Edition 708 - January 5, 2018

Chart Scan with Commentary - Wedges

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Once in a while I have a longing for the old “geometrical” ways of trading, which for some are still the best ways for trading. What I will show you incorporates the Law of Charts, but it does so while answering a question I received: “What is a bullish descending wedge pattern?” While I’m at it, I’ll show you a bearish ascending wedge.

As you can see in the first chart below, the wedge has grown increasingly narrow. Of course, where to begin drawing the wedge is somewhat in the eye of the beholder. I could have drawn the lower line from the May low (dotted line), and I could have gone way back to the high that occurred in November (not shown). I think you get the idea. The interesting thing is that as the wedge has narrowed, we see the beginning of what may turn out to be a 1-2-3 low. If I had room (I don’t’) I could also show you that from a technical point of view there is a rising trend line on MACD, indicating divergence.

The next chart below shows a narrowing rising wedge. Amazingly, prices have been trading at 300 times earnings! It stubbornly resisted the forces of gravity until just this week, when it formed a 1-2-3 high. Could we see more selling ahead? Could the descent be severe? It will be interesting to find out. But at least now you know what the old-timers called ascending and descending wedges. To make money out of these still requires good management. It is always challenging to see some traders make money from a trade while some traders lose money from the very same trade.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - It’s not the Money, It's the Challenge

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Why do you trade? Most people would think it's obvious. It's for the money, right? What many winning traders know, however, is that money is a poor motivator in the end. It's much more satisfying to pursue trading for the pure joy of mastering the markets, regardless of how much money you make. Winning traders are motivated more by the process of trading than by the profits they are making. It's common to hear traders say, "I love trading so much that I would do it for free if I had to." Indeed, when one looks into the backgrounds of top traders, the story seems to be the same: They all tried to get a job in the trading industry as soon as possible, any job as long as it involved trading in some way. The markets fascinated them. The money was either secondary or not an issue at all. Successful traders love the challenges the market offers and view their work as meaningful.

Consider what Ben, a successful trader, said about money to our TE staff, "Money doesn't make a person happy. Trading is what I do and I enjoy doing it. The money aspect of it is obviously cool and everybody wants that, but I don't know how to do anything else." Staying detached and apathetic towards money can help put you in the proper mindset. Curt, a successful winning trader wrote in to say, "One of the reasons I was successful was because money wasn't the reason I wanted to trade. Because the allure of money wasn't the reason I was trading, it was a lot easier for me to withstand the ups and downs of the market, and to execute without that affecting the way I was executing." When you aren't worried about the money, you can take a more carefree approach to trading. You feel that you don't have to win, and knowing you can make a mistake here and there allows you to relax and trade more creatively.

In modern society, we are pushed to make money. We think we need money, and see trading as a way to make a lot of it. Ironically, if you are focused only on the money, you will become disappointed and eventually fail. Pursuing trading as a passion is a more satisfying way to trade. It's more useful to focus on pursuing goals that are intrinsically interesting and personally meaningful. One should pursue trading because he or she enjoys the intellectual challenge. Market action is intrinsically interesting. It is a rewarding intellectual challenge to devise innovative new trading strategies and to see how well your ideas pan out, just for the fun of it. Viewing trading from this perspective can powerfully motivate you.

Whether it's art, sports, or business, the folks at the top are not primarily motivated by fame, glory, respect, or status. They are driven by the pure love of the game. Winning traders, similarly, have strong interests in the markets, and this passion is the driving force that puts them at the top, year after year. Those who find trading intrinsically satisfying, enjoyable, and meaningful will put in the necessary hard work and achieve high performance levels. So don't focus on the money and status that successful trading may bring. Enjoy the process of trading. Seek out challenges and the satisfaction of meeting them. You'll end up more profitable by doing so.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Trade with No Losses

WDC Trade

On 12th December 2017 we gave our Instant Income Guaranteed subscribers the following trade on Western Digital Corporation (WDC). Price insurance could be sold a few days later on temporary weakness:

-

On 15th December 2017, we sold to open WDC Jan 19 2018 72.5P @ 0.65$ (average price), with 34 days until expiration and our short strike about 11% below price action.

-

On 18th December 2017, we bought to close WDC Jan 19 2018 72.5P @ 0.25$, after 3 days in the trade for quick premium compounding.

Profit: 40$ per option

Margin: 1450$

Return on Margin annualized: 335.63%

Kind regards,

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

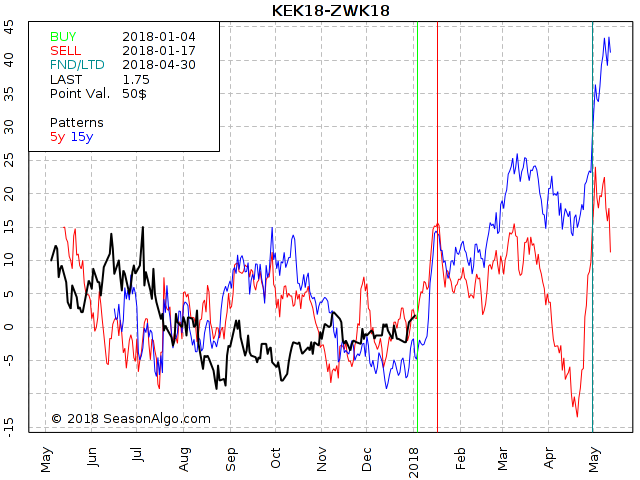

Trading Example: KEK18 – ZWK18

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

This week, we're looking at KEK18 – ZWK18: long May 2018 Kansas Wheat and short May 2018 Chicago Wheat (KCBT on Globex).

Today we consider a Wheat Inter-Market spread: long May 2018 Kansas Wheat and short May 2018 Chicago Wheat. This trade is simply based on the seasonal statistic. With 22 winning trades in a row it looks promising. This trade should work out immediately because the seasonal time window (01/04 – 01/17) is really small.

Learn how we manage this trade and how to get detailed trading instructions every day by subscribing to Traders Notebook!

Click Here!

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Trading Error: Averaging into a Losing Position

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco talks about one of the most common, and also one of the most deadly mistakes traders can make, and that's averaging into a losing position. He also gives you some insights as to why this is so tempting, and shows you why you should avoid it at all costs.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.