Trading Educators Blog

One of the questions every trader has to think about at some point is, how much of my account should I risk per trade? A percentage? If so, what percentage? I’d love to have the right answer in my pocket for you, like "exactly 1.25% per trade/market and no more than 5% at the same time," but unfortunately, I don’t. Again I know you don’t want to waste too much time with this bo...

Not many traders are familiar with futures spread trading. Even fewer traders understand multi-leg spreads. However, trading these types of spreads is as easy as trading an outright futures contract. Below is a 3-leg butterfly spread in Lean Hogs that we recently closed out in Traders Notebook: short one contract in June and in August, 2016, and long 2 contracts in July, 2016. The blue line on the...

I just uploaded Episode 3 of my Questions & Answers Series to YouTube. It covers questions on the usefulness of demo-trading and on trading 123 formations. In the last part I talk about why I developed my own python-based backtesting platform which is probably only interesting for those of you who're hardcore into system-development. So if you're not, just stop there ;)

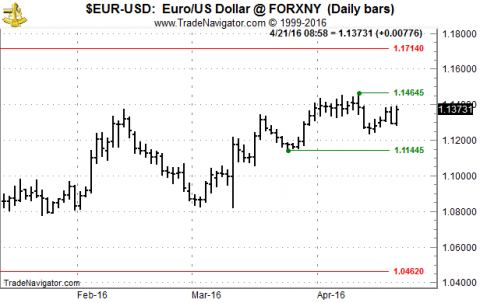

The last I did a post about what's going on in EUR/USD and that it's unlikely we'll see a significant move unless the pair breaks out of it's established range. Now that finally happened and the Euro is on a strong run for a few days now already. Now what to do? If you're already long, should you keep on holding the position? If you're not in the trade already, should you still buy at the market? ...

About a year ago I wrote an article about measuring performance where I explained the concept of measuring trading performance in Rs instead of $s. Everyone who trades for a while quickly realizes that $s don't really say too much about performance. You made $10? Maybe great. You made $50.000? Maybe not so good. The question always is in relation to what? What account size does the t...

You alone determine whether you will succeed or fail at trading. You alone are in control; take responsibility for your performance and your life. There are always tremendous opportunities in the markets. It is not what happens; it is what you do with what happens that makes the difference between profit and loss. However, you cannot marry a market or a single trading style. You have to look. Look...

As you can see on the chart below, the 90000 level is an important one. It was a clear resistance level in February and March of this year and could now work as support. I'd try to buy the June Japanese Yen one tick above today's high using the TTE with a first target at around 90470 with the idea of a possible 1-2-3 low. I would risk about $300/contract on the trade. Update 04/28, 6 AM CT: The Ja...

There seems to be a massive obsession out there among traders about the EUR/USD, what's going on with it, where it's going and why. Whenever I go on twitter or Facebook or any of the financial news pages, I find at least a couple of posts on what's going on in that market, usually with some bogus comment on why. Classic one would be "EUR/USD moves higher after breaking through 1.1350" or "EUR/USD ...

The second Episode of my Q&A Series is uploaded to YouTube. I only managed to answer two questions this time, so I probably should be a bit briefer in the future... Topics are disciplined trading and the lifetime of trading methods, and how to decide when to stop trading them. Enjoy!

"I review my checklist. It’s a handwritten sheet laminated in plastic and taped to the right-hand corner of my desk where I can’t overlook it. If you have a game plan prepared ahead of time, it can help you find courage in the heat of the battle.” - Marty Schwartz Yes, I also have a checklist and I look at it every day. On my checklist you can find reminders like “trade onl...

Hi Trader, now this has been a quite volatile week so far in many markets and I hope you've also been able to capture some nice profits out of these wild moves! Thanks to my trading being almost completely systematic right now I still had a few minutes to record a new video for YouTube and actually start of a new Series. In the first one I explain what a BID/ASK spread is for those of you who're c...

“Michael Marcus taught me one other thing that is absolutely critical: You have to be willing to make mistakes regularly; there is nothing wrong with it. Michael taught me about making your best judgment, being wrong, making your next best judgment, being wrong, making your third best judgment, and then doubling your money.” – Bruce Kovner This is an immense important quote from Bruce Kovner. This...

I have received the following question: I assume the Ross Hook (RH) and Traders Trick Entry (TTE) are applicable in whatever time frame the trader uses. However, there are some time frames that are simply too erratic or wild to trade. And pertaining to stop running, there must be some that are favorites of those attempting to do so. So is there a recommended time interval from which to trade, or i...

Richard Wyckoff wrote: “My stop was moved down so there couldn't be a loss, and soon a slight rally and another break gave me a new stop, which insured a profit, come what might… I strongly advocate this method of profit insuring. The scientific elimination of loss is one of the most important factors in the art, and the operator who fails to properly protect his paper profits will find that many ...

Richard Wyckoff wrote in his book "Studies in tape reading": Successful tape reading requires ability to judge which side has the greatest pulling power and one must have the courage to go with that side. There are critical points which occur in each swing, just as in life of a business or of an individual. At these junctures it seems as though a feather's weight on either side would determine the...

I hope so since thanks to Ambush we're short the USD across the board today. Entry in the Euro FX Future for example was at 1.11825 around the low of the day.