Edition 709 - January 12, 2018

~ Use Coupon Code During Checkout ~

newyear

Trading is a Business

Trading the Ross Hook

Life Index

Recorded Webinars:

The Law of Charts In-Depth

Traders Trick - Advanced Concepts

Blog Post - The "Now Trap"

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

There is a great attraction in all aspects of the modern age to immediacy. Likewise, most of the trouble in trading occurs through...read more.

Receive daily guidance from Andy Jordan! Traders Notebook Complete shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook Complete

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Trading the Obvious

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

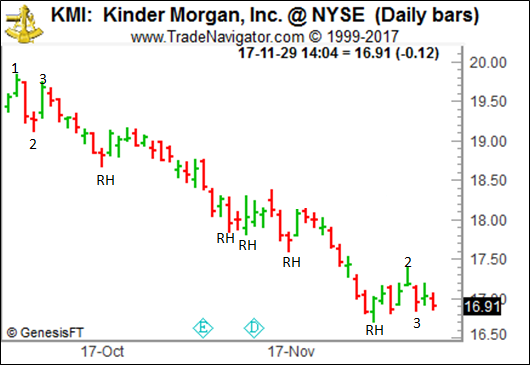

I can't recall how many times I have said or written, "Trade what you see, not what you think." In fact, those very words have become my motto. In this week's Chart Scan, let's look at the obvious — an easy trade that requires nothing more than the willingness to take a look. So many traders have their noses buried in indicators that it is a wonder they don't suffocate. If you look at the daily chart shown below, you will see that once prices violate a #2 point and then violate a Ross Hook, you can expect at least one more hook violation and often two. However, be careful about expectations once prices have violated a third Ross Hook. The violation of a third hook is generally very near the end of a move. From there prices make a 1-2-3 formation at least temporarily ending the trend, or simply consolidate for a while. In the case below, prices made the 1-2-3 after a violation of the fourth hook.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Are You Sabotaging Yourself?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

People come from humble beginnings to achieve wealth, status, or fame. But to get ahead, successful people often had to break conventional rules. This readiness to break the rules is often associated with an affinity toward risk. Although they may achieve success, they may also have a shaky self-image. Sure they achieved a lot, but a voice deep inside their psyche still questions their self-worth or competence. They don't have the birthright and the psychological security that matches their current status in life. They beat the odds and they know it, but they never quite feel secure. Their demons lurk in the back of their mind, ready to take over.

Everyone has his or her talents. Some people are intelligent. Other people are natural born athletes while others have physical attractiveness that turns heads. The identity you form early in life can give you an ego boost when you need it, but may throw you off when you are under pressure. Bill Clinton, for example, described himself as an unattractive dork in his autobiography, "My Life." His early self-image didn't match his later success, and his hidden demon lurked below the surface. His need to validate his attractiveness and desirability led to his downfall.

Many people have insecurities and demons that can come out when they least expect them. If you question your intellectual ability, for example, you may be prone to question your trading decisions while under stress. A voice in the back of your mind may say, "Who do you think you are? You're not smart enough to completely trust your decisions." Your ability to combat these self-statements depends on your life experiences. Some people conquer their demons while other people try to ignore them. If you pretend they are not there, however, they can catch you off guard.

How do demons exert their power? Many demons have a common core. People with hidden insecurities feel that you don't belong and that they’re identify can collapse at any minute. In contrast, people who have conquered their demons may feel "natural" in whatever they do. Nothing is a big deal. For example, a person raised in the trading environment is more likely to see trading events as commonplace. Trading is natural. It's no big deal. Trading events are not imbued with emotional significance.

Other people have demons that may impact their trading. What are some popular ones? Consider the imposter demon. Imposters feel they don't belong in the trading profession. They feel that they are just faking it. They assume that they are going to get caught at any minute, so they might as well not take anything seriously. Then there is the gambler demon. Gamblers believe that they are just having fun. They like the risk. They like the rush. It's all about living in the moment and getting high. Some demons aren't as deep seated. Consider the slacker demon. Slackers spent most of their early life blowing off responsibility. They didn't do well in school and ended up a success later in life. Because they spent their early life avoiding structure and discipline, they easily entertain the idea of breaking the rules. They are likely to throw out their trading plan while under stress.

How do you fight your demons? First, gain awareness. Demons only impact you when you are not conscious of them. When you are aware of your secret demons, you can neutralize their power. Second, change your self-talk. When you feel unworthy or uncertain, remind yourself that you are worthy. Remind yourself that your effort will pay off eventually and that you should protect yourself and keep working hard. Don't let your demons sabotage your efforts. Gain awareness of them and fight them. You'll stay profitable in the long run if you do.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

2017 Activity Summary: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

In 2017, conditions were particularly hostile for premium selling, with especially low implied volatility levels. We still managed to reach our objectives.

- Safety

- With implied volatility particularly low during the whole year, we had to widen our choice of candidates again, to keep maximum safety. We managed to maintain, on all our trades, a safe distance between price action and our short strikes (see AA and BPOP examples below).

We only had to roll 3 times in 2017 (and all these newly rolled trades are now closed for a profit), as a result of our safety policy. The way we roll now takes a lot of research and is better avoided. This releases more time for back testing, improving Instant Income Guaranteed, etc.

- We banked profits on many of our new long term spread trades with unlimited upside potential, always using other people’s money. We recently closed a trade on BHP for instance, which lasted 556 days in total, giving us annualized returns on margin of 179.73% and on principal of 35.95%. This is a very low stress way of yielding 35.95%/year on your cash, maximizing your profits along the way. The only “risk” in this trade was to acquire BHP for a net price of 16.50$ (BHP was quoting 48.84$ on 9th Jan 2018).

As of the 9th January 2018, we have completely closed 8 of these trades and we have 25 of them still opened (out of these 25 trades, 12 have no more margin requirements as we bought to close for a profit the short legs).

- In the last few months of the year, I put my efforts on 2 main topics:

- Enter our trades closer to the beginning of a daily uptrend, which allowed us to get higher capital efficiencies and returns, in spite of a particularly low implied volatility (see TIF and CSX examples below):

Refining a new promising spread trade type, much shorter term than the initial one, with excellent annualized returns; after back testing, we entered our first live trade of this type the last trading day of the year.

Wishing you all a great trading year,

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Outside Bars in the Russell 2000 Mini Future

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Marco Mayer explains the "Outside Bars" pattern as an entry signal. He shows you how if it works as an entry signal in the Russell 2000 Mini Future and how to evaluate entry signals in general by using a systematic approach.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

~ Use Coupon Code During Checkout ~

newyear

Trading is a Business

Trading the Ross Hook

Life Index

Recorded Webinars:

The Law of Charts In-Depth

Traders Trick - Advanced Concepts

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.