Trading Educators Blog

When I began trading, no one had ever heard of such a thing as "swing trading." Swing trading, as I recall, began when more and more people had the ability to day trade from a PC. In this issue of Chart Scan, I'm going to provide you with some swing trading help that you need when just starting out. If you follow these rules you will avoid a great majority of mistakes made by beginners. Swing Trad...

Hey Joe! How can I get a feel for what's happening in the market? One of the things that has helped me was beginning to use tick charts for my day trading. In a past issue of Chart Scan, I explained that there are two kinds of volume: Contract Volume and Tick Volume. Almost everyone is familiar with contract volume. It's usually shown as a histogram at the bottom of a price chart. For a given time...

Hey Joe! You've said that prices are not always moved by supply and demand; That they are heavily manipulated in some cases. We know that they intentionally run the stops, but what else do they do? Besides intentional stop running, those who have the power to move prices often resort to other dirty tricks. This may be more-true of stocks and Forex than of futures, but I believe all of the tricks b...

Hey Joe! Have you ever traded the Gold/Silver Ratio? How do you go about doing it? I think I traded the ratio a couple of times. It's not something I pay a lot of attention to. Here's some background about this ratio: According to a Mocatta Metals Corporation article, as of April 1980, when the price ratio of one ounce of gold to one ounce of sliver approaches 40:1 gold should be sold and silver b...

During the years I've been in the markets, I have been trained by two super-disciplinarians. One was my great uncle, Julius, and the other was John Wooden. Both emphasized extreme discipline and both told me to be all I can be, which for me was not a great outlook. Having been dyslexic all my life, I grew up with an inferiority complex. My dyslexia was very much present in the area of numbers and ...

Hi Joe, I've attended some time ago the IIG webinar and it opens my eyes to the advantages of selling options. But I've found a lot of webpages on the internet where are listed the many benefits of selling Commodity options instead of Stock options (higher return, lower margin requirements, more liquidity, more premium far OTM..) In the IIG webpage on your website is written: "In 2007, we began to...

Lately, we've been hearing a lot about an Inverted Yield Curve. What is it, and what does it mean? Yield curve inversion signals late phases of bull market rally. The market's "melt-up" phase is coming. Some of the best gains lie ahead. Canaccord Genuity's Tony Dwyer is known for being incredibly prescient regarding his market calls. As a result, many Wall Street asset managers listen to whatever ...

If you are unfamiliar with the term, insider buying refers to when insiders of a company - such as CEOs or directors - purchase shares of company stock on the public market or via private placement. Sometimes, the purchase may be the result of a stock option exercise, but often they are public market transactions. Insider buying typically means that the insider is bullish on the company's stock; t...

I never knew so much about the VIX until I looked it up and began investigating its value. There are many popular and simple ways that options are used to gauge the sentiment of investors. They are used as contrary indicators. When at extreme levels, VIX calls Market Bottoms. VIX is extremely reliable. The CBOE (Chicago Board Options Exchange) Volatility Index – aka "the VIX" This indicator, known...

Oscillators tend to be somewhat misunderstood in the trading industry, despite their close association with the all-important concept of momentum. At its most fundamental level, momentum is actually a means of assessing the relative levels of greed or fear in the market at a given point in time. Markets ebb and flow, surge and retreat—the speed of such movement is measured by oscillators. An oscil...

Short-term Pullbacks provide opportunities to enter trades in the direction of the longer-term trend. Trade set-ups like these occur against short-term momentum (the pullback) but are in alignment with the longer-term trend and typically offer high probability and low risk trade ideas with a 2:1 (or better) reward-to-risk ratio. A great way to trade short-term pullbacks is to use a moving average....

Swing Traders tend to spend longer monitoring markets and considering trading opportunities than day traders. Swing traders utilize chart, fundamental, and technical analysis in their considerations. Since swing trading does not require hours of daily monitoring, it's a good strategy for traders who wish to explore trading without treating it as a full-time job. Of course, intraday charts also inv...

Swing Low is a term used in technical analysis that refers to the troughs reached by a security's price or an indicator. A swing low is created when a low is lower than any other surrounding prices. Successively lower swing lows indicate that the underlying security is in a downtrend, while higher lows signal an uptrend. A swing low's opposite counterpart is a swing high. Swing low can be effectiv...

A Double Bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. It describes the drop of a stock or index, a rebound, a drop to the same or similar level as the original drop, and finally another rebound. The double bottom looks like the letter "W". The twice-touched low is considered a support level. \/\/ D...

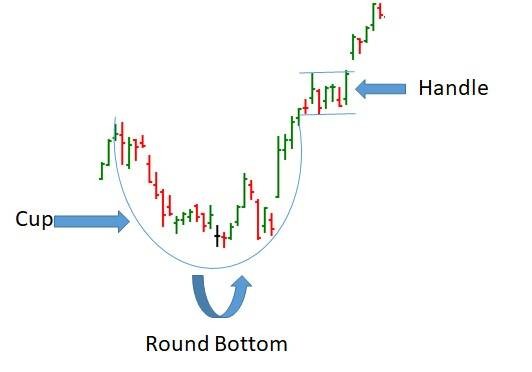

The cup and handle is a great trading pattern that works well with different time frames and with most markets like stocks, futures, commodities and foreign currency markets. Here's what it means, how to trade it, and tips to use it for potentially bigger profits. The Cup and Handle pattern is a bullish continuation pattern that begins with a consolidation period followed by a breakout. The patter...

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. It is primarily used to attempt to identify overbought or oversold conditions in the trading of an asset. Traditional interpretation and usage of the RSI is that RSI values of 70 or above indicate that a security is becoming overbought or overv...

The Squeeze is the central concept of Bollinger Bands. When the bands come close together, constricting the moving average, it is called a squeeze. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. Conversely, the wider apart the bands move, the more likely the chance of a decrease in ...

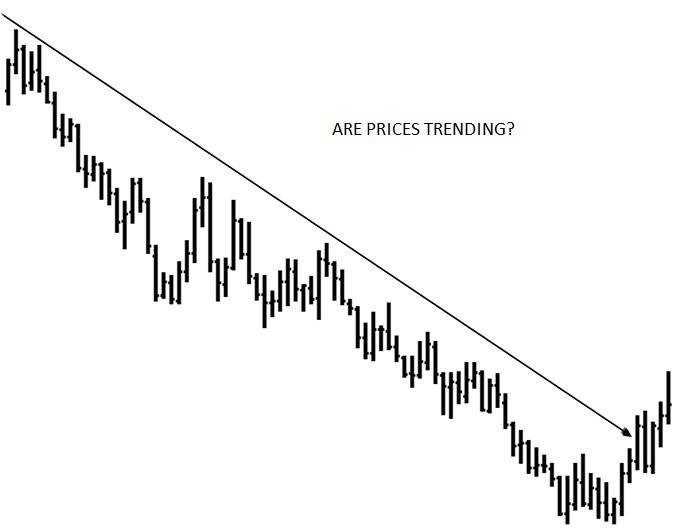

Trend Trading is a trading strategy that attempts to capture gains through an analysis of the momentum of prices in a particular direction. Trend traders enter into a long position when a security is trending upward (e.g. successively higher highs) and/or enter a short position when a security is trending lower (e.g. successively lower highs). Higher highs and lower lows is about as basic a defini...

Volume is the number of contracts or shares bought and sold each day in any given financial, commodity, index or currency instrument. High volume suggests that there is a heightened interest in the financial instrument, and if it is combined with a move higher in share price, then it is often used as a signal of strong upward momentum. Keeping an eye on volume will ensure that you are on the right...

"Hey Joe! I'm pretty new at this. Can you tell me the rules for buy and sell stops?" When the market trades above a buy stop price order, it becomes a market order. The first down tick after the market order price is activated determines the highest price at which the buy stop order may be filled. The rule to remember placing stops is this, "Buy above and sell below." Buy stops are placed above th...