject of spread trading.

Ordering of spread trades is another draw-back for many traders. It takes a greater effort to place a spread order than other types of orders. Although the ordering of a spread trade involves no more than a few additional words, this seems to be an insurmountable obstacle for those not willing to make the effort. I believe this degree of reluctance derives from the fact that traders are not sure of themselves when it comes to placing spread trades. This lack of certainty revolves around not understanding the mechanics of ordering, and also a lack of understanding of how spread trades work.

Ignorance in this area is not solely in the realm of the trader. It also involves the broker. This leads to another disadvantage of spread trading, broker uncertainty.

I’ve been amazed at how few brokers know anything about how to place a spread order. Therefore they are sometimes of little help to the trader seeking such information. That’s too bad, isn’t it?

Perhaps the final disadvantage of spread trading is found at the spread desk itself. For spreads that involve the existence of an actual spread desk, i.e., spreads like the TED spread which involves a spread across two markets, and therefore trades at an official TED spread desk of the International Money Market, there is a loss of the confidentiality that is available were the trader to avoid the spread desk and simply leg into the spread trade.

I feel that it is often better to leg into spreads, especially where the trader has the time and resources to observe the market and enter at a more propitious differential. The back office computer is oblivious to legging in. It cannot tell whether the spread was entered as a spread or was entered by legging-in.

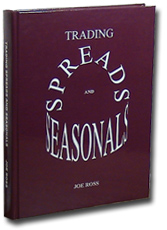

Trading Spreads and Seasonals is a truly complete trading manual

10% off item, expires 2/28/2017:

Use coupon code during checkout: tss10

$150.00

Trading Spreads and Seasonals Book

Dimensions: H 11 1/4" x W 8 5/8"

309 pages

30-day Money Back Guarantee*

Hardcover only

*If you aren't thrilled with Trading Spreads and Seasonals, just send it back within 30 days and we'll refund 100% of your purchase price (less s&h).

OTHER BEST SELLERS FROM JOE ROSS' COLLECTION

One concept that every trader must master is that of knowing which elements of analysis are telling him the truth at any given time. The overriding factors of trading are those of common sense and trading what you see. However, there may be a time to use technical indicators, knowledge of cyclicals, perhaps even your own theories to help you in trading what you see. There is also a time to virtually discard all of these and trade only what you see without regard to confirmation. You might call that “intuitive” trading. At other times, confirmation can be achieved from the fundamentals in the market place. It is best to have confirmation of some sort before trading.

Although an individual trader, without the benefit and support of a research staff, can hardly afford to delve deeply into the underlying fundamentals, almost any individual trader can easily ascertain from the news and various reports and advisories some of the basic fundamentals needed for confirmation.

In this way a technical trader differs from a fundamentals trader, who may spend hours and days researching the fundamentals of a market in which he wishes to trade. Technical traders can satisfactorily use the research of others to know which futures, stocks or currencies to watch, and can outperform fundamentals traders by correctly timing his trades through both chart and technical analysis.

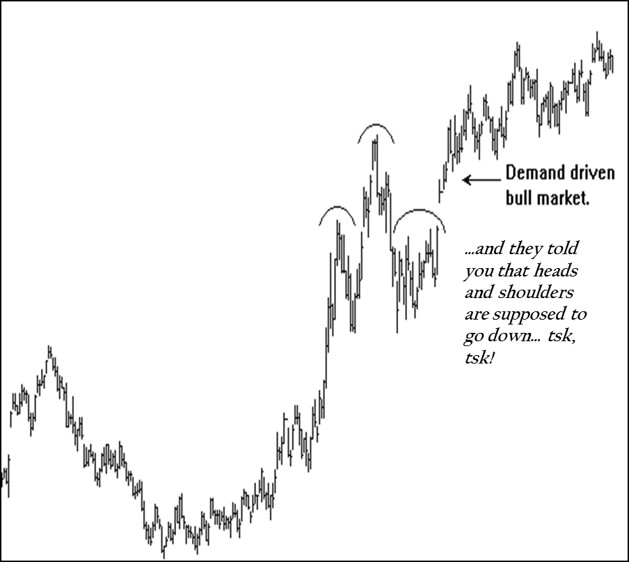

In a demand driven market, only an appreciation of the fact that prices are rising should suffice. All the technical and fundamental analysis in the world goes out the window in such a market. Only trading what you see on a chart makes any sense.

A demand driven bubble in stocks, which resulted in a corresponding bubble in the stock indexes such as seen in the latter part of the twentieth century, defies every type of analysis other than an admission that if you see prices rising, you should be long, albeit with protective stops to make sure you lock in profits.

The demand driven bubble situation in the U.S. stock markets left many analysts shaking their heads in confusion. Avoiding confusion is one reason why we maintain that you should trade what you see. For safety sake and a feeling of reassurance in non-bubble markets, what you see usually should be backed up and confirmed by some other method of analysis. There are situations in which there is no time for confirmation. Choosing that “other” area is an individual choice based upon experience and success. You learn to use what works for you.

Avoiding confusion is why you should never marry a market, a certain way of trading, or a particular method of analysis. The most successful traders we’ve seen learn to trade from a toolbox of analytical methods. They learn to use the appropriate tool for a particular market condition.

To avoid confusion, you must not marry a philosophy. When asking yourself or asked by others which way you think a market will go, you should be able to answer, “I don’t know, but by following the market’s own action and my own analysis, then more often than not, I will be positioned appropriately – even if that position is one of standing aside.”

As a trader, you must learn to dance with the market. You, also, must learn that if a market you are trading decides to do the “Cha-cha,” you do it too. But before you can dance with the market you have to learn how. You have to get to know and understand the basic forces that drive prices (Hint: Fear and Greed). You have to develop pattern recognition skills, and it can be helpful to include indicators that tell you things about the market you cannot readily see. The indicators are there to enhance your analysis, not to be your analysis. Indicators are no substitute for your own perception based upon what you see and know.

What is it that was driving the stock markets throughout the latter part of the decade of the 1990's? It was demand! People were pouring money into mutual funds at a fantastic rate. Those funds could not just sit on that money, they had to invest it where the people want it placed – in the U.S. stock market. Anyone paying attention to their constantly rising price charts could have seen that.

A Turnkey Business?

There are far too many traders who enter this profession looking for a turnkey business.

An accountant can buy an existing practice. So can a doctor and, to some extent, an attorney. An engineer can usually buy into an existing firm. Entrepreneurial-minded individuals can buy a franchise. If you have enough money, you can get a high-profile, big-name franchise. A good one comes with training for you and for your hired help. It comes fully equipped with everything you’re supposed to need to run the business. Your advertising is laid out for you. You have an employee manual and an operations manual. You are shown how to set up your books, and trained in how to do it all on a computer using the software provided by the franchiser. Unless you are at the level of a functional idiot, you can pretty well be certain that you are going to succeed.

However, trading is far from being a turnkey business. You simply cannot go out and buy a mechanical trading system that is going to guarantee you any viable degree of success. Oh, we know they are advertised that way – so are some franchises in other areas of business. But there are fakes and frauds the world over. Caveat emptor!!

When you are a trader, no one gives you an employee manual. No one offers you an operations manual. There is no school to which traders can go to be trained specifically in this business. (We are hoping to correct that somewhat with our books, webinars, and tutoring sessions.)

No one will sit down with you to show you which markets to trade and in which time frame to trade them. Trading is something that cannot be packaged. There are too many aspects of trading that derive from the individual personality and mind set of the trader him/herself. Trading is not the only occupation that is that way. Anything truly creative cannot be packaged as a business.

The Art of Trading

People talk about trading as though it were scientific. With varying degrees of success (failure??), they try to apply mathematics and scientific theories to markets, and consequently to the trading of them. But if you allow trading to define itself, it is quickly seen that it is an art form and not a science. Trading is more nearly compared with art and music than it is with science. Great traders are individuals, and almost always creative ones at that. Could anyone package and franchise the ingredients that created a Salvador Dali, or a Picasso? Would it have been possible to package and franchise the make-up of an Arthur Rubenstein, Elvis Presley, or Whitney Houston? Trading is an art based on an artist’s perception of what is happening in the markets. If it weren’t, there would be many more traders.

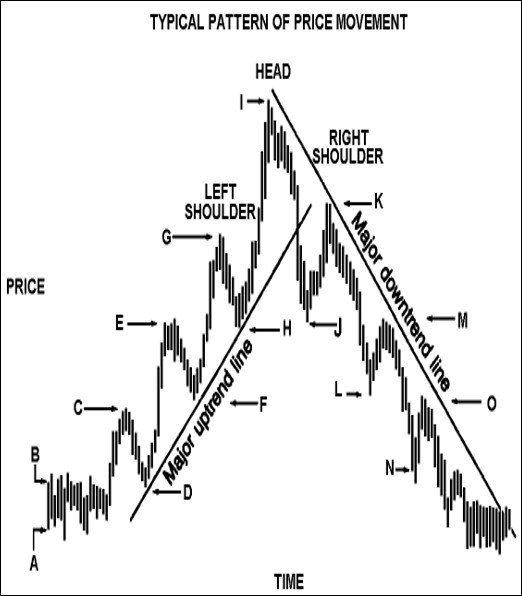

Notice the head and shoulders pattern on the preceding chart. If prices followed some sort of law, or if chart analysis were a science, why didn’t that result in the market moving down instead of up? If something is scientifically provable, then it ought to be able to be reproduced repeatedly with the same results. If markets and trading were scientific, you ought to be able to obtain the same results every time you see a particular market pattern. But it just isn’t so! If it were, you could enter the trading profession and memorize all the major price patterns made by markets. You would then know exactly what to do in every case. You would have learned a job, and the pay for trading would be like most other paying jobs – low.

A similar observation can be made about theories. A theory is a theory until it becomes a fact. A fact is a fact because it is a result that can be proved repeatedly. A fact becomes fact when the result of something is always the same. If you jump out of an airplane, you’re going to fall – fact. If you slide down a forty foot razor blade...well you know! So why have we never seen an Elliott Wave fact? Because seemingly, no two people can agree on which wave they are in until after the fact!!

Many artists train and study with and under great artists, but to become successful on their own, they have to develop their own style based on their own perception of the world around them.

Musicians study under musicians having greater knowledge, experience, and maturity than themselves. But before they, too, can become proficient or achieve a level of greatness, they have to interpret music from their own perception of what they see and hear.

Not every trader is destined to be a great one. You should be the last one to ever consider yourself to be a great trader. Your success in trading will be derived from becoming proficient in the discipline of perceiving markets for what they really are and how they really work.

Classical Trading Patterns

We would have to guess that one of the first attempts at a scientific approach to the markets was that of pattern recognition. Pattern recognition has come full circle. It went out of vogue many years ago and now is back via the route of computer generated pattern recognition. The old-timers did a lot of their trading from these patterns, and maybe some still do: heads and shoulders, ascending and descending triangles, flags, pennants, coils etc. Do they work? Yes and no! You see, it is all a matter of perception. There were rules about how to trade these patterns. We can tell you this, they will work for you if you know when they are telling you the truth, and when to discard them as worthless.

Remember the heads and shoulders pattern we showed you on the previous page? The fact of real demand removed any semblance of reality for the heads and shoulders pattern – heads and shoulders tops are supposed to go down!

Nevertheless, an understanding of what is behind classic chart patterns will help to make you a better trader.

Classic Price Patterns

Assume prices trade within a relatively narrow Trading Range (between points “A” and “B” on the chart).

Recognizing the sideways price movement, the ‘longs’ might buy additional contracts if the price advances above the recent Trading Range. They may even enter orders to buy at “B,” to add to their position if they should get some confirmation the trend is higher. But by the same token, recognizing prices might decline below the recent Trading Range and move lower, they might also enter sell orders below the market at “A” to limit their loss.

The ‘shorts’ have exactly the opposite reaction to prices. If the price advances above the recent Trading Range, many of them might enter orders to buy above point “B” to limit losses. But they, too, may add to their position if the price should decline below point “A” with orders to sell short at some point below point “A.”

A third group is not in the market, but they are watching it for a signal either to go long or short. This group may have orders to buy above point “B,” because presumably the price trend would begin to indicate an upward bias if point “B” were penetrated. They may also enter orders to sell below point “A” for converse reasons.

Assume the market advances to point “C.” If the Trading Range between points “A” and “B” has been relatively narrow and the time period of the lateral movement relatively long, the accumulated buy orders above the market could be quite numerous. Also, as the market breaks above point “B,” the result is a stream of market orders to buy. As this flurry of buyers becomes satisfied and profit-taking from previous long positions causes the market to dip from the high point of “C” to point “D,” another distinct attitude begins working in the market.

Part of the first group that went long between points “A” and “B” did not buy additional contracts as the market rallied to point “C.” Now they may be willing to add to their position ‘on a dip.’ Consequently, buy orders trickle in from these traders as prices drift down.

The second group of traders with short positions established in the original Trading Range have now seen prices advance to point C, then decline to move back closer to the price at which they originally sold short. If they did not cover their short positions with a buy order above point “B,” they may be more than willing to cover on any further dip to minimize the loss.

Those not yet in the market will place price orders just below the market with the idea of ‘getting in on a dip.’

The net effect of the rally from “A” to “C” is a psychological change in all three groups. The result is a different tone to the market, where some support could be expected from all three groups on dips. (Support on a chart is defined as the place where buying brings sufficient demand to halt a decline in prices.) As this support is strengthened by an increase in market orders and a raising of buy orders, the market once again advances toward point “C.” Then, as the market gathers momentum and rallies above point “C” toward point “E,” the psychology again changes subtly.

The first group of long traders may now have enough profit to pyramid additional contracts with their profits. In any case, as the market advances, their enthusiasm grows and they set their sights on higher price objectives. Psychologically, they have the market advantage.

The original group who sold short between “A” and “B” and who have not yet covered are all carrying increasing losses. Their general attitude is negative because they are losing money and confidence. Their hopes fade as their losses mount. Some of this group begin liquidating their short positions either with stops or market orders. Some reverse their position and go long.

The group which has still not entered the market – either because their orders to buy the market were never reached or because they had hesitated to see whether the market was actually moving higher – begins to "buy at the market".

Remember that even if a number of traders have not entered the market because of hesitation, their attitude is still bullish. And perhaps they are even kicking themselves for not getting in earlier. As for those who sold out previously-established long positions at a profit only to see the market move still higher, their attitude still favors the long side. They may also be among those who are looking to buy on any further dip.

So, with each dip the market should find the support of: 1) traders with long positions who are adding to their positions; 2) traders who are short the market and want to buy back their shorts if the market will only “back down some;” and 3) new traders without a position in the market who want to get aboard what they consider a full-fledged bull market.

This rationale results in price action that features one prominent high after another, and each prominent reactionary low is higher than the previous low. In a broad sense, it should appear as an upward series of waves of successively higher highs and higher lows.

But at some point the psychology again subtly shifts. The first group with long positions and fat profits is no longer willing to add to its positions. In fact, they are looking for a place to “take profits.” The second group of battered traders with short positions has really been worn down to a nub of die-hard shorts who absolutely refuse to cover their short positions. They are no longer a supporting element, eagerly waiting to buy the market on dips.

The third group of those who never quite get aboard the up-move become unwilling to buy because they feel the greatest part of the upside move has been missed. They consider the risk on the downside too great when compared to the now-limited upside potential. In fact, they may be looking for a place to “short the market and ride it back down.”

When the market demonstrates a noticeable lack of support on a dip that “carries too far to be bullish,” this is the first signal of a reversal in psychology. The decline from point “I” to point “J” is the classic example of such a dip. This decline signals a new tone to the market.

The support on dips becomes resistance on rallies, and a more two-sided market action develops. (Resistance is the opposite of support. Resistance on a chart is the price level where selling pressure is expected to stop advances and possibly turn prices lower.)

The Downturn

Now the picture has changed. As prices begin to advance from point “J” to point “K,” traders with previously-established long positions take profits by selling out. Most of the hard-nosed traders with short positions have covered their shorts, so they add no significant new buying impetus to the market. In fact, having witnessed the recent long(er) decline, they may be adding to their short positions.

If the rally back toward the highs fails to establish new highs, this failure is quickly noticed by professional traders as a signal the bull market has run its course. This is even more true if the rally carries only up to the approximate level of the rally top at point “G.”

As profit-taking and new short-selling forces the market to decline from point “K,” the next critical point is the reactionary low point at “J.” A major bear signal is flashed if the market penetrates this prominent low (support) following an abortive attempt to establish new highs in prices. In the vernacular of chartists, a head-and-shoulders reversal pattern has been completed. But rather than simply explaining away price patterns with names, it is important to understand how the psychology of the market action at different points causes the market to respond as it does. It also explains why certain points are quite significant.

In a bear market, the attitudes of the traders would be reversed. Each decline would find the bears more confident and prosperous and the bulls more depressed and threadbare. With the psychology diametrically opposite, the pattern completely reverses itself to form a series of lower highs and lower lows.

But at some point, the bears become unwilling to add to their previously-established short positions. Those who were already long the market and had refused to sell higher would eventually be reduced to a hard core of traders who had their jaws set and refused to sell out. Traders not in the market who were perhaps unsuccessfully attempting to short the market at higher levels will begin to find the long side of the market more attractive. The first rally that “carries too high to be bearish” signals another possible trend reversal.

With this basic understanding of market psychology through three phases of a market, a trader is better equipped to appreciate the significance of all chart price patterns.

No one expects to establish short positions at the high or long positions at the low, but development of a feel for market psychology is the beginning of the quest for trades that even hindsight could not improve upon.

When you analyze charts, approach them with the idea that they reflect human ideas about prices that are the result and the struggle between supply and demand forces. Your attitude and ability to judge market psychology will determine your success at chart analysis. Unexpected occurrences can change price trends abruptly, and without warning. Also, some of the chart formations may be hard to visualize, you’ll sometimes need a good imagination as well.

MEMORIZE THESE THREE PHASE SCENARIOS – EVERY TRADER SHOULD BE ABLE TO RECITE IT FROM MEMORY!!

This concludes our free trading lesson series by Joe Ross. We thank you for investing in yourself by broadening your trading knowledge.

The correspondence sent by trading educators is intended to help teach you how to trade, improve your trading skills, or both. As you continue to receive our weekly emails, there may be sections which are difficult to understand upon first reading. Our material and concepts are meant to be studied, and studied multiple times. Many traders may not be able to grasp these with just a cursory reading of the text. Feel free to email us with questions and check our blog.

Chart Scan Newsletter is delivered to your inbox every Friday. Happy studying!

Joe Ross wants you to succeed! Check out our many products that Trading Educators has to offer. Our most popular resource that our students take advantage is Private Mentoring. Accelerate your trading knowledge and work one-on-one with the trader of your choice. Click here for more information and book your session today!

Thoughts on managing money.

We often hear from students who greatly desire to trade managed money. At the opposite end of the spectrum, we also hear from students who want money managed for them. In either case, the experience can be gut-wrenching.

In both scenarios, this lesson should be a warning and caution to you. What I am going to share with you is based upon my own experiences. This lesson could be entitled “Confessions of a Trader.”

The psychological basis for successful trading is indeed a delicate subject. We have never heard of anyone who has been able to pinpoint exactly what it is that gives one trader success while another trader fails. Although some claim to have done this, coming up with an attribute profile of the “average” winner, no one we know of has identified a set of common denominators among professional winning traders. Besides, which of us is “average?” Is it you?

Winning in the markets seems to involve a fine balance of traits that differ among winning traders. To make the identification of winning traders even more complicated, there seems to be a distinction between those traders who can successfully trade their own money, and those traders who can successfully trade the money of others. I have met both.

Two of the most successful money managers I know personally began by trading managed money. They began trading other people's money for lack of sufficient money of their own with which to trade. Later in their careers, when they did have sufficient money with which to trade their own account, they found that they failed miserably. They were not able to trade their own money with any degree of success. More than that, when they traded their own money simultaneously with trading managed money, they failed at both.

Upon further investigation, and after speaking with a number of traders who have tried both, I discovered that there are many traders who are successful at trading managed money, but who can't trade their way out of their hat when trying to trade their own money. Invariably, upon further probing, some admitted that they were much more daring and courageous with other people's money than they were when the money was their own.

Also in this group of those who trade better for others than themselves, I have been able to identify traders who said they were much more careful and conservative with the money of others than they were with money of their own.

Within this group of traders, all of them students of ours who can successfully trade managed money, some are successful because they are more daring with other people’s money, and some are successful because they are more careful with money not their own.

Next, we come to those traders who successfully manage their own money and who have attempted to manage money for others, but failed.

I have heard from quite a few traders who attempted to manage money for others. In this group I include those who have failed miserably. I have spoken with a number of students who have had the experience of losing at least half of the money under their management prior to returning the balance to those who invested with them. Amazingly, the answers are the same as with the group who successfully manage money. Managed money seems to be a “monkey” on their backs. They find that they trade too carefully, too conservatively, when the money is not their own. Worse than that, when things go wrong with a trade, they do not act as rationally and with the same cool determination as they do with their own money. When they trade their own account, they do not think of it as money. When they trade someone else's account, all they can think of is that it is money. And, because it is not their own, they try their hardest to not lose it. Unfortunately, experience shows that what they fear the most happens – they do lose the money.

I have spoken with students who successfully manage their own money because they are more careful with their own than with the money of others. They, too, have failed with managed money, and have resigned themselves to trading only their own accounts.

Among these students and acquaintances, I have identified at least four categories of traders who attempt to manage money. I’m sure there are other categories, but these are the ones I've found:

- Those who successfully manage money for others, but cannot manage their own account with any great degree of success, because they are too careful with their own money while they are more daring with the money of others.

- Those who successfully manage money for others, but cannot manage their own account with any great degree of success, because they are too daring with their own money while they are more careful with the money of others.

- Those who successfully manage their own money, but fail with managed money because they are too careful when managing money for others.

- Those who successfully manage their own money, but fail with managed money because they are too daring when managing money for others.

Among these students, I found none who successfully traded both managed accounts and their own accounts. The size of the population for this study was too small to come up with any meaningful statistics, but there are some warnings and cautions that can be concluded:

To those of you who want to have your money managed, be aware that the individual success of any trader trading his/her own money is no guarantee that that person can successfully manage the money of others. Be sure to place your managed money with a trader who has proven to be a successful manager of other people’s money.

To those of you who want to manage money for others, be aware that successfully trading your own account is no guarantee that you will be able to successfully trade the account of others.

Be very careful, because in both of these situations the result can be great personal pain. Failure in either of these situations is painful for all concerned! In fact, the pain can be so great as to prematurely end the trading hopes of either party. The pain may be both physical and mental, and can cause you to abort your trading career. I feel it is my duty to caution you about getting involved with managed money, whether you try to manage the money of others, or whether you want someone else to manage yours. The costs can be horrendous.

Interestingly, most of my students come to me relating that the reason they want to learn how to trade is so they can become independent and not have to work at a regular job. The responsibility of trading managed money can really wear you down. You may have to go for years without a vacation. You find yourself working late into the night, and working a significant portion of the weekends. All work and no play is not a good thing for your trading career. Managing other people’s trades, using their money, is one of the most grueling jobs you can ever undertake.

If you currently are or have been contemplating this side of trading, I hope you’ve taken my thoughts to heart, and received some insight about managing trading money.

This concludes our trading lesson for today. We thank you for investing in yourself by broadening your trading knowledge. Be on the lookout for tomorrow's lesson!

The correspondence sent by trading educators is intended to help teach you how to trade, improve your trading skills, or both. As you continue to receive our weekly emails, there may be sections which are difficult to understand upon first reading. Our material and concepts are meant to be studied, and studied multiple times. Many traders may not be able to grasp these with just a cursory reading of the text. Feel free to email us with questions and check our blog.

Check out our eBooks - Let Joe teach and explain trading.

Chart Scan Newsletter is delivered to your inbox every Friday. Happy studying!

Many traders run into the following situation quite often. See if it has been happening to you:

You have been faithfully following your trading plan and the rules you've set for trading. By following them you are now in a trade that doesn't look so good. At the same time, by following your trading plan, you see that you've missed a beautiful move in a different market, one that could have made you a lot of money.

You are in a bad trade, and you've missed out on a great trade. You become disgruntled. You think to yourself that your trading plan must not be perfect. You think there must be a better methodology that you should use that will prevent this from happening. You think to yourself, “Yes! That's it! I'll change the way I do things.” You create a new rule, or modify an old one, so that such a rule would have let you capture the trade you missed, and avoid the one you took. Have you been making this mistake?

Here's another way it can happen: You are in a trade, and your rules cause you to be stopped out with little or no profit. Shortly after you exit the trade according to plan, prices take off and move to where, had you stayed in, you would have made substantial profits. The move leaves you sitting there thinking you are stupid. You reason that there must be something wrong with the way you do things.

Your rules, your plan, or both, must not be right. You change what you are doing, or make a new rule, so that the next time this happens you won't be left behind.

You have just abandoned all your previous hard work that enabled you to trade successfully. You've ignored your education and learning. You've disregarded the wisdom that will enable you to be consistently successful as a trader. You've just started trading history, and you are supposed to be trading on the future movement of prices. You are trading what happened, not what will happen. By not being willing to be left behind, you are setting yourself up for being left out.

If you've been having thoughts, or have been acting as we've just described, you have a terrible problem with greed. Why is it problem? Because greed can never get enough. You can't satisfy greed. Greed wants more, and yet more.

Not every trade is your trade. Not every trade has to work out for you. You have to be satisfied with getting a reasonable share of trades that fit your description of a good trade. Some of those trades will turn out to be great trades, others are good trades, and a certain percentage of your trades will end up bad. There's no way around it.

Not every good trade will turn into a great trade. When you enter a trade according to your rules and trading plan, you have no idea whether or not it will turn out to be a good trade, much less a great trade. The reality of trading is that, try as you might, you cannot know the future.

Whenever we miss a big move and then try to find some pattern, indicator, rationale, or modification to make what we are doing so that the next time we will not miss the “big” move, it is a part of the hunt for something magic ¾ a continuation of our quest for “the holy grail of trading”.

What a terrible mistake to allow yourself to make. Winning as a trader consists of making some small profits and some larger profits on a regular basis. Obviously, there will be some losses. Our goal is to keep losses small, but there are times when a loss will get away from us and turn out to be bigger than desired.

If adversity causes you to become disgruntled, then you really need to examine your thinking and your approach to trading. Your trading plan must allow for disappointment and loss.

You've got to believe in what you are doing, and be able to trade from the knowledge that when you follow your rules and your plan, you will make money from your trading.

When you become disgruntled and begin to change your plan, your rules, or both, you are setting yourself up for almost certain failure, and the worst thing that can happen to a trader ¾ you will lose the courage of your convictions. Without it, you cannot trade with any level of confidence.