Edition 1024

April 19, 2024

Learn the Art of Trading Joe Ross' Way!

"Trading is tough, but I'm tougher." -- Master Trader Joe Ross

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: What are Oscillators?

Lots of traders use oscillators, also known as indicators. Lately, I’ve been showing you ways of viewing the containment of prices. All these ways have been based on moving averages.

However, moving averages are also used to create oscillators. Most of the studies we call indicators are nothing more than oscillators, which, in turn, are nothing more than detrended moving averages. They also suffer from the same weaknesses as moving averages in that they are subject to a guess as to how many bars or candles to include in the moving average, and to a lesser degree, which kind of moving average to use.

In my book "Trading the Ross Hook," I showed several ways my students are using indicators. But I also included a chapter about "Plain Vanilla" trading - trading without indicators of any kind - something I still do to this day. In fact, most of my trading is done without indicators.

Nevertheless, an indicator can be helpful in certain situations. If the price action is taken as the primary reason for a trade, that price action can often be confirmed by using an oscillator. (From this point on, "oscillator" and "indicator" will be synonymous).

Most oscillators are nothing more than detrended moving averages, and they pretty much measure the same thing - momentum. MACD, Stochastics, RSI, %R, DEMA, and others, are all momentum indicators. The differences are in how they are calculated based on an underlying detrended moving average.

The moving average can be simple, exponential, or in some way weighted, but it is still a moving average, and it still has the same weaknesses — how many bars to use, and which type of moving average to use.

Note: A displaced moving average oscillator, DPO, is not a momentum indicator.

Oscillators have a problem associated with them which complicates matters, and that problem is how they should oscillate: should they oscillate on a fixed scale? or on no scale at all? with no limit as to how high they can rise, or how low they can fall?

The indicator known as CCI (Commodity Channel Index) oscillates with no limit as to how high or low it can go. However, CCI is primarily a volatility indicator. The creator of CCI, a fellow named "Lambert," placed it so that it displays as an oscillator. He could just as easily have placed it so that it displayed along with prices, much as do Bollinger Bands.

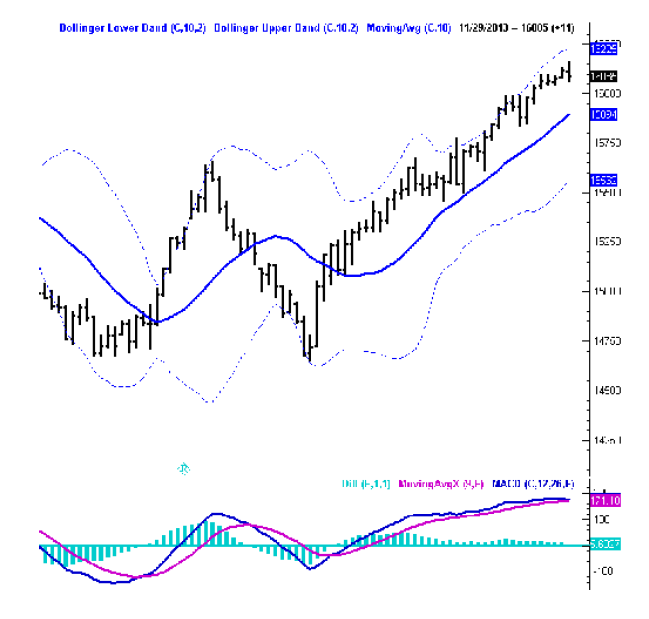

Notice the difference between Bollinger Bands and CCI:

BBs are computed as the Standard Deviation of today’s close relative to a moving average of closes.

CCIs are computed as the Mean Deviation of today’s typical price relative to a moving average of typical prices. (Typical price can be the high plus the low, divided by 2; the high plus the low plus the close, divided by 3; or the high plus the low, plus the close, plus the open, divided by 4).

Plotted in the same way as BBs, CCI would produce something quite similar to a BB display. Conversely, BBs, if plotted as an oscillator, would produce a display quite similar to that of CCI.

One of the most inane things we see at Trading Educators is confirmation of one momentum indicator by another momentum indicator. Traders will put up a Stochastic, an RSI, and a %R, and excitedly proclaim that they are in agreement, therefore a signal to trade is in existence. Excuse my rant, but they are all momentum indicators. They are supposed to agree.

In order to achieve any kind of confirmation value from multiple indicators, use a momentum indicator in combination with a volatility indicator.

The chart below shows how a momentum indicator (MACD) combined with a Volatility indicator (BBs), can give confirmation for a move based on what a trader sees in the price action. The settings for both are standard settings. I marked a couple of places where price action was confirmed by the indicator combination. I’ll leave the rest up to you.

If you want to see how we trade a combination of Stochastics with Bollinger Bands, along with the appropriate settings, learn this and more with "Trading with More Special Setups" Recorded Webinar.

© by Joe Ross, first release 2014. Re-transmission or production of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Don't Overdo It

If you're like most traders, you are in this business to make money big money. In all probability, you are ambitious, independent minded, and ready to take on the world. With this ambition usually comes a need to be the best.

Only the people at the top of the field achieve the highest level of success. Although striving for expertise is a prerequisite for success, it usually coincides with a need to be perfect, and a fear of failure. If you are too much of a perfectionist, you may fear being wrong, losing money, or missing an important trading opportunity. Ironically, if you strive for extreme perfectionism, you may choke under the...read more.

© by Joe Ross first release 2005. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Extended Sale with Joe Ross' Ocillators Article!

Use coupon code "tmss35" during checkout.

35% Off Savings!

Trading with MORE Special Set-Ups

This newsletter and future publications are created to keep Master Trader Joe Ross' lessons readily available to traders that want to learn and improve their skills and to show his written word is still very relevant in today's trading world. He passed away on September 7, 2021 and will be greatly missed, but his writings will stand the test of time for generations to come. Take it to heart and learn from the best through Joe Ross' trading examples and articles which have impacted thousands of traders on every continent for over 60 years. Enjoy and let's start learning the art of trading Joe Ross' way.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, and Day Trading, and Editor for 20+ years with Traders Notebook, daily advisory newsletter.

Forge Your Path in Options Trading

This is an opportune time to re-calibrate our strategies in the options market. Don't just follow trends, but to understand and apply a strategic approach that aligns with your goals.

Reflecting on past performance, like the growth trajectory represented in my trading graph, provides valuable insights. These results, marked by a commendable win/loss ratio and net profits, illustrate the potential of a disciplined approach. Yet, it’s crucial to remember that past results are not necessarily indicative of future performance. Every year is a new chapter in the market’s story, and 2024 is no exception.

With that in mind, my mentorship program is designed to equip you with the tools and mindset for making informed decisions, grounded in a methodology that has been refined over time. In a year where many traders are seeking direction, I offer the lessons drawn from experience to help chart a course that’s uniquely yours.

As we look ahead, let's collaborate to develop a strategy that takes into account the lessons from the past while forging ahead with fresh, educated trades. Your journey through the options market this year can begin with a conversation about where you are, where you want to be, and how we can get there together.

Embrace 2024 with the readiness to learn, adapt, and grow. Let's build your success story in trading, one informed decision at a time.

If you’re ready to take your options trading to the next level this year, I'm here to help. Reach out to me at This email address is being protected from spambots. You need JavaScript enabled to view it., and let's discuss how my mentoring can help you achieve your trading goals. Don't let another year pass by - let's make 2024 a year of strategic growth and success together.

Embracing Options: A Strategic Approach for Private Traders

As the financial markets evolve, private traders are continually seeking strategies that yield consistent returns while managing risk effectively. Options trading emerges as a powerful tool, offering a pathway to success that's distinct from traditional stock trading. Here's why options trading stands out as a superior choice for individual investors.

1. Superior Approach for Private Traders

Options trading is not just another investment strategy; it's a sophisticated method that, when understood and implemented correctly, can substantially increase a trader's profitability. Unlike direct stock trading, options provide strategic alternatives that private traders can use to their advantage, offering a blend of risk management and earning potential.

2. Evading the Pitfalls of Short-Term Trading

One of the significant hurdles in short-term stock trading is the intense competition against institutional traders equipped with supercomputers and real-time data. Options trading sidesteps this competition, offering a less frenetic environment where private traders can make calculated decisions without the need to outpace technological giants.

3. Freedom from Constant Monitoring

Trading options liberate investors from the need to monitor markets continuously. With the right strategies, such as selling premium options or setting up spreads, traders can set up their positions and manage risk without the need to watch every market tick. This aspect makes options an ideal choice for individuals seeking a balance between their investment activities and personal life.

4. Scalability for Every Investor

Whether starting with a modest sum or looking to manage a substantial portfolio, options trading is scalable to your needs. It allows traders to start small and grow their investment gradually or to employ large capital when appropriate strategies and risk management techniques are in place.

5. Diversification Through Strategy

Options provide a diverse range of strategies. Traders can hedge against market downturns, bet on market stability, or leverage market upswings. This versatility is a significant advantage, allowing traders to adapt to various market conditions.

6. Flexibility in Market Conditions

Options trading is not bound to bullish markets. Whether the market is up, down, or sideways, options strategies can be tailored to exploit these conditions, making them a versatile tool for all seasons.

7. Leverage Without Overcommitting Funds

Options trading allows for leverage, enabling traders to control a larger position with a smaller initial investment. This leverage can lead to significant returns, but it's crucial to understand and manage the accompanying risks.

Conclusion

Options trading is not just another investment avenue; it's a strategic, flexible, and scalable approach to market participation. It offers private traders a way to navigate the financial markets with a robust set of tools tailored to their risk tolerance and investment goals. By understanding and leveraging the intrinsic benefits of options trading, private traders can open doors to diversified, strategic, and potentially more profitable investing.

Ready to unlock the potential of options trading? Join me for personalized mentoring where I'll share the strategies and insights that have led to my success. Whether you're starting out or looking to refine your approach, let's navigate the path to profitable trading together. Reach out to me at This email address is being protected from spambots. You need JavaScript enabled to view it. to start your journey today!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush-Signals.com Launched in 2016 - Still Going Strong

Marco Mayer announced in 2016 a new AlgoStrats service was launched: Ambush Signals for Futures. This is how it all got started....read more.

by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Ambush Trading System was created in 2009 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Even though Master Trader Joe Ross passed away September 7, 2021, his trading knowledge of over 60 years will carry a trading legacy and will live on. As you learn about Joe Ross and understand what he was trying to teach his students, you will find that within his writings, he had a very special gift. Most importantly, it was his students that kept him striving to provide comprehendable trading material to actually teach traders and become independent, to rely on anyone, but themselves.

Joe Ross has been trading and investing since his first trade at the age of 14, and is a well known Master Trader and Investor. He was able to survive all the up and downs of the markets because of his adaptable trading style, using a low-risk approach that produces consistent profits.

Joe Ross has written twelve major books and countless articles and essays about trading. All his books have become classics, and have been translated into many different languages. His students from around the world number in the thousands. His file of letters containing thanks and appreciation from students on every continent is huge: As one student, a successful trader, wrote: "Your mastery of teaching is even greater than my mastery of trading".

Joe Ross holds a Bachelor of Science degree in Business Administration from the University of California at Los Angeles. He did his Masters work in Computer Sciences at the George Washington University extension in Norfolk, Virginia. He is listed in "Who's Who in America." After 5 decades of trading and investing, Joe Ross still tutors, teaches, writes, and trades regularly. Joe is an active and integral part of Trading Educators. He is the founder and contributor of the company's newsletter Chart Scan™.

Learn the Art of Trading Joe Ross' Way!

"Trading is tough, but I'm tougher." -- Master Trader Joe Ross

Joe's philosophy for helping traders is:

"Teach our students the truth in trading - teach them how to trade."

and

"Give them a way to earn while they learn - realizing that it takes time to develop a successful trader."

Joe sets forth the mission of Trading Educators as follows:

To show aspiring futures traders the truth in trading by teaching them how to read a chart so that they can successfully trade what they see, and by revealing to them all of the insider knowledge they need in order to understand the markets.

To enable them to trade profitably by training them to properly manage their trades as well as their mindset and self-control.

To accomplish our mission for our students we educate them so that they know and understand:

Benefits for our Clients:

- Where prices are likely to move next.

- Independence from complicated trading methods, magic indicators, and black-box systems.

- Independence from opinion, anyone's opinion, including their own.

- Independence achieved through knowing how to read a chart.

- Independence through having knowledge of insider actions.

- Independence achieved by taking holistic and eclectic approaches.

- Independence coming from knowing how to manage both the trades and themselves.

- Independence because they understand and trade what they see.

- Independence because they have learned how and why prices move as they do, through studying the truth in trading and the truth about markets.

Students learn only proven methods and techniques, which helps them to preserve capital and create more consistent profits; they are offered simple methods that will assist them to earn while they learn.

- They learn to work smarter and more effectively.

- They learn to treat trading as a business; we offer no Holy Grail or magic systems.

- They learn to adapt to changing market conditions.

- They learn a systematic approach to trading rather than a mechanical system for trading.

- Why prices will move there.

- Who and what cause prices to move.

- How far prices are likely to move when they do move.

- Their own role in the movement of prices..

- How to take advantage of the knowledge they receive.

- How to properly manage and exit a trade which they have entered.

- How to manage themselves and acquire the discipline needed to become successful traders.

Read some personal testimonials which Joe has received.

WE APPRECIATE YOUR TRUST IN US AND THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please click on the "newsletter" button located at the top of our website.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2023 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

Dear Traders,

Master Trader Joe Ross passed away September 2021, and prior years he was continously sending me folders filled with Chart Scan and Trading Articles. The emails would be titled "More to follow" and I would reply, "Keep'em coming". I am calling these lessons "hidden vault" material because if Joe were still alive, this is exactly what would be shown in your inbox every Friday morning. This is not regurgitated material; this is new stuff written by Joe or as he would refer to it with such passion, "This is good stuff".

As we continue to receive newsletter sign ups, new students from every continent will start to learn trading Joe's way especially in this challenging market. This is where he would reinforce to his students, yes, that includes you, that learning to trade is possible even in this environment, "A chart, is a chart, is a chart". His writings will stand the test of time to provide teaching lessons and guidance.

The proceeds of Trading Educators will continue to support Joe's wife, Loretta, of 62 years of marriage, which she is our number one priority. We thank everyone with continued support and prayers for her well-being in late stages of dementia.

As expressed in the past editions, the trading world has lost a unique and passionate trader and his material will continue to be relevant. Let's start learning to trade Joe Ross' way with our future Chart Scan publications. I am here to help, so feel free to email me with any comments, questions or concerns.

This newsletter and future publications are created to keep Master Trader Joe Ross' lessons readily available to traders that want to learn and improve their skills. Our father passed away on September 7, 2021 and will be greatly missed, but his writings will stand the test of time for generations to come. Take it to heart and learn from the best through Master Trader Joe Ross' trading examples and articles which have impacted thousands of traders on every continent for over 60 years.

Happy trading,

Martha Ross-Edmunds

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent